TTSTE trade ideas

TATA STEEL at Resistance ZoneThis is Daily Chart of TATA STEEL.

Tata steel having good Law of Polarity at 163-168 range.

If this level is sustain , then We may see lower prices in the stock again.

Tata steel is a good support zone at 125-130 range.

Two EMAs are also supporting the stock, with the first EMA positioned at ₹140 and the second at ₹129.

THANK YOU !!

Tata Steel Ltd view for Intraday 21st May #TATASTEEL Tata Steel Ltd view for Intraday 21st May #TATASTEEL

Resistance 160 Watching above 161 for upside momentum.

Support area 155 Below 155 ignoring upside momentum for intraday

Watching below 154 for downside movement...

Above 160 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

TATA Steel Ltd view for Intraday 13th May #TATASTEEL TATA Steel Ltd view for Intraday 13th May #TATASTEEL

Resistance 155 Watching above 155 for upside movement...

Support area 148-150 Below 150 ignoring upside momentum for intraday

Watching below 147 for downside movement...

Above 155 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

TATA Steel Ltd view for Intraday 13th May #TATASTEEL TATA Steel Ltd view for Intraday 13th May #TATASTEEL

Resistance 155 Watching above 155 for upside movement...

Support area 148-150 Below 150 ignoring upside momentum for intraday

Watching below 147 for downside movement...

Above 155 ignoring downside move for intraday

Charts for Educational purposes only.

Please follow strict stop loss and risk reward if you follow the level.

Thanks,

V Trade Point

Review and plan for 13th May 2025 Nifty future and banknifty future analysis and intraday plan.

Quarterly results.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

TATASTEEL - Tata Steel LTD (2 hours chart, NSE) - Long PositionTATASTEEL - Tata Steel LTD (2 hours chart, NSE) - Long Position; short-term research idea.

Risk assessment: High {volume & support structure integrity risk}

Risk/Reward ratio ~ 3.25

Current Market Price (CMP) ~ 154

Entry limit ~ 153

1. Target limit ~ 158 (+3.27%; +5 points)

2. Target limit ~ 161 (+5.23%; +8 points)

3. Target limit ~ 166 (+8.50%; +13 points)

Stop order limit ~ 149 (-2.61%; -4 point)

Disclaimer: Investments in securities markets are subject to market risks. All information presented in this group is strictly for reference and personal study purposes only and is not a recommendation and/or a solicitation to act upon under any interpretation of the letter.

LEGEND:

{curly brackets} = observation notes

= important updates

(parentheses) = information details

~ tilde/approximation = variable value

-hyphen = fixed value

Long on TATA STEEL | Bullish Metal countersI'm Bullish on the Metal sector especially stocks like TATA STEEL & HINDALCO.

TATA Steel seems to be in a nice consolidation pattern on the 1H chart and the buyers seem to be in control.

Price has bounced off the major low support formed on 9th Apr-25.

I have a strong hunch that the stock can test the 155 price level this month.

That would be an impressive 9% move for a stock like TATA STEEL.

P.S. Not a recommendation. Pls due your own due diligence.

TataSteel , 1WThe Channel Pattern Breakout is looking very Good ,

we can consider this Breakout at this point also because it is at 20 EMA Support

if you are not Confident wait for Proper Retest to enter or if you want to take some risk then You can Enter at this Place .

Follow For More Ideas like this Swing Trade Ideas

Trendline Breakout in tata steelThe price has now broken above the trendline.

The current weekly candle has closed above the trendline, which is a sign of a potential breakout.

The breakout is also supported by a strong green candle with increased momentum.

If the price sustains above the trendline in the next few candles, it can confirm a trend reversal.

