TW. trade ideas

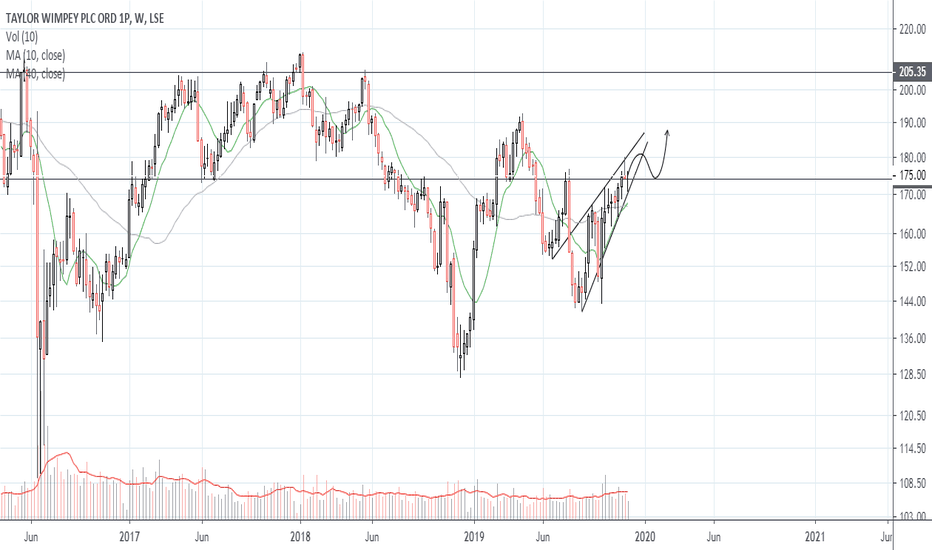

Taylor Wimpey PlcUK home-builder and development space looking interesting at current (technical) levels (also see Barratt Developments - BDEV).

TW at lower range of linear regression channel as well as testing prior breakout/supply area (now potentially support).

Not sure if going trade lower in the next few days but the reward to risk at current levels appear attractive while a break of line A_B would inspire more confidence that the next leg up is commencing.

Provisional Levels

Current: 171.40p

Buy Range 166p-170p

Stop: 161p

Target Range: 185p-189p

Taylor Wimpey TW *GOOD LONG TERM BUYING OPPORTUNITY*Taylor Wimpey Analysis.

Currently trading at more than a 54% discount from the current yearly highs and price is sat around 109/110 support zone. This price level was the very bottom of the lows seen during the 2016 sell-off.

They have a strong dividend yield history paying over 9% and before covid-19 came on to the scene, their company financials were looking good. Revenue increased by 10% last year and their cash in hand balance is over 600m.

Interest rates have been cut further last week and this theoretically will help to boost new home sales when we pull through the current market climate. It also appears that the construction industry is still firing on all cylinders with site works continuing until further notice.

Taylor Wimpey Stock Price Potentially Can Re-Test Its Swing HighWeekly just made a new high before the stock price fall to test support level @ 193.05. Potentially, TW can re-test the swing high at 237.10, however, further decline below 185 is more desirable before buying the stock.

N.B

- Let emotions and sentiments work for you

-ALWAYS Use Proper Risk Management In Your Trades

Taylor Wimpey - Long 10% TargetTaylor Wimpey typically trade well over the Winter period which we are about to enter.

154 resistance level has been broken.

Possible bounce off the current highs at 165 and a retest at the 154 support level.

Alternatively and hopefully it will break through the trending highs at 165 and onto 176 where it will test the support level

Aiming for 10%

Taylor Wimpey - More down likelySELL - TAYLOR WIMPEY (TW.)

Taylor Wimpey plc is a residential developer. The Company operates at a local level from 24 regional businesses across the United Kingdom, and it has operations in Spain.

Fundamentals

Brexit uncertainties continue to undermine the performance of certain UK housebuilders. The ongoing political threat is sending shares in Taylor Wimpey lower. The latest set of results showed that first half operating profits were down 9.4%, which reflects higher build costs and tougher standards. House prices are stagnating, particularly in London and the South East where Taylor Wimpey are significantly exposed. Tougher times potentially remain ahead.

Best Broker Target Price: 200p (Berenberg Bank 05/03/2019)

Worst Broker Target Price: 140p (Peel Hunt 10/12/2018)

Technical Analysis

Taylor Wimpey has been unable to reach the heights it saw in the aftermath of the Brexit result in 2017 and since then has traded in a sequence of lower highs and lower lows. The break of support seen this week at 153.8p suggest we are going to see a continuation lower in the short term. The immediate downside target is at the December 2018 lows of 128p, then below that we are targeting the Brexit vote lows of 110p.

Recommendation: Sell between 140-160p

Stop: 180p

Target: 128p & 110p

Taylor Wimpey – More losses below 148.50UK House builders have faded post budget spike. The daily candle is now a inverted bearish hammer.

That has ensured the falling channel is intact.

Prices currently trade around 149.40. A daily close below 148.58 (38.2% Fibo) would add credence to the failure at the channel resistance and open doors for a sell-off to 140.00 levels.

Taylor Wimpey – Falling channel intactUK’s FTSE 100 index was boosted today by house builder Taylor Wimpey which said trading had been "strong" in the second half of the year.

Technicals – Falling channel on the daily

The share is trading around 150p. Prices need to close above the falling channel hurdle, which would signal continuation of the rally from the post Brexit low. On the higher side, resistance is seen at 160.02 (Oct 4 high) – 160.67 (50% Fibo of May high – June low).

Given the 50-DMA and 100-DMA are sloping lower; the odds of a bullish break from the falling channel are low.

Taylor Wimpey – Awaiting bullish break from congestionDaily chart pattern – sideways channel

At 157.20, Prices are currently flirting with upper end of sideways channel. The daily RSI has already ended sideways action and is pointing northwards.

Hence, a bullish break on day end closing basis would open doors for a 100-DMA located today at 169 levels.

On the lower side, a breach of small rising trend line would expose the lower end of the sideways channel.