Crude Oil Mini Futures

CRUDEOILM1! trade ideas

MCX Crude oil Weekly LevelsAs shown in the attached chart, now MCX Crude Oil having Support at 5995 (1 hour chart) and need to sustain above the said level (hourly basis) for another major movement.

Disclaimer:- All the shared views are for educational purposes only. We provide Technical Indicators only for educational purposes. As we are not SEBI registered, there will be no claim rights reserved. Please consult your financial advisor before trading or investing.

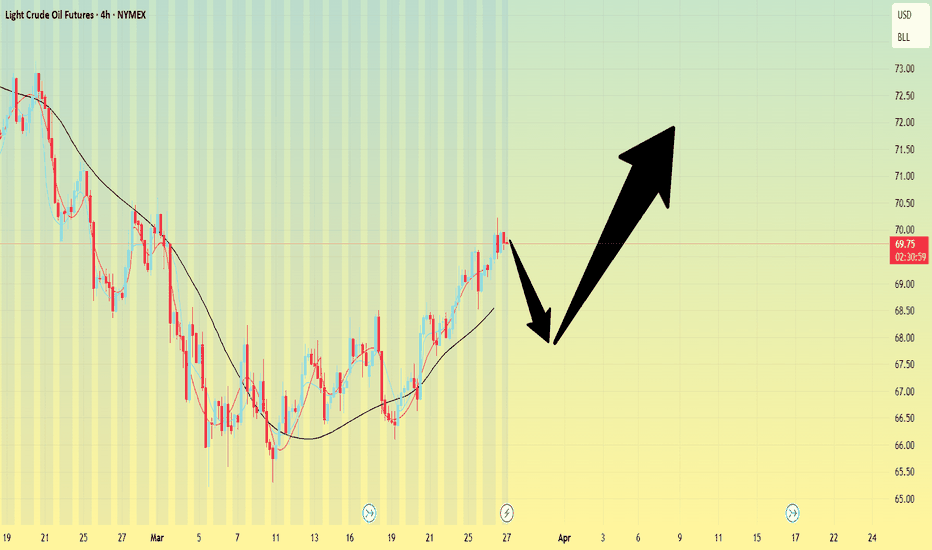

Crude oil-----buy around 69.00, target 69.90-70.90Crude oil market analysis:

Crude oil has not been so strong for a long time. The K-line has uploaded the daily moving average, and the bulls have begun to rush up. The current suppression position is 70.00-70.60. Yesterday, the highest peak was 70.22. Today's idea is to follow the short-term buying, buy at a low price to see its moving average rebound, and the daily moving average is also starting to attack. We don’t speculate whether this wave of upward rush will change the trend of the daily line, but we can be sure that the short-term is bullish. Today’s idea is to buy directly around 69.00.

Fundamental analysis:

Although there is no big data this week, the US tariffs still cause huge market fluctuations in terms of fundamentals.

Operation suggestions:

Crude oil-----buy around 69.00, target 69.90-70.90

Crude Oil Market Insights: A Bullish Perspective on Price MovemeThe crude oil market continues to demonstrate resilience, with recent price action revealing intriguing patterns that warrant close attention from investors and traders. At the current juncture, crude oil has successfully found critical support at the $66 level, a development that aligns precisely with earlier market expectations.

Current Market Dynamics

Traders and market analysts are observing an emerging rally targeting long-term resistance levels. Interestingly, the early 2024 market upswing serves as a compelling analog for current price movements, providing a historical context for understanding potential future trajectories.

Market Movement Characteristics

The current market momentum presents a nuanced picture:

Continued upward movement is evident

Trading volume shows interesting characteristics

Price action indicates a slightly less volatile impulse compared to previous trends

What’s particularly noteworthy is how the market is maintaining its upward trajectory. Despite potential concerns about increased supply, the market has demonstrated remarkable stability. The current rally appears to be developing with a different volatility profile compared to previous market phases.

