LUNCUSDT trade ideas

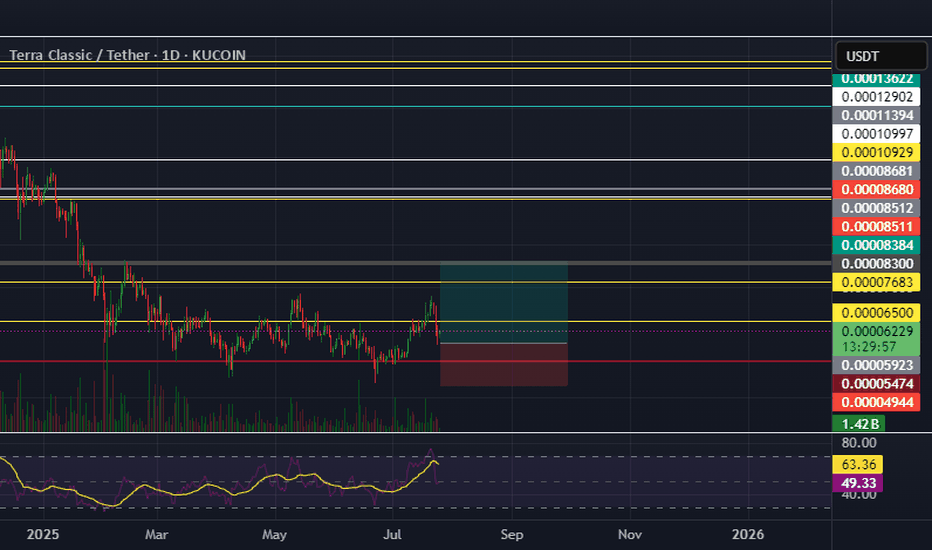

Terra Luna Classic LT Double-Bottom & 771% Potential ProfitsYou can say it is a long-term (LT) triple-bottom when taking into consideration the July-August 2024 support.

Terra Luna Classic (LUNC) has been reacting at the same level for years. Each time this strong support range gets challenged, what follows is a bullish wave.

» August 2023 marked the bottom of the bear market. And this produced a bullish wave.

» July-August 2024 marked the bottom of a correction and this produced a new period of growth.

» February-June 2025 is the present low and this too marks a market bottom, from this point on we will see so much growth. This support level is already confirmed and the action has been turning bullish. Here is what I mean.

A low in February 2025, a higher low in April and now a new higher low in June. LUNC has been growing from its base. This reveals what comes next.

When the market is bearish, these lows become lower and lower, by a significant amount. Instead, there is no bearish momentum, no bearish force, in fact, the bearish wave is over, we are seeing accumulation, four months of accumulation before a new wave of growth.

Hundreds of percentages of points up follow next. The chart shows 771% profits potential but there will be more, likely to be much more. This is the best time to buy, when prices are low. Comeback to this publication and see the results in October or November 2025. You will see the difference in price. Right now LUNCUSDT is trading at 0.00006066. In 4-6 months, prices will be many times higher. Wait and see.

Namaste.

LUNCUSDT 1D#LUNC is currently moving inside a Falling Wedge pattern on the daily chart — a classic bullish setup.

A breakout above the wedge resistance and the daily MA100 could trigger a strong upward move. Potential targets:

🎯 $0.00007163

🎯 $0.00008068

🎯 $0.00009774

🎯 $0.00011154

🎯 $0.00012533

⚠️ Always use a tight stop-loss to manage risk and protect your capital.

LUNC Bullish Inverted Head and Shoulders – Testing Neckline Agai🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Testing Neckline Again 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern and is now testing the neckline in red once again. This could be the final breakout we’ve been waiting for! 🔥

LUNC Bullish Inverted Head and Shoulders – Target Ahead!🚀 SEED_DONKEYDAN_MARKET_CAP:LUNC Bullish Inverted Head and Shoulders – Target Ahead! 📈

SEED_DONKEYDAN_MARKET_CAP:LUNC has formed a bullish inverted head and shoulders pattern. If confirmed, the first target could be the green line level! 📊

