Crude Oil Mini Futures

CRUDEOILM1! trade ideas

Crude oil-----buy near 68.90, target 69.90-72.00Crude oil market analysis:

Yesterday's crude oil daily line showed continuous tombstones, which was suppressed near 72.00. Today's idea is to continue to look at the rebound in the short term and pay attention to the support near 68.70. This position is a buy rebound. We will wait for opportunities in the Asian session. Crude oil has begun to move on a weekly trend. We need to pay attention to this week's closing to determine whether it will start a weekly trend in the future.

Fundamental analysis:

Trump's midnight tariffs caused the market to tremble again. In addition, ADP rose sharply, with a result of 155,000 people, 80,000 people in advance, and 115,000 people expected. The bulls still pulled up under such a big negative situation.

Operation suggestions:

Crude oil-----buy near 68.90, target 69.90-72.00

Crude oil---Buy near 70.60, target 71.90-76.00Crude oil market analysis:

Today's crude oil is still bought at a low price, and short-term bulls have started. Yesterday, gold fell in the US market, but did not fall in the Asian market, but repaired at a high level. The strong support of the daily line has reached 70.00, and the small support is 70.50. Today's idea is to find buying opportunities above 71.50. The daily moving average of crude oil is lined up, and there is still a lot of room for growth.

Fundamental analysis:

This week is a data week. Today, pay attention to the ADP employment data, which is the pre-agricultural data.

Operation suggestions:

Crude oil---Buy near 70.60, target 71.90-76.00

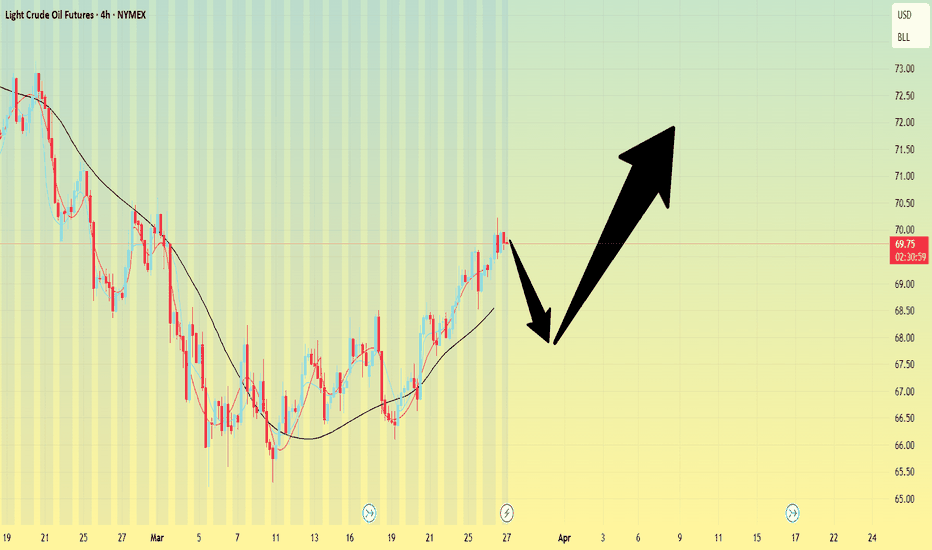

Long Next Week: Crude Oil Set for Potential Price Recovery

- Key Insights: Crude oil sees potential upward momentum with prices trading

above the 8-day moving average. Market sentiment favors short-term recovery

despite mid-level volatility due to geopolitical tensions and supply-demand

dynamics. Analysts emphasize crude oil's undervaluation and opportunities

due to supply constraints and potential oil production peaks by 2025.

- Price Targets: Next week targets aim for a recovery from the current level.

Tight stops and returns provide a trading framework.

- T1: $71

- T2: $72

- S1: $67

- S2: $66

- Recent Performance: WTI crude oil is trading around $68, with predictions

suggesting a pullback to $67 before potentially rising. Trading above its

8-day moving average suggests persisting upward momentum, pending market

movement. Market volatility exists due to fluctuating demand-supply dynamics

and geopolitical factors, with price support at $64.75 and resistance around

$70 to $73.50, indicating critical levels for potential trends.

- Expert Analysis: Analysts highlight the undervaluation in commodities,

including crude oil, suggesting investment opportunities as the energy

sector benefits from supply constraints. Expectations exist for peak oil

production by 2025, which could lead to long-term market shortages and

volatility. Companies like Occidental Petroleum remain sensitive to price

variations, focusing on debt reduction and dividend increases.

