SOYB trade ideas

Not a farmer but corn could be ready to pick here. MMHVW - so apparently the adverse flooding and wet weather hitting certain parts of USA at the moment will have a negative impact on corn as the lands over waterlogged and therefore nothing is grow at the moment. Could see a break out from this descending wedge soon.

ETFS Corn is designed to enable investors to gain an exposure to a total return investment in corn by tracking the Bloomberg Corn Subindex (the "Index") and providing a collateral yield. The product reflects the performance of the Index such that, for example, if the Index were to rise in value by 5% over a period, the product would increase in value by 5% over that same period (before fees, expenses and adjustments) and if the Index were to fall in value by 5% over a period, the product would fall in value by 5% over that same period (before fees, expenses and adjustments). The product is an exchange traded product ("ETP"). Securities in this ETP are structured as debt securities and not as shares (equity). They are traded on exchange just like shares in a company. The ETP is backed by swaps with Citigroup Global Markets Limited and Merrill Lynch International. The payment obligations of the swap counterparties to the Issuer are protected by collateral held in a segregated account at an independent custodian, The Bank of New York Mellon.

Again - this should not be taken as financial advice.

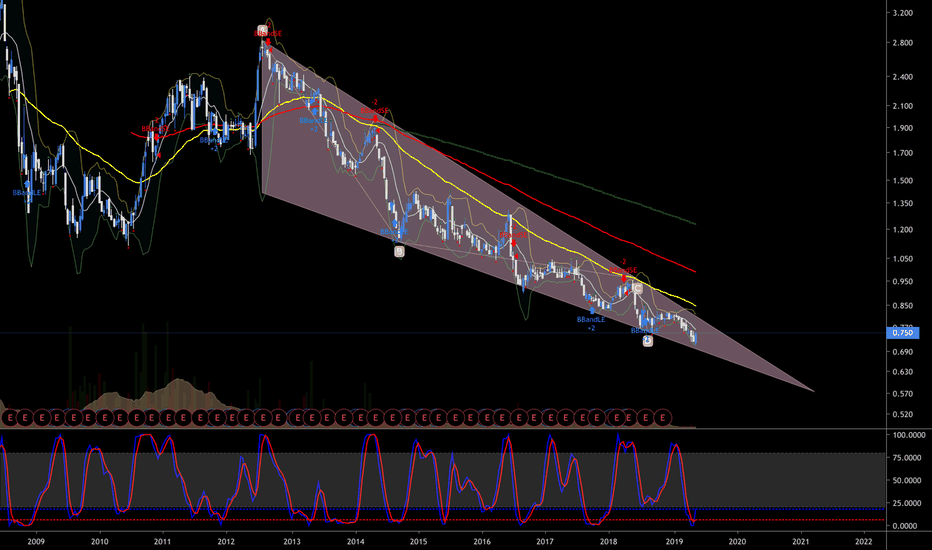

Channel Formation -> Short, Then LongWe bounced from the top channel border four times before. There was a small false breakout from the bottom line, which later lead to all-green rally period all the way to the upper green line. This was supported by beneficial weather period. However, the strength of the rally seems to fade. I am in short expecting us to go down for some time, but I will definitely close above the bottom green line. There is also a blue 150 daily moving average. I think it might act as support. It did work before as a resistance.

ETFS Coffee before the 82% rise... I believe that based on my analysis, Coffee will start to rise. The rise begins with a rise from the W1 ATR axis. After leaving the ATR axis, the exchange rate can build a rising wave structure on the wave axis (green line). The size and size of the wave structure may be similar to the size of the wave crossing the wave axis previously. The rising target price is 1.2306 usd.

Sugar: Positive outlook if stabilizing over key 6.6 area6.46 - 2015 low and coincidentally was the breaking of the downward trend which last between Nov 17- Oct 18

6.62 Where i would eventually like to enter.. with the 50 d/Ma turned up and moving higher

* has been a floor in Feb 18

* and resistance Jun 18 + Nov 18 + Jan 19

Stops can be placed at 6.4 - 5.9

Target 7.0 sell 25% stop 6.62

Target 8.0 sell 25% stop 7.0

Eventual Target 11.0 depending on price action

This Indicator Gives Reliable SignalsLook at Slow Stochastics. They have been giving good signals recently (purple arrow, top indicator). We are also on the bottom of the trendline. I see an opportunity for long here. If you want to be more careful, perhaps, wait for the relative vigor index signal to complete (bottom indicator).