SEINV trade ideas

Paisalo Digital Co-Origination Loan Model

State Bank of India has signed its first Co-Origination of Priority Sector Loan Agreement with Paisalo Digital Limited. State Bank of India’s Low Cost of Funds, and Paisalo’s Low Cost of Operations results in Lowest Borrowing Cost Offering to the bottom of the pyramid customer. Under this model, SBI contributes 80% of Loan Value while PAISALO contributes the remaining 20% of the loan value. Risk and Reward sharing is 80:20 ratio under the model.

PAISALOStock Name - Paisalo Digital Ltd.

✅#PAISALO trading above Resistance of 188.

✅Next Resistance is at 240.

✅Moved 78% in 8 weeks.

Weekly chart setup

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Master Score - B

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

PAISALO - Poised to break all time high, for a swing of 25%The stock is in strong uptrend in all time frames - higher to daily and above.

The stock is in strong momentum based on RSI in D, W, M. All above 60.

Daily is reversing from a Higher low formation with double bottom and Morning star formation.

One may consider an entry based on today's close candle, or even at cmp if aggressive.

Entry - 104/105

Target - 112 , 126, 136.

Trail profits after each target.

Trade idea in Paisalo Stock

👋 Hey there! Ready to dive into the trading game? I'm your go-to Technical Analyst for some cool trade observations and trading wisdom. Just a heads up, my recommendations are all about learning and watching – no pressure to jump in. Let's break down those charts and turn them into some savvy trading know-how. Ready for a laid-back but enlightening journey through the markets? Let's do it! 📈✨

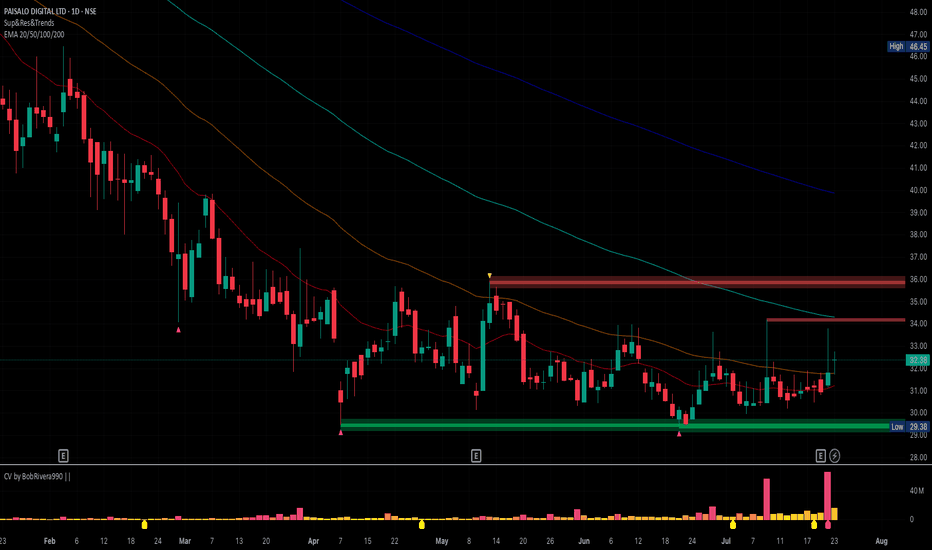

NSE:PAISALO

PaisaloStock name = Paisalo Digital Limited.

Weekly chart setup

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. this is not buying and selling recommendations. I am not SEBI registered. please consult your financial advisor before taking any trade.

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Trendline Breakout in PAISALO

BUY TODAY SELL TOMORROW for 5%

Buy Today, Sell Tomorrow: PAISALODON'T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Book profits within the first 30 minutes of the market opening

- Try to exit by taking 3-5% profit of each trade

- SL can be taken when the 5/15 min candle closes below 44EMA

- SL can also be maintained as 1% or closing below the low of the breakout candle

The levels mentioned on the chart are calculated using the BREAKOUT INDICATOR

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that 90% of the stocks give most of the movement in just 1-2 days and the rest of the time they either consolidate or fall

Resistance Breakout in PAISALO

Buy Today, Sell Tomorrow: PAISALO