Global plan for LTCIn this video I considered the global possible price movement, also made possible scenarios for the current week

The price has already reached an important level and is now trying to stay above it, if the price fails to stay above the Pivot point, there are more chances to see a fall to the first support zone.

Write a comment with your coins & hit the like button and I will make an analysis for you

The author's opinion may differ from yours,

Consider your risks.

Wish you successful trades! MURA

LTCUSD.P trade ideas

LTCUSD INTRADAY uptrend supported at 840.00LTC/USD shows a bullish price action sentiment, supported by a sustained upward trend. Recent intraday activity indicates sideways consolidation, hinting at potential accumulation before a breakout.

Key Levels:

Support: 840 (primary), followed by 800, 777, and 738

Resistance: 901, with extended targets at 936 and 964

The 840 level remains the key pivot and prior consolidation zone. A pullback to this level, followed by a bullish rebound, would reinforce the current trend and open the path toward resistance at 901, with potential extensions to 936 and 964 over the longer term.

Alternatively, a confirmed break and daily close below 840 would invalidate the bullish outlook, signaling the risk of a deeper correction. In this scenario, support levels to watch include 800, followed by 777 and 738.

Conclusion:

LTC/USD is currently consolidating within a broader bullish trend. Holding above the 840 support level is critical for continued upward momentum. A breakdown below this level would shift focus to lower support zones and suggest increased downside pressure.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

LTCUSDT | Signs of Recovery Meet Strong ResistanceLTCUSDT has shown encouraging signs of a bounce, but it’s now approaching the red box, which marks a significant resistance zone. This area has repeatedly capped any rally, and without clear confirmation, attempts to push higher are likely to stall.

🔴 Key Resistance Zone

The red box represents a cluster of prior supply where sellers stepped in aggressively. Any move toward this zone demands caution, because history tells us price struggles to clear it.

📉 Short Setup Criteria

Lower-Time-Frame Breakdowns

Wait for a clear rejection inside the red box on a 5‑ or 15‑minute chart. A shift from higher highs to lower highs signals weakening bullish momentum.

CDV Confirmation

Look for a negative divergence or uptick in selling volume on CDV to confirm sellers are winning the battle at resistance.

Defined Entries

Enter short only when both price structure and volume align. Place your stop just above the red box to manage risk.

🟢 Bullish Flip Conditions

I will not insist on my short idea. If LTCUSDT breaks above the red box with strong volume and then retests it successfully as support, I will switch to a bullish bias. In that scenario, lower‑time‑frame breakouts back toward new highs will be my trigger to enter a long position.

💡 Why This Matters

We’re not guessing—this approach is built on watching how price interacts with key zones and waiting for the market’s confirmation. By trading only when conditions align, you avoid emotional decisions and position yourself for higher‑probability moves. Keep an eye on that red box. Let price show its true intent, and then act with confidence.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

LTCUSD eyes bearish bat patternOn the daily chart, LTCUSD stabilized and rebounded in the short term, and bulls have the upper hand. Currently, the upward trend is looking towards the previous supply area of 90.9-96.5. If the price reaches 92.70, pay attention to the potential bearish bat pattern.

Litecoin (LTCUSD) – A Massive Move Brewing? 1350$ Target Aligns Litecoin has been consolidating in a symmetrical triangle for nearly a decade on the macro 6M chart. Despite recent price weakness, the structure remains bullish. The triangle’s apex is nearing, and historically, such long-term squeezes lead to explosive moves.

Here’s the interesting part:

If we project the distance from the triangle’s base to its tip onto a breakout point (end of triangle), the target aligns perfectly with the 3.618 Fibonacci extension, which is around $1350.

This isn’t just a random number — it implies a market cap of around $100B for Litecoin, which is absolutely imaginable in a scenario where:

• Bitcoin reclaims its ATH,

• BTC dominance declines (altseason begins),

• and sentiment shifts risk-on for large-cap alts.

⸻

Fundamentals Supporting the Move:

• MWEB (MimbleWimble Extension Block): Adds optional privacy and fungibility.

