0Y6X trade ideas

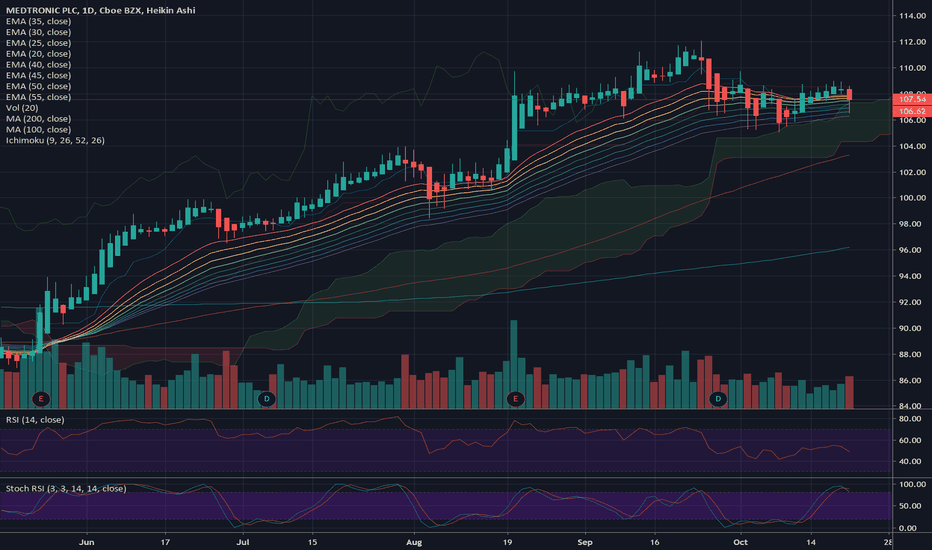

MDT - Bull Flag ContinuationThe stock price created a bull flag pattern, more visible on the weekly chart. This is the daily chart which provides a zoomed-in look as the price has consolidated following its flag breakout.

Now that the bullish momentum seems ready to continue I have labeled my three potential price targets I'm aiming at. Note the lack of established volume above the current price. This stock has run potential.

This Medical Device Will Save Our Aging Population!Hey Friends!

Cardiovascular disease is the biggest killer in the world... And it's responsible for one of every three deaths in America. The leading medical solution to this deadly problem is installing an artificial pacemaker. These devices detect and fix irregular or abnormal heartbeats, called arrhythmias.

Market research firm Statista says that more than 1 million pacemakers were installed globally in 2016. As the world population ages, the pacemaker market could easily double – presenting a wealth of opportunity for early investors.

Traditional pacemakers have two main components: a computer that monitors electrical signals and wire leads that stimulate your heart. The wire leads are like the jumper cables you use on your car. When the computer registers a breakdown in the heart's electrical circuit, it completes the circuit by sending a timed pulse of electricity into the heart. This makes your heart contract uniformly.

In traditional pacemakers, the major components are implanted in your chest. Wire leads feed through your chest wall, into a major artery or vein, and into the heart chamber. Putting all this equipment into your body requires a large incision in your chest. And the pacemaker's wires connect to a device that hangs around your neck or attaches to the outside of your chest.

But now, Medtronic (NYSE: MDT) is changing the game.

Its revolutionary new product – Micra – is the smallest pacemaker in the world. It's the size of a multivitamin pill. That's 93% smaller than conventional pacemakers. Yet it still has the same basic functions.

Most important for both patients and doctors, Micra is also self-contained and less invasive than its predecessors.

The entire device goes directly into your heart. It fits into the right ventricle, one of two main pumping chambers of the heart. There are no wire leads. There's no bulky equipment hanging off your chest. And perhaps best of all, there's no large incision. Similar to a heart stent, Micra is implanted through a catheter up a vein in the patient's leg. This is the safest and easiest way to access your heart. It's also the least risky method of implantation...

One of the most serious complications among pacemaker patients is infection. You see, most folks who need pacemakers are older. And because older patients have weaker immune systems, they also have the highest risk of complications both related to the surgery itself and simply from exposure to infection in hospitals.

In clinical trials, Micra – which won U.S. Food and Drug Administration ("FDA") approval in 2016 – successfully controlled cardiac pacing in 98% of people. And compared with traditional pacemakers, it added a noticeable 48% reduction in complication rates. Micra has enormous untapped potential.

