Litecoin (LTC): Possible Recovery of 30%Litecoin has recently done another liquidation movement where usually we have had a similar move of recovery.

That's what we are looking for: a recovery to upper zones where the first target is going to be the EMAs and the second one would be the upper resistance zone (the region around it).

Swallow Team

LTCUSDT.P trade ideas

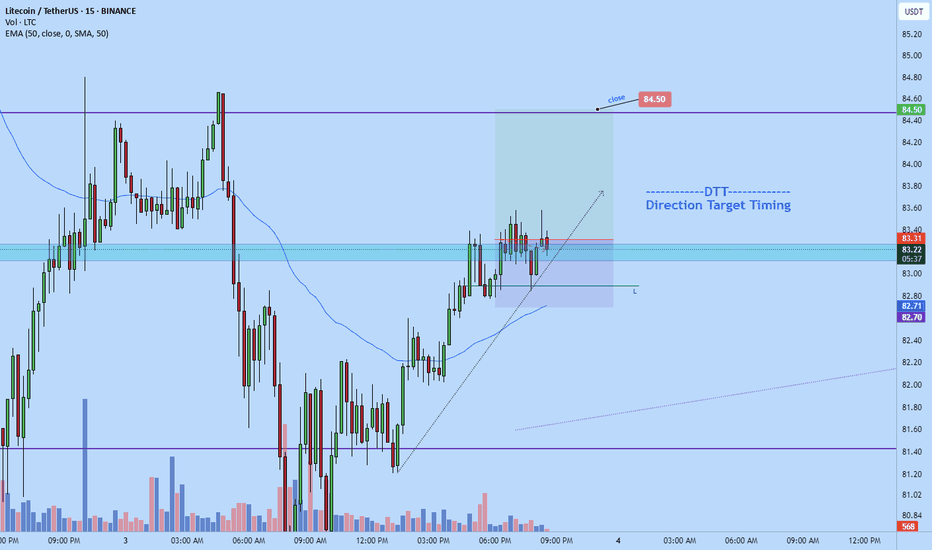

Short-Term Short Position LTC/USDT🔥 LTC/USDT – Approaching Key Short Zone

Litecoin (LTC) has formed a rising wedge structure after rebounding sharply from local lows. Price now faces a critical short zone near 81.62 - 84.16, where sellers could potentially step in if LTC fails to break above with conviction.

🟣 Zone to Watch

“Possible Short Zone” (in purple) — a high-probability entry area for short trades given the overhead resistance and wedge convergence.

Entry Points:

Entry 1: ~81.62 (initial level within the wedge)

Entry 2: ~84.16 (upper boundary, near resistance)

📉 Momentum & Setup

Chart Formation: The rising wedge implies potential exhaustion of bullish momentum if price fails to continue upward. A break below wedge support often signals a bearish turn.

Volume Consideration: Look for a sell-volume uptick or a clear rejection around Entry 1 or 2 or within the short zone to confirm a likely reversal.

🟢 Take-Profit Zones

✅ TP1: ~79.25

✅ TP2: ~75.08

✅ TP3: ~69.55

✅ TP4: ~63.53 (Extended downside if momentum persists.)

❌ Invalidation Level: 87.30+

(A strong close above this level indicates a breakout from the short window)

🧠 Narrative

This setup showcases a potential bearish retest, as LTC’s swift rebound has led price into a narrowing wedge. If buyers fail to push beyond 81.62 – 84.16

Savvy traders may anticipate a correction. A volume-backed rejection in this zone could send LTC back toward its lower support levels.

🎲 Market Context

Monitor broader market sentiment and Bitcoin’s performance; a strong BTC rally could invalidate downside expectations.

📌 Risk Management

Position Sizing: Trade responsibly according to your risk tolerance.

❌ Stop-Loss: Place it above the invalidation level (e.g., around 87.30+ to mitigate unforeseen breakouts.

Reevaluate if the market shows signs of bullish continuation beyond the wedge.

Litecoin analysis using multiple toolsPlease read the full analysis to get the complete picture.

Let's start with the trend lines.

We have three increasing angles of support trend lines. The third one marked with this week's low so it might change if we happen to get a lower low.