Let’s catch this breakout together! 💼💸

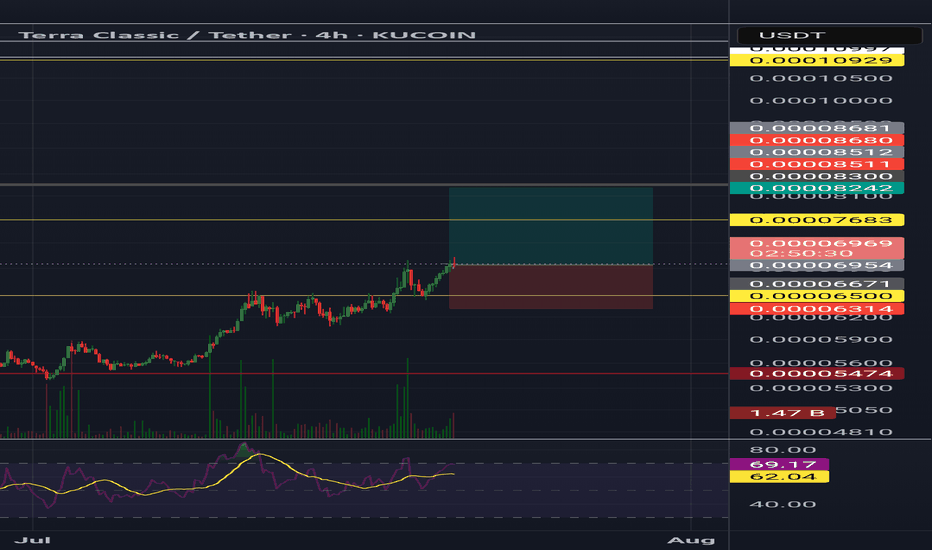

LUNC ANANLYSIS (2D)LUNC, after a strong pump in the form of an X wave, appears to have entered a diametric pattern and is now at the end of Wave E.

In the green zone, we are looking for buy positions in spot, while in the red zone, we are looking for sell/short positions in futures.

To invalidate the buy and sell outlooks, we have marked two invalidation levels on the chart. If a daily candle body closes above or below these levels, the respective outlook will be invalidated.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Terra Luna Classic ($LUNC) Hits Major Burn MilestoneThe Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) ecosystem has reached a significant milestone, burning over 405 billion LUNC since May 2022. This deflationary move, alongside the burning of 3.5 billion USTC, has fueled optimism for a potential price breakout. As fundamental and technical indicators align, market sentiment suggests an imminent shift in trajectory.

The Impact of LUNC and USTC Burns

The Terra Luna Classic community has remained committed to revitalizing the ecosystem following its 2022 collapse. The burning of tokens serves as a crucial deflationary strategy aimed at reducing supply and, in turn, boosting demand. According to the latest burn tracker update, the total LUNC burned has reached 405,867,335,786, with USTC burns surpassing 3.5 billion tokens.

One of the key contributors to this burn mechanism is Binance, which has reaffirmed its commitment to reducing LUNC’s circulating supply. The exchange recently incinerated 760 million LUNC from trading commission income for February, highlighting the sustained community and partner contributions toward the token’s long-term sustainability.

Despite the aggressive burn, LUNC has struggled to break past major resistance levels. However, the positive market sentiment stemming from these fundamental shifts could be the catalyst needed for a substantial price movement.

Technical Outlook

LUNC’s price is currently trading at $0.00006094, marking a 5% increase in the past 24 hours. However, the broader market turbulence has caused LUNC to decline 5.74% over the past week and 46% Year-to-Date (YTD).

Key Technical Indicators:

The RSI is pegged at 41, a neutral zone that signals room for a potential bullish surge while still susceptible to downside risks. SEED_DONKEYDAN_MARKET_CAP:LUNC is currently testing the 38.2% Fibonacci retracement level. A breakout above this key resistance could signal the start of a bullish reversal.

If selling pressure persists, a dip below the 1-month low could be inevitable, potentially dragging LUNC back into bearish territory.

LUNC Ecosystem Updates: What’s Next?

Earlier this year, the Terra Luna Classic development team outlined five major updates aimed at strengthening the ecosystem. These include removing fork modules, enhancing token burns, and refining governance mechanisms. While most of these plans have been successfully implemented, the long-term success of LUNC still hinges on broader market sentiment and further adoption.

Conclusion

The latest burn figures have reignited optimism within the Terra Luna Classic community, setting the stage for a potential bullish turnaround. With key technical indicators aligning with fundamental improvements, LUNC traders are eyeing a breakout above critical resistance levels.

XRPUSDT (OKX) Analysis - Summary OKX:XRPUSDT.P

XRPUSDT is at a critical juncture. The long-term trend (TF Day) shows early signs of an uptrend, but the medium-term (TF4H) is becoming uncertain, and the short-term (TF15) is in a downtrend.

* **TF Day:** Early Uptrend, Money Flow indicates buying pressure.

* **TF4H:** Becoming uncertain, pullback, Money Flow indicates uncertainty.