• ETF speculation & recognition by major institutions like Grayscale and Fidelity.

• Payment use cases remain strong – LTC is still one of the most used coins for transactions.

• Memetic potential: The rise of meme culture can shift retail attention quickly.

• Historical correlation with BTC cycles.

⸻

Technicals:

• Price respecting triangle structure

• Holding macro higher lows

• Fibonacci levels show confluence with projected breakout

• RSI hovering in neutral zone – lots of room for upside

• Low volume suggests coiling pressure building up

⸻

Key Levels:

• Support: $65–70 zone (bottom of triangle)

• Resistance/Breakout Trigger: ~$140

• Fibonacci Targets:

• 0.618: $255

• 1.618: $630

• 3.618: $1350

⸻

Potential LTC/BTC Ratio:

If LTC hits $1350 and BTC retests ATH, that gives LTC/BTC a ratio of 0.01, a historic level and psychological milestone.

⸻

Conclusion:

All eyes on this triangle. Fundamentals are aligning with technicals. If the bull market resumes and BTC dominance breaks down, Litecoin is poised for a breakout that could surprise many.

Let the triangle decide. 🚀

LITECOIN to new highs, fib retracement completeLitecoin - officially a commodity as declared by the SEC - is about to hit major support and if it holds, which it most likely will, it is going to go to new highs as it is intended to.

Not financial advice, simply looking at trendlines and following fundamentals.

DYR

LTC is Bearish Below $80.0: What's Next?FenzoFx—Litecoin slipped below $76.4 and is currently testing this level as support. With bearish momentum stemming from $80.0, the market outlook remains bearish while the price stays below this threshold.

>LTC/USD may target $71.00 next, and selling pressure could drive it further down to $64.45.

>A bullish shift would require a break above $80.0, paving the way toward $88.50 resistance.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

Bearish Trend Persists: Litecoin Targets $71.0FenzoFx—Litecoin is trading at $75.9 after closing below $76.4 and testing it as resistance. The Stochastic Oscillator signals oversold conditions, suggesting a possible price bounce, although the bearish trend persists below $80.0.

If the bearish momentum continues, the next target could be $71.0.

Alternatively, stabilization above $80.0 may extend gains toward $88.5.

>>> No Deposit Bonus

>>> %100 Deposit Bonus

>>> Forex Analysis Contest

All at F enzo F x Decentralized Forex Broker

LTCUSD INTRADAY oversold bounce back capped at 880,00Market Sentiment:

The prevailing trend for LTCUSD remains bearish, with the recent price action appearing to be an oversold bounce rather than a sustained recovery.

Key Levels:

Resistance: 880.00 (Previous consolidation zone)

Support Levels: 672.60 followed by 630.20 and 577.50

Potential Scenarios:

Bearish Continuation: If LTCUSD fails to break above 800.00 and faces rejection, it could resume its downtrend, targeting 672.60 initially, followed by 630.20 and 577.50 over the longer term.

Bullish Breakout: A confirmed breakout and daily close above 800.00 would shift the sentiment bullish, paving the way for a rally toward 933.00 and potentially 975.00.

Conclusion:

LTCUSD remains in a bearish structure unless a breakout above 800.00 is confirmed. Until then, price action suggests that any rally is likely to be a short-term relief within a broader downtrend.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

LTC/USD "LiteCoin vs US Dollar" Crypto Heist (Scalping / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the LTC/USD "Lite Coin vs US Dollar" Crypto Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is to escape near the high-risk MA Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (80.00) then make your move - Bullish profits await!"

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level for pullback entries.

📌I strongly advise you to set an "alert (Alarm)" on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: "🔊 Yo, listen up! 🗣️ If you're lookin' to get in on a buy stop order, don't even think about settin' that stop loss till after the breakout 🚀. You feel me? Now, if you're smart, you'll place that stop loss where I told you to 📍, but if you're a rebel, you can put it wherever you like 🤪 - just don't say I didn't warn you ⚠️. You're playin' with fire 🔥, and it's your risk, not mine 👊."

📍 Thief SL placed at the recent/swing low level Using the 3H timeframe (72.00) Scalping/Day trade basis.