For the resistance we have R1 which is anchored at the ATH at the December 2024 top. This resistance trend line was tapped twice more, in January and February 2025, creating marginally lower highs marking the triple top which sent Litecoin to its recent low.

R1 and any of the support trend lines, most notably S2 create a symmetrical triangle. This triangle can break either way and any time. So in theory, it could take it's time until late 2026 or early 2027. If it breaks in 2026, I would expect it to breakdown given that would correspond to the bear market timing of the bitcoin four year cycle.

Next let's take a look at the pitchfork.

This is a Schiff pitchfork from the 2018 bear market lows to the all time highs to the 2022 bear market lows. Macro pitchforks like this one tend to be respected. We can see that the August 2024 low hit the outside line of the pitchfork. The 0.5 line (green) flipped multiple times in this cycle between being support and resistance.

The Schiff pitchfork in this case gives us the most conservative targets. More bullish targets are observed when switching to the modified Schiff pitchfork. However, for proper risk management it is better to start with the Schiff pitchfork and only if the price breaks the resistance levels, then switch to the modified Schiff. Here is the modified Schiff pitchfork:

We can see interesting price interaction here as well. The August 5th 2024 weekly close was still above the outside line. The currently weekly low also hit the outside line. Similarly to the Schiff pitchfork, the 0.5 line also flipped multiple times being support and resistance.

Zooming in on the price action since the December 2024 high, we can examine the Fibonacci retracement and how it aligns with the pitchfork, supply zones and a fair value gap (FVG).

At the time of this writing, we are about 5 hours away from a pretty bullish weekly candle about to close above the 0.236 Fib with the first significant volume increase since the week of February 24th. The next Fib levels are potential resistance levels. The 0.382 and 0.5 Fibs fall within the first supply zone. The 0.786 and the final 0.886 Fibs fall within the second supply zone. The most bullish artifact on the chart is the weekly FVG. These gaps tend to be filled and the one we have here borders the 0.618 Fib. Moreover, the pitchfork 0.5 line falls withing this FVG. If the FVG will be completely filled during a rally in the next few months, the price will break above the pitchfork 0.5 line and hit the resistance at 0.618 Fib.

If the price breaks the 0.618 Fib the next resistance area will be composed of the second supply zone, 0.786 and 0.886 Fibs and R1. Once this resistance area is cleared and price breaks above the December 2024 high at 147$ it can challenge the Schiff pitchfork median line with price targets at 180-190$ depending on when it will be hit. The median line is expected to be a major resistance, especially since it will be the first touch hitting it. If broken, the modified Schiff pitchfork gives targets at 230-250$ depending on when it will be hit.

For completeness, a quick look at the RSI and SRSI.

RSI is around 43. SRSI is about to cross bullish ( [ending the weekly close) and still needs both the fast line and slow line to cross 20 for a complete bullish signal.

No altcoin analysis is complete without examining the BTC pair.

LTCBTC had last week the lowest weekly close since the week of November 4th 2024. In the RSI this resulted in the first instance of a bullish divergence since the LTC significantly outperformed BTC in November 2024. A similar bullish divergence happened leading into the week of November 4th 2024. However, note that since January 2024 LTCBTC made lower lows while most of the time the RSI made higher lows. Therefore, we can observe a continued period of weekly bullish divergences since January 2024 but it only unfolded into significant outperformance in November 2024. So, the bullish divergence is clearly bullish but it is hard to tell if it will result in LTC outperforming BTC in the near or far future.

The SRSI is oversold but I wouldn't build too much on that.

Also, not shown, LTCBTC MACD and LMACD are clearly crossed bearish.

To sum up, LTC seems to have a clear path to the upside if the BTC bull run continues. As for whether or it will outperform BTC, it is hard to tell.

LiteCoin (LTC) - Chart reading with Weis Wave with Speed Index

Lesson 15 Methodology:

1. Largest up volume wave at the bottom after while (probable buyers but let's confirm using AVWAP and Weis Wave with Speed Index and it's Plutus Signals.

2. Placed AVWAP at the beginning of the previous down wave and wait for price to pullback to it.

3. Price Respects AVWAP.

4. Abnormal Speed Index 40.8 is a sign that price has a hard time to move down.

5. Enter Long on PL signal.

... and up we go!!!!

Target Fib area which was reached!

No entries now - Fib could risky!

