1BIIB trade ideas

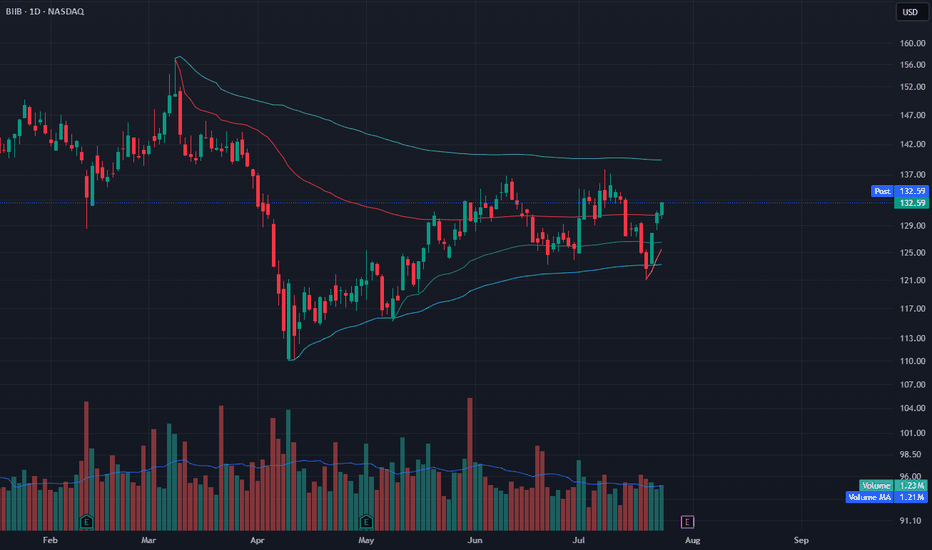

BIIB Bounces from VWAP ClusterBIIB is climbing after bouncing off a VWAP cluster (yellow and green zones) and reclaiming key levels. Price held support near $125 and is now pushing toward the upper range near $134.

Volume is slightly above average (1.23M vs. 1.21M MA), and price structure looks constructive with a clean higher low in place. The red VWAP still acts as overhead resistance, but if cleared, a move toward $136–138 could follow.

Indicators used:

Anchored VWAPs (support confluence and resistance setup)

Volume and Volume MA

Trend structure (higher low + bullish follow-through)

Entry idea: Above $133 or on dip to $130

Target: $136–138

Stop: Below $127 or VWAP cluster

BIIB - Picture Perfect Market Maker ModelQuite Frankly This Is a Piece of Art.

Ai is been helping Bio Tech massively

Using the 3 Month and 1 Month Time frames we have a perfect Market maker model. Consolidation up top with market manipulation straight to distribution (A,M,D)

- 2 main accumulations before it hit's a perfect fair value gap.

Picture perfect <3

BIIB Long, Coming Soon!The price has sold off from the $207.59 pivot level, dropping to $193.84 as of the Monday, September 30th close. The sharp decline from $200 to $190 over two days last week was largely due to sector-wide weakness, as reflected in the IBB (Biotech ETF). Since then, both the ETF and BIIB have been consolidating, showing signs of stabilization. Buyers have begun to step in, especially noticeable on the 65-minute chart. Following the rapid sell-off, the price bounced higher, testing the $193.65 resistance level, which corresponds to a monthly pivot.

Although price initially failed to close above this level, the next day saw a gap up, with price holding above the resistance. Yesterday, the stock consolidated tightly throughout the day, indicating some strength. While there isn’t a definitive daily technical setup to warrant immediate conviction, the stock looks promising for a potential long swing trade in the coming days, particularly based on the oversold condition and technical recovery. Keep an eye on how the price action evolves for a better entry signal.

Biogen Stock Surge 4.85% on Approval For ALS DrugBiogen ( NASDAQ:BIIB ) has received a significant boost with the Food and Drug Administration's accelerated approval for Qalsody, a drug aimed at treating ALS, a debilitating muscle-wasting disease. While the approval marks a significant milestone in Biogen's efforts to address critical medical needs, the company faces challenges amidst concerns over its earnings quality and ongoing transformations under new leadership.

Hope Amidst Challenges:

The FDA's accelerated approval for Qalsody represents a beacon of hope for ALS patients, offering a potential treatment for a devastating disease with limited therapeutic options. Biogen's collaboration with Ionis Pharmaceuticals underscores the importance of innovative partnerships in advancing medical research and addressing unmet medical needs. However, despite this positive development, Biogen's stock performance remains under pressure amidst broader market uncertainties and investor concerns.

