Key facts today

Meta Platforms Inc. (META) reported better-than-expected earnings, causing a notable increase in its stock price, aligning with trends seen in other major tech firms after earnings releases.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

28.31 USD

62.36 B USD

164.50 B USD

2.17 B

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

FIGI

BBG000MM2P62

Meta Platforms, Inc., engages in the development of social media applications. It builds technology that helps people connect, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

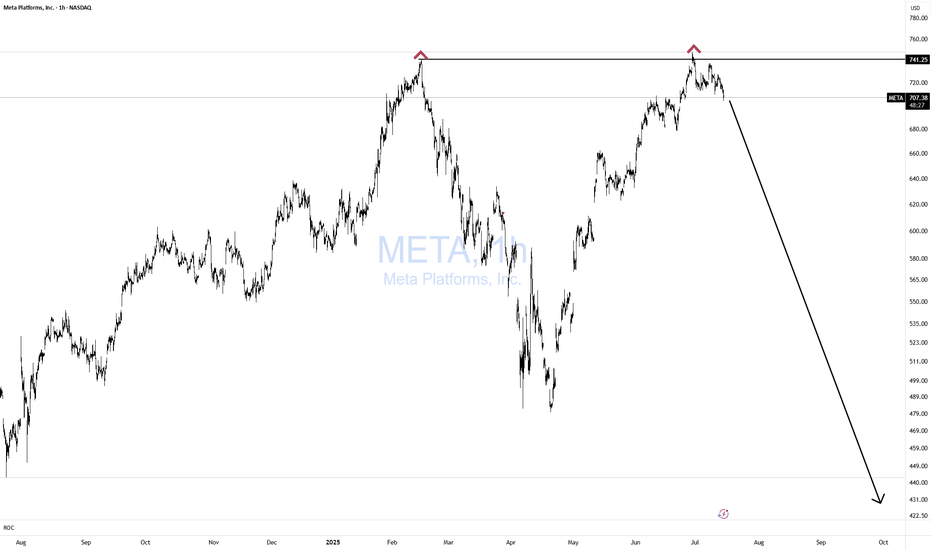

Incoming 40% correction for FacebookOn the above 10 day chart price action has rallied 500% since October 2022. It is somewhat unfortunate to see so many long ideas at the moment.

Motley Fool August 8th:

“Here's how Meta could achieve a $2 trillion valuation within three years, and if it does, investors who buy the stock today could

7/30/25 - $meta - And u think they'll miss?7/30/25 :: VROCKSTAR :: NASDAQ:META

And u think they'll miss?

- we continue to collect data pts that the consumer is spending like a drunken sailor and somehow the market still wants to bid the trash meme stocks that will burn cash until kingdom come

- amazon prime day

- dubious/ but still... go

META CANT KEEP THE HULK DOWN!!!!META has been consolidating for a few weeks now, but it's still in this bull flag that looks like it might break out soon, hopefully before earnings on Wednesday, July 30. I love technical analysis on charts, and this inverse head and shoulders pattern has been effective on most semiconductor names

META Earnings Trade Setup — July 30 (AMC)

## 🧠 META Earnings Trade Setup — July 30 (AMC)

📈 **META (Meta Platforms Inc.)**

💥 **Confidence**: 85% Bullish

💡 **Play Type**: Pre-earnings call option

📊 **Fundamentals + Flow + Setup = High Conviction Swing**

---

### 📊 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +16.1% YoY

✅ **Profit Margin**:

