Litecoin Bull Market Bullish Wave Now In The MakingUsing the leverage or not will really depend on what you buy. Bitcoin is trading right now almost at 100K and very close to its All-Time High but this isn't the case for Litecoin or other Altcoins.

Not all your capital should be used for leverage or spot, it can be divided a portion here and a portion there, it is not black or white there is a full color spectrum to choose from and each color have a huge range of gradation. Think about that one for a minute.

If you have to ask the question, "Can I use leverage now?" the answer is always no. The person that can use it don't need to ask. If you have to ask means that you are not prepared or don't know what to expect. Since it is risky and the game is not only the first step, it is better to be prepared.

Using leverage, you can have positions open and "winning" for months and when correction time comes, one mistake can lead to the next until the whole house of cards breaks down and you are left with nothing. It is a complex game to say the least. Learning of course requires practice and for success it is very important to have great entry price and right timing.

How you choose to trade is up to you.

Maybe nobody can beat index funds with compounded interest after tax for 20 years straight or with billions of dollars but individually it can be done in so many ways. It can be done and has been done a countless number of times for 3 years, 5 years, 10 years, 15 years and so on. You don't need a lifetime of this system you just need a big hefty profit and continue with a strategy that adapts to market conditions as you trade and grow.

Investing is not the same as trading. Investors always vouch for buy and hold and do nothing, but trading can be a great asset yet requires work and big money makes it harder, and harder it becomes the bigger the pot.

Individually, as in us, we can make a fortune easy with the right timing, mindset and buy and hold. Buy near the bottom of the bear market or a strong correction. It doesn't have to be the perfect bottom, can be just close and even months away. Sell when prices are high or going up. It doesn't have to be the top nor the exact All-Time High date.

If we can put our capital to grow between 200-500% within each cycle with Crypto, we are not talking billions as we are all small, we can make millions of times more profits than choosing stocks or the investor favorite stock index funds.

The index funds are paying less and less with each passing decade. Crypto is here to shake things up a little bit. A breath of fresh air.

We can go back to high earnings, high profits with very little effort and easy enough that anybody who invest time to actually studying the systems will get their moneys worth. The stock market is so 1950s... Crypto is the future of finance, I don't think there is any doubt anymore.

As long as your money is in the market, you will win long-term.

Namaste.

LTCUSDT.P trade ideas

The key is whether there is support near 95.73

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(LTCUSDT 1D chart)

The key is whether the price can be maintained above the M-Signal indicator on the 1M chart.

Accordingly, the key is whether there is support near 95.73.

If it fails to rise, you should check whether there is support near 79.84.

In order for the stepwise uptrend to begin, it is likely to start by rising above 113.39.

If you are trading LTC, you should check whether there is support near 95.73 and create a trading strategy.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote it to update the previous chart while touching the Fibonacci ratio range of 1.902(101875.70) ~ 2(106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point to watch is whether they can receive support and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

Litecoin Breakout And Potential RetraceHey Traders, in today's trading session we are monitoring LTCUSDT for a selling opportunity around 85 zone, Litecoin was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 85 support and resistance area.

Trade safe, Joe.

LTC/USDT 12H chart reviewHello everyone, let's look at the 12H LTC chart to USDT, in this situation we can see how the price came out of the downward trend and currently you can see the movement of the newly created upward trend line. Going further, let's check the places of potential target for the price:

T1 = $ 89

T2 = $ 97

Т3 = $ 109

Let's go to Stop-Loss now in case of further declines on the market:

SL1 = 85 $

SL2 = $ 77

SL3 = $ 67

SL4 = $ 63

Looking at the RSI indicator, we see

Return to the lower limit, which can potentially give energy to make the price re -perform upward movement.

Bullish on Litecoin: Targets Set at $135 and $145Litecoin (LTC) is showing strong signs of a bullish reversal after a sustained period of consolidation and a failed breakdown from a critical support level. The price recently bounced from the strong support zone at $62.97, confirming this level as a reliable base. Notably, the asset failed to break below this support, suggesting accumulation and potential for upward momentum.

Currently, LTC is trading around $87, just above the local resistance and forming a bullish structure. A clear breakout above this region could trigger a strong upward move toward the next resistance target of $135.43, and potentially the second target at $145.46, which aligns with a historical resistance level.

A well-placed long trade setup is visible:

Entry Point: $87.04

Stop Loss: $74.66 (approx. -14.80% risk)

Take Profit: $135.43 (approx. +54.55% potential upside)

This trade offers a favorable risk-to-reward ratio of 3.69, making it attractive for bullish traders.

The MACD indicator below the chart is also showing early bullish crossover signals, with the MACD line approaching a break above the signal line. If this momentum continues, it would further support the bullish outlook.