* **TF15:** Downtrend, Money Flow indicates selling pressure.

**Strategies:**

1. **Wait & See (Best Option):** Due to conflicting timeframes.

2. **Buy on Dip (Day, 4H) - *Very High Risk*:** Must wait for reversal signals on TF15 first.

3. **Short (15m) - *Very High Risk*:** If price fails to break above EMA/resistance on TF15.

**Recommendations:** Exercise extreme caution, wait for clear signals, and prioritize risk management.

LUNCUSDT (OKX) Analysis - Summary OKX:LUNCUSDT.P

LUNCUSDT is facing selling pressure and the trend is becoming uncertain. Although there were previously positive signs on the TF Day, now all three timeframes (Day, 4H, and 15m) are showing selling pressure.

* **TF Day:** Becoming uncertain, Money Flow starting to show selling pressure.

* **TF4H:** Downtrend, Money Flow indicates selling pressure.

* **TF15:** Downtrend, Money Flow indicates selling pressure.

**Strategies:**

1. **Wait & See (Best Option):**

2. **Short (High Risk):** If price fails to break above EMA/resistance on any TF.

3. **Not Recommended to Buy:** Until there are clear reversal signals.

**Recommendations:** Exercise extreme caution, LUNC is very high risk, wait for clear signals, and prioritize risk management.

$LUNC Long Setup see on Chart, LUNC Price on the Rise as Terra..LUNC Price on the Rise as Terra Classic Moves Closer to 403B Target

The Terra Luna Classic (LUNC) market rose continuously during five trading days and surpassed its essential resistance barrier. On February 12, LUNC reached its peak value at $0.0000784 while showing a 59% rise relative to its yearly market lows.

LUNC Burn Activity Triggers Price Surge

The upward price trend of LUNC joins altcoins in general, which have recovered from their local winter lows reached on Monday. LUNC’s latest price increase stems directly from the continuous token-burning efforts on the Terra Classic network.

LUNC Metrics demonstrates that the network has destroyed more than 628 million tokens throughout the previous week. The latest round of burning operations has expanded the total destroyed LUNC supply up to 402.78 billion since the initiative commenced.

The current pace indicates that the total burned supply will cross the 403 billion threshold during the latter part of this month. Between on-chain network transactions and Terraform Labs donation amount, 67.86 billion of the total burned tokens have been eliminated thus far, but 334.92 billion tokens were directed toward the burn wallet.

Binance stands out as the primary supporter of LUNC burning through its destruction of more than 70.8 billion tokens, as noted in our earlier post. The burn process received substantial support from the DFLUNC Protocol, which managed to destroy 4.52 billion tokens, along with LunaticsToken, which burned 1.97 billion tokens.

The Terra Classic community believes that ongoing burn operations alongside staking might possibly resolve the issues that affect TerraClassicUSD (USTC).

USTC, the stablecoin that lost its peg during the Terra ecosystem collapse, also recorded a notable surge. USTC price rose above 13.22% today to reach the value of $0.01875. However, the current value of USTC remains 5,233% below its target dollar value of $1, therefore necessitating further increase in price.

LUNC Price Analysis Today

On Wednesday, LUNC price continued surging, trading at $0.00007805, up by 5.12% at press time. A formation of hammer candlestick pattern emerged at this price level with its long lower wick and tiny body structure, which often indicates a bullish reversal move, as mentioned in our previous story.

The LUNC price exceeded the upper boundary forming the pattern of declining wedge. The falling wedge is created by descending trend lines that move toward one another and generally signal bullish price movements. Terra Classic overcame its previous support area at $0.00007140 in early September.

Terra Classic stands to potentially reach its next major resistance point at $0.0001025 after breaking through this barrier because this level corresponds with the 38.2% Fibonacci retracement measure. The future price potential stands at 40% above its current value according to this target measurement. Hence, the current bullish outlook would become invalid if market bearishness drives prices beneath the $0.00005525 support

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always conduct your own research before making any investment decisions. Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.

LUNC outlookLunc price has come back down to support.

Option to long from support (after confirming on LTF that we have some kind of reaction).

There is one more support level below so possibility of price coming back here if we see a retrace in the market. Again, if price does come back to the lower support area, this would definitely be a good area to long with appropriate risk management.

$LUNCUSDT - goal is move higherPropose 2 scenarios for BYBIT:LUNCUSDT - first moving up during the 6 months, second is the nearest correction and long after with the good potential in a year.

Does not constitute a recommendation.

