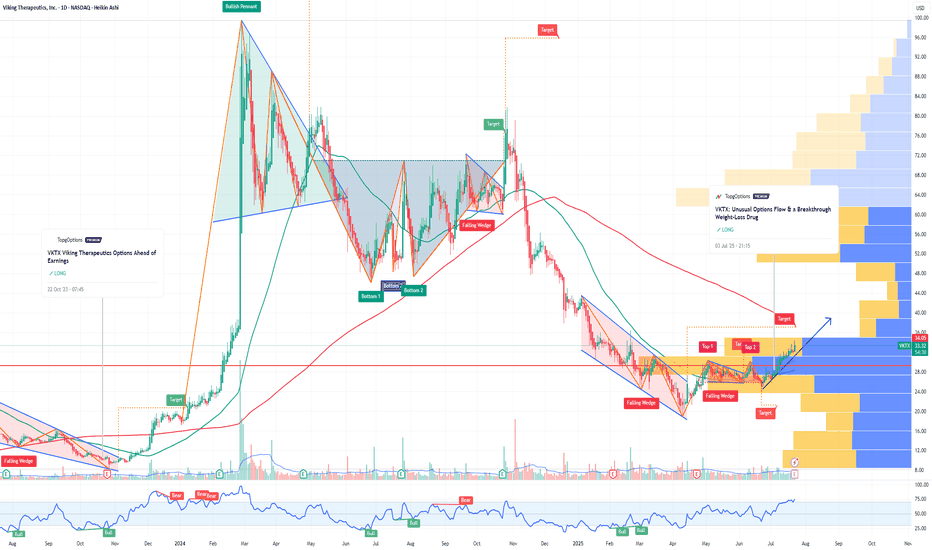

VKTX looking good at current levelsSummary of the Chart – Viking Therapeutics, Inc. (VKTX), 1W Chart (NASDAQ):

Current Price: ~$33.99

Support Levels:

Major Support: ~$23.93

Intermediate Support: ~$33.81

Resistance Levels:

Near-Term Resistance: ~$34.66

Major Resistance / Target Zone: ~$60.98 to ~$61.15

Technical Pattern:

The chart suggests a bullish reversal setup forming after a prolonged downtrend.

The red arrow indicates a projected breakout above $34.66, targeting the resistance zone around $61.00+.

Volume & Indicators:

Volume is marked at 8.85M, with support/resistance suggesting bullish momentum buildup.

Interpretation:

If price breaks above $34.66, a potential upside target of $60.98–$61.15 is projected.

Failure to hold $33.81 support may push the stock back toward $23.93.

0VQA trade ideas

VKTX Viking Therapeutics Options Ahead of EarningsIf you haven`t bought VKTX before the breakout:

Now analyzing the options chain and the chart patterns of VKTX Viking Therapeutics prior to the earnings report this week,

I would consider purchasing the 40usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $7.65.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

VKTX: Unusual Options Flow & a Breakthrough Weight-Loss DrugIf you haven`t bought CKTX before the recent rally:

Now you need to know that Viking Therapeutics (VKTX) is a speculative biotech stock in the GLP-1/GIP agonist space, aiming to challenge market leaders like Eli Lilly and Novo Nordisk. Recently, I noticed unusual options flow — specifically, Jan 16, 2026 $60 strike calls

Key Bullish Points

1) Riding the Obesity Drug Boom

VK2735 is Viking’s dual agonist candidate showing promising early weight-loss efficacy, with potential overlap benefits in NASH (liver disease). The obesity treatment space is expected to exceed $100B by 2030—huge upside if their trials continue positively.

2) Options Flow Tells a Story

Those Jan 2026 $60 calls caught my attention precisely because the stock currently trades in the mid-$60s. These aren’t cheap lottery plays—they’re strategically timed wrt trial readouts, partnerships, or acquisition interest. Essentially, someone anticipates meaningful upside in the near future.

3) Descending Wedge — Chart Looks Bullish

VKTX peaked near $100, then pulled back into a well-defined descending wedge. If it breaks out above $70–$72 with volume, that could kick off a classic reversal trade.

Smart Money Options Flow — Near-Term Bet:

Recently, I spotted unusual open interest in $60 strike calls expiring Jan 16, 2026 — that’s only about 7 months away.

