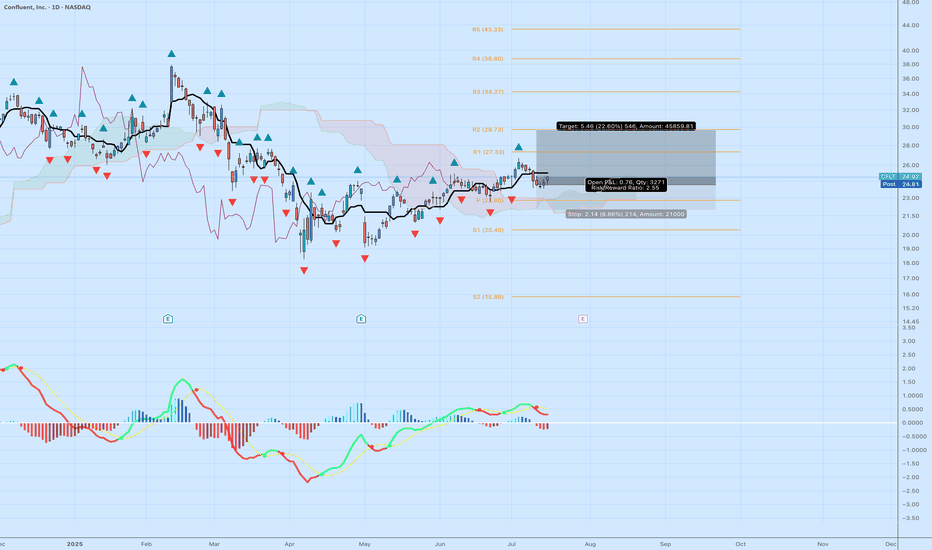

CFLT: Bullish Momentum Breakout Targeting $29.76 – Strong R/R Ticker: NASDAQ:CFLT (Confluent, Inc.)

Bias: Long

Timeframe: Daily (with momentum building from May lows)

Entry: Around $24.30 (near recent breakout above pivot at $22.80)

Stop Loss: $22.14 (below swing lows, ~8.86% risk)

Target: $29.76 (near R2 resistance, ~22.60% reward)

Risk/Reward Ratio: 2.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.795 EUR

−333.33 M EUR

930.86 M EUR

281.86 M

About Confluent, Inc.

Sector

Industry

CEO

Edward Jay Kreps

Website

Headquarters

Mountain View

FIGI

BBG01TNXKKS0

Confluent, Inc. engages in creating a data infrastructure platform focused on data in motion. The firm provides application architecture engagement, multi data center, security and upgrade engagement, and Amazon web services cloud deployment services. Its products include Confluent Cloud, Confluent Platform, WarpStream BYOC, Connectors, Flink, Stream Governance, and Confluent Hub. The company was founded by Edward Jay Kreps, Neha Narkhede, and Jun Rao on September 1, 2014, and is headquartered in Mountain View, CA.

Related stocks

Moonshot Ideas $CFLT > $40- We are entering era of Agentic AI which requires real time data and agent decides to take an action on that event in near real time.

- Confluent valuation is so cheap in a massive TAM and an exploding tailwind of AI Agents. I am seeing all the tech companies and startups are building AI Agents a

$CFLT will break $35 range if Q1 | FY 2025 is good- NASDAQ:CFLT has been range bound for two years now where the lower end is $14-18 and upper range is $35-38.

- If FY 2025, Q1 exceeds expectation of the analyst then this stock will be able to get through the long term resistance and turn it into support.

- NYSE:IOT is a peer company which o

CONFLUENT ($CFLT) – DATA STREAMING’S RISING STARCONFLUENT ( NASDAQ:CFLT ) – DATA STREAMING’S RISING STAR

1/7

Ready for a snapshot of Confluent? Here’s what’s sparking chatter on X: 23% YoY revenue growth, $0.09 EPS (beats by $0.03), and free cash flow at $ 29M—above estimates! Let’s dive in. 🚀💹

2/7 – REVENUE & EARNINGS BLAST

• Overall revenue:

Bullish on data streaming but CFLT to $15 for better risk/reward- While I believe NASDAQ:CFLT chart looks good and it might go to $40 after earnings in Q1 2025. But data platform infra is getting very competitive.

