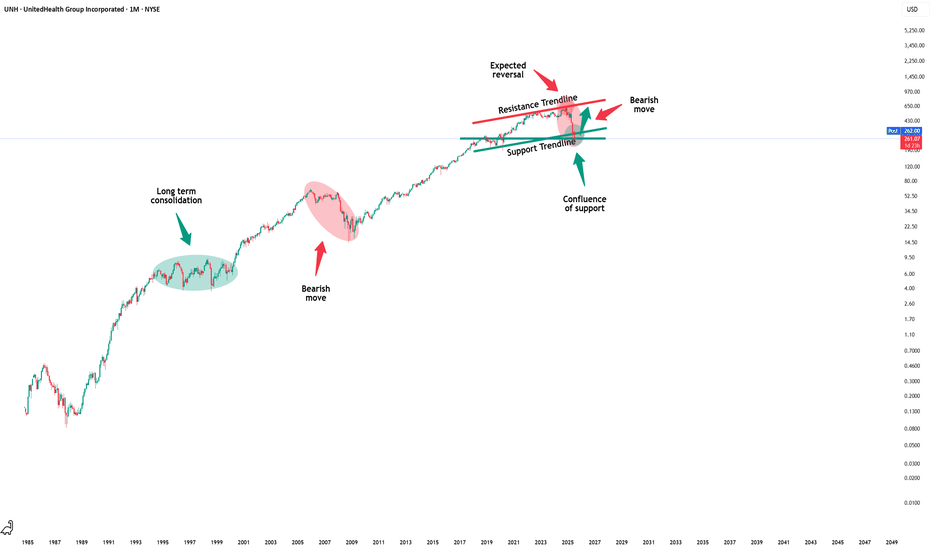

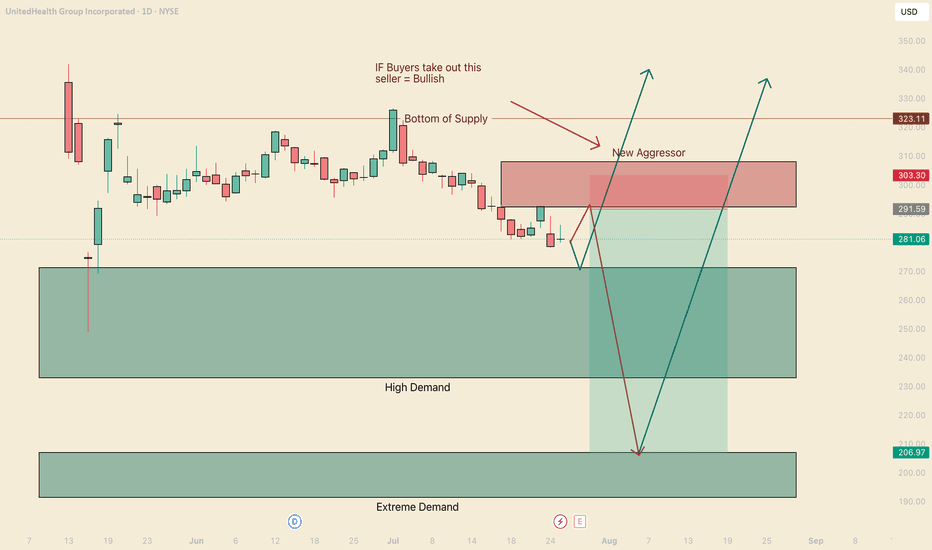

United Health - The perfect time to buy!⛑️United Health ( NYSE:UNH ) finished its massive drop:

🔎Analysis summary:

Over the past couple of months, United Health managed to drop an incredible -60%. This drop however was not unexpected and just the result of a retest of a massive resistance trendline. Considering the confluence of su

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

14.40 B USD

400.28 B USD

904.63 M

About UnitedHealth Group Incorporated

Sector

Industry

CEO

Stephen J. Hemsley

Website

Headquarters

Eden Prairie

Founded

1977

FIGI

BBG00JRQSD39

UnitedHealth Group, Inc. engages in the provision of health care coverage, software, and data consultancy services. It operates through the following segments: UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. The UnitedHealthcare segment utilizes Optum's capabilities to help coordinate patient care, improve affordability of medical care, analyze cost trends, manage pharmacy benefits, work with care providers more effectively, and create a simpler consumer experience. The OptumHealth segment provides health and wellness care, serving the broad health care marketplace including payers, care providers, employers, government, life sciences companies, and consumers. The OptumInsight segment focuses on data and analytics, technology, and information to help major participants in the healthcare industry. The OptumRx segment offers pharmacy care services. The company was founded by Richard T. Burke in January 1977 and is headquartered in Eden Prairie, MN.