Earnings Quality Debate:

Biogen's recent earnings report, while beating expectations, has sparked debate over the quality of its earnings performance. Analysts have raised questions about the sustainability of Biogen's growth trajectory under new CEO Christopher Viehbacher, citing ongoing transformations and challenges in key therapeutic areas. The company's stock reaction to the earnings beat reflects investor caution and underscores the need for clarity regarding Biogen's long-term strategic direction.

Strategic Initiatives and Pipeline Potential:

Biogen's strategic initiatives, including its Alzheimer's and depression treatment efforts, holds significant potential to drive future growth. The accelerated approval of Leqembi for Alzheimer's and the optimism surrounding zuranolone for depression underscore Biogen's commitment to addressing critical neurological disorders. However, challenges persist, particularly in the multiple sclerosis franchise, where competition and generic alternatives continue to impact sales.

Navigating Market Dynamics:

Biogen's resilience amidst market challenges hinges on its ability to effectively execute strategic initiatives, manage portfolio dynamics, and capitalize on emerging opportunities. The company's reaffirmed outlook for full-year sales, despite headwinds in certain therapeutic areas, reflects confidence in its pipeline potential and strategic resilience. As Biogen ( NASDAQ:BIIB ) charts its course forward, investor sentiment will likely be influenced by developments in key therapeutic programs, regulatory decisions, and market dynamics.

Legendary Sharkley A combination of a Shark harmonic pattern and a Gartley has emerged at the pattern completion zone. There is also bullish divergence on the RSI at the comfirmation double bottom. NASDAQ:BIIB has been oscillating between around $190-$440 since 2013 and seems to be at a good bargain price of $218 currently which is on the lower side.

BIIB Overdue for Gap UpBIIB's at a support level, but it's also been gapping up significantly every 2-6 quarters for the past few years. Its last gap was exactly a year ago, so it's overdue for a gap up. It's also within a month of earnings, so management is likely keen on pushing for newsworthy developments. I'll be rolling far OTM calls every week until earnings given the upside for such a gap.

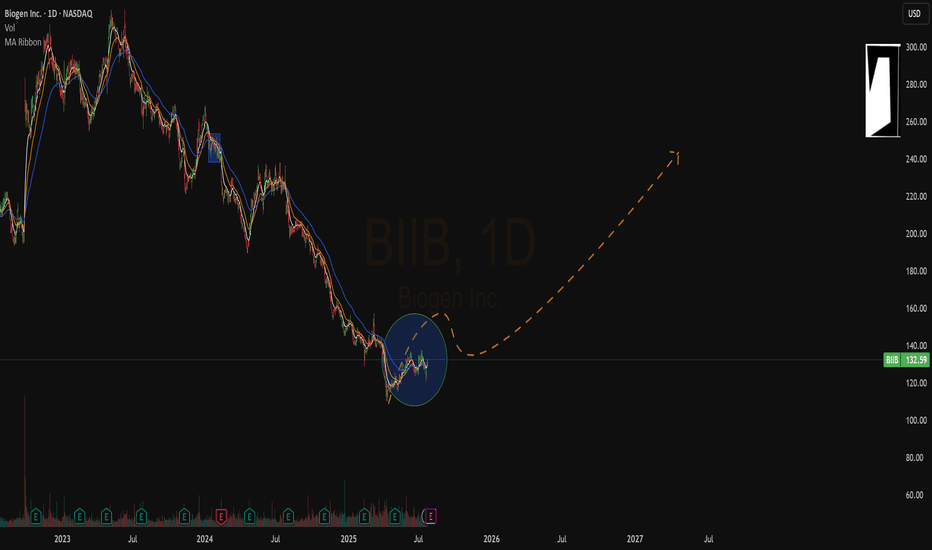

$BIIB: Monster trade, brace yourselvesBiogen has a monster trade brewing here, can't afford to miss this trade. I've been trading it actively since they received FDA approval for their Alzheimer's drug a while back.

The current setup looks very strong and implies a massive uptrend can start from right here.

Best of luck!

Ivan Labrie.

Biogen testing channel supportBiogen Inc. (BIIB) currently testing channel support, able to absorb weekly selling pressures.

