Super Performance CandidateNASDAQ:DASH , market leadership commanding 60% of U.S food delivery market, outpacing competitors, consistent revenue growth, strong financials positions this equity to gain market share with our upcoming roaring market.

At a RS Rating of 95,

I have reasons to believe this equity value could increase

1DASH trade ideas

DASH Weekly Options Trade — June 15, 2025📈 DASH Weekly Options Trade — June 15, 2025

💡 Ticker: DASH

🎯 Strategy: Bullish Swing — Call Option

📅 Expiry: June 20, 2025

⏱ Entry Timing: Market Open (only if breakout confirmed)

📈 Confidence: 70%

🔍 Analysis Summary

All four models (Grok, Llama, Gemini, DeepSeek) point to short-term bullish momentum with DASH currently trading:

🔼 Above key EMAs on the 5-min and daily charts

🧭 MACD & RSI in bullish alignment

💬 Supported by strong volume and market sentiment

While there is caution due to overbought RSI and a wide gap between price and max pain ($187.50), the models favor a breakout scenario if DASH clears resistance at $219–$220.

✅ Trade Recommendation

🛒 Trade Type: Long CALL (Naked)

🎯 Strike: $230.00

💵 Entry Price: ~$0.67

📅 Expiration: June 20, 2025 (weekly)

📈 Profit Target: ~$1.34 (100% gain)

🛑 Stop Loss: ~$0.33 (50% loss)

🔎 Entry Note: Only enter if price confirms breakout above $219–$220 zone at open

🧠 Key Risks to Monitor

❗ Overbought signals could lead to a pullback before continuation

⚖️ Max pain at $187.50 may pressure price toward expiration

📉 Avoid entry if DASH fails to hold above $219 at open

🔄 Wider bid/ask spreads due to volatility—manage slippage carefully

🚨 Watchlist Trade: This setup is conditional. Enter only on breakout confirmation above $220.

Let’s see if DASH delivers another leg up—or stalls at resistance.

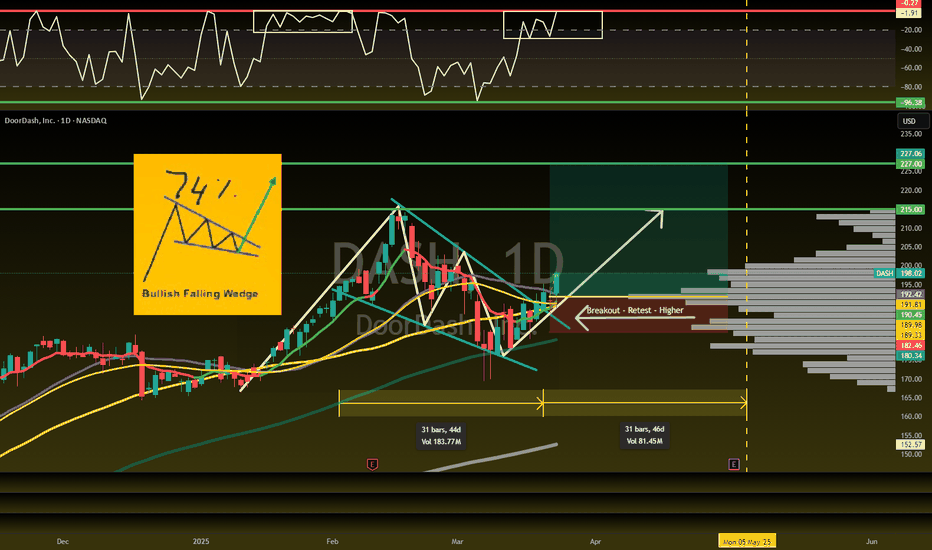

DASH Breakout From Cup & HandleDoorDash ( NASDAQ:DASH ) posted a strong breakout today, clearing all-time highs with clean technical structure and rising relative strength.

This move is mimicking the HOOD breakout from yesterday, showing similar behavior: tight action near the highs, a well-formed cup and handle base, and a breakout that signals accumulation. Before that, DASH formed a double bottom, creating a base-on-base pattern — a classic sequence seen in leadership stocks.

Price is stacked above all major moving averages (10, 21, 50, 200), showing technical health. Relative strength is trending higher and confirms DASH as a name showing early leadership. While volume wasn’t explosive today, we’d like to see it increase to validate the move.

Trade Setup:

📈 Entry: 215.25 – 226.28

🛑 Stop: 204.49 – 214.97

🎯 Target: 245.39 – 257.96

DASH continues to expand in delivery and logistics while improving operational efficiency — a strong fundamental backdrop to pair with this technical setup. We’re watching for continuation or a secondary entry on a pullback or tight flag.

DoorDash May Be Done BasingDoorDash has been consolidating for months, and now some traders may look for more upside.