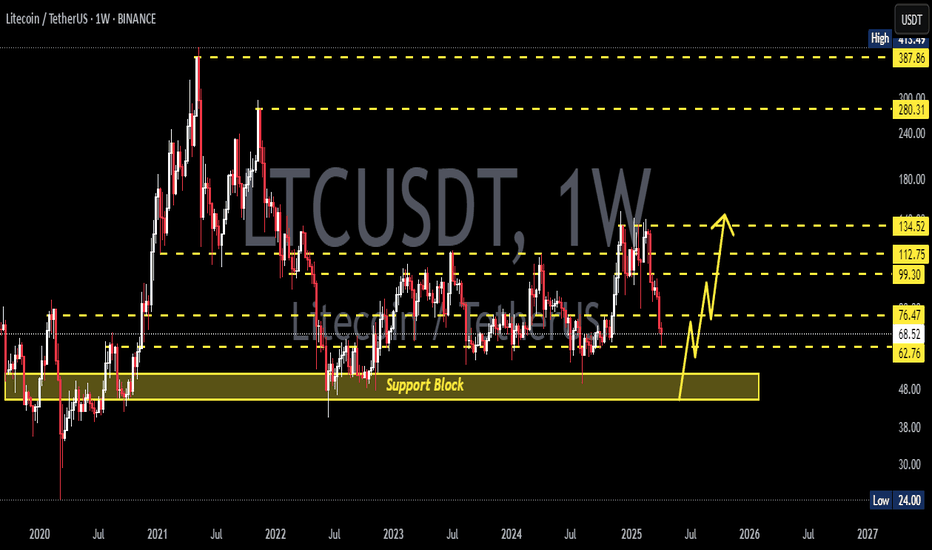

LTC/USDT 1W ChartHello everyone, I invite you to review the current situation on LTC. When we enter the one-week interval, we can see how the price is struggling to return above the upward trend lines.

Here you can see how the current rebound is going towards resistance at $ 82.82, then resistance is visible at $ 95, but an important resistance point will be around $ 115.

Looking the other way, you can see that the price has gone below the support level at $ 70, however, we could see a quick rebound, in a situation where the price continues to go down, the next very strong support is around $ 50.

It is worth looking at the RSI indicator, which shows another descent in the week interval to the level where we could previously see strong price rebounds, which could potentially repeat itself.

Litecoin: Your Altcoin ChoiceAn ultra long-term accumulation zone has been activated. Litecoin has been producing higher lows since 2018.

Right now we are looking at a major, major buy opportunity. Likely the lowest price before the start of the 2025 bull-market.

Litecoin just activated its 2022-2024 buy-accumulation-support zone. A very long, wide and strong zone.

I don't think there is much to say about Litecoin other than the time is right and the time is ripe. Growth can only happen after the completion of a bearish wave. A bearish wave is exactly what is seen on the chart now between December '24 and present day, with the bottom being hit just two days ago on April 7. This is no "bear market" as Litecoin has been sideways long-term as it can be seen clearly on this chart.

Long-term consolidation can only happen for so long. Litecoin bottomed in June 2022, almost three years and a half ago. This is the longest accumulation phase ever, and this in-turn will produce a bull market that is equally strong.

A new All-Time High is definitely on the cards for this year. This is true for Litecoin as it is true for Bitcoin, Ethereum, Cardano and most of the Altcoins market.

It is still early though and I know it is easy to doubt, and this is ok. But this long-term view of the chart leaves no room for doubt, the market has been rising from its base. Long-term higher lows, since December 2018, a signal of strength. The last bullish jump was the "initial bullish breakout," it tends to happen before the bull market phase.

The bull market is the cycle when everything grows.

A bull market tends to end in a bull-run.

A bull-run means euphoria across the market. Maximum bullish momentum accompanied with maximum growth.

We are getting so close now. We are looking good and we are looking up.

My recommendation stays, buy and hold.

Go all-in 100% Crypto.

Plan ahead if you decide to trade anything other than spot.

Spot is an easy buy and hold focusing on the long-term.

Leverage (margin) can be more complex and everything can be lost with a mistake. If you have any doubts, do not use this system for now. Only use it with profits or money to spare.

Right now is the time to secure very good and strong entry prices before the best since 2021. It will be amazing.

