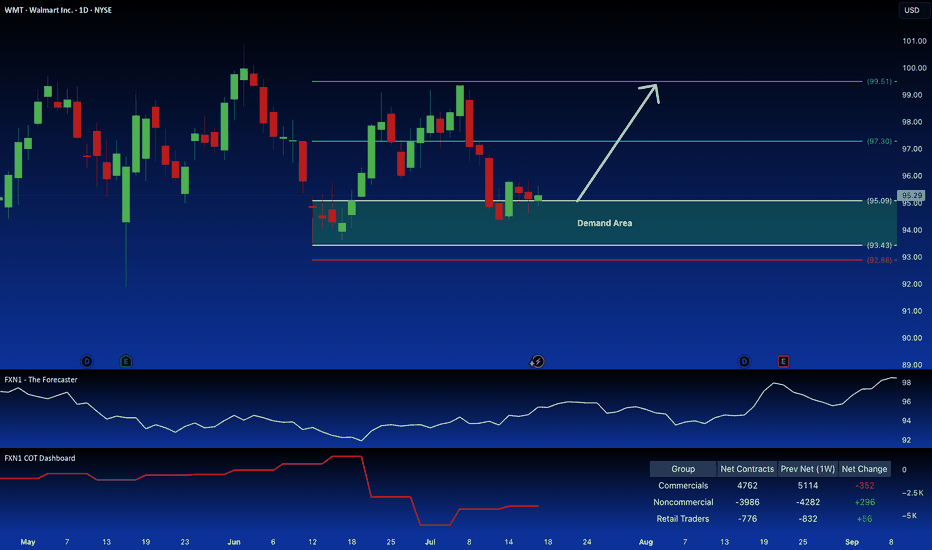

Walmart: Long Position Attractive on Demand ZoneWalmart Inc. presents a compelling long opportunity. The price action is reclaiming a key demand zone, suggesting a continuation of the current uptrend, a pattern reinforced by seasonal factors. Further bolstering the bullish case is the observed increase in large speculator positions.

✅ Please

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.3 USD

19.44 B USD

680.99 B USD

4.35 B

About Walmart Inc.

Sector

Industry

CEO

C. Douglas McMillon

Website

Headquarters

Bentonville

Founded

1962

FIGI

BBG00NGT4L43

Walmart, Inc. engages in the retail and wholesale business. The company offers an assortment of merchandise and services at everyday low prices. It operates through the following business segments: Walmart U.S., Walmart International, and Sam's Club. The Walmart U.S. segment operates as a mass merchandiser of consumer products, operating under the Walmart and Walmart Neighborhood Market brands, including walmart.com. The Walmart International segment includes operations of wholly-owned subsidiaries in Canada, Chile, China, and Africa, and majority-owned subsidiaries in India, as well as Mexico and Central America. The Sam's Club segment manages membership-only warehouse clubs and operates samsclub.com. The company was founded by Samuel Moore Walton and James Lawrence Walton on July 2, 1962 and is headquartered in Bentonville, AR.

Related stocks

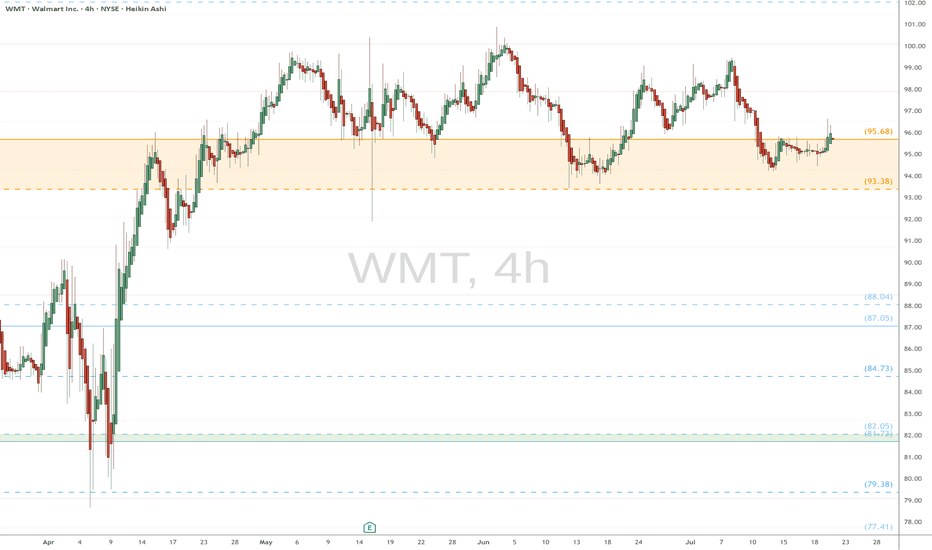

WMT eyes on $95.68 above 93.38 below: Double Golden fibs are KEYWMT has been orbitting this Double Golden zone.