Supply and Demand Considerations

The prevailing market narrative around demand is progressively validating earlier predictions. Traders are speculating about the potential for an even stronger rally in the near term. While significant volatility might not be anticipated at current levels, the market remains dynamic and responsive.

Comparative Market Analysis

When examining the current market phase against historical patterns, several key observations emerge:

Volatility in the current market area differs substantially from previous periods

Price movements are showing measured, calculated progression

Supply increases are being absorbed without significant market disruption

Forward-Looking Perspective

Market participants should prepare for potential continued movement, albeit with a more measured approach. The expectation is not for explosive, high-volatility reactions, but rather a more controlled and strategic market progression.

Conclusion

Crude oil markets continue to provide fascinating insights for investors and traders. The current support level, emerging rally, and measured market dynamics suggest a cautiously optimistic outlook.

Key Takeaways

Crude oil finding strong support at $66

Potential for a measured rally

Reduced volatility compared to previous market phases

Continuing positive momentum in market trends

This analysis is for educational purposes only and should not be considered investment advice.

CrudeOil Breakout or Reversal?📈 CRUDEOIL – 1 HOUR TIMEFRAME ANALYSIS

CrudeOil is currently testing a key resistance zone near 5995–6000. Price action has respected the rising trendline, and the structure looks poised for a breakout or rejection move.

🔍 Two Possible Scenarios:

🔹 Bullish Breakout Above 5995 If crude sustains above 5995 with volume confirmation, we may see a sharp move toward:

🎯 Target 1: 6030

🎯 Target 2: 6065

🔹 Bearish Rejection Failure to break 5995 may trigger a rejection and lead to a correction toward:

📉 Support 1: 5931 (EMA)

📉 Support 2: 5870 (Trendline base)

📊 Key Levels:

Resistance: 5995 / 6030 / 6065

Support: 5931 / 5870

Volume will be the key factor in validating the breakout. Until then, keep a watchful eye for a trap or fake-out near resistance.

📌 Disclaimer:

This analysis is for educational purposes only. Always manage your risk and trade with proper position sizing. Market sentiment can change quickly.

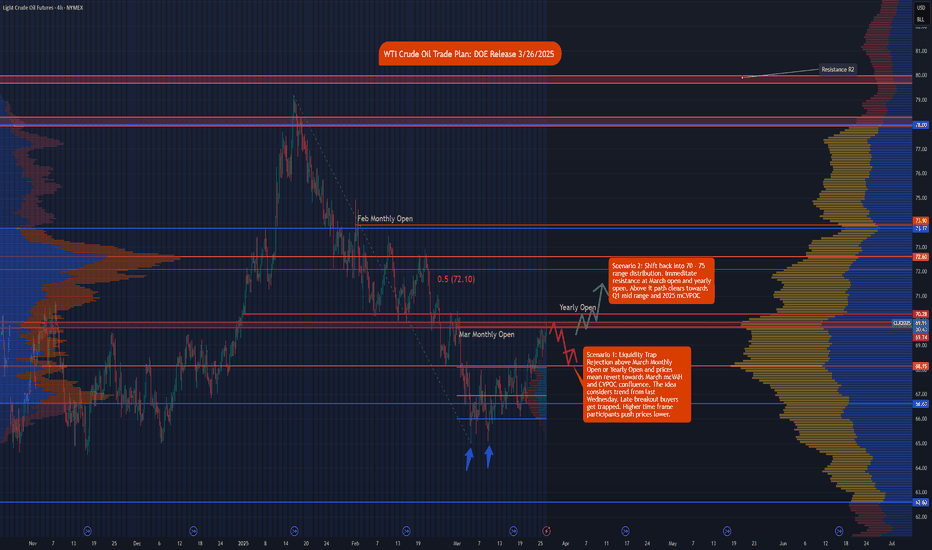

WTI Crude Oil Trade Plan: DOE Release NYMEX:CL1!

In this tradingview blog, we go over our technical setup and trade idea for Crude oil.

It is important to note we also have DOE inventory numbers coming at 10:30 ET.

Once the release has settled in, the trade idea can be framed using either of our two scenarios.

