DXY Will Go Higher! Long!

Please, check our technical outlook for DXY.

Time Frame: 9h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 100.428.

Considering the today's price action, probabilities will be high to see a movement to 102.304.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

DOLLARINDEX trade ideas

DXY 4HR , Daily AnalysisThe DXY is expected to make a minor bullish move until it reaches the 101.56 level. From there, a bearish reversal is anticipated, potentially driving the index lower until it forms a new lower low or reaches the key support zone between 96.80 and 95.40. At that level, a significant bullish reversal or a strong upward movement is likely to occur.

DXY May 11 week in review and week ahead notesDXY

May 11

Week in review

Monday price was in consolidation, Tuesday Price lower to take sell stops creating the low and then started to seek higher prices into Tuesday, Wednesday and Thursday, while Friday retraced Thursday’s delivery. Price broke its range on Thursday for Friday to create the high.

Fridays Delivery

Price was in a premium in Asia Price expanded to take minor buy side. Price reversed to lower prices to noted inefficiencies to rebalance. Price lowered to the .618 to then retrace in NY and went into consolidation to close.

Week ahead

Price on the weekly is a discount

Price current range is a Premium

Previous session is delivering to a discount

Price is seeking higher prices to rebalance a W SIBI and a 4 hour FVG

I suspect that DXY could be shifting to a bull bias in the coming weeks. I note the event horizon at lower prices to keep watch for.

NO news Monday and Wednesday

I suspect for Price to enter Monday with a continuation seeking higher prices to rebalance the 4 hour FVG. Note the equal lows that could be a magnet.

Let Sundays delivery occur and plan from there.

Dollar Plunge To 97.921: Trump’s Tariff Tsunami Erodes DollarDollar Index fell to 97.921, its lowest since April 2025, as Trump’s aggressive tariffs on critical minerals and China trade retaliation spooked investors.

Analysts warn the dollar’s status as a reserve currency is under threat, with foreign holdings of U.S. assets declining sharply.

However in the short-term, dollar might see appreciation up into premium PD arrays, namely the weekly fair value gap outlined.

My Thoughts #006My Thoughts

Are that we still continuing with the bullish trend still waiting for a choch on the 4h demand zone to take my trade as illustrated...

We need to see the pair move from bearish to bullish trend in line with the overall trend

The pair could sell

use proper risk management

Let's do the most

USD Week 3 of Gains - 23.6% Fibonacci RetracementThis week has been the third consecutive week of gains for DXY and this comes in stark contrast to the bearish trend that drove price in early-April trade. This week was of course a lift from the FOMC rate decision, and next week brings inflation back to center-stage with the Tuesday release of CPI.

In DXY, we've only seen a mere 23.6% retracement of the 2025 sell-off so this move is still very much in the early stages. We also can't rule out sellers taking another shot here, as the oversold RSI reading from a few weeks ago often doesn't mark the exact low - because trends can usually take some time before they actually turn.

What will probably weigh on the matter is EUR/USD and whether a larger pullback can show there, but for now, it's the 1.1200 handle that's led to a bounce for this week. In DXY, there's key support at 100.22, 100 and then 99.18 for bulls to defend into next week. And key resistance is around the 102.00 handle in DXY. - js

Bearish Crab Pattern Will Start from 100.7The dollar index has retreated from 100.7, a movement potentially correlated with a bearish crab pattern observed in market analysis.

Further observation is warranted to confirm the validity and predictive power of this pattern in forecasting future dollar index fluctuations.

EU SHORTS FOR TODAY___ Mount Olympus Capital says.I am looking for a short on the EURO. Price showing clear signs of bearish orderflow and structure with and signatures (accumulation manipulation and distribution).

Looking to target previous day and Asia session low!

LETS GET IT! and safe trading everyone.

DOLLAR INDEX (DXY): Bullish Reversal Confirmed?!

Dollar Index formed an inverted head and shoulders pattern on a daily.

Its neckline breakout is a strong bullish reversal signal.

The broken neckline of the pattern turns into a significant support now.

We can expect a growth from that at least to 101.25 resistance.

❤️Please, support my work with like, thank you!❤️

US DOLLAR INDEX(DXY): Bullish Outlook & BreakoutThe Dollar Index formed a significant inverted head and shoulders pattern on a 4-hour chart.