Fundamental Insight: Why Litecoin Has Long-Term Potential

Litecoin offers several key technical differences compared to Bitcoin:

Faster transaction speed: 2.5-minute block time vs. Bitcoin’s 10 minutes

Lower transaction costs

Uses Scrypt instead of SHA-256 for its proof-of-work consensus

Larger maximum supply: 84 million vs. Bitcoin’s 21 million

Positioned as the "silver" to Bitcoin's "gold," Litecoin serves as a faster, more scalable alternative in real-world transactions. With its four-year halving cycle, similar to Bitcoin, and historical resilience, LTC continues to be a solid mid-cap crypto asset for long-term holders.

Litecoin (LTC) Lesson 15 said - This is How to Read the ChatLesson 15 Methodology Chart Reading:

1. Highest up volume wave (sellers could be there)

2. Placed AVWAP lines at the beginning of the wave

3. Wait for price to cross downward AVWAP line

4. Pull back with an Abnormal Speed Index of 24.1S , that's a hard to move up, meaning sellers are absorbing on the up move

5. Enter Short on a Plutus signal which in this case is a double signal WS (Wyckoff Spring) and PRS (Plutus Reversal Short)

Enjoy!!!

Litecoin LTC price analysis“By hook or by crook,” they are trying to keep the price of #LTC upper to the blue trend line, which has been in place since 2019.

On this chart, we have depicted horizontal and dynamic Fibo levels, and they are working well.

1️⃣ If the OKX:LTCUSDT price stays above $75, it will be a strong signal that it's time to go up.

2️⃣ If the #LTCUSD price drops to $66-68, it will be back on the trend line and will fight for the right to exist.

3️⃣ It would seem that a few dollars of difference, but the prospects are radically different.

In general, I'd like to see #Litecoin at least at $165-175.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

LITCOINFounder of Litecoin

Charlie Lee is the founder of Litecoin.

He created Litecoin in 2011 as a "lighter" version of Bitcoin, aiming to provide faster transaction confirmation times and a different hashing algorithm (Scrypt) to allow broader mining participation.

Charlie Lee is a well-known figure in the cryptocurrency community and has been active in promoting Litecoin’s adoption and development.

Summary

Short-Term Bias Cautiously bullish with volatility

Founder Charlie Lee

Founder’s Vision Faster, more accessible alternative to Bitcoin

Conclusion:

Litecoin’s trade directional bias in April–May 2025 leans toward a bullish rally with expected price appreciation up to around $120, tempered by potential mid-month corrections. Investors should monitor key support and resistance levels closely. The coin’s founder, Charlie Lee, remains a prominent advocate for Litecoin’s role as a faster, more accessible cryptocurrency alternative.

Litecoin (LTC) - Long Setup📋 Context:

🔵 Open Interest stable or slightly increasing → healthy position building.

🔵 Top Traders Ratio strongly rebounding → top traders are re-accumulating long positions.

🔵 CVD Spot rising → real spot buying support is coming back.

🔵 CVD Futures rebounding → shorts being squeezed and absorbed.

🔵 Funding Rate neutral → no immediate risk of short squeeze against longs.

🔥 Liquidations:

🔵 95% of potential liquidations are shorts → strong imbalance to exploit.

🔵 Optical Map shows a wall of short liquidations just above the current price → objective is to grab them.

📈 Technical Structure:

🔵 Clean bullish structure on the 15-minute timeframe.

🔵 Stop Loss placed just below the recent swing low.

🎯 Trade Plan

Entry: Current price zone 85.7

Immediate Target (TP1): 87 $ → grabbing short liquidations.

Extension Target (TP2): 88 $ → if momentum remains strong.

Stop Loss (SL): Below 84 $ → invalidation if clean break of structure.

Is #LTC on the Edge of a Major Breakdown? Watch Key Levels Yello Paradisers! Is #Litecoin about to collapse after completing a suspicious Ending Diagonal pattern? Let’s dive into this critical setup on #LTCUSDT:

💎#LTC is currently trading around $87, sitting just below a major resistance zone between $92 and $97. Price has been moving inside a textbook Ending Diagonal formation, and based on the current structure, the 5th wave of this diagonal appears to still be unfolding—but the clock is ticking.

💎Volume has been fading even as price attempts to push higher, a classic warning sign deep inside a wedge. At the same time, momentum indicators are showing bearish divergence, hinting that the strength behind this up-move is running out of steam.

💎The red Resistance Zone above is absolutely critical. If #LTCUSD manages to break and hold above $96, the bearish setup would be invalidated, opening the path for a strong impulsive move toward $104 and beyond. However, unless that breakout happens with convincing volume, the odds strongly favor the downside.

💎If price fails to push higher, the first sign of confirmation will be a break below the ascending support trendline near $86–$84. A decisive move below this support would likely trigger a fast drop toward the next major support around $76. If that fails to hold, a full breakdown into the $64 region becomes very likely, as that's where strong historical demand exists according to the Volume Profile.

Play it safe, respect the structure, and let the market come to you!

MyCryptoParadise

iFeel the success🌴

Forming Bearish Head and Shoulders PatternWelcome to today's analysis! Let’s break down the current price action on CRYPTOCAP:LTC and potential trade setups.