Medtronic's research department is building technology that senses the electrical signals in the atrium so it can keep the pace of a healthy heart.

This means the next iteration of Micra will work for about 55% of all patients who require pacemakers. That's a big jump from today's technology, which can address 16% of heart arrhythmias for folks who have atrioventricular block ("AV block") and atrial fibrillation ("AFib"). Global cardiac pacemaker sales increased by about 100,000 annually from 2015 to 2018. That rate is projected to grow even faster from here. To take advantage of this growth, Medtronic needs to keep up its excellent track record of innovation.

This shouldn't be a problem...

The early leader in the leadless-pacemaker space – Abbott Laboratories (ABT) – has faced quality issues with its devices... leaving the market wide open for Medtronic.

By revenue, Medtronic is the second-largest "pure play" medical-devices firm in the world – reporting $31 billion in the last 12 months. It holds $10 billion in cash against $27 billion in debt and owns more than 46,000 patents – about half of which are for cardiovascular treatments... Cardiovascular devices – including replacement heart valves, coronary stents, cardiac mapping products, and implantable defibrillators – are the bulk of Medtronic's business. Its largest business segment, Cardiac and Vascular Group, represented 38% of its total sales in its 2019 fiscal year.

Across all four of its divisions, Medtronic has huge 70% gross profit margins. The medical technology industry average is around 48%. Still, one of my favorite metrics to track is free cash flow ("FCF"). That's what's left after paying all capital expenses and operating costs. I love companies that generate stacks of FCF... And over the last 12 months, Medtronic has generated $5.6 billion in FCF.

The company also loves to reward its shareholders...

Over the past year, Medtronic has returned $4.4 billion to shareholders through dividends and buybacks. So for every dollar Medtronic brings in in sales, 15 cents go right back to its shareholders. Medtronic develops better devices, patents them, wins FDA approval, and improves quality and longevity of life for patients around the world. As more Baby Boomers become senior citizens, and as the Micra pacemaker becomes more widely used, this growing market will offer a wealth of opportunity.

Sometimes investing is simple!

$MDT OPTIONS TRADERS BET BIG ON MEDTRONIC GAINS. =====TARGET PRICE $115-$118=======.

Medtronic Plc is a medical technology company, which engages in the development, manufacture, distribution, and sale of device-based medical therapies and services. It operates through the following segments: Cardiac and Vascular Group; Minimally Invasive Technologies Group; Restorative Therapies Group; and Diabetes Group. The Cardiac and Vascular Group segment consist Cardiac Rhythm and Heart Failure, Coronary and Structural Heart, and Aortic and Peripheral Vascular divisions. The Minimally Invasive Technologies Group segment comprises Surgical Innovations and Respiratory, Gastrointestinal, and Renal divisions. The Restorative Therapies Group contains Spine, Brain, Specialty Therapies, and Pain Therapies divisions. The Diabetes Group segment focuses in the development, manufacturing, and marketing of products and services for the management of Type I and Type II diabetes. The company was founded in 1949 and is headquartered in Dublin, Ireland.

