Gold Petal Futures

GOLDPETAL1! trade ideas

Gold ExpansionCOMEX:GC1! reversed off the weekly average zone and is gradually working through that 4H FVG.

Looking for a clean break above it, then a retrace back to that zone. My target is the Daily Major Buyside Liquidity, with an eye on a potential extension toward the Weekly Average Expansion area if momentum holds.

Be the Choosy trader on Gold!Price is dragging on dropping. being very indecisive. Looks like the entire market is waiting on News to help give it a push. I need to see price break out of value before I can get a read on a sold move. in the mean time this is sclaping conditions. You can hold trades. Have to cut them short quick with this price action. Since we have some USD news tomorrow that indicates that the market might be waiting for that before proceeding on any decisions. Patience is key!

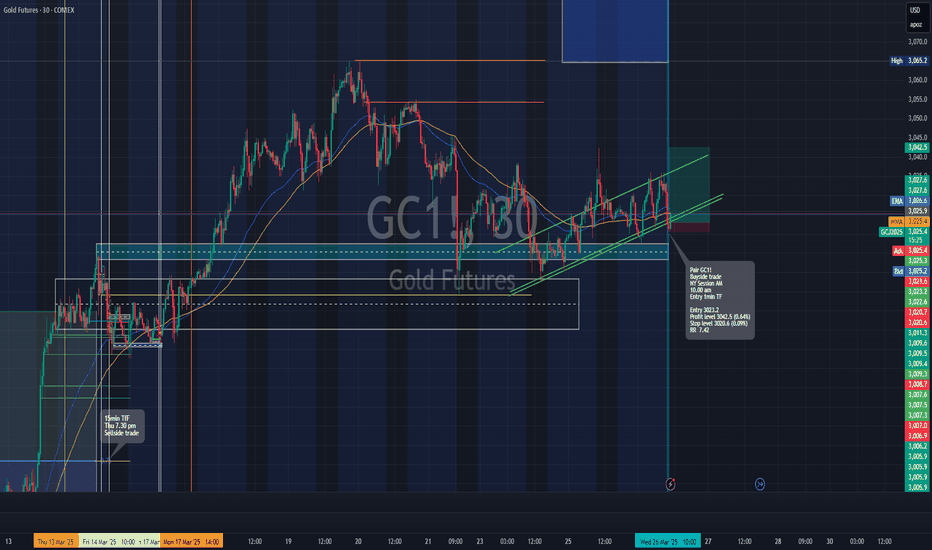

Long trade

30min TF overview

1min TF Entry

Pair GC1!

Buyside trade

NY Session AM

10.00 am

Entry 3023.2

Profit level 3042.5 (0.64%)

Stop level 3020.6 (0.09%)

RR 7.42

Reason: Looking left at previous price action and respected levels along with the Periodic Volume Profile (PVP) indicator and ascending channel seemed to suggest we were at a prime demand level indicative of a buyside trade.

GOLD TOP IS NEARGold appears to be distributing on all timeframes excepting daily , this added to the extensive media coverage recently makes me think that a significant all time top is near , gold still maintains support on all timeframes but that is probably the only thing holding it from a big crash.

Tesla es Mini Gold oil3.24. 25 in this video it looks like the Market's going up on the ES and Tesla. the oil Market has only traded a little bit lower than its recent High and it's not clear if the Market's going to make another move to a new high or if it's going to go a little bit lower and you can see that in the bars which are very narrow in their range and this looks different from when the market was actually actively going higher until it went to the end of the ABCD pattern which is a reversal pattern. Because the gold went to the end of the ABCD patterns going higher I am concerned that the Market's going to make a significant correction lower.... but I would be prepared for retest and minor Moves In the goal going higher and lower and that's what I tried to show to you in the video and I'm sorry that my presentation was so scattered and probably not easy to follow. the way you trade a market has to do with the kind of Trader you are... do you scalp a market or do you trade for longer trades. you could have made a few trades in gold and you could have made nice returns if several $1000 trades are suitable for you... and you could have traded as a buyer and a seller if you recognize the reversals.... but that is not an easy way to live. you could do it with discretion and not take every trade and if that works you may not need to take antacids and ulcer medication.... most people are not geared to that kind of trading and probably have a very low chance of being profitable. I am not a stop and reverse Trader.... but I show the patterns because I believe markets trade to the buyers and the sellers and that it is evident on a chart. if you don't care to be a stop and reverse Trader it is still to your advantage to know how markets trade and retest. to my thinking it's much better to at least know what it looks like as opposed to staring at your chart and having no real point of view other than the fact that you're not quite sure what the Market's going to do and all you can think about is losing money..... and even worse stay in a good trade too long and give all the money back because you don't know when to get out of a good trade. when you learn how to trade you still have to deal with the reversals in the market it's never going to stop... the need that you have to evaluate the price action that can work against you. my personal belief is that it's not easy to trade, I personally don't enjoy Trading but I don't mind making money if I do trade. my mission is to show you the trade location and the direction of the market. and the stop and a little Target without hitting the stop first... and if you can do that then the market should trade in your favor for at least a while and if it gets to that initial Target you have a reasonable reward and if it continues going in a Direction that could take some of your gains back.... but you haven't lost money yet.... that's okay..... it's still better than getting into markets and immediately losing money because you're not reading the market and you don't have a reasonable plan. I am sorry for my delivery during the videos... it's not intentional... and if it gets worse I'm going to have to stop. a fully intend to trade at this point Until evidence shows that I'm not trading well. I will go with the flow it's been fun.