🌐 Overview: CRYPTOCAP:LTC Forming Bearish Head and Shoulders Pattern

📈 CRYPTOCAP:LTC is currently forming a head and shoulders pattern, which is typically bearish and could indicate a potential downward move.

🔄 Current Scenario:

CRYPTOCAP:LTC has formed a left shoulder, head, and is now developing the right shoulder. The purple neckline is a key support level to watch.

A break below the purple neckline could signal a bearish continuation and a potential move toward the green line target level.

🔑 Key Levels to Watch

🔴 Neckline Support: Purple Neckline (Key level to watch for a breakout)

🟢 Target: Green Line Level (Measured move equal to the distance from the head to the neckline, projected downward from the breakout point)

🛠️ Trade Scenarios

📌 Bearish Scenario (Breakout Below Neckline)

If CRYPTOCAP:LTC breaks and holds below the purple neckline support, it could move toward the green line target level.

This breakout would confirm the head and shoulders pattern and suggest a potential downward trend.

📌 Bullish Scenario (Failure to Breakout)

If CRYPTOCAP:LTC fails to break below the purple neckline and instead moves higher, it could retest the resistance levels within the pattern.

A failure to hold below key resistance levels could indicate a potential reversal or further consolidation.

📌 Conclusion

CRYPTOCAP:LTC is forming a head and shoulders pattern. A breakout below the purple neckline support could signal a bearish move toward the green line target level. If the price fails to break out, further consolidation or a retest of resistance levels may be necessary

Litecoin scalp longJust now hopped into this litecoin scalp long. Targetting $84.5

Expecting to tp within next 4hrs or less....maybe like 2hrs.

DTT applied but a little bit more risky hence why want to get in and out quickly.

Overall market is trending up, this an attempt to take advantage of the momentum

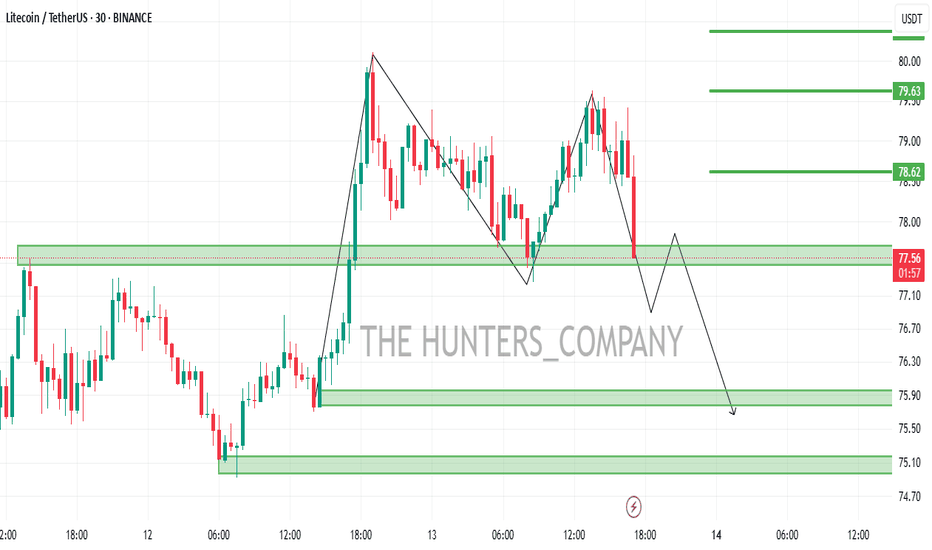

Litecoin Breakout and Potential RetraceBINANCE:LTCUSDT : Hey Traders,

In today's session, we're keeping a close eye on LTC/USDT as it approaches the $77 area, a key support-turned-resistance zone.

Litecoin recently broke below its previous uptrend, indicating a potential shift in momentum. It is now in a corrective phase, with price retracing back toward the broken trendline and horizontal resistance around $77.

This level could act as a strong rejection zone, offering a potential selling opportunity if bearish confirmation shows up.

LTC/USDT:BUYHello friends

Due to the good price growth, we see that the price has hit a lower ceiling and has fallen, which we can buy in stages during the price decline, within the specified ranges and move with it to the specified targets.

Observe capital and risk management.

*Trade safely with us*

Litecoin (LTC): Getting Ready For Another 30% Drop?Litecoin is forming a smaller bullish trend here, where usually after the correction if we see these kinds of moves we are experiencing a further dip, so let's see if we manage to form a breakdown!

More in-depth info is in the video—enjoy!

Swallow Team

Litecoin (LTC): Forming Bullish Channel, Might Shoot UpLitecoin is forming here a nice bullish channel from where we might see a quick spike to upper zones.

Our first target zone is that bullish CME gap, which we intend to see filled, and once we see further dominance, then the upper resistance zone (where there are a lot of FVGs).

Swallow Team

Litecoin (LTC): Possible 22% Recovery IncomingLitecoin has a chance to recover 22% from current zones as we have one unfilled CME gap and we are in overbought zones with Bollinger Bands. Waiting for confirmations now but it seems we will fill the CME soon!

More in-depth info is in the video—enjoy!

Swallow Team