Thank you for reading.

Litecoin, a great Altcoin Choice!

Namaste.

LTC 1W Support Level ..Bullish Case (If Trendline Holds):

• Possible upside targets:

• Resistance at $100

• Medium-term: $160

• Long-term potential: $280+, if the crypto market enters a strong bullish phase.

⸻

Bearish Case (If Trendline Breaks):

• If it breaks below this trendline with volume, downside risk could open to:

• $36

• $22

• or even retest the lows around $13, depending on market sentiment.

⸻

Long-Term Spot Strategy:

• High-probability entry zone for long-term holders.

• Dollar-cost averaging (DCA) around this zone can be a solid plan.

• Stop-loss placement (for risk-managed traders) can be considered slightly below the trendline, e.g., $60 or $50, depending on your risk tolerance.

LTC Holding Key Support Zone Within Multi-Year RangeCRYPTOCAP:LTC is currently trading within a well-defined wide range, bound by a strong support zone near $63 and a resistance zone around $130–$140. The price has once again bounced from a rising support trendline that has held firm since 2020, confirming its significance as a long-term bullish structure.

Each time price approached this rising trendline within the support zone, it has historically led to a reversal or a strong upward move. Currently, LTC is showing signs of support around this zone again, suggesting the potential for another bounce.

However, the range-bound nature of the chart implies that until a breakout above resistance or breakdown below support occurs.

DYOR, NFA

#LTCUSDT #Litecoin

LTC/USDT: at important resistance Until the price closes below 100, the current trend structure suggests a one more leg down toward the 76–70 macro support zone.

However, if the price successfully clears the 100 resistance level - rising and closing above it with strong volume - the odds will shift in favor of a correction ending and the potential start of a new uptrend toward the 210–270 macro resistance zone.

Macro-structure:

Thank you for your attention!

Litecoin Approaching Resistance: 20% Drop to $70 Support ExpecteHello and greetings to all the crypto enthusiasts, ✌

Let’s dive into a full analysis of the upcoming price potential for Litecoin 🔍📈.

Litecoin is situated within a parallel channel and is nearing an important trendline and resistance zone. Given the current market conditions, I foresee a potential correction of approximately 20%, with a key support level at $70. This price point not only holds psychological significance but also acts as a crucial technical support area.📚🙌

🧨 Our team's main opinion is: 🧨

Litecoin is near a key trendline and resistance, and I expect a 20% drop to $70, a strong support level with psychological significance.📚🎇

Give me some energy !!

✨We invest hours crafting valuable ideas, and your support means everything—feel free to ask questions in the comments! 😊💬

Cheers, Mad Whale. 🐋

LTC Targets $70: A High-Probability Reversal SetupLitecoin (LTC) has just broken below the critical $80 low, signaling that bearish pressure is firmly in control. Currently trading at $79—just beneath the swing low at $80—LTC is also sitting below the monthly open at $82.98. With the bears flexing their dominance, traders are left wondering: Where does the price head next? What’s the target for the bears, and where can bulls find an opportunity to re-enter the market? Let’s dive into the charts, pinpoint the key levels, and craft a plan that could turn this downturn into a golden opportunity.

The Current Market Picture

LTC’s recent breach of $80 confirms the bearish momentum that’s been brewing since its peak at $147.06 on December 5, 2024. Litecoin enjoyed a stellar 122-day bullish run, soaring +195% from $49.80 to high at $147.06. Now, we’re on the 122nd day of a downtrend—a poetic symmetry that hints at a potential turning point. The question is: where will this descent find its floor, and how can we position ourselves for what’s next?

Support Zone: The $70 Fortress

To identify a robust support zone, we need confluence—multiple technical factors aligning to form a level that’s tough to crack. Here’s what the chart reveals:

Fibonacci Retracement: Using the Fib tool from the 2024 low at $49.80 to the high at $147.06, the 0.618 retracement at $86.95 has already been lost, turning our focus to the 0.786 level at $70.61. This deep retracement is a classic spot for reversals, making it a prime candidate for a support zone.

Yearly Level: At $70.14, this pivot is nearly identical to the 0.786 Fib level, adding significant weight to the area.

Volume Profile: The Point of Control (POC) from a 1.5-year trading range sits right around $70, just above the Fib level. This is the price with the highest traded volume over that period—a natural magnet for price action.