The first pattern on today’s chart is March’s low, April’s lower low and May’s higher low. That rounded basing pattern is a potentially bullish continuation pattern.

Second, DASH got stuck at a falling trendline last month but now seems to be free of it.

Third, the 50-day simple moving average (SMA) is above the 100-day SMA. Both are above the 200-day SMA. That kind of alignment, with faster SMAs above slower SMAs, could be indicative of an uptrend.

Fourth, the 8-day exponential moving average (EMA) crossed above the 21-day EMA and has remained there since. MACD is also rising. Those signals may be consistent with bullishness in the short term.

Check out TradingView's The Leap competition sponsored by TradeStation.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

$DASH Ready to Breakout?NASDAQ:DASH looks like it is getting ready to break out. It is only $11 off, its 52-week high. Recent upgrades increased price targets to $235 and $240.

One could look at the chart pattern and say it is a complex reverse head and shoulders, and today’s bar found support right at the neckline. I have been in this name for about 2 weeks as it recovered the 50 DMA (red). I will be looking to add to my position if it can clearly break above the area of resistance at the horizontal line, around $207.

This is a trade I am already in, and it is my idea. If you like the thought, please make it your trade that fits your trading plan.

DoorDash presents an offer to acquire Deliveroo

Ion Jauregui – ActivTrades Analyst

DoorDash has made an offer to acquire Deliveroo in a deal that could reshape the home-delivery sector in Europe.

Deliveroo (LON:ROO), the UK delivery platform that debuted on the stock market in 2021 with a valuation of £7.6 billion, is in talks to be acquired by DoorDash (NASDAQ:DASH). The proposal amounts to approximately £2.7 billion, offering £1.80 per share—a 20 % premium over last Friday’s closing price. Since its IPO, Deliveroo’s stock performance has been disappointing: it fell more than 25 % on its first trading day and now trades around £1.46—60 % below its initial listing price. Although the company achieved its first annual profit in 2024, fierce competition from players like Uber Eats (NYSE:UBER) and Amazon (NASDAQ:AMZN) has constrained its growth.

DoorDash Analysis (DASH.US)

DoorDash closed 2024 with revenues of $10 722 million (up 24 % year-on-year) and reported its first full-year GAAP net profit of $117 million. In Q4 2024 it generated $2 873 million in revenue (+25 %), net income of $141 million, processed 685 million orders, and reached a Gross Order Value (GOV) of $21 300 million. From a technical standpoint, the company has consistently hit new milestones since October 2022 and has returned to its 2021 trading range. It currently trades around $185.76 within a band between $181.70 and $213.39. The long-term Point of Control (POC) sits much lower, near $60. Moving-average crossovers suggest the upward trend remains intact and could push the price back to $215.35. If breached, the November 2021 peak of $257.25 may come into play. The RSI stands at 54.16 %, indicating there is still room for further expansion.

Key aspects:

The proposed acquisition is particularly significant because DoorDash— with $10.7 billion in annual revenues and operations in over 30 countries—does not directly compete in Deliveroo’s core markets. This could ease regulatory approval. If completed, it would be a strategic merger with the potential to strengthen DoorDash’s position in the European market.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

DoorDash (NASDAQ: $DASH) Gains Strength Ahead of May EarningsDoorDash, Inc. (NASDAQ: NASDAQ:DASH ) is showing strong momentum in a volatile market. As of April 11, DASH closed at $180.49, up 1.10% for the day. The stock has risen about 9% year-to-date, while the overall Computer and Technology sector has dropped around 11.8%. This places DoorDash ahead of many of its peers.

DoorDash belongs to the Computer and Technology group, which ranks #6 out of 16 sectors based on the Zacks Sector Rank. The company currently holds a Zacks Rank of #2 (Buy), signaling positive analyst sentiment. Over the last three months, analysts have revised DoorDash's full-year earnings estimate up by 14.7%. This indicates growing confidence in the company’s future performance.

Investors are now watching closely as DoorDash prepares to release its earnings report on May 7, 2025. The stock's upward trend and revised estimates may influence how it reacts to the upcoming results.

Technical Analysis

The daily chart shows that DASH recently bounced off a strong support zone around $162. This zone has acted as a demand area before, pushing the price higher in past sessions. Currently, DASH is approaching key resistance level at $200. A break above these could lead the stock toward the recent high at $215.25. The chart also suggests a possible retracement before a new leg up, reflecting a bullish continuation structure.

Volume increased during the bounce, indicating strong buying interest. RSI is at 48.16, which suggests neutral momentum with room for further upside. DoorDash remains one to watch heading into earnings season.