📍 SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 88.00 (or) Escape Before the Target

💰💵💸LTC/USD "LiteCoin vs US Dollar" Crypto Market Heist Plan (Day / Scalping Trade) is currently experiencing a bullishness,., driven by several key factors.👇👇👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, On Chain Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

LTCUSD Bullish Reversal in Progress? Key Levels to WatchLitecoin (LTCUSD) is showing early signs of a potential bullish reversal after bouncing off a strong demand zone around $70–$76 (highlighted in orange). Here's a breakdown of the technical setup:

Key Technical Zones:

Support Zone: $70–$76 (High Volume Node + Demand Area)

Resistance 1: $81.27 – Immediate resistance that could turn into support if broken.

Resistance 2: $104.79 – A key level to watch if momentum continues.

Supply Zone: $116.73 – $131.03 (Marked by heavy previous selling pressure)

Bullish Signals:

Price has tested the demand zone multiple times and held, indicating strong buyer interest.

LTC is now pushing above the lower consolidation zone, aiming for the $81.27 resistance.

Volume around this area is tapering, which could lead to a breakout rally if bulls maintain control.

Trade Idea:

Aggressive Entry: On a confirmed 4H candle close above $81.27.

Conservative Entry: Wait for a retest of $81.27 as support with bullish confirmation.

Targets: $104.79 short-term, $116–$131 longer-term.

Stop Loss: Below $75 support zone to manage risk.

Outlook:

If bulls manage to break and hold above $81.27, Litecoin could enter a mid-term rally toward the $100–$130 zone. However, failure to hold current levels might push price back to retest the demand zone.

Let me know your thoughts – are you bullish or bearish on LTC this month?

#Litecoin #LTCUSD #Crypto #Altcoins #TechnicalAnalysis #TradingView #SupplyAndDemand #LuxAlgo

Litecoin Is An Absolute Bargain Right NowFrom a technical perspective, the recent reaction at the lower trendline of the parallel channel since 2016 has been respected many times, and once again, it has held.

I anticipate that the price will explode in the next several months. We just need to be patient and wait for the Fed to pivot their monetary policy, and then cryptocurrencies will soar. Global liquidity has been rising, which is positive for cryptocurrencies. My prediction is that in May, we will finally start to see some significant bullish price movement, and this trend will continue for many months thereafter. Stay patient.

Let me know what you think.

Best regards.

Look for Buys on litecoin at bottomHello,

The most common advice given to new investors is to "buy low and sell high." While this sounds simple, it’s one of the hardest strategies to execute due to the psychological challenges of investing. Emotions like fear and greed often override rational decision-making, leading many to act against their best interests.

Why does this happen? Greed drives investors to buy at market peaks, chasing the belief that prices will continue to rise indefinitely—yet markets rarely sustain upward momentum forever. Conversely, fear prompts selling at the bottom, as investors panic and assume prices will keep falling. This behavior causes them to miss out on both profit-taking opportunities and long-term growth potential.

Taking Litecoin as an example. As shown in the chart, it has been consolidating near its bottom for over 1,000 days. Buying at this level could be a strategic move, offering the potential for gains exceeding 700% in the long run. Investors looking to buy can position themselves for buys at around $600. Our long-term target for this coin is $3,000.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Litecoin LTCUSD Completing Final Leg Down Before LaunchAs you can see Litecoin is forming a very similar pattern. I think the rest of March will be corrective. Litecoin will likely come down and bounce off the trend line which coincidental also is a major support level. April will be slightly bullish, May and June will be majorly bullish which I believe Bitcoin will also fly up to 140k as well in this time. I believe Litecoin will outperform the majority of the market. Major hyperinflation will begin this summer which will be very positive for crypto. Many cryptos will die in this hyperinflation period. Only some will survive. Dollar is going to crash. Get ready for a wild ride into 2026. People calling for a bear market are ill informed and will kick themselves for selling. This is the beginning of the biggest run in some cryptos, we've ever seen. Buckle up. Good luck. Not financial advice.