Scenario 1: Liquidity Trap

Rejection above March Monthly Open or Yearly Open and prices mean revert towards March mcVAH and CVPOC confluence. The idea considers the trend from last Wednesday. Late breakout buyers get trapped. Higher time frame participants push prices lower.

An example swing trade idea would be taking a long position once the release has settled and waiting for a pull back around 69.50.

• Entry: 69.50

• Stop: 70.30

• Target: 68.15

• Risk: 80 ticks

• Reward: 135 ticks

• Risk/Reward ratio: 1.69

This is an example swing trade idea that may play out by the end of the week.

Scenario 2: Shift back into 70 - 75 range distribution.

Immediate resistance is at March monthly open and yearly open. Above it the path clears towards Q1 mid-range and 2025 mCVPOC.

An example of a trade idea for this scenario is to wait for a breakout and close of candle on the 30 minutes time frame above yearly open. Wait for a pullback towards 70.28

• Entry: 70.35

• Stop: 69.50

• Target 71.45

• Risk: 85 ticks

• Reward: 110 ticks

• Risk/Reward ratio: 1.29

Please note that these are example trade ideas. Trades are advised to do their own preparation. Stops are not guaranteed to trigger, and losses may be greater than predetermined stops.

Crude oil ------ Buy around 68.60, target 70.00-70.60Crude oil market analysis:

Today's crude oil can be sold at short positions of 70.20-70.60, and the buying position is around 68.60. It is strong in the short term. We need to pay attention to the situation when it stands above 70.00. If the daily line stands above it, we need to pay attention to the new buying opportunities later, and the big drop will come to an end. However, the long-term trend of crude oil is still selling. In addition, with the increase in inventory data, the price of crude oil is unlikely to rise much.

Operation suggestion:

Crude oil ------ Buy around 68.60, target 70.00-70.60

Crude Oil Set for Mixed Outcomes Amidst Economic Tensions

- Key Insights: The crude oil market is experiencing mixed signals, with recent

positive momentum but an overarching bearish sentiment. Despite the slight

uptick, the market remains sensitive to economic and geopolitical factors,

suggesting cautious trading strategies. Investors should monitor key support

and resistance levels closely to inform trading decisions.

- Price Targets: Next week, traders might consider these targets:

- T1: $70.50, T2: $72.00

- S1: $66.50, S2: $65.00

This positioning aligns with the anticipation of potential upward movement while

guarding against lower breaks.

- Recent Performance: Crude oil has recently closed above key moving averages,

hinting at possible short-term gains. However, the broader market is

bearish, influenced by decreasing oil and gasoline prices, which may reduce

overall economic costs. The market's volatility is driven by broader

economic conditions and geopolitical influences.

- Expert Analysis: Opinions in the oil market are divided, with some experts

foreseeing bearish trends due to supply constraints and production capacity

issues. Others remain bullish in the long term, expecting economic

conditions like stagflation and inflation to drive demand and prices higher.

The imminent strengthening of the US dollar and its impact on linked indices

remains an area of attention.

- News Impact: Several notable events are influencing crude oil. Concerns about

sustaining production levels amidst declining rates and constrained spare

capacity highlight the critical need for investment in new projects.

Geopolitical tensions involving key global players are impacting supply

chains and pricing, potentially escalating inflationary pressures. Within

the sector, shifting production strategies and shareholder expectations may

redefine performance prospects in the near term.

Overall, while the short-term outlook might see some gains, traders should

remain cautious and informed, given the complex interplay of economic and

geopolitical factors affecting crude oil.

Crude Oil Technical Outlook Crude Oil has once again found support near the $65 area, initiating a modest rebound. This bounce may extend toward the $72 level, which I view as a potential area of interest for initiating a short position.

Should price action reach that zone, I would look to enter short with a defined target range between $50 and $42. In this scenario, the stop loss would be fixed at $80.60, preserving a clear and disciplined risk management structure.

I’ll be closely monitoring price behavior and momentum as we approach resistance, particularly looking for signs of exhaustion around $72 to validate the setup.

