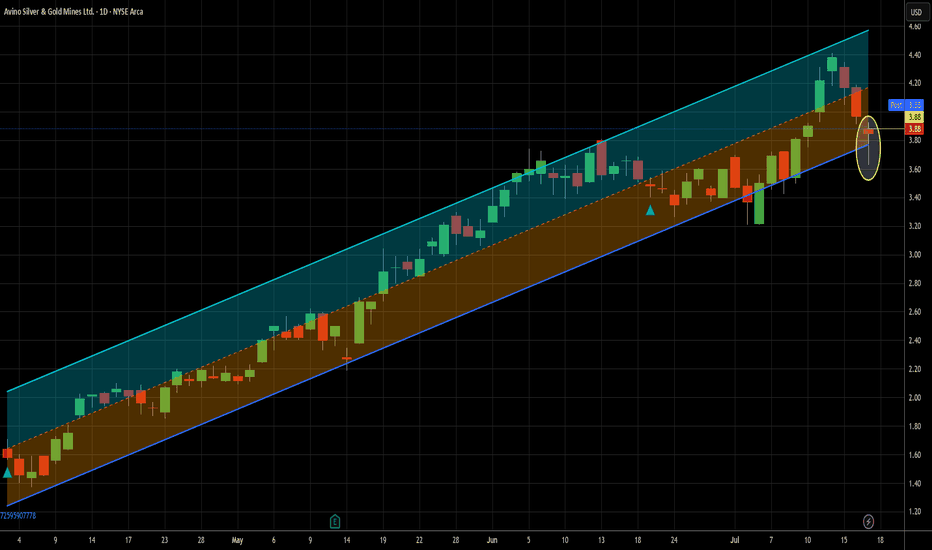

I'm just going to keep putting the hammer down - Long at 3.88I've done two other ideas for ASM in the last 3-1/2 months, so I'm not gonna rehash all those details here. If you are new to me or to my ideas for this ticker, just look at those. In them, I make a fairly compelling argument for short term trading this name. I'll sum it up quickly here - it's be

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.15 CAD

11.10 M CAD

91.97 M CAD

136.51 M

About AVINO SILVER & GOLD MINES

Sector

Industry

CEO

David Wolfin

Website

Headquarters

Vancouver

Founded

1968

FIGI

BBG00Z3K8B56

Avino Silver & Gold Mines Ltd. engages in the mining and exploration activities. It focuses on silver reserves in the Durango region of North Central Mexico. It operates through the Silver, Gold, and Copper segments. The company was founded on May 15, 1968 and is headquartered in Vancouver, Canada.

Related stocks

I'm starting to really like trading this stock - long at 3.47I cheated and bought intraday on this one, because it threw a signal yesterday and I didn't bite then. I couldn't resist today.

You might remember that in my first idea for this stock on April 3, I had some nervousness about this stock. I was happy getting out with a 3.7% gain in four days. What

I'm coloring outside the lines today - Long at 1.64In times of duress (and we can all agree this qualifies, I think), go back to a classic - the 200d MA. Not many stocks these days are trading above their 200d MA. Fewer still are in a business that is a built in hedge for inflation. I think these tariffs will be even more inflationary than they a

ASM – Buying in the StormThis is a bad time for the long term. The macroeconomic scenario is challenging, and indices like the S&P 500 and Nasdaq seem to be at the end of a bullish cycle.

Still, the temptation to buy can be strong when the setup looks promising.

Technical Factors Supporting the Trade:

Weekly Heiken Ashi

ASM - Strong Case for Reversal The descending curve is a bullish chart pattern called a descending scallop

Higher lows are also present within the triangle I have drawn

The breakout on this would be pretty aggressive and probably reach right back up to its starting point.

Looks like a crypto chart lol.

Weekly Chart.

Avino Silver & Gold (USA: $ASM) Ready For Precious Metal Boom!⛏️Avino Silver & Gold Mines Ltd., together with its subsidiaries, engages in the acquisition, exploration, and advancement of mineral properties in Canada. It primarily explores for silver, gold, and copper deposits. The company owns interests in 42 mineral claims and four leased mineral claims, inclu

$ASM fireworks soonASM is nearing the apex of a symmetrical triangle while holding 10% above its 200 day EMA since January of this year. I see a lack of oversold conditions while the stock is within a consolidation pattern. With precious metals prices resuming their uptrend (or so that is my opinion) the evidence weig

Super tight rangeBollinger bands are showing volatility has died right off. The last two times this happened were followed by a big pulse up.

Price is still hovering just below 50-day EMA but a break above this level could be enough to set off a nice breakout, but be careful of the fake-out like in May.

cheers!

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of 0XGF is 5.05 CAD — it has decreased by −3.37% in the past 24 hours. Watch AVINO SILVER & GOLD MINES COM NPV stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange AVINO SILVER & GOLD MINES COM NPV stocks are traded under the ticker 0XGF.

0XGF stock has fallen by −6.71% compared to the previous week, the month change is a 2.73% rise, over the last year AVINO SILVER & GOLD MINES COM NPV has showed a 304.11% increase.

We've gathered analysts' opinions on AVINO SILVER & GOLD MINES COM NPV future price: according to them, 0XGF price has a max estimate of 5.38 CAD and a min estimate of 3.82 CAD. Watch 0XGF chart and read a more detailed AVINO SILVER & GOLD MINES COM NPV stock forecast: see what analysts think of AVINO SILVER & GOLD MINES COM NPV and suggest that you do with its stocks.

0XGF reached its all-time high on Jul 14, 2025 with the price of 6.00 CAD, and its all-time low was 0.60 CAD and was reached on Feb 27, 2024. View more price dynamics on 0XGF chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0XGF stock is 4.52% volatile and has beta coefficient of 2.47. Track AVINO SILVER & GOLD MINES COM NPV stock price on the chart and check out the list of the most volatile stocks — is AVINO SILVER & GOLD MINES COM NPV there?

Today AVINO SILVER & GOLD MINES COM NPV has the market capitalization of 729.62 M, it has decreased by −7.11% over the last week.

Yes, you can track AVINO SILVER & GOLD MINES COM NPV financials in yearly and quarterly reports right on TradingView.

AVINO SILVER & GOLD MINES COM NPV is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

0XGF earnings for the last quarter are 0.06 CAD per share, whereas the estimation was 0.04 CAD resulting in a 33.33% surprise. The estimated earnings for the next quarter are 0.05 CAD per share. See more details about AVINO SILVER & GOLD MINES COM NPV earnings.

AVINO SILVER & GOLD MINES COM NPV revenue for the last quarter amounts to 27.11 M CAD, despite the estimated figure of 24.55 M CAD. In the next quarter, revenue is expected to reach 26.18 M CAD.

0XGF net income for the last quarter is 8.06 M CAD, while the quarter before that showed 7.12 M CAD of net income which accounts for 13.18% change. Track more AVINO SILVER & GOLD MINES COM NPV financial stats to get the full picture.

No, 0XGF doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 22, 2025, the company has 264 employees. See our rating of the largest employees — is AVINO SILVER & GOLD MINES COM NPV on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. AVINO SILVER & GOLD MINES COM NPV EBITDA is 32.69 M CAD, and current EBITDA margin is 28.72%. See more stats in AVINO SILVER & GOLD MINES COM NPV financial statements.

Like other stocks, 0XGF shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade AVINO SILVER & GOLD MINES COM NPV stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So AVINO SILVER & GOLD MINES COM NPV technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating AVINO SILVER & GOLD MINES COM NPV stock shows the buy signal. See more of AVINO SILVER & GOLD MINES COM NPV technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.