- News Impact: Geopolitical tensions related to Russian, Iranian, and Venezuelan

oil could pressure supply chains and affect price stability. The move

towards renewable energy continues to reshape long-term demand; however,

robust demand is anticipated until major shifts occur. China's crude oil

strategies will significantly impact global supply and price alignment.

Monitoring these developments is crucial for understanding future price

trajectories in the crude oil market.

#202513 - priceactiontds - weekly update - wti crude oil futuresGood Evening and I hope you are well.

comment: Bulls continued and surprised a bit with the follow-through. 3 consecutive bullish weeks now and market has touched 70 multiple times. 70-72 is my neutral target while leaning bullish below 68. Volume is atrocious but market is free to do whatever. Could see a retest of 66 as well as going higher for 72. Absolutely no opinion on this or interest in trading, other than small scalps. Look at the weekly tf and tell me how obvious everything is, be my guest.

current market cycle: trading range

key levels: 65 - 72

bull case: Bulls produce decent tails below daily bars and keeping the market above the daily 20ema and 69. Right now they have taken somewhat control of the market after many weeks of selling, likely due to bears being exhausted. Only a daily close above 70 would change my assessment though. Sideways is more likely for me and I have no bigger interest in buying at 70 when it could be the high of a potential trading range 65 - 70.

Invalidation is below 65.

bear case: Bears sold the market relentlessly for 2 months straight and do seem exhausted. Right now they want to keep 70 resistance and since this is the first decent bounce the bulls got, the odds of this going much further up are low. It’s still a bear flag on the weekly tf and a retest of 65/66 is possible. Daily close below 68 would make me look for shorts for 100-200 ticks lower but that’s about it.

Invalidation is above 71.

short term: Neutral around 70. Bulls need a daily close above and bears something below 68 again.

medium-long term - Update from 2025-02-23: Bear trend is getting weaker but I still see this going sideways around 70 instead of a range expansion.

current swing trade: None

chart update: Removed last bear trend line, market is neutral at 70.

Crude Oil at Decision Point — Breakout Coming or Just More Chop?Crude is nearing the apex of a descending triangle, but the conflicting signals across timeframes make this a tough read. The daily is breaking out to the upside, while the 4H is pushing lower — classic mixed market structure. Are we about to fake out in both directions before rolling over to fresh lows, or is this a genuine attempt to break higher? Honestly, both long and short setups feel like low-probability plays right now. Sometimes, the best trade is no trade.

buyers coming into the marketprice hit a higher timeframe resistence area at the end of the week, which we see lots

of selling off & a bearish engulfing candle.

price has now hit an institutional candle & is showing sighns of rejection from that area

buyers have already started to enter the market , as we can see on a lower timeframe.

i will be looking for buys at market open,

Crude Oil (WTI) Bullish Breakout – Eyes on $78.47!🚀 Crude Oil (WTI) Bullish Breakout – Eyes on $78.47! 🚀

📊 Trade Setup:

Entry Price: $73.12

Take Profit 1: $73.99

Take Profit 2: $76.20

Take Profit 3: $78.47

Stop Loss: $71.21 (below key support zone)

📈 Analysis:

After months of trading in a range, WTI Crude Oil has broken above the upper boundary of the channel , signaling a bullish breakout. This breakout is supported by:

1️⃣ China's Economic Optimism: Growth pledges and potential stimulus are boosting demand expectations.

2️⃣ Technical Momentum: Key resistance at $71.50 and $74 has been breached, opening the path toward higher targets.

3️⃣ Tight Weekly Chart Range: A big move was anticipated, and the bulls delivered!

🎯 Targets:

With momentum on our side, we’re targeting:

$73.99: Quick resistance retest.

$76.20: Alignment with prior highs.

$78.47: Major resistance and breakout zone.

🔹 Risk Management:

Stop loss at $71.21, well below the key support zone, ensures controlled risk in case of reversal.

⚡ Are you riding the breakout, or watching from the sidelines? Let me know your thoughts below! ⚡

Bearish Analysis: Crude Oil (CL Futures)1️⃣ Rejected at Supply Zone:

The price was strongly rejected from the $80 supply zone, where sellers clearly took control. This zone has been a key resistance level, and the recent bearish momentum confirms strong selling pressure.

2️⃣ Bearish Momentum in Play:

The sharp decline from the supply zone has broken short-term supports, signaling sustained bearish movement. The next major target is the $66–$67 demand zone, where buyers may step in.

3️⃣ Technical Indicators Supporting Bears:

RSI: At 54.88, the RSI suggests there’s room for further downside before reaching oversold conditions.