Crude oil-----sell near 69.00, target 67.00-66.00Crude oil market analysis:

Recently, crude oil has been hovering at the bottom. There are short-term stabilization signals, but it is basically difficult to turn around if you don't buy at 70.00. Today's idea is still bearish. Crude oil is sold regardless of weekly or short-term. Today's idea is still to sell at a high price and bearish. Crude oil pays attention to the inventory data later.

Operational suggestions:

Crude oil-----sell near 69.00, target 67.00-66.00

Light Crudeoil Futures hourly trend forecast for March 24, 2025According to my analysis, this commodity is at its strong resistance at 68.46 and the likely support levels are at 67.56 and 66.83.

According to my "Advanced Market Timing" indicator, Light Crudeoil Futures is likely to see a bearish trend and then bounce back.

Those who trade are suggested to use your own technical studies for entries, stops and exits.

#202512 - priceactiontds - weekly update - wti crude oil futuresGood Day and I hope you are well.

comment: 4h chart tells the story the best. No acceptance below 66.5 and above 68. Bulls managed to get the second weekly bull bar but they have gained almost nothing. It could continue up and keep the multi-year contraction alive, since the double bottom at 65 looks good.

current market cycle: trading range

key levels: 65 - 70

bull case: Bulls need to print 70. That’s about it. The double bottom at 65 is decent enough to buy pull-backs with that stop. Bulls also managed to close above the daily 20ema on Friday and above 68. They now need to break above the last bear trend line around 68.5 and are then free to test 70. They do need to prevent another lower low below 65 if they want to have a major trend reversal.

Invalidation is below 65.

bear case: Bears look like they are exhausted and not pushing for new lows. If we close green next week and above 70, clear major trend reversal. Bears could surprise again and push below 65, which would open up targets below 64 and 63. Issue for bears is that below are so many support prices, that it’s hard to argue for more selling but since this is a commodity, could surprise to the downside as well. Technically, bears do not have much below 68. They need to keep the bear trend line around 68.5 alive or give up until market hits 70 again.

Invalidation is above 71.

short term: Neutral but if bulls continue above 68.5, leaning bullish for 70. Odds favor continuation of sideways movement 65-68.

medium-long term - Update from 2025-02-23: Bear trend is getting weaker but I still see this going sideways around 70 instead of a range expansion.

current swing trade: None

chart update: Removed bear trend lines that were broken or likely not relevant anymore.

CRUDE - WEEKLY SUMMARY 17.3-21.3 / FORECAST🛢 CRUDE – 16th week of the base cycle (28 weeks). A double bottom has formed, signaling the start of the second phase. The extreme forecast on March 19 pushed crude upward from a sideways trend. However, the beginning of the second phase is very weak. A strong resistance level lies ahead at 70 on current futures.

👉 My bearish outlook remains unchanged, as outlined in my summer 2024 crude oil post. The crude market has been in a sideways trend since fall 2022. This resembles the 2010-2014 period. Timing suggests a resolution in 2025. However, this does not mean history will repeat exactly—it is simply a similar setup. We will continue to navigate based on the current extreme forecasts.

⚠️ The current base cycle cannot yet be classified as bearish, as it has not broken its starting point. Watch for the midpoint of retrograde Mercury on March 24. The next important extreme forecasts for crude are March 27 and March 31.

Crude oil ------- sell around 70.00, targeCrude oil market analysis:

Yesterday's crude oil daily line closed with a big positive, is it a buying opportunity? In fact, looking at the pattern, it has been hovering at this position for a long time, and the short-term is basically a snake. If the position of 70.00 is not broken, it is difficult to form a buying opportunity. The idea of crude oil today is still bearish. Continue to sell on the rebound. The previous contract delivery of crude oil has not changed the trend. I think it still needs to fluctuate.

Operation suggestion:

Crude oil ------- sell around 70.00, target 68.00-66.00

Crude Oil Futures Stock Chart Fibonacci Analysis 032025Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 67/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.