$95.68 is a Golden Genesis, $83.38 a Golden Covid.

This is the "highest gravity" cluster any asset can have.

This is a very important landmark in this stock's lifetime.

==================================================

.

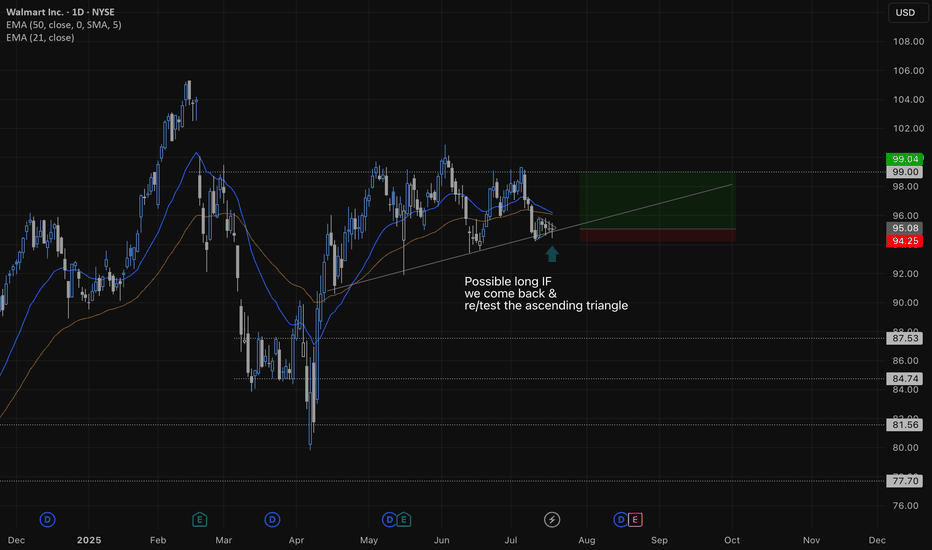

Walmart Long Taking Walmart long here, got a nice ascending triangle on the daily. We have 4 nice rejecting from the bottom trend line with nice consolidation on the daily. This was a 1h wedge and played it pretty aggressive expecting a break to the upside. I could have waited for a 1h break giving me more confi

Stocks SPOT ACCOUNT: WMT stocks Buy Trade with Take ProfitStocks SPOT ACCOUNT: NYSE:WMT stocks my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

Walmart: Retail Giant Positioned for Growth Amid Bullish MomentuCurrent Price: $94.40

Direction: LONG

Targets:

- T1 = $98.20

- T2 = $101.80

Stop Levels:

- S1 = $92.10

- S2 = $90.40

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ident

WMT is ready for another phase of the price discoveryThis Week (July 8 - 12):

Support: The 20-day moving average around $96.70 is the first floor. Below that, the key range support is at $95.00.

Resistance: The top of the range and the all-time high around $101.50 is the ceiling that needs to break.

Next Month (July):

Support: The main support for

Exact Entry Levels & Profit Potential (July 3, 2025)🎯 Market Structure Breakdown – Exact Entry Levels & Profit Potential (July 3, 2025)

📊 In today’s session, I revisit the market for the second time – and you’ll see why I’m ruling out some setups altogether. There’s value in looking twice. What did I miss earlier? It's all in the structure.