#furoreggs #investing #currency #idea #forecast #trading #analysis

If you want to discuss, please subscribe and challenge this point of view

Luna Classic: Burn Tax Proposal Sparks Debate Amid Price DeclineThe Terra Luna Classic ( SEED_DONKEYDAN_MARKET_CAP:LUNC ) community has initiated a heated discussion surrounding Proposal 12149, which aims to increase the on-chain tax rate from 0.5% to 1.5%. While this measure promises to enhance LUNC’s burn rate and bolster funding for the community and Oracle pools, it has not been without controversy. The vote comes in the wake of the successful v.3.3.0 network upgrade, which simplified tax handling and improved the ecosystem for developers and dApps.

The Proposal: A Closer Look

The proposed tax increase would triple the burn tax, allocating 1.2% for burns and 0.3% for community and Oracle pools. Proponents argue this move could significantly reduce the total supply of LUNC, accelerate burns, and increase funds available for staking rewards and ecosystem growth.

However, critics, including Binance co-founder Changpeng “CZ” Zhao, have raised concerns about higher taxes potentially deterring developers and layer-2 projects from building on the Terra Luna Classic network. Validators have also expressed divided opinions, with 43.24% voting "Yes," 16.01% voting "No," and 40.74% voting "No with veto" as of the latest tally.

Current Market Performance

Despite the promising implications of the burn tax proposal, LUNC has struggled in the market, dropping 9% in the last 24 hours to $0.0001135. The token’s trading volume surged by 38% during the same period, indicating heightened market activity. Similarly, USTC has seen a 7% drop, trading at $0.02029, with an 87% increase in trading volume.

Technical Analysis

From a technical standpoint, SEED_DONKEYDAN_MARKET_CAP:LUNC is in oversold territory, with the Relative Strength Index (RSI) at 28. This low RSI typically signals a potential correction or breakout, presenting two possible scenarios:

1. Upside Potential: The active community and the burn mechanism could drive renewed investor confidence, sparking a rally.

2. Downside Risk: If the broader market correction persists, LUNC may continue its downward trajectory, especially as Bitcoin’s ( CRYPTOCAP:BTC ) price movement exerts influence over the altcoin market.

Immediate support for SEED_DONKEYDAN_MARKET_CAP:LUNC is seen at $0.0001115, with resistance at $0.0001243. A breakout above this resistance could signal a short-term recovery, while a failure to hold support might lead to further declines.

Fundamental Outlook

The burn tax proposal highlights the Terra Luna Classic community's commitment to reducing token supply and strengthening the ecosystem. However, the divided vote underscores the challenge of balancing ecosystem growth with immediate investor sentiment.

Despite the current price volatility, LUNC's long-term potential remains tied to the community's ability to execute on its vision and navigate market challenges. If Proposal 12149 passes, the increased burn rate and enhanced community funding could lay the groundwork for a more robust Terra Luna Classic network.

Conclusion

While LUNC’s recent price action reflects broader market trends and skepticism around the burn tax proposal, its strong community backing and proactive governance measures position it as a token with significant long-term potential. Traders and investors should closely monitor the outcome of Proposal 12149 and key technical levels to gauge the token’s next move.

LUNC 3-Day Chart

▶️In my longer term view for LUNC, we are currently in black wave 2 correction inside the larger gray wave 3.

▶️If this scenario plays out, we would be looking at a 2-3x gain in the next few months.

▶️It is not yet clear if black wave 2 is finished or we are still in a longer correction (A).

▶️ The blue descending trendline is the key for price to pump.

LUNC looks ready to test my targets !boost and follow for more ❤️🔥

I really like what Im seeing on LUNC, the bounce from major support.. trend breakout and then retest (bullish), now approaching a major pivot level.

If we can break .00012 then a rally higher to .00018-.00025 should come within days or a week..

this is my first post in a while, will try to get back into sharing my thoughts here on tradingview! see you all soon with more 🙏🚀

$LUNC Price above $0.00015000 and it will Touch $0.00016000 BINANCE:LUNCUSDT Price above $0.00015000 and it will Touch $0.00016000 price level. Its price now Big FVG area and touch the Dynamic Price level area. See on chart more Details

Disclaimer: Digital asset prices are subject to high market risk and price volatility. The value of your investment may go down or up, and you may not get back the amount invested. You are solely responsible for your investment decisions and Binance is not available for any losses you may incur. Past performance is not a reliable predictor of future performance. You should only invest in products you are familiar with and where you understand the risks. You should carefully consider your investment experience, financial situation, investment objectives and risk tolerance and consult an independent financial adviser prior to making any investment.