The New week can give us a Pullback on Gold!Waiting for the bigger move and for that bigger move to happen we need a solid pill back to fill in some gaps. Focused on the patience for this in order to maximize the reward. Allow Monday and Tues to show if they will reach for the lows and set up. Logically the best entry should come after Tuesday. But you never know. Just wait for it cause price will show when it is ready.

GOLD SILVER PLATINUM COPPER: Metals Are Bullish! Wait For Buys!This is a FUTURES market outlook for the Metals, for the week of March 24-28th.

In this video, we will analyze the following markets:

GC | Gold

SIL | Silver

PL | Platinum

HG | Copper

The USD continues its bearish ways this upcoming weak. It's currency counterparts will likely see some upside this week. Especially the JPY.

Patience and an ear to the news will be the best way to approach the equity markets. The same would also apply to news sensitive commodity markets like US OIL, Gold and Silver.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

GOLD - WEEKLY SUMMARY 17.3-21.3 / FORECAST🏆 GOLD – 4th week of the new base cycle (15-20+ weeks), which began with retrograde Venus on March 3 from the extreme forecast level of October 28 (2850 on current futures). The start of retrograde Mercury had no impact on gold’s bullish trend. Mercury simply lacked the energy, as Venus is far stronger. Gold entered a correction at the pivot forecast on March 19, which I mentioned last week in the context of the stock market.

⚠️ Holding the long position from the extreme forecast on March 3. The movement range to the pivot forecast on March 19 for GC futures exceeded USD12K per contract. The next extreme forecast for gold is March 24 – the midpoint of retrograde Mercury. There is also a pivot forecast on March 27, but that is more relevant to crude.

directional zones to bias your tradeshi.

I use fibonacci zones and the concept of price expansion to draw these zones.

they help you determine which way price will go

via backtesting price can travel from one orange zone to another, with 70% accuracy, for the orange line I can only guarentee it'll touch the orange line, not follow through on there

throw on rsi and mfi and look at if both overbought or sold for an interesting zone reversal.

happy trading

GC1! : Buy opportunityOn GOLD, we have a strong likelihood of seeing a strong uptrend after the rebound off the support line. However, you must wait until all the analytical conditions are met before entering a buy position.

Furthermore, you can strengthen your buy position after the Vwap indicator breaks.

Bullish Gold Trajectory and Fundamental Analysis of XAU/USDThe gold market (XAU/USD) has been exhibiting strong bullish momentum, as evidenced by the price patterns and macroeconomic conditions.

Bullish Price Trajectory: Historical Patterns

The attached chart highlights two distinct bullish patterns in gold's price movement:

1. Pattern 1 (July 18, 2024 – October 30, 2024)

Initial Price: $2,394

Closing Price: $2,762

Percentage Increase: Approximately 15.37%

This pattern reflects a steady upward movement within a defined bullish channel.

2. Pattern 2 (January 7, 2025 – March 14, 2025)

Initial Price: $2,706

Anticipated Closing Price (March 14): $3,100

Applying the same percentage increase from Pattern 1 to Pattern 2 predicts a potential price of $3,121.96, suggesting further upside.

Argument for Repetition of Pattern

The market structure in Pattern 2 closely mirrors that of Pattern 1, with consistent higher highs and higher lows.

The current price trajectory remains within the bullish channel, reinforcing the likelihood of continued upward momentum.

Fundamental Drivers Supporting Bullish Gold Prices

Gold's bullish outlook is supported by several macroeconomic and geopolitical factors:

1. Safe-Haven Demand

Economic Uncertainty: Persistent economic instability, including geopolitical tensions (e.g., wars in Gaza and Ukraine) and global trade disputes, has increased demand for safe-haven assets like gold.

Market Sentiment: Consumer confidence has been declining due to inflation fears and policy uncertainty, prompting investors to hedge risks by buying gold.

2. Central Bank Accumulation

Central banks worldwide have been aggressively buying gold to diversify reserves amid geopolitical risks and concerns about fiat currency stability. This trend provides strong support for gold prices.

3. Easing Monetary Policy

Recent data shows U.S. inflation easing to 2.8% year-on-year in February 2025, down from 3% in January. This has fueled expectations of Federal Reserve interest rate cuts.