Related stocks

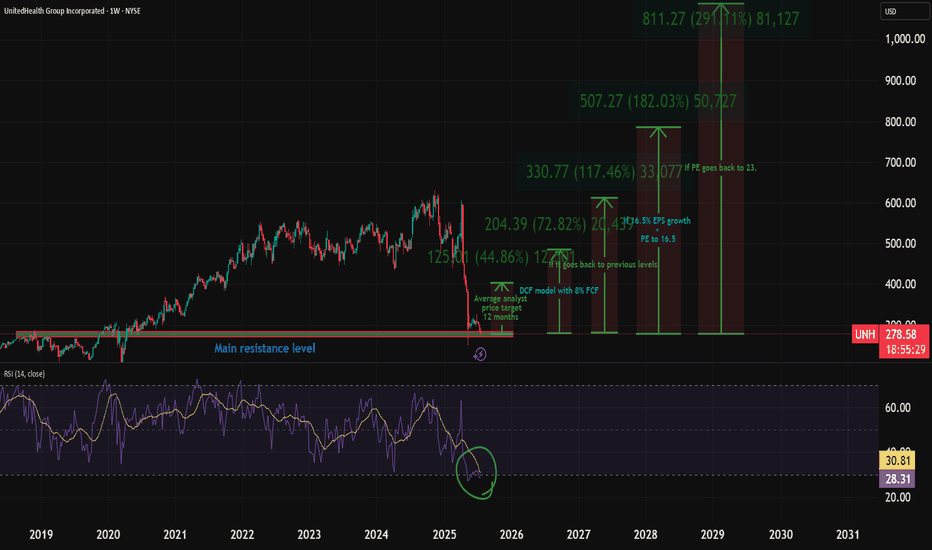

My UNH Thesis: Betting on a Healthcare Giant's Come BackThe healthcare sector has been in decline, which creates interesting opportunities. I recently talked about a few pharma plays - Eli Lilly, Novo Nordisk, and Pfizer.

Here's why I'm investing in NYSE:UNH :

UnitedHealth Group (UNH) has tanked ~50% in the past year, but the July 29 (VERY SOON) ea

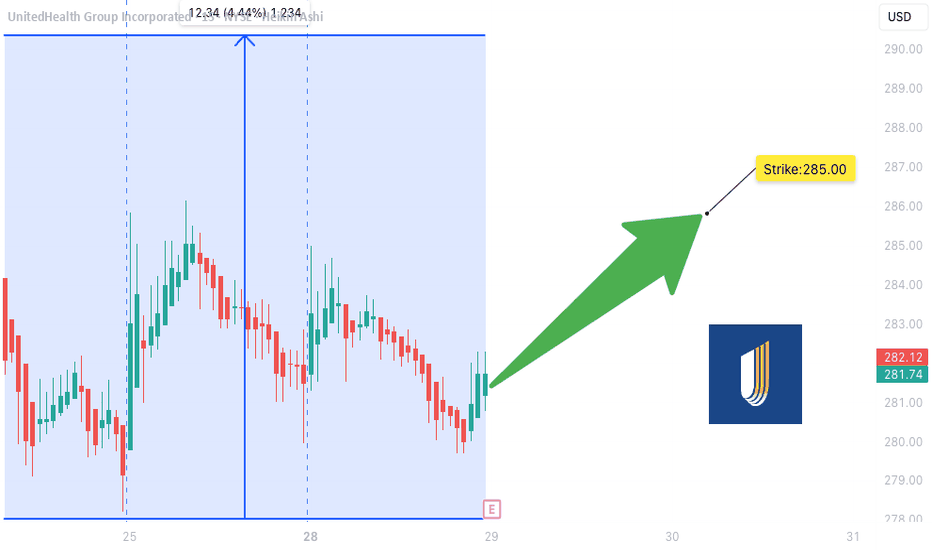

UNH Earnings Lotto Setup** (2025-07-28)

📊 **UNH Earnings Lotto Setup** (2025-07-28)

