Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.0 GBP

−21.21 M GBP

600.49 M GBP

2.08 B

About RESOLUTE MINING LIMITED

Sector

Industry

CEO

Christopher Eger

Website

Headquarters

Perth

Founded

2001

ISIN

AU000000RSG6

FIGI

BBG00PGSBLT5

Resolute Mining Ltd. operates as a holding company, which engages in exploration, development, and operation of gold mines across Australia and Africa. The company was founded on June 8, 2001, and is headquartered in Perth, Australia.

Related stocks

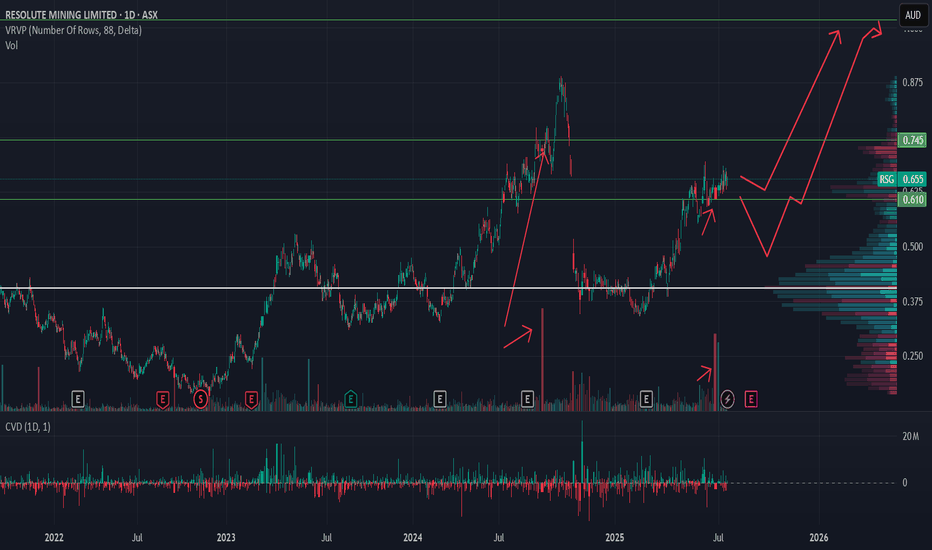

RiskMastery's Breakout Stocks - RSG EditionWelcome to RiskMastery's Breakout Stocks - Stocks with breakout potential.

In this edition, we'll be looking at ASX:RSG ...

I believe this code is at a point of potential volatility.

If price can hold above $0.425 ... Bullish potential may be unlocked.

My key upside targets include:

-

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of RSG is 31.7 GBX — it has increased by 0.16% in the past 24 hours. Watch RESOLUTE MINING ORD NPV (DI) stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange RESOLUTE MINING ORD NPV (DI) stocks are traded under the ticker RSG.

RSG stock has risen by 3.57% compared to the previous week, the last month showed zero change in price, over the last year RESOLUTE MINING ORD NPV (DI) has showed a −3.94% decrease.

We've gathered analysts' opinions on RESOLUTE MINING ORD NPV (DI) future price: according to them, RSG price has a max estimate of 87.66 GBX and a min estimate of 36.59 GBX. Watch RSG chart and read a more detailed RESOLUTE MINING ORD NPV (DI) stock forecast: see what analysts think of RESOLUTE MINING ORD NPV (DI) and suggest that you do with its stocks.

RSG stock is 6.82% volatile and has beta coefficient of 0.61. Track RESOLUTE MINING ORD NPV (DI) stock price on the chart and check out the list of the most volatile stocks — is RESOLUTE MINING ORD NPV (DI) there?

Today RESOLUTE MINING ORD NPV (DI) has the market capitalization of 677.08 M, it has decreased by −2.39% over the last week.

Yes, you can track RESOLUTE MINING ORD NPV (DI) financials in yearly and quarterly reports right on TradingView.

RESOLUTE MINING ORD NPV (DI) is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

RSG net income for the last half-year is −36.84 M GBP, while the previous report showed 16.78 M GBP of net income which accounts for −319.54% change. Track more RESOLUTE MINING ORD NPV (DI) financial stats to get the full picture.

As of Jul 22, 2025, the company has 1.1 K employees. See our rating of the largest employees — is RESOLUTE MINING ORD NPV (DI) on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. RESOLUTE MINING ORD NPV (DI) EBITDA is 138.27 M GBP, and current EBITDA margin is 23.01%. See more stats in RESOLUTE MINING ORD NPV (DI) financial statements.

Like other stocks, RSG shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade RESOLUTE MINING ORD NPV (DI) stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So RESOLUTE MINING ORD NPV (DI) technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating RESOLUTE MINING ORD NPV (DI) stock shows the buy signal. See more of RESOLUTE MINING ORD NPV (DI) technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.