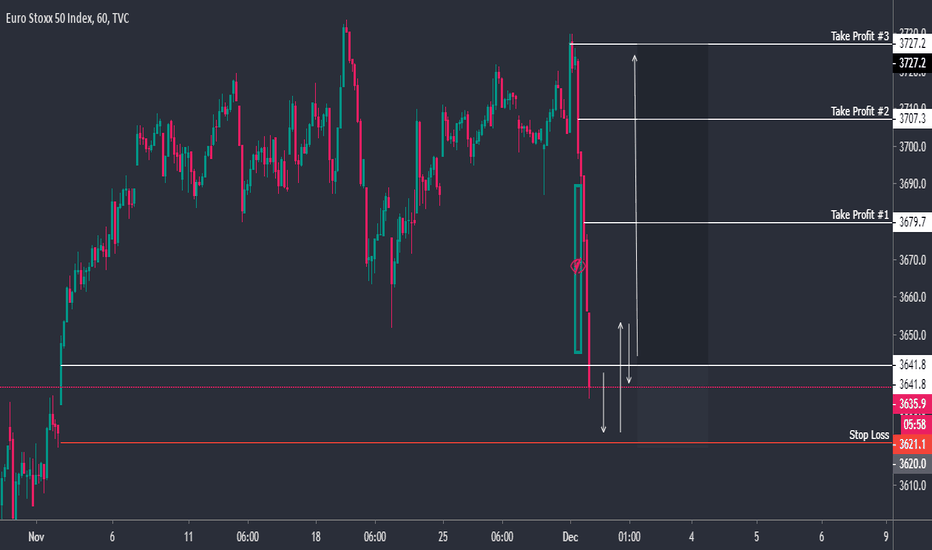

"EuroStoxx breaking the Ascending Trendline" by ThinkingAntsOk4H Chart Explanation:

- Price was on an Ascending Wedge since August.

- Price bounced on the Resistance Zone.

- Price broke the Ascending Wedge.

- Now, it has potential to move down towards the Support Zones.

Weekly Vision:

Daily Vision:

Updates coming soon!

EUROPE50 trade ideas

EU50EUR is close to the Historical Key Level!We can open Sell after the false breakout of Historical Key Level 3824.0.

The price was at that level 5 years ago.

Potential profit will be in 3...5 times bigger than risk.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

EURO STOXX 50 (SX5E) May Drop Soon!

Euro stocks index is approaching a 4 years' high!

there is a high chance to see a strong bearish reaction from the underlined weekly resistance,

but because the trend is bullish, I will trade the market only with a good confirmation signal.

On 4H chart, the market is currently forming the right shoulder of a head and shoulders pattern.

I pay close attention to 3725.0 neckline.

Being broken, it will trigger a selling reaction and it will be a perfect signal for us to open short.

The initial target will be 3625.0 level

The second target 3410.0 level.

Stop will be above head!

Good luck!

Key level for Eurostoxx50 index - at 5 year highEurostoxx 50 has been on a very strong run. Key level being tested on the 5 year weekly chart. The index has already reached a 5 year high but if can break and hold above the resistence line at 3705 it could head up 3824 and anything above that would be the high going all the way back to May 2008

EUROPE50 STOXX Index SHORT - divergence and momentum resistanceAfter the sharp rise it has slowed down and we can see more bearish bars on the chart. This has also created a divergence on the RSI. The loss of momentum has established a momentum resistance around 65 on the RSI which price doesn't seem to be able to push through and the 9EMA on the RSI has caught up with the signal line.

All this suggest a technical reversal which maybe will re-test the MA200 support.

"EuroStoxx: at an important Resistance Zone" by ThinkingAntsOkDaily Chart Explanation:

- Price bounced from the Support Zone and went towards the Resistance Zone where it is now.

- Bearish Divergence on MACD.

- If price starts its down move from here, it has potential to go towards the Support Zone one more time.

- We are looking for sell setups on lower timefremes.

Weekly Vision:

Updates coming soon!