0VHA trade ideas

$SHOP Ready to Move Higher?It is hard to believe but there is a lot to like about this NYSE:SHOP chart. What I like is that it has recently come back and touched the rising 40 Week MA (white). It Just bounced off the AVWAP from all time high (meaning that the aggregate of shareholders since that time are in the money). It is well above the 18-month AVWAP. And it is moving up through the short-term MAs. It is yet to cross the 21 EMA (blue). MACD has just crossed up. If / when the market turns positive, I will be looking for a long entry likely using the 40 Week MA as a stop area.

Ideas, not investing / trading advice. Comments always welcome. Thanks for looking.

SHOP - accumulation opportunityNYSE:SHOP has had an incredible year and we may have another strong accumulation opportunity in front of us. SHOP has been in a strong uptrend since recovering its 200MA in January. We the December 2022 low and an overbought condition in February 2023 set a range for the measured move of the gap up on May earnings.

The May gap came close to closing during the August drawdown, but support held at the VWAP from the December 2022 low.

I'm skeptical that the most recent gap up is an exhaustion gap that will fill quickly (note the low volume). If this gap closes and recovers the pattern may resemble a cup and handle.

Also note the following:

A fib timezone from July 2022 earnings to October 2022 earnings aligning to key pivot points.

The red VWAP from all time high converging with the 200SMA and the VWAP from the December 2022 low

Blue VWAPs from the May gap up, July high, and August low

Game plan

Entry 1 ~61, above the August gap open and aligning to the VWAPs from the May gap and July high

Entry 2 ~58, aligning with the top of the August gap open and the VWAP from the August low

TP 1 ~67 which would likely conclude the formation of a cup and handle

TP2 ~71 top of the measured move from the August gap and a higher high below a fib extension

SL ~56-57

Re-entry - If I'm stopped out I will likely re-enter ~50-52 on a retest of the red and green VWAP and 200SMA

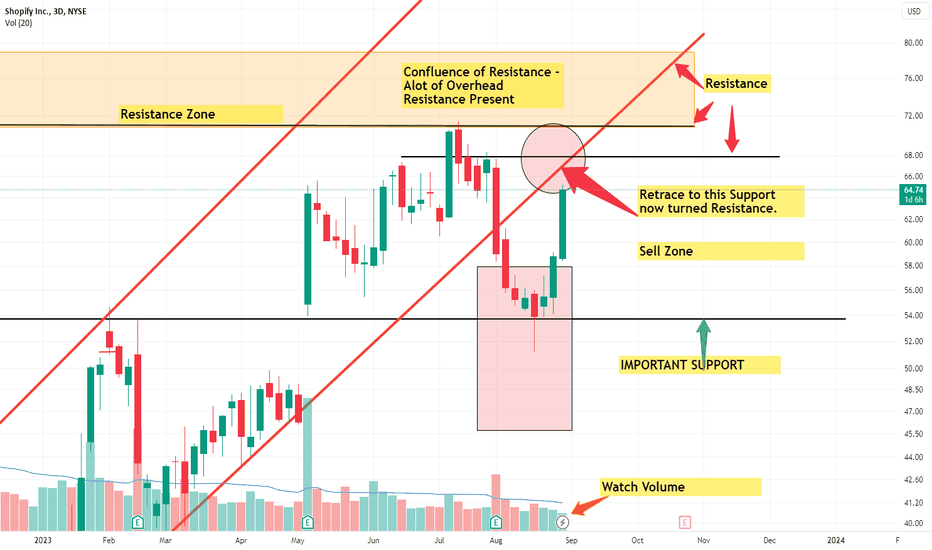

Shopify Short term Sell Target Off Major Support BounceHI guys, ive been following Shopify (SHOP), since its test of some important SUPPORT. This is a quick update from my previous idea. (Which you can find down below for more context)

We've currently bounced extremely bullish off the SUPPORT level, heading towards a SUpport turned Resistance line associated with the UPTREND channel i identified.

Normally when we break down or break above trend lines, that we have respected for some time. We tend to retrace back to that same line to Re-Test it.

Such is the case for Shopify.

Watch the Volume, an INCREASE/ SPIKE in Volume is absolutely needed to get back ABOVE, resuming our UPTREND.