Stochastic Oscillator: A bearish crossover between the %K and %D lines confirms increasing selling pressure, with momentum favoring a continuation of the trend.

4️⃣ Fundamentals Adding Pressure:

Trump’s Energy Policy: Potential policy changes to increase domestic oil supply could create a bearish outlook for crude oil.

Stronger Dollar: The strengthening USD makes oil more expensive for global buyers, further dampening demand and supporting the bearish case.

🎯 Strategy:

TP1: $75 (Near-term target, close to the current price).

TP2: $74.30 (Minor support, a potential bounce or pause area).

TP3: $72 (A strong psychological and technical level).

TP4: $67 (Major demand zone).

🔔 Note:

Consider using a positive stop loss to secure gains and reduce risk. Always practice proper risk management to protect your capital and maintain consistent results.

CRUDE - WEEKLY SUMMARY 24.3-28.3 / FORECAST🛢 CRUDE – 17th week of the base cycle (28 weeks), second phase. The extreme forecast on March 27 halted the second phase’s upward movement at the 70 resistance level and reversed the trend. This forecast was specifically highlighted for crude at the beginning of the year. A short position has been opened. The next universal extreme forecast is April 7. The next crude-specific extreme forecast is May 5.

USOIL BUY Trade Review Bias: BULLISH due to price trading inside 1hr +NWOG (new week opening gap)

Entry model: Bull unicorn model created after price tapped into 1hr +NWOG. Confirmed with a +BB (breaker block), stop hunt, displacement thru +BB w/ FVG

Left chart shows entry model targeting equal highs created during London morning session which I use as buy side liquidity which gives price an incentive to trade higher.

MCX Crude oil Weekly LevelsAs shown in the attached chart, now MCX Crude Oil having Support at 5995 (1 hour chart) and need to sustain above the said level (hourly basis) for another major movement.

Disclaimer:- All the shared views are for educational purposes only. We provide Technical Indicators only for educational purposes. As we are not SEBI registered, there will be no claim rights reserved. Please consult your financial advisor before trading or investing.

Crude oil-----buy around 69.00, target 69.90-70.90Crude oil market analysis:

Crude oil has not been so strong for a long time. The K-line has uploaded the daily moving average, and the bulls have begun to rush up. The current suppression position is 70.00-70.60. Yesterday, the highest peak was 70.22. Today's idea is to follow the short-term buying, buy at a low price to see its moving average rebound, and the daily moving average is also starting to attack. We don’t speculate whether this wave of upward rush will change the trend of the daily line, but we can be sure that the short-term is bullish. Today’s idea is to buy directly around 69.00.

Fundamental analysis:

Although there is no big data this week, the US tariffs still cause huge market fluctuations in terms of fundamentals.

Operation suggestions:

Crude oil-----buy around 69.00, target 69.90-70.90

Crude Oil Market Insights: A Bullish Perspective on Price MovemeThe crude oil market continues to demonstrate resilience, with recent price action revealing intriguing patterns that warrant close attention from investors and traders. At the current juncture, crude oil has successfully found critical support at the $66 level, a development that aligns precisely with earlier market expectations.

Current Market Dynamics

Traders and market analysts are observing an emerging rally targeting long-term resistance levels. Interestingly, the early 2024 market upswing serves as a compelling analog for current price movements, providing a historical context for understanding potential future trajectories.

Market Movement Characteristics

The current market momentum presents a nuanced picture:

Continued upward movement is evident

Trading volume shows interesting characteristics

Price action indicates a slightly less volatile impulse compared to previous trends

What’s particularly noteworthy is how the market is maintaining its upward trajectory. Despite potential concerns about increased supply, the market has demonstrated remarkable stability. The current rally appears to be developing with a different volatility profile compared to previous market phases.

Supply and Demand Considerations

The prevailing market narrative around demand is progressively validating earlier predictions. Traders are speculating about the potential for an even stronger rally in the near term. While significant volatility might not be anticipated at current levels, the market remains dynamic and responsive.

Comparative Market Analysis

When examining the current market phase against historical patterns, several key observations emerge:

Volatility in the current market area differs substantially from previous periods

Price movements are showing measured, calculated progression

Supply increases are being absorbed without significant market disruption

Forward-Looking Perspective

Market participants should prepare for potential continued movement, albeit with a more measured approach. The expectation is not for explosive, high-volatility reactions, but rather a more controlled and strategic market progression.

Conclusion

Crude oil markets continue to provide fascinating insights for investors and traders. The current support level, emerging rally, and measured market dynamics suggest a cautiously optimistic outlook.