Yearly Order Block: Visualized as a green channel, this order block reinforces the $70 zone, suggesting past institutional buying interest or significant support.

Together, these factors create a $70 support zone that’s brimming with confluence. It’s not just a random level—it’s a fortress where bulls could mount a serious stand.

Long Trade Setup:

Entry Strategy: Use a Dollar-Cost Averaging (DCA) approach to build your position. Start with small buys around $75, laddering down to $70, and increase your position size as price nears the core of the support zone. Aim for an average entry of $73/72.

Stop Loss (SL): Set it below $68 to protect against a deeper breakdown while giving the trade room to breathe.

Take Profit (TP): First Target: $80 (the swing low and monthly open not far off). Main Target: $100 (a key psychological and resistance zone).

Risk-to-Reward (R:R): With an average entry at $73 and SL at $68, you’re risking $5 to gain $27 (to $100)—a stellar 5:1 R:R or better. This is a high-probability setup that rewards patience.

Execution Tip: Watch for bullish signals in the $70-$75 range—candlestick pattern, volume spikes, or RSI divergence. This isn’t about chasing; it’s about precision.

Resistance Zone: The $100 Battleground

If bulls reclaim control and push LTC higher, the $100 psychological level looms as a major resistance zone. Here’s why it’s a HOTSPOT:

Yearly Open: At $103.28, this level is close enough to $100 to bolster its significance.

Anchored VWAP: Drawn from the 2024 low at $49.80, the VWAP currently sits around $102.4, adding another layer of resistance.

Historical Context: The $100 mark has been a recurring battleground, with bulls and bears clashing repeatedly. It’s a price that carries weight.

A rally to $100 wouldn’t just be a recovery—it’d be a statement. A clean break above could hint at a broader trend reversal, but until then, it’s a ceiling to respect.

What’s Next? Bears vs. Bulls

For now, the bears are driving LTC lower, with the break below $80 opening the door to the $70 support zone. That’s their likely target—a level where selling pressure could exhaust itself. For bulls, $70 isn’t just a floor; it’s a launchpad. The DCA long setup offers a low-risk, high-reward entry.

Wrapping It Up

Litecoin’s drop from $147.06 to $79 has been brutal, but the chart is screaming opportunity. The $70 zone—backed by Fibonacci, levels, volume, and order blocks—is where bulls could turn the tide. With a DCA entry at around $73/72, SL below $68, and a main target at $100, you’ve got a trade setup that could deliver a 5:1 payoff. Meanwhile, $100 stands as the bears’ next big test if momentum shifts.

So, will you wait for LTC to hit $70 and strike, or watch the action unfold? The levels are clear—now it’s your move. Use this analysis to sharpen your edge, and let’s see where Litecoin takes us in the days, weeks, and months ahead.

________________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know, I’m here to break down the charts you want to see.

Happy trading =)

Litecoin 52RLitecoin is potentially just about to enter into a major support zone.

There is a larger degree white pattern forming an ABC correction wave and a smaller degree purple wedge pattern currently heading into the support zone.

This convergence makes this potentially a great opportunity if it moves into the zone as shown.

Trade rating 8.5/10

Probability 7/10

Risk to reward 10/10

LTC ANALYSIS (support & resistance)🔮 #LTC Analysis 🚀🚀

💲💲 #LTC is trading between support and resistance area. There is a potential rejection again from its resistance zone and pullback from its major support area. If #LTC sustains above major support area then we will a bullish move till its major resistance area

💸Current Price -- $82.20

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀💸

#LTC #Cryptocurrency #DYOR

LTC - Perfect Signal/TA Was Given Days AgoLook at those Levels.

I post both previous signal too, so you you can track it and see how those Levels and Lines played out nicely :).

I wrote : "Lower points like VAL and last low are local key levels. If the price loses these levels, then a it goes lower."

We got several beautiful Short, even a small long.

💲💵 7.6 %

💲💵 6.6 %

💲💵 5.9 %

💲💵 2.5 %

and even more ... 👌 🎯

TA given on 16th March:https://www.tradingview.com/chart/LTCUSDT/Uuxk9kRM-LTC-Some-POIs-Better-to-Short/

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️