This means someone is positioning for a big upside move relatively soon, likely betting on positive Phase 2b/3 data, a partnership deal, or even buyout chatter within the next few quarters.

Short-dated, out-of-the-money call flow like this often hints at near-term news — not just a long-dated hedge.

Here come the VikingI’ve been watching this chart for a little while now. It’s been an absolute shipwreck. I remain neutral but it’s high on my watchlist. Watching for signs of strength, we are not quite there yet.

The chart reflects the lack of enthusiasm from investors, this company doesn’t generate revenue but are very close to breaking into the duopoly that is the GLP1 market, subject to their phase 3 trials. So things could change rapidly.

Viking Therapeutics VKTX announced that it has initiated the phase Ill VANQUISH program, evaluating the subcutaneous (SC) formulation of its experimental obesity drug VK2735 in adult patients with or without type Il diabetes. This is bullish news.

Technicals continue to look weak, the grand supercycle is over, that remains a reason not to get immediately long, wait for a sign of strength. Keep an eye on this as it could be easily do a 3-5x if their trials are successful, they’d become an acquisition target, if not even before then.

Not financial advice

VKTX – 30-Min Long Trade Setup!📈 🟢

🔹 Asset: Viking Therapeutics, Inc. (VKTX – NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Symmetrical Triangle Breakout + Retest

📊 Trade Plan – Long Position

✅ Entry Zone: $23.60 (Breakout confirmation above triangle resistance)

✅ Stop-Loss (SL): $22.50 (Below structure & trendline support)

🎯 Take Profit Targets:

📌 TP1: $24.89 – Key resistance zone

📌 TP2: $26.79 – Strong supply zone

📐 Risk-Reward Calculation

🟥 Risk: $1.10/share

🟩 Reward to TP2: $3.19/share

📊 R/R Ratio: ~1 : 2.9 – Strong technical setup

🔍 Technical Highlights

📌 Breakout from triangle resistance ✔

📌 Retest candle confirming support ✔

📌 Trendline support intact with higher lows ✔

📌 Momentum building with bullish candle follow-through ✔

📉 Risk Management Strategy

🔁 Move SL to breakeven after TP1

💰 Book 50% profits at TP1

🚀 Let remainder ride toward TP2

🚨 Setup Invalidation If:

❌ Price closes below $22.50

❌ Breakout fails with low volume

❌ Rejection near $24.00–$24.50 zone

🔗

#VKTX #BreakoutPlay #SwingTrade #NASDAQ #ProfittoPath #TrianglePattern #MomentumTrade #RiskReward #TradingView #SmartEntry

VKTX – 15-Min Long Trade Setup!📈 🟢

🔹 Asset: Viking Therapeutics, Inc. (VKTX – NASDAQ)

🔹 Timeframe: 15-Min Chart

🔹 Setup Type: Symmetrical Triangle Breakout + Retest

📊 Trade Plan – Long Position

✅ Entry Zone: $22.21 (Breakout confirmation above yellow zone)

✅ Stop-Loss (SL): $21.38 (Below rising trendline + structural base)

🎯 Take Profit Targets:

📌 TP1: $23.63 – Resistance zone

📌 TP2: $25.42 – Swing high level

📐 Risk-Reward Calculation

🟥 Risk: $0.83/share

🟩 Reward to TP2: $3.21/share

📊 R/R Ratio: ~1 : 3.8 – Excellent swing play

🔍 Technical Highlights

📌 Triangle squeeze breakout on volume ✔

📌 Structure forming higher lows + pressure build-up ✔

📌 Clean breakout above confluence zone ✔

📌 Breakout candle forming right at apex = strong momentum

📉 Risk Management Strategy

🔁 SL to breakeven at TP1

💰 Take partial profits at TP1

🚀 Hold remainder for full TP2 extension

⚠️ Setup Invalidation If:

❌ Price closes below $21.38

❌ No follow-through above yellow resistance

❌ Breakdown with increasing volume

🚨 Final Thoughts

✔ Classic triangle breakout with perfect R/R

✔ Tight SL, wide reward = trader’s dream

✔ Keep watch on volume — it’s the fuel

🔗 #VKTX #BreakoutSetup #SwingTrade #ProfittoPath #ChartAnalysis #NASDAQStocks #TechnicalSetup #SmartMoney #VolumeSpike #RiskReward

VKTX: Support Levels to Watch A double bottom formed in early March, leading to a strong bounce above $30. Since then, the stock has pulled back into the mid-$20s. Given current market conditions and the chart setup, a retest of S-1 at $24.50 looks likely. If that level breaks, S-2 at $17.96 comes into play as the next key support.

