Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

10.6 USD

566.22 M USD

4.95 B USD

46.55 M

About Abercrombie & Fitch Company

Sector

Industry

CEO

Fran Horowitz-Bonadies

Website

Headquarters

New Albany

Founded

1892

FIGI

BBG00JVRN179

Abercrombie & Fitch Co. engages in the retail of apparel, personal care products, and accessories. The firm operates through following geographical segments: Americas, EMEA and APAC. The Americas segment includes operations in North America and South America. The EMEA segment includes operations in Europe, the Middle East and Africa. The APAC segment includes operations in the Asia-Pacific region, including Asia and Oceania. The company was founded by David Abercrombie in 1892 and is headquartered in New Albany, OH.

Related stocks

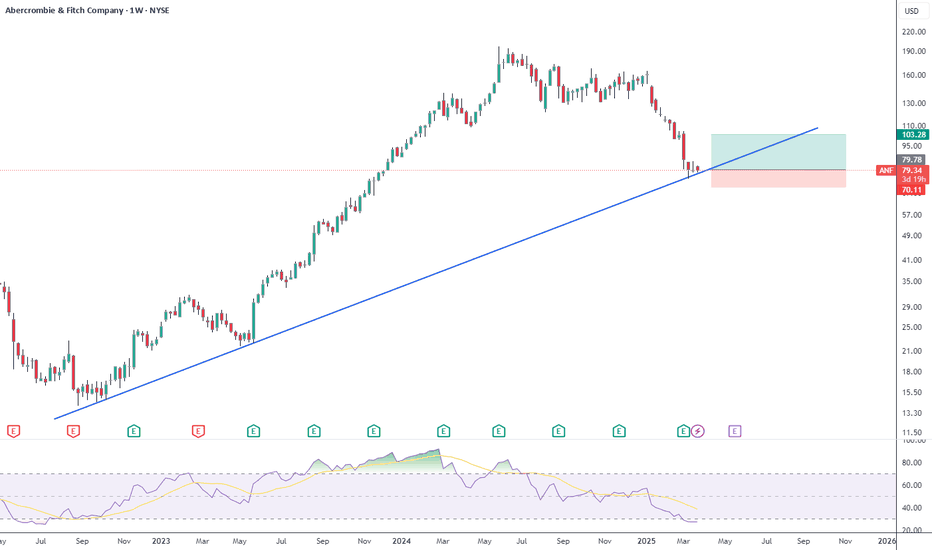

ANF | Direction: Long | Retail Resilience | (June 23, 2025)ANF | Direction: Long | Key Reason: Brand Recovery & Retail Resilience | (June 23, 2025)

1️⃣ Insight Summary

Abercrombie & Fitch is showing signs of a longer-term brand turnaround. Despite recent earnings disappointment, its historic strength, broad international footprint, and stable balance sheet

6/6/25 - $anf - Upgrading this to a buy ~$806/6/25 :: VROCKSTAR :: NYSE:ANF

Upgrading this to a buy ~$80

- low teens fcf yield

- single digit PE

- brand healthy and growing

- stock beat/ stock ripped

- company buying back shares

- when i compare to something like $lulu... i think... this name is already priced for recession and anything lo

ANF Abercrombie & Fitch BELL CURVE SEEN.Abercrombie & Fitch looks to print a Bell Curve.

To date the Bell Curve Transform is not available without some manipulation of Sinusoids on the TV Platform that I can find.

While this is an early Study, time will tell that the theory should perform @ a 75% probability outcome.

Here the Risk to R

ANF | Long Setup | Strong Fundamentals | (May 2025)ANF | Long Setup | Strong Fundamentals + Earnings Momentum | (May 2025)

1️⃣ Short Insight Summary:

Abercrombie & Fitch (ANF) shows solid financial strength with consistent growth outlook. Current valuation is attractive with potential upside toward key resistance levels.

2️⃣ Trade Parameters:

Bias

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 0R32 is featured.

Frequently Asked Questions

The current price of 0R32 is 88.2 USD — it has decreased by −3.94% in the past 24 hours. Watch ABERCROMBIE & FITCH CO CL'A'COM USD0.01 stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange ABERCROMBIE & FITCH CO CL'A'COM USD0.01 stocks are traded under the ticker 0R32.

0R32 stock has fallen by −3.22% compared to the previous week, the month change is a 14.69% rise, over the last year ABERCROMBIE & FITCH CO CL'A'COM USD0.01 has showed a −47.97% decrease.

We've gathered analysts' opinions on ABERCROMBIE & FITCH CO CL'A'COM USD0.01 future price: according to them, 0R32 price has a max estimate of 141.00 USD and a min estimate of 82.00 USD. Watch 0R32 chart and read a more detailed ABERCROMBIE & FITCH CO CL'A'COM USD0.01 stock forecast: see what analysts think of ABERCROMBIE & FITCH CO CL'A'COM USD0.01 and suggest that you do with its stocks.

0R32 reached its all-time high on Jun 13, 2024 with the price of 194.2 USD, and its all-time low was 9.6 USD and was reached on Aug 3, 2020. View more price dynamics on 0R32 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0R32 stock is 3.34% volatile and has beta coefficient of 1.27. Track ABERCROMBIE & FITCH CO CL'A'COM USD0.01 stock price on the chart and check out the list of the most volatile stocks — is ABERCROMBIE & FITCH CO CL'A'COM USD0.01 there?

Today ABERCROMBIE & FITCH CO CL'A'COM USD0.01 has the market capitalization of 4.25 B, it has decreased by −3.18% over the last week.

Yes, you can track ABERCROMBIE & FITCH CO CL'A'COM USD0.01 financials in yearly and quarterly reports right on TradingView.

ABERCROMBIE & FITCH CO CL'A'COM USD0.01 is going to release the next earnings report on Aug 21, 2025. Keep track of upcoming events with our Earnings Calendar.

0R32 earnings for the last quarter are 1.59 USD per share, whereas the estimation was 1.36 USD resulting in a 16.96% surprise. The estimated earnings for the next quarter are 2.26 USD per share. See more details about ABERCROMBIE & FITCH CO CL'A'COM USD0.01 earnings.

ABERCROMBIE & FITCH CO CL'A'COM USD0.01 revenue for the last quarter amounts to 1.10 B USD, despite the estimated figure of 1.06 B USD. In the next quarter, revenue is expected to reach 1.18 B USD.

0R32 net income for the last quarter is 80.41 M USD, while the quarter before that showed 187.23 M USD of net income which accounts for −57.05% change. Track more ABERCROMBIE & FITCH CO CL'A'COM USD0.01 financial stats to get the full picture.

ABERCROMBIE & FITCH CO CL'A'COM USD0.01 dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 16, 2025, the company has 39.2 K employees. See our rating of the largest employees — is ABERCROMBIE & FITCH CO CL'A'COM USD0.01 on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ABERCROMBIE & FITCH CO CL'A'COM USD0.01 EBITDA is 861.73 M USD, and current EBITDA margin is 17.90%. See more stats in ABERCROMBIE & FITCH CO CL'A'COM USD0.01 financial statements.

Like other stocks, 0R32 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ABERCROMBIE & FITCH CO CL'A'COM USD0.01 stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ABERCROMBIE & FITCH CO CL'A'COM USD0.01 technincal analysis shows the buy rating today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ABERCROMBIE & FITCH CO CL'A'COM USD0.01 stock shows the sell signal. See more of ABERCROMBIE & FITCH CO CL'A'COM USD0.01 technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.