🎯 **Targeting a 2x return on post-earnings upside move**

---

### 💡 Trade Thesis:

**UnitedHealth (UNH)** is primed for a potential bounce on earnings:

* ✅ **Revenue Growth**: +9.8% YoY

* 🔥 **EPS Beat Rate**: 88% over last 8 quarters

* ⚠️ Margin compres

$UNH Fighting Back After Sharp DropCurrently at $265.46, NYSE:UNH is trading below both its 50-period SMA (~$270.00) and 200-period SMA (~$285.00) on the 30-minute chart. The stock found support at $260.00, where it staged a small bounce, but it remains under pressure with clear resistance at $312.29. The trend remains bearish unti

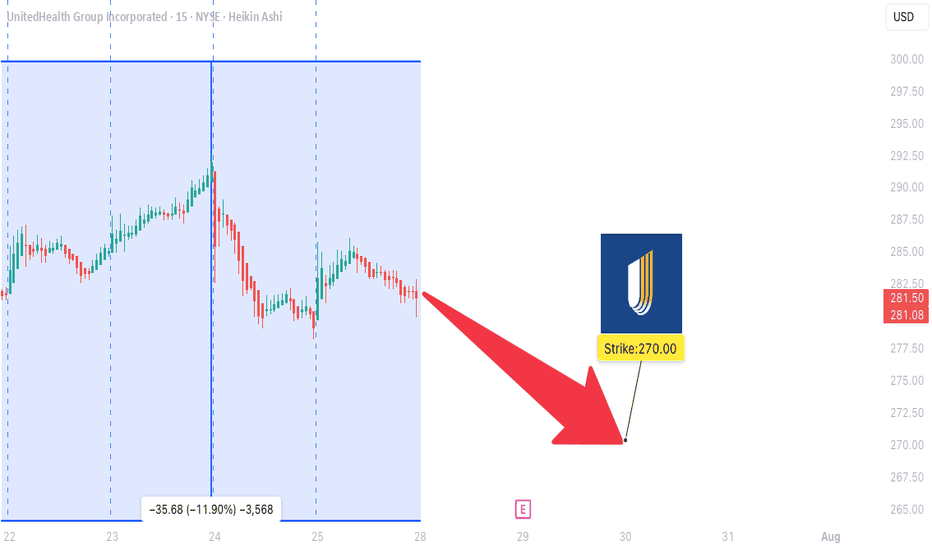

UNH WEEKLY TRADE IDEA (07/27/2025)

**🚨 UNH WEEKLY TRADE IDEA (07/27/2025) 🚨**

**Trend: Bearish Bias with Contrarian Options Flow**

🟥 **Technical Breakdown** + 🟩 **Bullish Flow Confusion** = Strategic Put Play

---

📊 **Key Technicals**

🧭 **Daily RSI:** 37.0 ⬇️

📉 **Weekly RSI:** 27.9 ⬇️ = *EXTREME BEARISH MOMENTUM*

📊 **Volume:** 1.2x

UnitedHealth (UNH) Shares Plunge Following Earnings ReportUnitedHealth (UNH) Shares Plunge Following Earnings Report

Yesterday, prior to the opening of the main trading session, UnitedHealth released its quarterly results along with forward guidance. As a result, UNH shares dropped by over 7%, signalling deep disappointment among market participants. Acc

UNH: Mapping Out a Defined-Risk LEAPS Strategy in the "Buy Zone"UNH is approaching a broad structural support region I’ve been tracking -- a wide zone from $239 down to $186, where (for me) the stock begins to offer compelling risk/reward and long-term value. Momentum, IMO, is still decisively lower, but we’re nearing levels where I start preparing.

The midpoin

Bears are still in controlHello I am the Cafe Trader.

Today we are going to be taking a look at UNH. No doubt this has to have come across your feed or in the news recently. Why is every so Bullish? People are so bullish, that it spooks me... Everyone is pumping this emphatically, I feel like they are getting paid to pump