Watching these levels closely. Price action here will be telling.

Viking Rejecting This Price LevelBefore testing the $30 region, Viking is likely to retest the descending trendline around $34. This move could represent a 10% gain in the short term.

If the descending trendline breaks, the next potential target would be $44, signaling a strong bullish continuation. Keep an eye on price action and volume confirmation! 📈🔥

VKTX: Potential Double Bottom? VKTX bounced off $24.50, testing a key support level that could confirm a double bottom if it holds. If it breaks down, I expect a move toward $21, a longer-term support level I’ve been watching and where I may consider stepping in with cash-secured puts once it stabilizes. Let's see where it trades from here. Stay tuned. 👀

$VKTXyieahhh

We can go touch $46 and potentially go test the upper part of the channel.

Bunch of confluences for the bounce.

1. Parallel channel support

2. Wave C has same length as Wave A

2. Filled previous gap

3. Using previous high from 2023 as support

4. Weekly RSI and MACD turning around

Daily RSI is in an interesting point, will reach a resistance on the daily. I want this to go back down to have another dab at this, but if it breaks we are off to the races and will hope for a retest on the RSI break.

Be mindful this is another biopharma very volatile and many times news driven, which was already coincidentally this week!

yieahhh

VKTX: Bullish Divergence Leading to a Reversal?Viking Therapeutics has been in a downtrend since late 2024, with price consistently making lower lows. However, since mid January, 2025, both the Relative Strength Index (RSI) and Stochastic Momentum Index (SMI) have been sloping upward, diverging from the price action, which continued to trend lower.

IMO, this bullish divergence signals that selling momentum has been weakening despite the stock's decline, and today’s 11.5% spike reinforces the idea that this setup was in play. While a single strong move doesn’t confirm a full trend reversal, the divergence leading up to it suggests that downside pressure has been fading.

The key now is whether VKTX can sustain this momentum in the coming sessions. Stay tuned!

VIKING - To Crash, Or To Explode?VTV Therapeutics (VKTX) is a clinical-stage biopharmaceutical company focused on discovering and developing small molecule therapies to treat metabolic diseases. The company primarily targets areas such as non-alcoholic steatohepatitis (NASH), type 2 diabetes, and other metabolic disorders. Here's an in-depth look at the company, its position in the industry, unique aspects, developments, and market potential.

As we can see from the above chart, Viking has recently broken the upper channel resistance level and its currently gone in for the re-test to confirm this level as support. However, it appears to be inching back within the channel, signalling a potential break down in price.

Industry Overview: Metabolic Disease Therapies

The metabolic disease market is a rapidly growing sector, driven by the increasing prevalence of conditions like type 2 diabetes, obesity, NASH, and other liver diseases. The demand for effective treatments in these areas is rising as the global population experiences higher rates of these chronic conditions.

NASH, for instance, is a significant focus of research because it can lead to liver cirrhosis and liver cancer, and there are currently limited approved treatments for it. The diabetes and obesity market is also substantial, with new treatments focusing on insulin resistance, fat metabolism, and weight management in high demand.

Unique Aspects of VTV Therapeutics (VKTX)

1. Selective Receptor Modulators: [/i ] One of the company’s key differentiators is its use of selective receptor modulators (SRMs), which are designed to specifically target receptors involved in metabolic diseases. This approach allows for potentially more effective treatments with fewer side effects than traditional therapies.

2. Lead Drug Candidate - VTX-800: VTV’s lead candidate is VTX-800, a small molecule selective FFAR4 receptor modulator. This drug is being developed to treat NASH and type 2 diabetes, targeting the free fatty acid receptor 4 (FFAR4), which plays a crucial role in metabolism and insulin sensitivity. In preclinical and early clinical trials, VTX-800 has demonstrated potential for improving both liver function and insulin resistance in patients.