But due note: we are heading into Labor day weekend, thus RISK of LOW VOLUME.

I would then consider if you were able to take positions from the SUPPORT level bounce

To think about off loading some of your position here.

If we do get back into the UPTREND channel from my previous POST. We can look to take new positions if SUPPORT is CONFIRMED.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy

Shopify Macro Pattern Bullish Until Proven OtherwiseHi Guys! This is a Macro Technical Analysis on Shopify (SHOP) on the 1 Week Timeframe.

Its to add to my previous analysis while keeping it brief and concise.

Recently we Broke through and confirmed BELOW both the Uptrend Channel and the 21 EMA.

Normally this spells TROUBLE, especially if we confirm BELOW 21 EMA, as this moving average normally holds SUPPORT through BULLTRENDS.

Even more so that the MACD has crossed BEARISH as well.

However digging deeper, its seen that the channel and 21 EMA break was followed by DECLINING VOLUME.

Normally, for Trend Reversals and for the direction of a trend to actually go that way you need a spike in VOLUME.

(Watch VOLUME in the coming weeks. Can give us hints to what will come next.)

Comparing our current move to previous moves, look to "Similar Pattern". It may be probable that we just move side ways before continuing our UPTREND.

Notice how to the T, our current move follows the previous example. The 21 EMA is also flattening out, indicating this sideways movement.

Another likely scenario, if volume picks up can be a test of the 50 SMA (Green moving average).

BUT provided this Weeks candle closes ABOVE we are testing support. So if we can stay ABOVE this, 50 SMA is less Probable. So pay attention to this weeks candle close and for CONFIRMATION.

Also NOTE we have had a BULLISH CROSS of the 21 EMA above the 50 SMA.

Along with how previous history BUllish move played out.

This makes me think we are in the Early phases of a BULL run in Shopify.

This is NOT a DEFINITE, Sure thing but we may be mirroring the "Similar Pattern".

But always remember that things that happened before does not have to happen again.

I think other than Volume, another MAJOR thing to watch is the MACD.

Particularly, the main focus should be staying ABOVE the 0 level.

Going BELOW 0 level, may indicate further price DECLINES.

So watch how the Histogram bars shape up, we want smaller RED bars that change to a lighter RED color. Eventually would like to see GREEN bars in the coming weeks. That would give confidence that BULLISH momentum is coming back to Shopify.

Take a look at how the MACD shaped up during the "Similar Pattern". If we stay ABOVE 0 level, all is good.

Keep that in the back of the mind as you follow the MACD.

RSI also gives some clues. The area between the RED & BLACK Horizontal lines, coincides with being BELOW 21 EMA.

If we are below the RED line, normally its a good area to add to your position during a BULL run.

The warning sign is if the RSI drops towards and BELOW the BLACK line, that would lead to further PRICE Declines.

Using both the MACD and RSI in combination will help remove false signals. If you see that the histograms are turning light red, to light green and the RSI curved back up towards and ideally above RED line. This would likely push Price back ABOVE 21 EMA, and continue our BULL Run.

I think this week, its important to stay ABOVE the SUPPORT line. Staying above may bring in more confidence.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy.

SHOP: Bullish Pendant FormedI am bullish on SHOP for 4 reasons:

1) We held the 1W MA and it has acted as support since Feb 28. It is curling up, meaning that the trend is now bullish.

2) We have formed a bullish pendant on the daily and weekly time frame.

3) We have recently touched the green Bollinger band on the RSI.

4) The 0.236 fib level at 59.91 recently acted as support.

I am long until the earnings call on August 2 with a price target of $82, which corresponds to the 0.382 fib level and the previous support/resistance level back in Feb 2022. Stop loss is below $55.

Watch SHOP for Support on VolumeLooking for consolidation and/or bounce with volume on NYSE:SHOP this upcoming week to get long.

Overall market cooperation is likely needed. Especially mega cap tech and semis. Those charts aren't looking good. So relative strength (consolidation) may be interesting for long with stop just below prior resistance/pivot?

SHOP Entry, Volume, Target, StopEntry: when price clears 65.54

Volume: with daily volume greater than 17.46M

Target: 75 area

Stop: depending on your risk tolerance; 62.40 gets you 3/1 Risk/Reward.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamental analysis was performed while evaluating this trade idea. Do not take this trade based on my idea, do not follow anyone blindly, do your own analysis and due diligence. I am not a professional trader.