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

UNH4987619

UnitedHealth Group Incorporated 3.125% 15-MAY-2060Yield to maturity

7.19%

Maturity date

May 15, 2060

UNH4987618

UnitedHealth Group Incorporated 2.9% 15-MAY-2050Yield to maturity

7.16%

Maturity date

May 15, 2050

US91324PEF5

UTD. HEALTH 21/51Yield to maturity

7.02%

Maturity date

May 15, 2051

US91324PDU3

UTD. HEALTH 19/49Yield to maturity

6.89%

Maturity date

Aug 15, 2049

UNH4862956

UnitedHealth Group Incorporated 3.875% 15-AUG-2059Yield to maturity

6.77%

Maturity date

Aug 15, 2059

US91324PDF6

UNITEDHEALTH GRP 17/47Yield to maturity

6.74%

Maturity date

Oct 15, 2047

US91324PCZ3

UNITEDHEALTH GRP 17/47Yield to maturity

6.51%

Maturity date

Apr 15, 2047

US91324PDL3

UNITEDHEALTH GRP 18/48Yield to maturity

6.49%

Maturity date

Jun 15, 2048

UNH5186803

UnitedHealth Group Incorporated 3.05% 15-MAY-2041Yield to maturity

6.44%

Maturity date

May 15, 2041

UNH4987617

UnitedHealth Group Incorporated 2.75% 15-MAY-2040Yield to maturity

6.41%

Maturity date

May 15, 2040

UNH5415944

UnitedHealth Group Incorporated 4.95% 15-MAY-2062Yield to maturity

6.38%

Maturity date

May 15, 2062

See all 0R0O bonds

Curated watchlists where 0R0O is featured.

Frequently Asked Questions

The current price of 0R0O is 238.5 USD — it has decreased by −6.04% in the past 24 hours. Watch UNITEDHEALTH GROUP INC USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange UNITEDHEALTH GROUP INC USD0.01 stocks are traded under the ticker 0R0O.

0R0O stock has fallen by −14.87% compared to the previous week, the month change is a −25.69% fall, over the last year UNITEDHEALTH GROUP INC USD0.01 has showed a 7.71% increase.

We've gathered analysts' opinions on UNITEDHEALTH GROUP INC USD0.01 future price: according to them, 0R0O price has a max estimate of 440.00 USD and a min estimate of 198.00 USD. Watch 0R0O chart and read a more detailed UNITEDHEALTH GROUP INC USD0.01 stock forecast: see what analysts think of UNITEDHEALTH GROUP INC USD0.01 and suggest that you do with its stocks.

0R0O reached its all-time high on Jul 1, 2025 with the price of 326.0 USD, and its all-time low was 90.0 USD and was reached on Jan 16, 2018. View more price dynamics on 0R0O chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0R0O stock is 6.76% volatile and has beta coefficient of 0.03. Track UNITEDHEALTH GROUP INC USD0.01 stock price on the chart and check out the list of the most volatile stocks — is UNITEDHEALTH GROUP INC USD0.01 there?

Today UNITEDHEALTH GROUP INC USD0.01 has the market capitalization of 215.69 B, it has decreased by −2.34% over the last week.

Yes, you can track UNITEDHEALTH GROUP INC USD0.01 financials in yearly and quarterly reports right on TradingView.

UNITEDHEALTH GROUP INC USD0.01 is going to release the next earnings report on Oct 21, 2025. Keep track of upcoming events with our Earnings Calendar.

0R0O earnings for the last quarter are 4.08 USD per share, whereas the estimation was 4.45 USD resulting in a −8.32% surprise. The estimated earnings for the next quarter are 3.35 USD per share. See more details about UNITEDHEALTH GROUP INC USD0.01 earnings.

UNITEDHEALTH GROUP INC USD0.01 revenue for the last quarter amounts to 111.62 B USD, despite the estimated figure of 111.52 B USD. In the next quarter, revenue is expected to reach 113.22 B USD.

0R0O net income for the last quarter is 3.41 B USD, while the quarter before that showed 6.29 B USD of net income which accounts for −45.87% change. Track more UNITEDHEALTH GROUP INC USD0.01 financial stats to get the full picture.

Yes, 0R0O dividends are paid quarterly. The last dividend per share was 2.21 USD. As of today, Dividend Yield (TTM)% is 3.58%. Tracking UNITEDHEALTH GROUP INC USD0.01 dividends might help you take more informed decisions.

UNITEDHEALTH GROUP INC USD0.01 dividend yield was 1.62% in 2024, and payout ratio reached 52.75%. The year before the numbers were 1.38% and 30.55% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 400 K employees. See our rating of the largest employees — is UNITEDHEALTH GROUP INC USD0.01 on this list?

Like other stocks, 0R0O shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade UNITEDHEALTH GROUP INC USD0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So UNITEDHEALTH GROUP INC USD0.01 technincal analysis shows the strong sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating UNITEDHEALTH GROUP INC USD0.01 stock shows the sell signal. See more of UNITEDHEALTH GROUP INC USD0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.