3. Strong Pipeline: In addition to VTX-800, VTV Therapeutics has other promising compounds in its pipeline targeting type 2 diabetes, obesity, and non-alcoholic fatty liver disease (NAFLD). Their approach leverages cutting-edge metabolic biology to address large, underserved markets.

4. Collaborations: The company has also entered into various collaborations with larger biopharmaceutical companies to enhance its research and development capabilities. These partnerships help strengthen its position in the competitive market for metabolic disease therapies.

Recent Developments and Trials

Phase 2 Clinical Trials: VTX-800 is currently in Phase 2 clinical trials for NASH and type 2 diabetes. The drug has shown promising preclinical results in both liver function and glycemic control, positioning it as a potential breakthrough in these areas.

NASH Pipeline: VTV is also pursuing additional treatments for NASH, a field where there is intense competition due to the lack of approved therapies and the growing demand for effective solutions.

Type 2 Diabetes Research: Their research on type 2 diabetes involves addressing insulin resistance, a major contributor to the disease. This is a massive market, with increasing incidence globally, creating significant potential for therapies that can effectively manage or reverse the condition.

Current Market Cap and Financials

As of December 2024, VTV Therapeutics' market cap is approximately $225 million. The company has seen fluctuating stock prices based on clinical trial results and investor sentiment regarding its drug candidates. The small market cap reflects its current stage as a clinical-stage biotech firm, with significant risk and potential rewards as it moves through its clinical trial phases.

Potential Future Market Cap

The future market cap of VTV Therapeutics will heavily depend on the successful progression and approval of its key drug candidates. If VTX-800 proves to be effective in Phase 3 trials for NASH or type 2 diabetes, the company’s market cap could see a substantial increase, potentially in the $1-2 billion range or higher, similar to other biotech firms that have brought successful metabolic disease drugs to market.

1. NASH Market: The NASH market alone is expected to grow to more than $20 billion by 2025, driven by rising prevalence and lack of treatment options. If VTX-800 is approved for NASH, VTV Therapeutics could capture a significant share of this market, significantly boosting its valuation.

2. Type 2 Diabetes and Obesity : As the prevalence of type 2 diabetes and obesity continues to rise globally, therapies targeting insulin resistance and metabolic function are in high demand. Successful clinical results in these areas could substantially increase VTV Therapeutics’ market cap.

Conclusion

VTV Therapeutics (VKTX) is a promising player in the metabolic disease space with its innovative approach to targeting diseases like NASH and type 2 diabetes. The company’s progress in clinical trials, particularly with VTX-800, positions it to potentially disrupt the metabolic disease treatment market. While its current market cap reflects the risks associated with being a clinical-stage biotech, the company has significant upside potential, particularly if its leading drug candidate achieves clinical success and gains regulatory

$VKTX is about to FEAST! Don't miss out on this BioTech trade. 🚀 Here it is: Your Free Saturday Setup! 🚀

Just as promised, here is a detailed video analysis on NASDAQ:VKTX Viking Therapeutics! 🧬 This trade meets all the criteria of my "High Five Setup" trading strategy, backed by solid technical analysis. Also, it has the potential to return over 100% on your capital deployed.

With more probabilities on our side, the likelihood of success is through the roof! 📈💥

Check it out, and let’s ride this wave together! 🌊

Stay tuned for more insights! 🔔

NFA

#Trading #StockMarket #Biotech #Investing #HighFiveSetup

A 14% drop in $VKTX and I might still win. Here's why! NASDAQ:VKTX

A 14% drop in NASDAQ:VKTX and I might still win. Here's why!

In this video analysis update on my position in NASDAQ:VKTX , we will discuss why I didn't sell after the 14% pullback and why it's important not to sell based on price movement! Enjoy.

Have you ever sold a stock and right after it flew to the upside?

Next move in progress... This is just my personal trading setup so that I keep it in mind.

Viking Therapeutics (VKTX) prepares for its next move. The following things need to happen for me to be bullish:

On the 3D chart:

1. The RSI needs to move above the moving average.

2. On the RCI indicator, the mid-trend line (blue) needs to move above the long-trend line (green).

3. The chart needs to break out of its channel to the upside.

If so, the next target is around $200.

www.barrons.com