Litecoin big fall commenced to $49 thanks to RumpThe operational costs are rising sky high for Litecoin which is becoming very expensive to mine.

And based on the Crypto Depression, it seems like there is more downside to come for the alt coin due to some of the following:

📉 Weak On-Chain Activity

Fewer active wallets and transactions lately—shows low interest.

🔻 Bearish Price Action

LTC just broke key support levels on the chart—bad sign for bulls.

💼 Lack of Big Investor Moves

No major whale activity—institutions are sitting this one out.

📉 ETF Hype Fading

Talk of a Litecoin ETF has cooled off—momentum’s dying down.

Technicals also look bad including:

Inv Cup and Handle

Price<20 and 200

Target $49.60

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Buyers might be waking up in the Litecoin zoneOn the COINBASE:LTCUSD 3W chart, price has dropped into a wide demand zone between 68 and 50, an area that has provided strong support in the past. This drop aligns with the 78.6 Fibonacci retracement of the last bullish leg, suggesting that long term buyers might soon show interest. As long as price stays above 50, the structure remains favorable for a possible reversal. A strong bullish reaction from this zone, followed by confirmation on lower timeframes or a reclaim of the 68 level, could signal a move toward the 147 target. This setup offers a solid long term opportunity with a favorable risk to reward ratio.

Disclaimer: This content is for educational and informational purposes only. It does not represent financial advice or a recommendation to buy or sell any financial instrument. Trading involves risk, and you should only trade with money you can afford to lose.

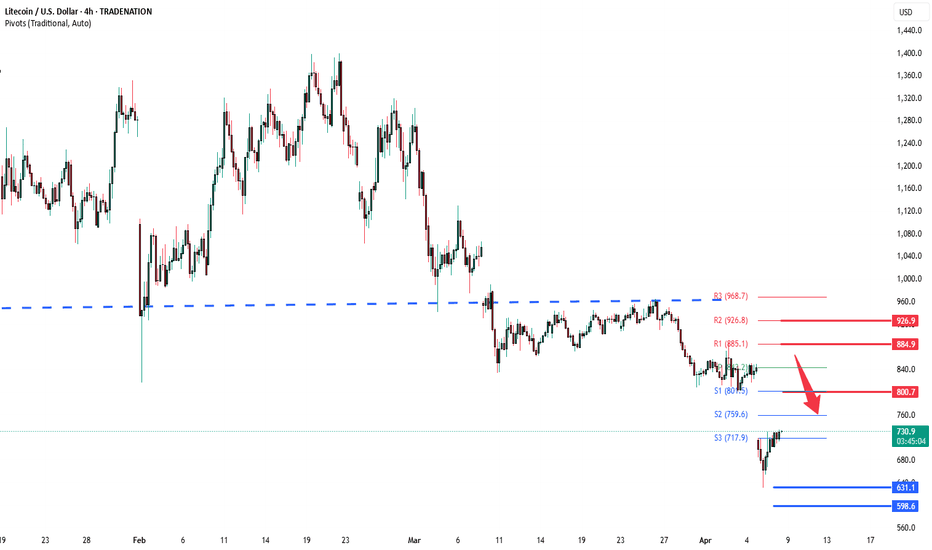

LTCUSD bearish continuation “Gap Close” resistance at 800.70Market Sentiment:

The prevailing trend for LTCUSD remains bearish, with the recent price action appearing to be an oversold bounce rather than a sustained recovery.

Key Levels:

Resistance: 897.70 (Previous consolidation zone)

Support Levels: 826.80 → 790.20 → 746.40

Potential Scenarios:

Bearish Continuation: If LTCUSD fails to break above 800.70 and faces rejection, it could resume its downtrend, targeting 631.10 initially, followed by 598.60 and 520.00 over the longer term.

Bullish Breakout: A confirmed breakout and daily close above 800.70 would shift the sentiment bullish, paving the way for a rally toward 885.00 and potentially 927.00.

Conclusion:

LTCUSD remains in a bearish structure unless a breakout above 800.70 is confirmed. Until then, price action suggests that any rally is likely to be a short-term relief within a broader downtrend.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.