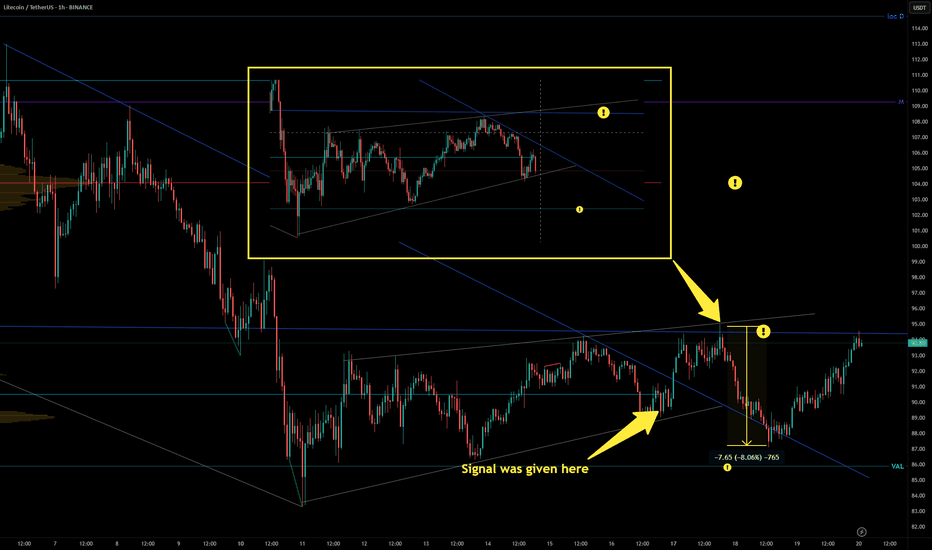

LTC - What a Nice SIGNAL was given days ago.That marked level (yellow point) gave us 2 beautiful easy Shorts.

7.6 % 👌 🎯

4.5 % 👌 🎯

Original TA was here:https://www.tradingview.com/chart/LTCUSDT/Uuxk9kRM-LTC-Some-POIs-Better-to-Short/

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

LTCUSDT.P trade ideas

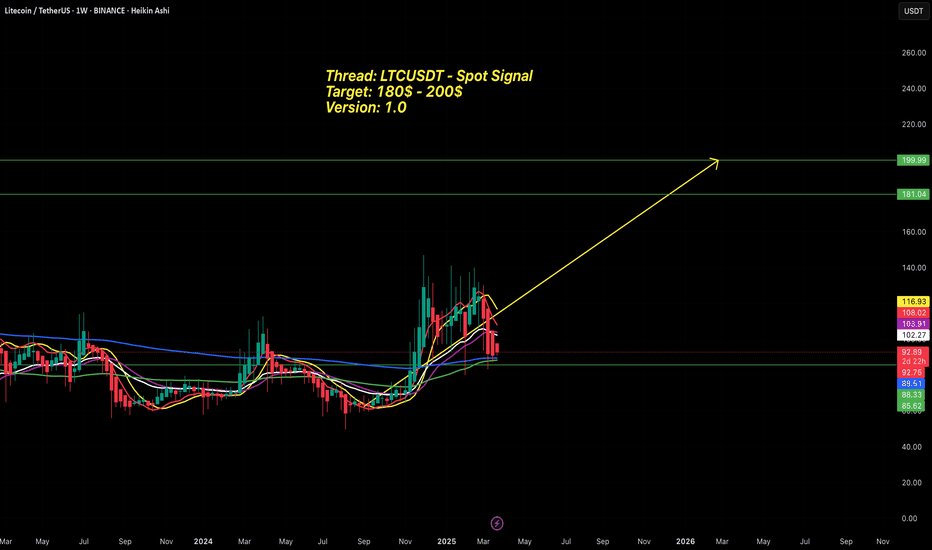

Thread 1: LTC - Spot Signal 2025Hello there,

Today, I’m kicking off 50 dedicated threads to track key parameters and critical trading pairs. Specifically, these will cover Total, Total 2, Total 3, BTC.D, BTC, the top 50 coin list, and select standout tokens.

I’ll focus on one thread at a time, delivering major updates within those threads instead of scattering small posts for every change. Feel free to hit Follow and keep tabs on the threads that catch your eye!

Thread 1: LTC - Spot Signal 2025

Buy Zone: $85 - $95

Targets: $180 - $200

Hold Time: Throughout 2025

Updates: I’ll drop additional updates here when LTC shows significant shifts.

Good luck out there!

LTC - Perfect Signal Gave 8 %What a beautiful short Signal. To the damn point!

👌 🎯 8 %

Original TA was give here:https://www.tradingview.com/chart/LTCUSDT/Uuxk9kRM-LTC-Some-POIs-Better-to-Short/

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

LTC - Some POIs - Better to ShortThere are some POIs for shorting.

Both upper yellow marks seem to be a good level.

BUT: We must do a new TA (volume etc...) if the price reaches there !

Lower points like VAL and last low are local key levels. If the price loses these levels, then a it goes lower.