I break

Long Position Targeting Key Resistance LevelsCurrent Price: $97.27

Direction: LONG

Targets:

- T1 = $100.25

- T2 = $102.50

Stop Levels:

- S1 = $95.50

- S2 = $94.25

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to ident

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US931142EV1

WALMART 21/51Yield to maturity

6.80%

Maturity date

Sep 22, 2051

WMT4887055

Walmart Inc. 2.95% 24-SEP-2049Yield to maturity

6.53%

Maturity date

Sep 24, 2049

US931142EU3

WALMART 21/41Yield to maturity

6.30%

Maturity date

Sep 22, 2041

US931142DW0

WALMART 2047Yield to maturity

6.18%

Maturity date

Dec 15, 2047

US931142EW9

WALMART 22/25Yield to maturity

6.00%

Maturity date

Sep 9, 2025

US931142EC3

WALMART 18/48Yield to maturity

5.99%

Maturity date

Jun 29, 2048

WMT3991377

Walmart Inc. 4.0% 11-APR-2043Yield to maturity

5.87%

Maturity date

Apr 11, 2043

WMT5472137

Walmart Inc. 4.5% 09-SEP-2052Yield to maturity

5.79%

Maturity date

Sep 9, 2052

WMT5571329

Walmart Inc. 4.5% 15-APR-2053Yield to maturity

5.76%

Maturity date

Apr 15, 2053

WMT4117478

Walmart Inc. 4.3% 22-APR-2044Yield to maturity

5.65%

Maturity date

Apr 22, 2044

WMT4055720

Walmart Inc. 4.75% 02-OCT-2043Yield to maturity

5.43%

Maturity date

Oct 2, 2043

See all 0R1W bonds

Curated watchlists where 0R1W is featured.

Frequently Asked Questions

The current price of 0R1W is 96.5 USD — it has increased by 0.60% in the past 24 hours. Watch WALMART INC COM USD0.10 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange WALMART INC COM USD0.10 stocks are traded under the ticker 0R1W.

0R1W stock has risen by 1.27% compared to the previous week, the month change is a 1.44% rise, over the last year WALMART INC COM USD0.10 has showed a −19.55% decrease.

We've gathered analysts' opinions on WALMART INC COM USD0.10 future price: according to them, 0R1W price has a max estimate of 120.00 USD and a min estimate of 101.00 USD. Watch 0R1W chart and read a more detailed WALMART INC COM USD0.10 stock forecast: see what analysts think of WALMART INC COM USD0.10 and suggest that you do with its stocks.

0R1W reached its all-time high on Oct 11, 2019 with the price of 120.0 USD, and its all-time low was 82.4 USD and was reached on May 10, 2018. View more price dynamics on 0R1W chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0R1W stock is 1.12% volatile and has beta coefficient of 0.81. Track WALMART INC COM USD0.10 stock price on the chart and check out the list of the most volatile stocks — is WALMART INC COM USD0.10 there?

Today WALMART INC COM USD0.10 has the market capitalization of 763.49 B, it has increased by 0.73% over the last week.

Yes, you can track WALMART INC COM USD0.10 financials in yearly and quarterly reports right on TradingView.

WALMART INC COM USD0.10 is going to release the next earnings report on Aug 21, 2025. Keep track of upcoming events with our Earnings Calendar.

0R1W earnings for the last quarter are 0.61 USD per share, whereas the estimation was 0.58 USD resulting in a 6.00% surprise. The estimated earnings for the next quarter are 0.73 USD per share. See more details about WALMART INC COM USD0.10 earnings.

WALMART INC COM USD0.10 revenue for the last quarter amounts to 165.61 B USD, despite the estimated figure of 165.62 B USD. In the next quarter, revenue is expected to reach 175.62 B USD.

0R1W net income for the last quarter is 4.49 B USD, while the quarter before that showed 5.25 B USD of net income which accounts for −14.60% change. Track more WALMART INC COM USD0.10 financial stats to get the full picture.

Yes, 0R1W dividends are paid quarterly. The last dividend per share was 0.23 USD. As of today, Dividend Yield (TTM)% is 0.93%. Tracking WALMART INC COM USD0.10 dividends might help you take more informed decisions.

WALMART INC COM USD0.10 dividend yield was 0.85% in 2024, and payout ratio reached 34.51%. The year before the numbers were 1.38% and 39.73% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 22, 2025, the company has 2.1 M employees. See our rating of the largest employees — is WALMART INC COM USD0.10 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. WALMART INC COM USD0.10 EBITDA is 42.86 B USD, and current EBITDA margin is 6.21%. See more stats in WALMART INC COM USD0.10 financial statements.

Like other stocks, 0R1W shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade WALMART INC COM USD0.10 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So WALMART INC COM USD0.10 technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating WALMART INC COM USD0.10 stock shows the strong sell signal. See more of WALMART INC COM USD0.10 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.