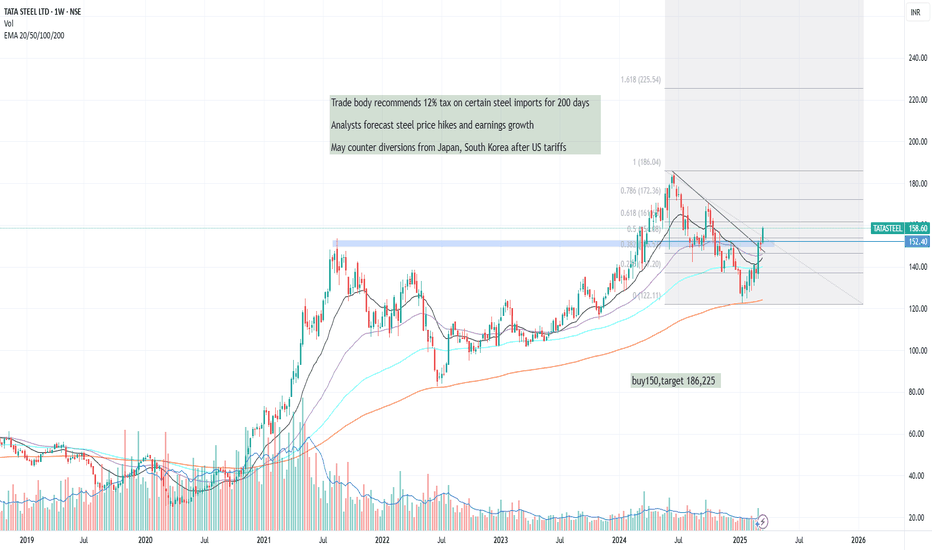

tata steeln December 2024, India launched a probe after record imports, largely from China, forced top steel mills to petition the government.

On Tuesday, India's Directorate General of Trade Remedies, which functions under the federal trade ministry, recommended a 12% temporary tax for 200 days on certain steel product imports in a bid to curb "serious injury" to the domestic industry.

The tax is proposed to be levied on products including hot-rolled coils, steel sheets and plates, as well as cold-rolled coils and sheets.

Analysts at J.P. Morgan see scope for raising estimates on steel companies' earnings as the tax "opens up ample room for imagination around profitability improvement."

"The tax can potentially lead to more room for price hikes in the next few months after rising to 1,500 rupees to 2,000 rupees in the near term," Parthiv Jhonsa, lead analyst for metal and mining at brokerage Anand Rathi, said.

"Earnings of steel companies are expected to increase in the next one to two quarters," he said.

The tax is expected to help Indian steel mills counter any potential trade diversions from countries like Japan and South Korea into the South Asian country after U.S. President Donald Trump imposed 25% import tariffs on the alloy, as per commodities consultancy BigMint.

The two Asian countries account for 15% of steel shipments to the U.S.

#TATASTEEL Supply Zone (Swing Trade)TATA Steel is approaching a significant supply zone, indicating a potential resistance area where selling pressure may increase. Swing traders can watch for bearish reversal signals (e.g., bearish candlestick patterns, rejection at the zone, or declining volume) to capitalize on a potential downward move. This zone represents a key level where the stock has historically faced selling pressure, making it an ideal area for shorting or exiting long positions.

#TATASTEEL Supply ZoneThe TATASTEEL Supply Zone is a strategically designed hub that ensures seamless procurement, storage, and distribution of raw materials and resources critical to TATASTEEL's operations. This facility plays a pivotal role in maintaining supply chain efficiency, reducing downtime, and supporting sustainable production processes.

Equipped with advanced inventory management systems and eco-friendly practices, the Supply Zone aligns with TATASTEEL's commitment to innovation, sustainability, and operational excellence. It serves as the backbone of the company's supply chain, enabling timely delivery of materials and driving productivity across its global operations.

TATA Steel 27 FEB PredictionNifty Metal Sector Analysis & TATASTEEL Forecast

The Nifty Metal sector has been showing strong resilience, retesting its monthly support level three times before breaking out this week. With all metal stocks within Nifty performing well, we now focus on TATASTEEL's key levels and potential price movements.

Current Market Structure :

The Nifty Metal index has confirmed a breakout after multiple retests at its monthly support.

A strong bullish trend is observed across metal stocks, indicating sector-wide strength.

TATASTEEL, one of the leading stocks in the metal sector, is approaching a crucial resistance level.

TATASTEEL Price Levels & Trading Plan:

Strong Resistance: 144.60

TATASTEEL is expected to face a significant rejection at this level.

If the price struggles to break above this point, a pullback is likely.

Support Zone: Around 135

In case of a rejection at 144.60, the stock may find support near 135.

This level will act as a buying opportunity if the price stabilizes.

Breakout Confirmation: Above 144.60

If TATASTEEL successfully crosses the 144.60 resistance, it could lead to a rally towards 152 in the near term.

A strong volume breakout will be a key confirmation factor for this uptrend.

Conclusion:

Traders should watch for rejection at 144.60 and potential support at 135.

A breakout above 144.60 could trigger a bullish momentum towards 152.

Market participants should closely monitor sector performance and global metal prices to validate the strength of the move.

Risk Management:

Stop-loss for long positions: Below 132

Stop-loss for short positions: Above 147

Always consider overall market sentiment and global cues before executing trades.

Disclaimer: This analysis is for educational purposes only and not financial advice. Traders should conduct their own research before making any investment decisions.