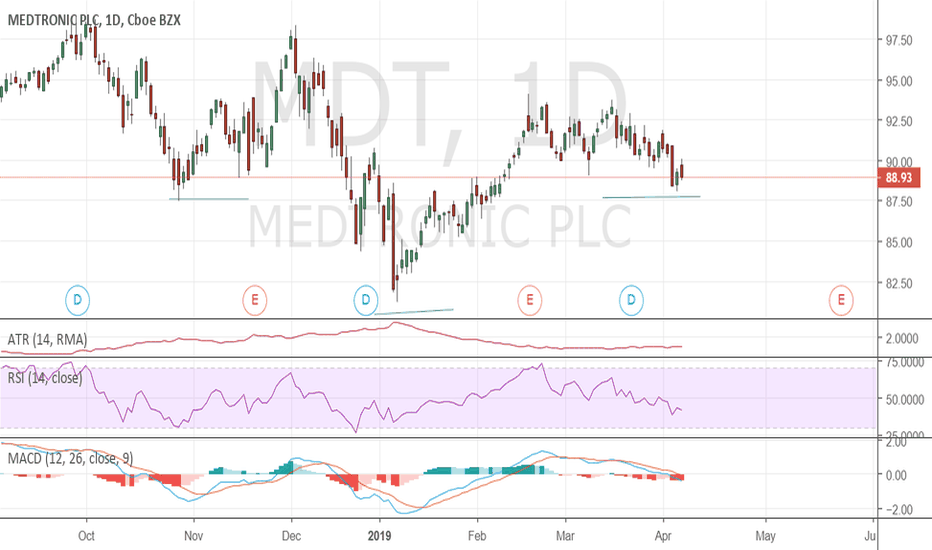

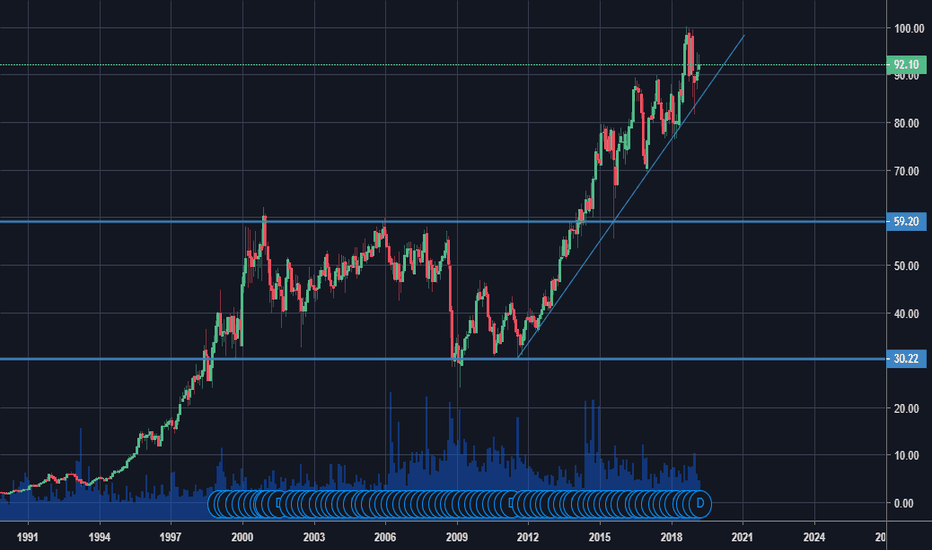

A Technical Analysis for a loved one May 7 2019Good Morning, as we can see NYSE:MDT is in an uptrend and an ascending channel since December 2009, as long as this trend is not broken i would not worry and i will keep my position, the growth has been stable and it looks like a very solid company, the price it is above all its MA, i would only worry if the prices comes lower than USD80.

Is this stock worth owning?Medtronic plc develops, manufactures, distributes, and sells device-based medical therapies to hospitals, physicians, clinicians, and patients worldwide. It operates through four segments: Cardiac and Vascular Group, Minimally Invasive Therapies Group, Restorative Therapies Group, and Diabetes Group. The Cardiac and Vascular Group segment offers implantable cardiac pacemakers, cardioverter defibrillators, and cardiac resynchronization therapy devices; AF ablation product; insertable cardiac monitor systems; mechanical circulatory support; TYRX products; and remote monitoring and patient-centered software. It also provides aortic valves; percutaneous coronary intervention stents, surgical valve replacement and repair products, endovascular stent grafts, percutaneous angioplasty balloons, and products to treat superficial venous diseases in the lower extremities. The Minimally Invasive Therapies Group segment offers surgical products, including surgical stapling devices, vessel sealing instruments, wound closure, electrosurgery products, hernia mechanical devices, mesh implants, and gynecology products; hardware instruments and mesh fixation device; and gastrointestinal, inhalation therapy, and renal care solutions. The Restorative Therapies Group segment offers products for spinal surgeons, neurosurgeons, neurologists, pain management specialists, anesthesiologists, orthopedic surgeons, urologists, colorectal surgeons, urogynecologists, interventional radiologists, and ear, nose, and throat specialists; and systems that incorporate energy surgical instruments. It also provides image-guided surgery and intra-operative imaging systems; and therapies for vasculature in and around the brain. The Diabetes Group segment offers insulin pumps and consumables, continuous glucose monitoring systems, and therapy management software. The company was founded in 1949 and is headquartered in Dublin, Ireland.

MDT. A good stock to buy and hold for the next 5-7 years?Everything is as usual, buy near uptrend. The company looks quite good, both from the point of view of fundamentals and technical analysis. I got in @ $88 and planning to hold this stock for the next 5 years or even more. In case of a reccesion or some other negative news, I'm looking to buy more @ $60-70.