Lower interest rates reduce the opportunity cost of holding non-yielding assets like gold, making it more attractive to investors.

4. Weakening U.S. Dollar

A weaker U.S. dollar often boosts gold prices as it becomes cheaper for international buyers. Current monetary policies and fiscal challenges in the U.S., including rising debt levels, are likely to put downward pressure on the dollar.

5. Inflation Hedge

With persistent inflationary pressures globally, gold continues to serve as a reliable hedge against inflation. Analysts expect this trend to persist through 2025.

Technical Analysis Supporting Bullish Outlook

1. Support Levels

The chart shows that gold has rebounded strongly from a well-defined support region around $2,600–$2,700.

This region aligns with prior consolidation zones, indicating strong buyer interest.

2. Moving Averages

Gold prices remain above key moving averages (e.g., EMA-65), signaling sustained upward momentum.

3. Oscillator Signals

The Stochastic Oscillator indicates that prices are rebounding from oversold levels, confirming renewed bullish momentum.

The combination of technical indicators and fundamental drivers strongly supports a bullish trajectory for gold prices in the near term:

Historical price patterns suggest that the current bullish channel could push prices beyond $3,100 by mid-March.

Macroeconomic factors such as easing inflation, central bank buying, geopolitical risks, and monetary policy shifts create a favorable environment for further upside.

Given these conditions, investors and traders should remain optimistic about gold's performance in 2025 while closely monitoring key support levels and macroeconomic developments.

Gold Above $3,000 and MoreAccording to the World Gold Council, more than 600 tons of gold — valued at around $60 billion — have been transported into vaults in New York. Why are they doing that?

Since Donald Trump election in November, there is around $60 billion worth of gold that has flowed into a giant stockpile in New York.

The reason why physical gold is flowing into the US is because traders are afraid Trump might put tariffs on gold.

Gold Futures & Options

Ticker: GC

Minimum fluctuation:

0.10 per troy ounce = $10.00

Micro Gold Futures & Options

Ticker: MGC

Minimum fluctuation:

0.10 er troy ounce = $1.00

1Ounce Gold Futures

Ticker: 1OZ

Minimum fluctuation:

0.25 per troy ounce = $0.25

Disclaimer:

• What presented here is not a recommendation, please consult your licensed broker.

• Our mission is to create lateral thinking skills for every investor and trader, knowing when to take a calculated risk with market uncertainty and a bolder risk when opportunity arises.

CME Real-time Market Data help identify trading set-ups in real-time and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Trading the Micro: www.cmegroup.com

Gold Breaks $3,000: Bulls Maintain Strong Control in the MarketGold Trading Update: The $3K Target Achieved

Gold has reached the $3,000 target as expected. Technical analysis indicates there's still room for further upside, potentially towards the overbought line of the larger uptrend channel. Notably, we're not seeing any signs of supply entering the market yet.

The $3,000 level was our focus, and gold has just hit that today. We've been watching this breakout, which tested on low volume. The upward momentum continues with an extension forming, and volume is now picking up, showing improvement in the trend.

What's Next for Gold Trading?

The current technical indicators suggest we can still move higher. Gold has been advancing for five to six consecutive days, demonstrating persistent improvement to the upside. Supply on the way up is comparable to the previous strong area we've discussed.

What makes this move particularly noteworthy is the absence of significant reactions or pullbacks. The market is showing only very small retracements, indicating bullish strength.

This continued strength without substantial corrections suggests the bull run in gold may continue in the near term. Traders should watch for potential targets at the overbought line of the larger uptrend channel as mentioned in our analysis.

This analysis is for informational purposes only and should not be considered investment advice.

Mcx Gold getting ready for further details (feds decision)### **Gold Futures (MCX) 4H Chart Forecast**

#### **Key Levels:**

- **Resistance:**

- **89,500 - 91,000 INR** (Upper boundary of the trend channel)

- **Support Zones:**

- **87,930 INR** (First minor support)

- **86,665 - 86,149 INR** (Stronger support)

- **85,000 INR** (Major downside target)

#### **Technical Outlook:**

- Gold futures are currently trading around **88,682 INR**, still inside the **ascending channel**.

- **Potential Bullish Scenario:**

- If gold **sustains above 87,930 INR**, it may test **89,500 - 91,000 INR**.

- **Potential Bearish Scenario:**

- If gold **breaks below 87,930 INR**, it could drop to **86,665 - 86,149 INR**.

- Further breakdown below **86,000 INR** could push prices toward **85,000 INR**.

#### **Trading Strategy:**

- **Buy on dips** near **87,930 - 86,665 INR**, targeting **90,000 INR**.

- **Sell below 87,930 INR**, targeting **86,149 - 85,000 INR**.

- Watch for a **breakout above 89,500 INR** for a bullish push toward **91,000 INR**.