DoorDash: Is it another advantage or a liquidity trap?Reading a slightly bearish sentiment on DASH at the moment. We have the swing high anchored VWAP combined with a riding wedge. In the short term, it could potentially reach 195, potentially creating a false breakout and trapping long liquidity. Therefore, it’s advisable to exercise caution and closely monitor this situation. Let’s see how it unfolds!

DOORDASH ($DASH) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSEDOORDASH ( NASDAQ:DASH ) – FROM FOOD DELIVERY TO GLOBAL POWERHOUSE

(1/7)

DoorDash just reported 25% YoY revenue growth to $2.9B! That’s a hearty slice of the delivery pie. 🚀🍕 Let’s dig into the numbers, risks, and what might lie ahead for $DASH.

(2/7) – EARNINGS SPOTLIGHT

• GAAP net income: $0.33/share—the second profitable quarter since going public! 💰

• Net revenue margin: 13.5%, inching up from last quarter.

• Plus, a SEED_TVCODER77_ETHBTCDATA:5B share repurchase plan signals management’s confidence in future earnings. 💎

(3/7) – SECTOR COMPARISON

• Market cap ~$80.2B, with the buyback at ~5% of that.

• Analysts (e.g., Oppenheimer) raising price targets → suggests undervaluation vs. Uber Eats & Grubhub. 🤔

• Strong performance in new verticals & international markets = diversification & growth advantage. 🌐

(4/7) – RISK FACTORS

• Market saturation: Competitors might lower prices or offer bigger discounts. 🛍️

• Regulatory: Gig worker laws could drive up costs. ⚖️

• Economic sensitivity: Consumer spending on delivery can be fickle during downturns. 💸

• Restaurant health: If restaurants stumble, so does DoorDash. 🍽️

(5/7) – SWOT HIGHLIGHTS

Strengths:

• Leading U.S. food delivery market share 🍔

• Expanding into grocery & retail → less restaurant dependence 🛒

• Solid international growth 🌍

Weaknesses:

• High operational costs to maintain delivery network 🚚

• Customer loyalty can be promo-driven vs. brand-driven 💳

Opportunities:

• Enter underpenetrated regions → more global share 🌐

• Expand non-restaurant deliveries → bigger wallet share 🏪

• AI-driven efficiency → streamlined ops 🤖

Threats:

• Heavy competition (direct & from self-delivery restaurants) ⚔️

• Consumer shift back to in-person dining if economy improves 🍴

(6/7) – BULL OR BEAR?

With 25% growth and a second profitable quarter, is DoorDash set to dominate? Or are looming regulatory and market saturation risks a speed bump? 🏁

(7/7) Where do you stand on DoorDash?

1️⃣ Bullish—They’ll keep delivering the goods! 🚀

2️⃣ Neutral—Impressed, but risks loom 🤔

3️⃣ Bearish—Competition & costs will weigh them down 🐻

Vote below! 🗳️👇

2/11/25 - $dash - I just like $uber more2/11/25 :: VROCKSTAR :: NASDAQ:DASH

I just like NYSE:UBER more

- i love this franchise

- but i also like NASDAQ:NVDA , $mu... but rn i just own NYSE:TSM

- but i also like CRYPTOCAP:ETH , $sol... but rn i just own CRYPTOCAP:BTC

- but i also like NASDAQ:FSLR , $enph... but rn i just own NASDAQ:NXT

...

- in this tape it's increasingly difficult to own the second best until the valuation gaps are wide enough to merit moving down the quality stack

- this is NOT to suggest dash doesn't have an awesome franchise, has built that route density to keep throwing off FCF... they do/ they will

- but while mgns are *yes* better than NYSE:UBER , the growth is just modestly better, at the same time NYSE:UBER continues to scale it's Eats offer (and mgns will reach parity with NASDAQ:DASH )

- and so for 1/3 the FCF and arguably a more discretionary product (Eats vs. Rides), is it "worth" half the mcap?

- reality is, it's grey zone.

- put a water balloon to my head and i'd guess the result is +ve and stock rallies

- but TBH, we've seen the NYSE:UBER result, the valuation is still attractive and i see no reason - per the original comments on second best - to leg out and complicate my PnL in a period where i think... we might see some rough tides. i'm shooting for simplicity, conviction and if/when valuation on the mgn is superior (as it is in the comparison of Uber vs. Dash)... a plus

- let's see. GL to the owners. i'll be rooting for u on this print from the sidelines.

V

Speculative Madness: The Market’s Bubble Stocks Some stocks areSpeculative Madness: The Market’s Bubble Stocks

Some stocks aren't just overvalued—they're in full speculative bubble mode. Fundamentals? Irrelevant. When euphoria takes over, rationality disappears.

Here’s my list of bubble stocks that scream unsustainable pricing:

SBUX, T, PLTR, BMY, PYPL, NFLX, GS, ISRG, ARM, C, SHOP, BSX, SPOT, UBS, IBKR, RELX, CEG, CRWD, MSTR, MMM, DASH, COF...