Key Takeaways

Crude oil finding strong support at $66

Potential for a measured rally

Reduced volatility compared to previous market phases

Continuing positive momentum in market trends

This analysis is for educational purposes only and should not be considered investment advice.

CrudeOil Breakout or Reversal?📈 CRUDEOIL – 1 HOUR TIMEFRAME ANALYSIS

CrudeOil is currently testing a key resistance zone near 5995–6000. Price action has respected the rising trendline, and the structure looks poised for a breakout or rejection move.

🔍 Two Possible Scenarios:

🔹 Bullish Breakout Above 5995 If crude sustains above 5995 with volume confirmation, we may see a sharp move toward:

🎯 Target 1: 6030

🎯 Target 2: 6065

🔹 Bearish Rejection Failure to break 5995 may trigger a rejection and lead to a correction toward:

📉 Support 1: 5931 (EMA)

📉 Support 2: 5870 (Trendline base)

📊 Key Levels:

Resistance: 5995 / 6030 / 6065

Support: 5931 / 5870

Volume will be the key factor in validating the breakout. Until then, keep a watchful eye for a trap or fake-out near resistance.

📌 Disclaimer:

This analysis is for educational purposes only. Always manage your risk and trade with proper position sizing. Market sentiment can change quickly.

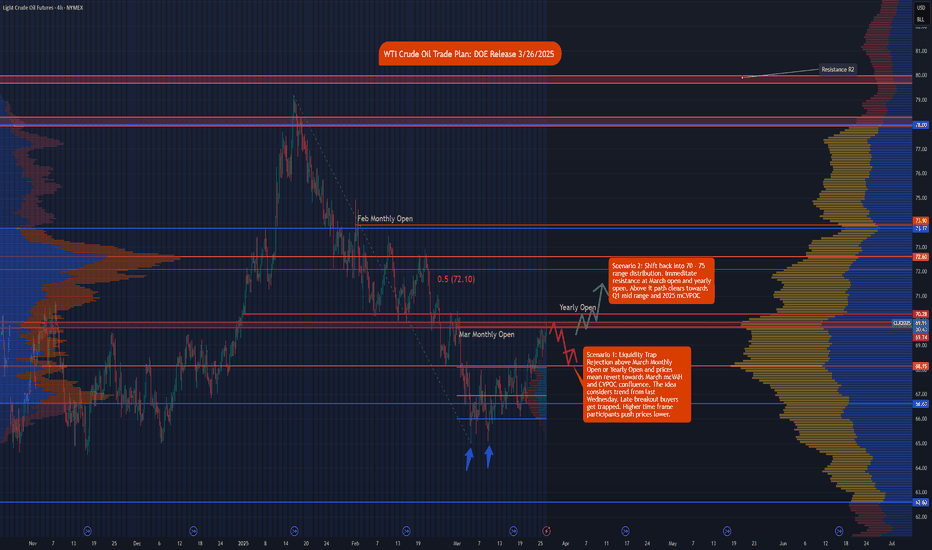

WTI Crude Oil Trade Plan: DOE Release NYMEX:CL1!

In this tradingview blog, we go over our technical setup and trade idea for Crude oil.

It is important to note we also have DOE inventory numbers coming at 10:30 ET.

Once the release has settled in, the trade idea can be framed using either of our two scenarios.

Scenario 1: Liquidity Trap

Rejection above March Monthly Open or Yearly Open and prices mean revert towards March mcVAH and CVPOC confluence. The idea considers the trend from last Wednesday. Late breakout buyers get trapped. Higher time frame participants push prices lower.

An example swing trade idea would be taking a long position once the release has settled and waiting for a pull back around 69.50.

• Entry: 69.50

• Stop: 70.30

• Target: 68.15

• Risk: 80 ticks

• Reward: 135 ticks

• Risk/Reward ratio: 1.69

This is an example swing trade idea that may play out by the end of the week.

Scenario 2: Shift back into 70 - 75 range distribution.

Immediate resistance is at March monthly open and yearly open. Above it the path clears towards Q1 mid-range and 2025 mCVPOC.

An example of a trade idea for this scenario is to wait for a breakout and close of candle on the 30 minutes time frame above yearly open. Wait for a pullback towards 70.28

• Entry: 70.35

• Stop: 69.50

• Target 71.45

• Risk: 85 ticks

• Reward: 110 ticks

• Risk/Reward ratio: 1.29

Please note that these are example trade ideas. Trades are advised to do their own preparation. Stops are not guaranteed to trigger, and losses may be greater than predetermined stops.