From here, (BIIB) can recover and turn higher to channel resistance, eliciting gains of 20-25% over the following 2 - 3 months.

A settlement above this week’s high would accelerate this upward momentum.

Inversely, closing below this channel support would indicate losses of 20% over the following 2 - 3 months where (BIIB) can bottom out into Q4.

BIIB earningsBiogen (BIIB) earnings are on Wednesday, July 19th, 2023, at 7:15am. Biogen (BIIB) reported Q1 March 2023 earnings of 3.40 per share on revenue of 2.5 billion. The consensus earnings estimate was 3.25 per share on revenue of 2.4 billion. The company said it continues to expect 2023 earnings of 15.00 to 16.00 per share. The current consensus earnings estimate is 15.47 per share for the year ending December 31, 2023.

Q2 June 2023 Consensus:

EPS = 3.70

Revenue = 2.38 B

PE = 12.7

100SMA = 290

200SMA = 279

BIIB 1 day (24hr ext.) chart TTCATR 20VWMA levels:

R3 = 317

R2 = 309

R1 = 302

pivot = 294

S1 = 286

S2 = 279

S3 = 271

Options data:

7/14 expiry

Put Volume Total 723

Call Volume Total 2,716

Put/Call Volume Ratio 0.27

Put Open Interest Total 257

Call Open Interest Total 1,277

Put/Call Open Interest Ratio 0.20

7/21 expiry

Put Volume Total 602

Call Volume Total 2,380

Put/Call Volume Ratio 0.25

Put Open Interest Total 5,614

Call Open Interest Total 10,199

Put/Call Open Interest Ratio 0.55

8/18 expiry

Put Volume Total 206

Call Volume Total 726

Put/Call Volume Ratio 0.28

Put Open Interest Total 436

Call Open Interest Total 795

Put/Call Open Interest Ratio 0.55

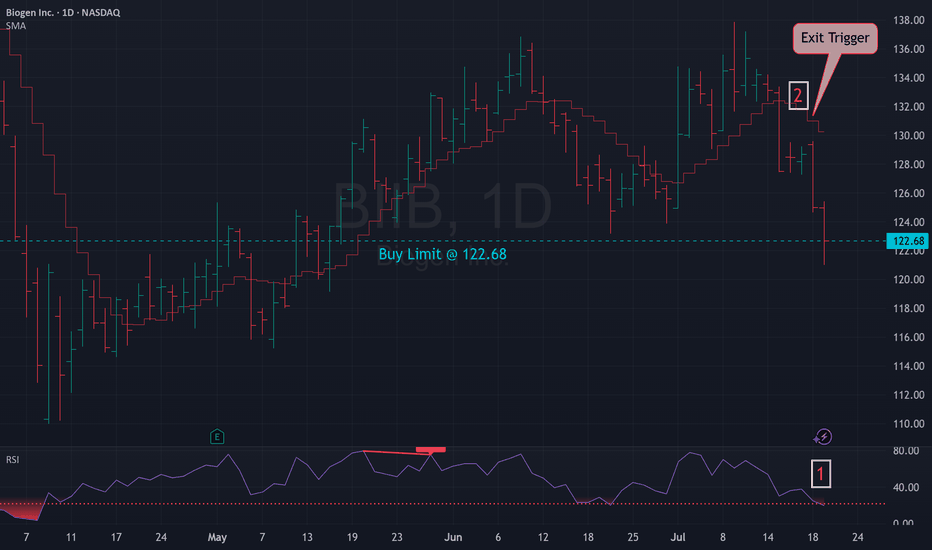

BIIB consolidation might get to end and a new move up possible.BIIB shares might the consolidation channel and prepare a move higher.

The reason would be that the market discounts the potential sales CAGR for Alzheimer's drugs, reimbursements being an issue.

If the problem gets solved, BIIB gets a clear path towards higher valuation.

Alzheimer's drug, from $BIIB and EisaiAccording to MarketWatch, The FDA approved the

Alzheimer's drug Legembi from

Eisai and Biogen

A quick look at the daily charts for $BIIB shows that it's already trading on or above major moving averages (ie. 9,21,50 SMA's). Also, seeing as this is a nice, green day for the SPY and BIIB has been beaten down recently, it's a nice long option for medium term traders and investors in general.

If I were to go long, a nice R:R profit target would be the top of the Bollinger bands with a stop loss below the "fast" moving average in use.

Good luck.