And let’s not forget the obvious: TSLA, META, AMZN, AVGO, GOOGL, JPM, MA, V, WMT.

Honestly, the entire banking sector, brokers, and tech are in bubble territory.

What the hell is going on with this market? Why are algos just buying, buying, buying, squeezing all the shorts?! Unbelievable.

The dump will be insannnnnnnne!!! 🚨

Revisiting The Great Post-Covid Comeback: DoorDashI must say, I am finding it increasingly fascinating to revisit companies that skyrocketed and subsequently crashed during the post-COVID boom of 2021 to 2023. The explosive growth of that period was driven by an unusual combination of factors, creating a perfect storm that sent valuations soaring and then crashing.

I have now written about this a few times, but I continue to find companies that have made it out alive or are in the process of getting the market's attention once again. They are making a comeback. And I love comeback stories! Just when everyone counted them out, they turnaround and surprise.

Yes, a surprising number of companies have shown resilience, adapting to the new environment with strategic pivots, improved efficiencies, and recalibrated growth plans.

Take DoorDash, for example (shown on the chart). This company epitomizes the highs and lows of the pandemic-era boom. For starters, it's up 300% since the bottom of its crash. During the lockdowns, DoorDash thrived as a lifeline for consumers stuck at home, but post-pandemic normalization presented significant challenges. Now, after navigating through turbulent waters, it seems to have found its footing once again. Its latest moves, bolstered by a mix of strategic innovation and operational focus, have nearly retraced the entirety of its crash.

What other companies from this era do you think are worth revisiting? Are there other potential comeback stories waiting to unfold?

$DASH seemingly perfect setup hindered by insider sales

The technical setup for DoorDash on Friday, along with the overall market conditions, should have undoubtedly driven stronger performance. However, the 2.53% gain was dampened by what appears to be an endless supply of company stock being exercised by insiders.

This candle looks magnificent after that 0.5% comeback and The support line has hit this spot 3 times in maybe 2 weeks of the session, so in December, that could change as we enter the newly formed cross as it strikes through the heart of that cross, making it a likely candidate for a reversal. As we move along, there are a few things to mention, like the flag pattern that acted as a bear until the last session proved otherwise. FYI, on 12/27, with stochastic, RSI ready to rest, the MACD curving towards a crossover, it almost touched 165 where another set of support sits, a little more minor, so a reversal looks likely. However, I would proceed with caution as there are indicators that have yet to be confirmed, as is the case on the daily, weekly (bullish flag), or even monthly chart (same retracement move before continuation lives at 156), so maybe in between those three there is a likely bottom the retrace of uptrend indication from the Fibonacci retrace from .38, .50, and .61. Retracement-continuation looking very much alive. Finally, in conclusion, the short-term EMA and more of a daily candle usage timeframe after the death cross has started to curve back up towards a crossover but hasn't quite got there yet; as I said, a few indicators are missing, giving us the green light, but that may not matter much. Volatility could also work as a dream, but it could also be a weekly play on options for maybe a month. A fascinating, in-depth look at how deep we can go and how much deeper we can continue by doing so.

DoorDash (DASH) Stock - Cup and Handle Pattern with Potential TaThe DoorDash stock NASDAQ:DASH is exhibiting a classic cup and handle pattern, signaling a potential upward movement with a target price of $254. The initial breakout was seen at the $118 level, followed by another key break above $143.25, reinforcing the bullish trend.

Currently, the entry looks strong, but it’s recommended to maintain risk management with a Stop Loss at $123.1 to guard against potential volatility.

About DoorDash

DoorDash is a leading American food delivery and logistics company that connects consumers with local businesses. Founded in 2013, it has rapidly expanded its platform to serve restaurants, grocery stores, and convenience stores, allowing users to order meals and essentials for delivery or pickup through its app. The company is listed on NASDAQ under the ticker DASH and continues to grow its presence in the on-demand delivery sector.

massive $DASH trade after earningstrade starts with 4h breaking linear regression channel, that came from a downtrend.

confluently, rsi line on daily breaks to upside on the same day.

with the downtrend established but then reversed, it is smart to let the price pull back to a lower entry price which happens in two days.

then the rest is history, as it notches many consecutive days of gains.

DoorDash, Inc. (DASH) Trade IdeaDASH is approaching a critical breakout point at $132. The recommended trading strategy includes exiting 25% at T1 ($137) with the stop loss moved to breakeven, exiting 50% at T2 ($143) with the stop loss moved to T1, and exiting the remaining 25% at T3 ($150). The stop loss is initially set at $124 to limit potential downside. It is important to monitor the volume closely for confirmation of a breakout above $132, as increased volume could signify a stronger breakout move.