IAG trade ideas

IAG - DAILY CHART Hi, today we are going to talk about IAG

We observe a D1, some important points. The details are highlighted above.

Thank you for reading and leave your comments if you like.

Join the Traders Heaven today, for more exclusive contents!

Link bellow!

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should use it as financial advice

IAG - About to flyBuy IAG (IAG.L)

International Consolidated Airlines Group, S.A. is an airline company that holds the interests in airline and ancillary operations. Its segments include British Airways, Iberia, Vueling, Aer Lingus and Other Group companies. It combines the airlines in the United Kingdom, Spain and Ireland. It has approximately 550 aircrafts to over 280 destinations. The Company operates various aircraft fleet services, including Airbus A318, Airbus A319, Airbus A340-600, Boeing 787-800, Embraer E190 and Boeing 777-200, among others. The Company, through its subsidiaries, is engaged in providing airline marketing, airline operations, insurance, aircraft maintenance, storage and custody services, air freight operations and cargo transport services.

Market Cap: £9.25Billion

International Consolidated Airlines share price has been hit hard over recent months. Following the sharp move lower we are now beginning to see the shares consolidate and potentially forming a bottom pattern. A break above the resistance at 4878p would confirm the bottom pattern and offer upside potential towards 560p. In extension of that, there is an unfilled gap at 643p, which may act as a magnet for the price over the medium term. The risk/reward is favourable from here.

Stop: 432p

Target 1: 560p

Target 2: 605p

Target 3: 640p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

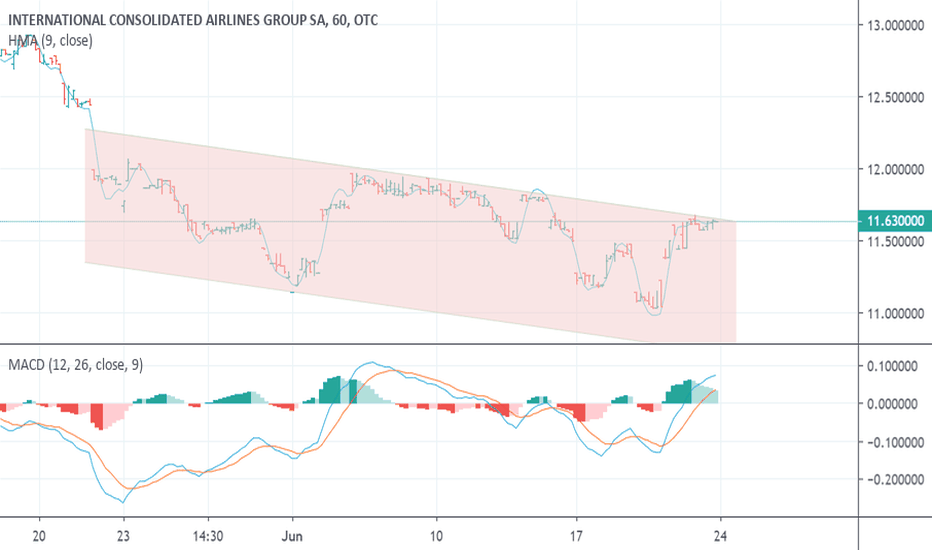

ICAGY short-term short play -- currently near channel topICAGY is a great value stock, and I've been watching for a turnaround for a long time. It's got excellent analyst ratings, a good dividend, and a great P/E.

Unfortunately, it's been in a downward trend for months and is likely to continue downward until a significant catalyst such as a beat on the August 2 earnings report.

It got a bump a couple days ago when it announced a big order of new Boeing jets, but this only pushed it to the top of its channel. With a lower high and bearish divergence on the MACD, I expect a turn downward toward channel bottom on Monday. The alternative is upward channel breakout, which is unlikely but would be nice.

Sidenote: ICAGY always does really well in November, leading up to its dividend payout, then drops hard on the ex-dividend date. That'll be a good month to go long on this stock, if not before.

IAG Plc building up blue sky pressure?IAG Plc LON:IAG) Last couple of days price has tested short term support and failed ending both days in more of a bullish mode - a possible sign of a build up of pressure to move into blue sky territory? Next upside Fibonacci longer term target in the early 800's. If it fails here, then the gap around the late 580's should be watched closely. EasyJet results out tomorrow and their potential move abroad may have some bearing on the short term.

Stars allign for an IAG SHORT! Fundamentally, Airlines are having a tough ride & it doesn't look like its going to stop anytime soon. The fragmented industry has failed to provide any consistent returns for the last 10 years (EBIT margins have averaged just over 1.2%!!), Full service airlines specifically have been struggling - not only due to the exogenous demand factors then rely on (Eurozone GDP), but also as they have been forced to cut previously revenue generating activities such as offering on board amenities in order to compete on price with low cost carriers.

IAG are currently making a loss on their operations with costs spiralling out of control. Labour disputes have further added to their headache as heavy unionisation prevents them cutting staff! Been looking for a short entry for just over a month, and with the OPEC decision yesterday (Oil accounts for 34% of operating costs!!), aswell as a rejection of the 450 level completing a long term head and shoulders pattern - looking to get short as soon as 420 price is broken to the downside.

Entry - 415

SL - 460

First Target - 360

Second Target - 320

INTERNATIONAL CONSOLIDATED AIRLINES PLC predictionRECOMMENDATION BUY

TARGET 575

The Major trend of INTERNATIONAL CONSOLIDATED AIRLINES PLC it is showing strength for buying. If it breaks the resistance level then one can initiate the buying position in the stock. If it breaks the level of 569 then it can show upside movement for the target of 575 with the stop loss of 563.

CHART FORMATION:-

Stock is trading in a range and breaking its neckline will lead to upside movement. Stock is trading above the 50 DMA with positive bias.

INDICATORS:-

RSI is trading near to 53.94 level with positive bias, in upcoming session upside movement is expected.

MACD and Signal line is sustaining above the zero level line.