Shopify Corrective Move and Potential TargetsHi guys! This is a Technical Analysis on Shopify (SHOP) on the 1 Week Timeframe.

Since its not the end of the Week, we have to wait till the end of week to see how this week's candle closes.

We ATTEMPTED to break

->1. The ORANGE resistance zone above the 1 FIB level

->2. The "MAJOR RESISTANCE" labeled line that represents a RESISTANCE trend that formed from the PRICE TOP.

WE WERE REJECTED after trying for 4 weeks (july 10th to August 7th).

The 4th weeks candle closed as an ENGULFING BEARISH candle.

Note: For price to break any trend line, it requires a minimum of atleast 3 major tests

This current one in my opinion, ONLY MAKES 2 touch points.

This strengthens the reason of why we got rejected.

So far this weeks candle is showing a much SMALLER body than previous weeks.

This can be an indication that perhaps SELLING is slowing down.

But come end of week, the CURRENT BODY cannot close larger than Today August 9th Candle.

We are currently:

-> BELOW the 21 EMA

-> Breaking the RED Channel i drew out

-> 0.786 FIB Level

Heading straight to the SUPPORT zone comprising of:

1. SUPPORT Horizontal black line

2. 0.618 FIB Level

3. The base of the DESCENDING Triangle.

***Being a confluence of 3 SUPPORT levels -> I believe us to attempt a bounce from the $53.00 area, maybe to retest the "MAJOR RESISTANCE" trendline

In my opinion, its important that we can somehow get back above these key levels come end of week.

If we cant, probabilities are pointing towards a small corrective move

Especially the 21 EMA, looking left reveals patterns where price can fall for upto couple weeks to even couple months.

Which can even validate or increase the probability of the descending triangle to play out

If that happens we will test:

1. First, the 0.5 FIB level at $47.44

2. Then the 0.382 FIB level, which is also around a intermediate Resistance turned SUPPORT line.

3. Worst case scenario = Range of 0.236 FIB level at $34.91 to about $23.90

----->*****going any lower would invalidate the current MACRO BULLISH trend****

-----> But going this low can have create some bullish patterns like a double bottom. But overall its just as of now, less probable.

But we have to just focus one step at a time, worrying about a target level, if the previous trend is broken and confirmed.

Ex). -> If we break below the 0.5 FIB level and confirm, only then is the 0.382 FIB lvl likely.

The STOCH RSI is showing BEARISH move down to the 20 level, we can continue to move below the 20 level and even stay down here for weeks to couple months. But the longer we stay at low levels especially those below 20 level, price tends to decline further.

So we need to pay attention to the level it ends up at.

The RSI is testing a SUPPORT zone, below it can indicate further price drop. Also notice that the RSI line is below the BLACK moving average. If you look left, if we are below it for extended periods RSI continues to drop, along with price. Keep this in mind.

Lastly, the ADX GREEN line, is on a decline, getting close to meeting with RED line. If a cross occurs, more BEARISH momentum can enter the stock. This could increase the probably that the correction continues for a longer timeframe.

We would need GREEN line to curve up and try to get ABOVE resistance line.

Stay tuned for more updates on SHOP in the near future.

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. When trading always spend majority of your time on risk management strategy.

SHOP to 75As you can see on the chart's bottom, when green line goes below 0, the following movement is a strong long one.

If we look up to this pattern on different timeframes, we could see the same.

The indicator's name is konkorde. But this indicator is not enogh to analyze.

You can use a oscilator as slow stochastic to have more information

Timeframe is 150min because I think is a middle point betweeen short term and medium term trading.

Bull momentum of Shopify has been completely releasedBull momentum of Shopify has been completely released

This chart shows the weekly candle chart of Shopify stocks over the past two years. The top to bottom golden section at the end of 2021 is superimposed in the figure. As shown in the figure, since the completion of the form at the end of October 2022, it has risen by 4 small bands, and theoretically, the bull momentum has been completely released! This week, Shopify's stock has made a significant pullback, returning to below the 2.382 position in the golden section of the chart! In the future, it is likely that there will be a longer period of bull rest!