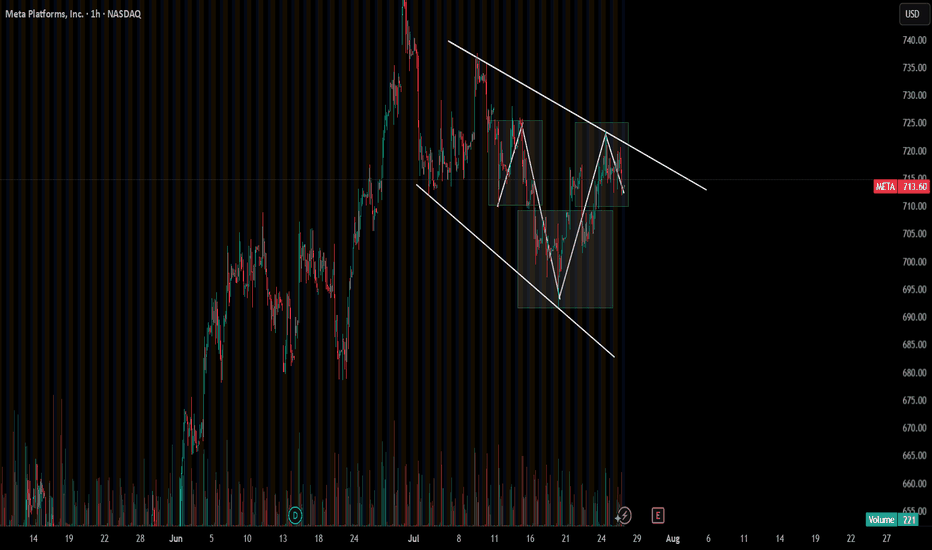

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time wil

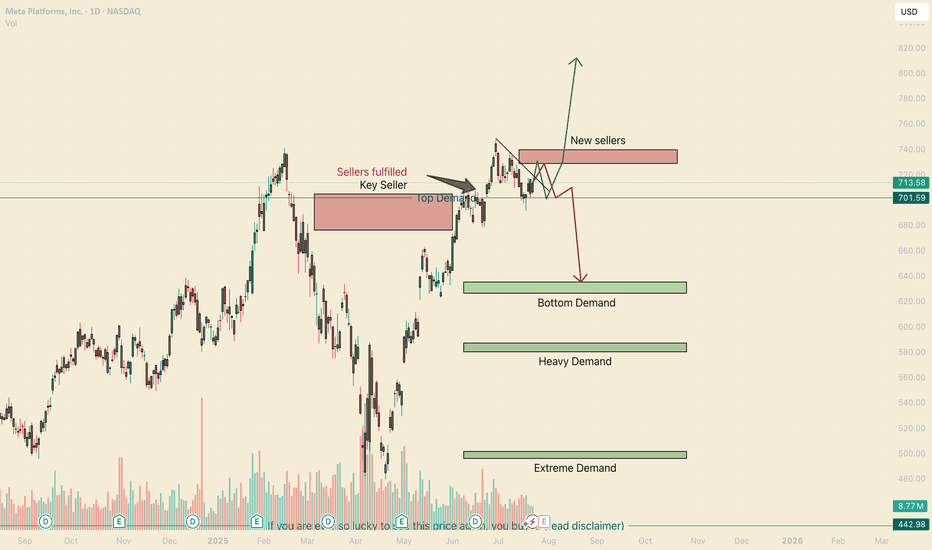

META’s Monster Gap — Gamma Ceiling. 8/1META’s Monster Gap — Gamma Ceiling at $785 or Room to Run Past $800?

🔍 GEX & Options Flow Insight (1st Image Analysis)

META ripped higher on earnings momentum, gapping from the $690s into the $770s, and is now stalling just under the Gamma Wall / Highest Positive NET GEX at $784.69. Options positio

META Double Top? Think Again. Hello, my name is The Cafe Trader.

As part of our MAG 7 Series, we tackle META next on the list.

This article is for:

– Long-Term Investors

– Long-Term Hedges

– Swing Traders

– Options Traders

⸻

Brief Notes:

1. Meta is going all-in on AI, integrating it across all platforms (Instagram, Facebook,

Meta surprises to the upside & strengthens its leadership in AIBy Ion Jauregui – Analyst at ActivTrades

Meta Platforms (TICKER AT: META.US) has posted strong quarterly results that significantly exceeded market expectations, driven by its solid positioning in artificial intelligence, advertising monetization, and the resilience of its digital ecosystem.

Key

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

16.29%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.02%

Maturity date

Aug 15, 2062

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

5.97%

Maturity date

Aug 15, 2052

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.74%

Maturity date

Aug 15, 2064

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.68%

Maturity date

Aug 15, 2054

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.65%

Maturity date

May 15, 2063

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.59%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

FB5458291

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

5.23%

Maturity date

Aug 15, 2032

See all META bonds

Curated watchlists where META is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of META is 750.01 USD — it has decreased by −3.03% in the past 24 hours. Watch Meta Platforms stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Meta Platforms stocks are traded under the ticker META.

META stock has risen by 4.62% compared to the previous week, the month change is a 4.85% rise, over the last year Meta Platforms has showed a 43.96% increase.

We've gathered analysts' opinions on Meta Platforms future price: according to them, META price has a max estimate of 1,086.00 USD and a min estimate of 570.00 USD. Watch META chart and read a more detailed Meta Platforms stock forecast: see what analysts think of Meta Platforms and suggest that you do with its stocks.

META reached its all-time high on Jul 31, 2025 with the price of 784.75 USD, and its all-time low was 17.55 USD and was reached on Sep 4, 2012. View more price dynamics on META chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

META stock is 3.77% volatile and has beta coefficient of 1.29. Track Meta Platforms stock price on the chart and check out the list of the most volatile stocks — is Meta Platforms there?

Today Meta Platforms has the market capitalization of 1.89 T, it has decreased by −3.35% over the last week.

Yes, you can track Meta Platforms financials in yearly and quarterly reports right on TradingView.

Meta Platforms is going to release the next earnings report on Oct 22, 2025. Keep track of upcoming events with our Earnings Calendar.

META earnings for the last quarter are 7.14 USD per share, whereas the estimation was 5.88 USD resulting in a 21.36% surprise. The estimated earnings for the next quarter are 6.54 USD per share. See more details about Meta Platforms earnings.

Meta Platforms revenue for the last quarter amounts to 47.52 B USD, despite the estimated figure of 44.82 B USD. In the next quarter, revenue is expected to reach 48.70 B USD.

META net income for the last quarter is 18.34 B USD, while the quarter before that showed 16.64 B USD of net income which accounts for 10.17% change. Track more Meta Platforms financial stats to get the full picture.

Yes, META dividends are paid quarterly. The last dividend per share was 0.52 USD. As of today, Dividend Yield (TTM)% is 0.27%. Tracking Meta Platforms dividends might help you take more informed decisions.

Meta Platforms dividend yield was 0.34% in 2024, and payout ratio reached 8.38%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 3, 2025, the company has 74.07 K employees. See our rating of the largest employees — is Meta Platforms on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Meta Platforms EBITDA is 95.54 B USD, and current EBITDA margin is 51.83%. See more stats in Meta Platforms financial statements.

Like other stocks, META shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Meta Platforms stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Meta Platforms technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Meta Platforms stock shows the buy signal. See more of Meta Platforms technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.