You can even trade the grey TL (rising channel)

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

LTCUSDT Breakout Loading….BINANCE:LTCUSDT has been consolidating for several days, repeatedly testing resistance levels. This pattern suggests a potential breakout is on the horizon. With ETH already gaining momentum, Litecoin could follow suit. Once the market starts moving, plenty of trading opportunities may arise.

Trade Smart: Always use a stop loss and manage your risk effectively.

BINANCE:LTCUSDT Currently trading at $91.5

Buy level: Above $91

Stop loss: Below $83

Target : $130

Max Leverage 3x

Always keep Stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

LTC Ready for PUMP or what ?The price can encounter a strong pump after declining to the bottom of the triangle, and after breaking the triangle, it can reach the desired targets.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

LTC/USDT 1W🩸 CRYPTOCAP:LTC ⁀➷

#Litecoin. Macro chart Another

💯 Intermediate Target - $194

🚩 Macro Target 1 - $270

🚩 Macro Target 2 - $422

🚩 Macro Target 3 - $638

- Not financial advice, trade with caution.

#Crypto #Litecoin #LTC #Investment

✅ Stay updated on market news and developments that may influence the price of Litecoin. Positive or negative news can significantly impact the cryptocurrency's value.

✅ Exercise patience and discipline when executing your trading plan. Avoid making impulsive decisions driven by emotions, and adhere to your strategy even during periods of market volatility.

✅ Remember that trading always involves risk, and there are no guarantees of profit. Conduct thorough research, analyze market conditions, and be prepared for various scenarios. Trade only with funds you can afford to lose and avoid excessive risk-taking.

Litecoin is in a bearish cycle (12H)From the point where we placed an arrow on the chart, it appears that Litecoin's complex correction has begun.

Currently, we seem to be in wave C of this correction.

Wave C, based on the 3D structure, could end at demand 1, leading to wave D, which is a bullish wave.

However, ultimately, wave E could conclude within the demand 2 zone.

Liquidity pools for waves C and E are marked on the chart, and it is expected that each will be swept in turn.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

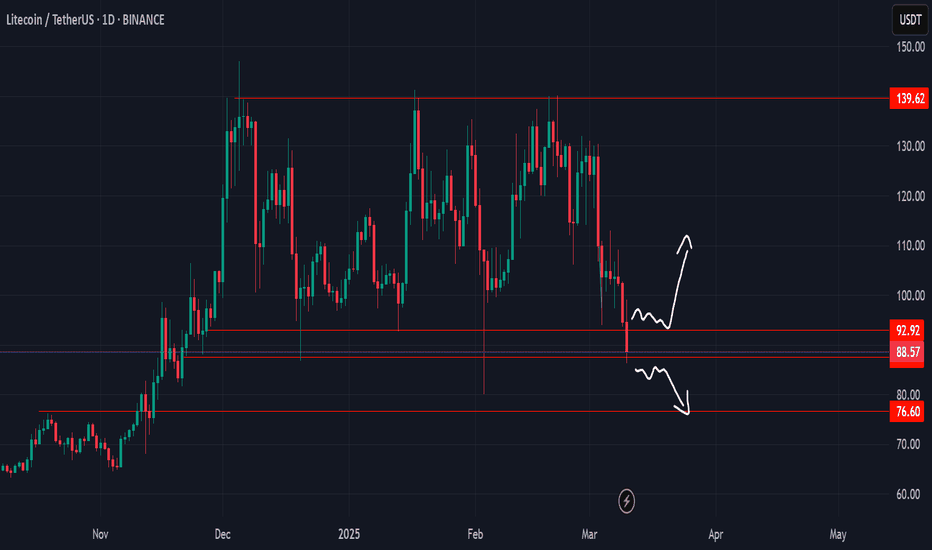

LTC at a Double Resistance ZoneLTC at a Double Resistance Zone

LTC faced a double resistance zone on the 4-hour timeframe, located near 112.80.

The price has already moved down, and on the 60-minute chart, a small bearish pattern has emerged, indicating a potential further decline.

It appears that LTC may begin a bearish trend from this zone.

Key support areas: 95, 88, and 80.50

You may find more details in the chart!

Thank you and Good Luck!

❤️PS: Please support with a like or comment if you find this analysis useful for your trading day❤️

Ltcusdt Hello guys welcome. Here I allready share idea about ltc's chart . But seller taken control so until selling market control by seller.

About me- if you all guys like my prediction and interested than follow me and I will help who trap in any trade . Top 3 select guys I will predict thair trade and share.

Notic - all market are risky and this business is possiblety base. Not be sure but do most successful home work

Ltcusdt So hello guys welcome. Here I share my idea about Trend. So I am not giving suggestion any investment so invest on your risk. If you want to learn so keep follow me and and look at my prediction how to react market

So here is the LTC chart so I found the symmetrical pattern this pattern can move any direction after break out market moment so bullish expectation so very high the reason is buying zone so let's see what happen the chat after the break out and get the target

Litecoin (LTC): Possible Downward Movement of 15%After filling the CME gap, we are seeing selling pressure here, which might send the price back by 15%. So far we have had a decent rejection as well so keep an eye on further BoS on the 5M timeframe!

More in-depth info is in the video—enjoy!

Swallow Team