Following the release of yesterday's economic data, the market surged and broke through both the neckline and a strong downward trend line.

This created an expanding demand zone with two broken structures.

I plan to take long positions in anticipation of a bullish trend continuing to at least 102 support level.

Heading into 61.8% Fibonacci resistance?US Dollar Index (DXY) is rising towards the pivot which is a pullback resistance and could reverse to the 1st support.

Pivot: 101.39

1st Support: 99.91

1st Resistance: 102.58

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Dxy bullish idea for next week - MMBMThis is a bullish possibility for DXY price action for next week.

Monthly:

- Price took a swing low confluent with a bearish breaker in discount and closed above the level;

Weekly:

- Price Took a swing below monthly swing with a bullish reaction. If this week closes with above previous weeks high, it confirms a bullish weekly swing;

Daily:

- Monday printed the likelly low of the week

- A daily fair value gap is open allow with a volume imballance around monday open signalling bullish price action - a retrace to these levels would be a good buying opportunity.

4h:

- there is a market maker buy model in play.

- as of now, price already printed an intermidiate term low signalling that low risk buy myght have happened.

News forecast:

- I expect NFP to either retrace price to daily fvg or daily volume imbalance and leave a bullish reaction.

- FOMC next week might bring the volatility to complete the mmbm

Thank you for reading

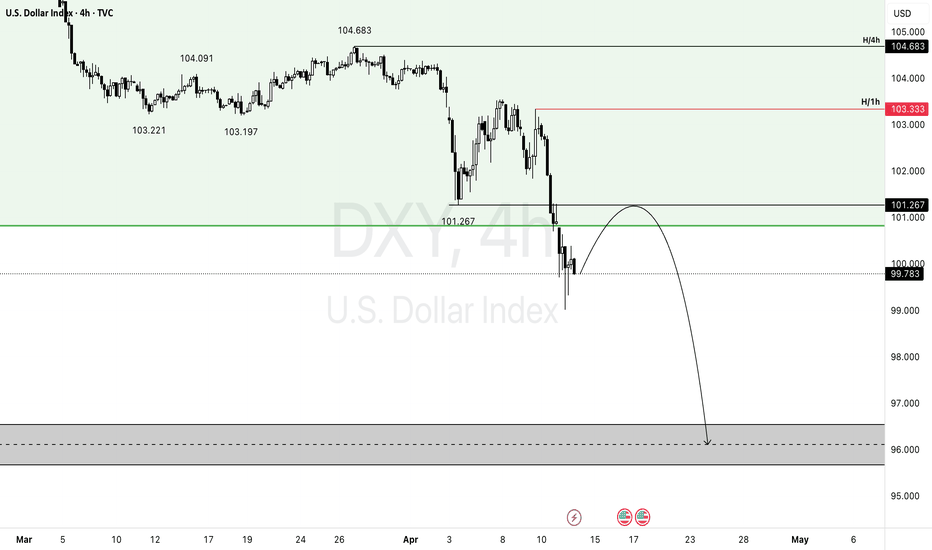

DXY - ANALYSIS👀 Observation:

Hello, everyone! I hope you're doing well. I’d like to share my analysis of DXY (Dollar Index) with you.

Looking at the DXY chart, I expect a price increase towards 101.267. After reaching this level, I anticipate a decline to around 96.00.

📉 Expectation:

Bullish Scenario: Price increases towards 101.267.

Bearish Scenario: After reaching 101.267, a decline to 96.00.

💡 Key Levels to Watch:

Resistance: 101.267

Support: 96.00

💬 What are your thoughts on DXY this week? Let me know in the comments!

Trade safe

Why I'm Bullish on the DXY: A Fundamental Approach!Powell continues to take a cautious tone, emphasizing a wait-and-see approach while acknowledging rising inflation risks, which suggests there's no urgency to cut rates. This leans slightly hawkish, especially compared to the market’s more dovish expectations, and could support some near-term Dollar strength. However, a more sustained move in the USD likely hinges on progress in upcoming trade discussions—particularly with China. Today's FOMC outcome is just one part of the broader picture; the next key signal may come with developments in the coming days. For now, the bias remains USD bullish heading into the London session.

Technically, the DXY has broken its downtrend, signaling a potential shift in momentum. I’ll be watching for a possible retracement toward the 99.700 area, which could serve as a key support level before any further upside continuation.