- First layer of competition comes from Hyperscalers like AWS, GCP and Azure which have their own variant of stream processing. Confluent had some

CFLT"Cup and Handle" Pattern:

The price movement forms a "cup" shape (yellow curve), which is a well-known bullish continuation pattern. This indicates a gradual recovery back to previous resistance levels.

The "handle" (on the right side) is a small consolidation phase, which could lead to a breakout

Exciting Opportunity in CONFLUENTHello fellow Traders,

I came across an interesting stock that I believe has strong potential for a rally soon. Upon analyzing its chart patterns and considering the upcoming earnings reports, it seems poised for a significant move.

Key Observations:

Current Support Level:

On the daily chart, the

JPMorgan Upgrades Riot Platforms Stock Rating. Idea 21/03/2024Investment analysts at JPMorgan have upgraded Riot Platforms Inc.'s stock rating from "Neutral" to "Overweight" and set a target price of 15.00 USD. This adjustment is based on the anticipated significant growth in Riot Platforms' hash rate, a key performance indicator in the cryptocurrency mining

Confluent Enters the Stream Processing Market - Idea 20/03/24Software development company Confluent Inc. has introduced a new solution for stream data processing. This is a promising direction for real-time information processing, and Confluent aims to capture a significant share of this future key IT segment.

Confluent has unveiled a new product called Ta

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where 1CFLT is featured.

US software stocks: Overlooked operating systems

17 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 1CFLT is 14.460 EUR — it has decreased by −7.26% in the past 24 hours. Watch CONFLUENT INC-CLASS A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange CONFLUENT INC-CLASS A stocks are traded under the ticker 1CFLT.

1CFLT stock has fallen by −38.50% compared to the previous week, the month change is a −32.89% fall, over the last year CONFLUENT INC-CLASS A has showed a −28.44% decrease.

We've gathered analysts' opinions on CONFLUENT INC-CLASS A future price: according to them, 1CFLT price has a max estimate of 31.53 EUR and a min estimate of 17.52 EUR. Watch 1CFLT chart and read a more detailed CONFLUENT INC-CLASS A stock forecast: see what analysts think of CONFLUENT INC-CLASS A and suggest that you do with its stocks.

1CFLT reached its all-time high on Jul 25, 2025 with the price of 23.515 EUR, and its all-time low was 17.175 EUR and was reached on May 2, 2025. View more price dynamics on 1CFLT chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1CFLT stock is 7.83% volatile and has beta coefficient of 1.98. Track CONFLUENT INC-CLASS A stock price on the chart and check out the list of the most volatile stocks — is CONFLUENT INC-CLASS A there?

Today CONFLUENT INC-CLASS A has the market capitalization of 5.19 B, it has increased by 2.31% over the last week.

Yes, you can track CONFLUENT INC-CLASS A financials in yearly and quarterly reports right on TradingView.

CONFLUENT INC-CLASS A is going to release the next earnings report on Oct 29, 2025. Keep track of upcoming events with our Earnings Calendar.

1CFLT earnings for the last quarter are 0.08 EUR per share, whereas the estimation was 0.07 EUR resulting in a 8.44% surprise. The estimated earnings for the next quarter are 0.09 EUR per share. See more details about CONFLUENT INC-CLASS A earnings.

CONFLUENT INC-CLASS A revenue for the last quarter amounts to 239.63 M EUR, despite the estimated figure of 236.34 M EUR. In the next quarter, revenue is expected to reach 256.49 M EUR.

1CFLT net income for the last quarter is −69.57 M EUR, while the quarter before that showed −62.46 M EUR of net income which accounts for −11.38% change. Track more CONFLUENT INC-CLASS A financial stats to get the full picture.

No, 1CFLT doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 3.06 K employees. See our rating of the largest employees — is CONFLUENT INC-CLASS A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. CONFLUENT INC-CLASS A EBITDA is −306.44 M EUR, and current EBITDA margin is −38.54%. See more stats in CONFLUENT INC-CLASS A financial statements.

Like other stocks, 1CFLT shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CONFLUENT INC-CLASS A stock right from TradingView charts — choose your broker and connect to your account.