Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.94 EUR

1.04 B EUR

6.88 B EUR

226.80 M

About Electronic Arts Inc.

Sector

Industry

CEO

Andrew P. Wilson

Website

Headquarters

Redwood City

Founded

1982

FIGI

BBG01K3WQXD5

Electronic Arts, Inc. engages in the development, marketing, publication, and distribution of games, content, and services for game consoles, PCs, mobile phones, and tablets. The company develops and publishes games and services across various genres, such as sports, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Anthem, Need for Speed, and Plants v. Zombies brands, and license games, including FIFA, Madden NFL, and Star Wars brands. The firm also provides advertising services and licenses its games to third parties to distribute and host its games. It markets and sells its games and services through digital distribution channels, as well as through retail channels, such as mass-market retailers, electronics specialty stores, and game software specialty stores. The company was founded by William M. Hawkins III and William Gordon in 1982 and is headquartered in Redwood City, CA.

Related stocks

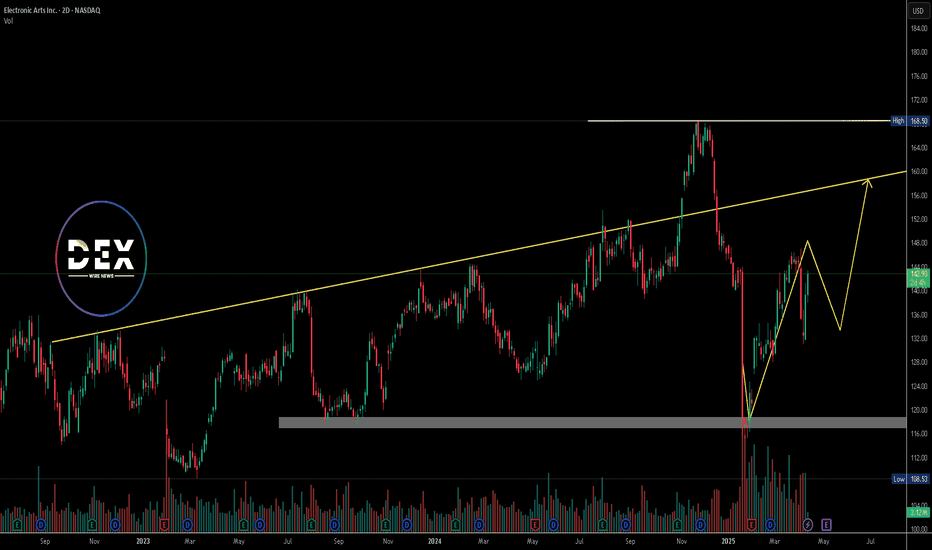

Electronic Arts: Under PressureEA has shown notable upward pressure, diverging from our expected downside continuation. Despite the recent strength, our primary scenario remains valid: we still anticipate an extension of the ongoing magenta five-wave decline, with wave (3) expected to break below support at $114.60. The remaining

Electronic Arts Inc. (EA) – Inverse Head & Shoulders Breakout📈 Long Setup

🔍 Description:

Electronic Arts Inc. (NASDAQ: EA) has broken out above the neckline of an Inverse Head & Shoulders pattern — a bullish reversal signal. Price action confirms breakout strength, with a surge in volume accompanying the move. Bullish continuation is expected if the br

Electronic Arts: Heading LowerElectronic Arts has dropped roughly 13% since our last update, continuing the expected decline within ongoing wave (3). This move is likely to break below support at $114.60 and gradually push the stock downward to the anticipated low. Our alternative scenario suggests the correction may already be

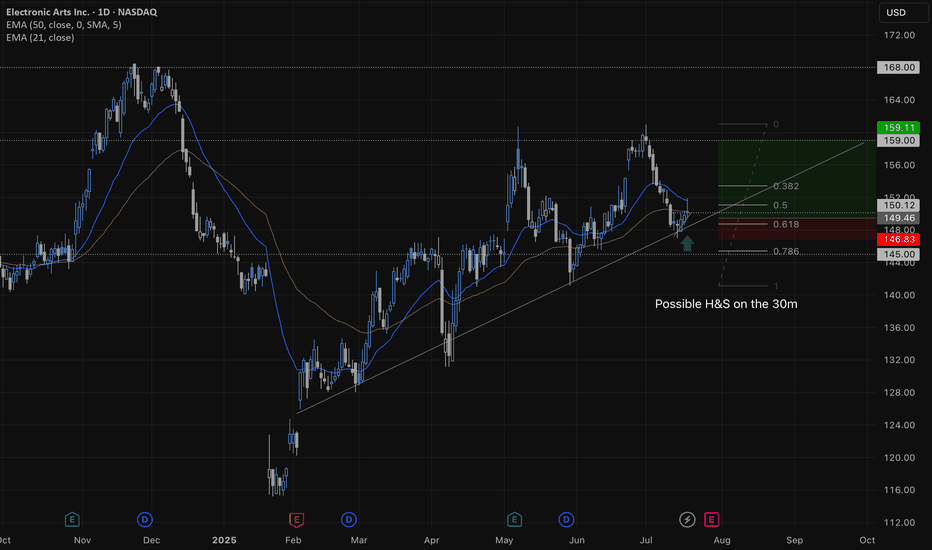

When the game is a quick flip, EA long at 149.27 for the winAs mentioned in the text box, this setup has done very well in the last 12 months with EA. But in addition to that historical performance, the uptrend since January is still intact, and the recent April pre-breakout highs are now acting as support.

The idea here is a quick flip, though I may or ma

Electronic Arts: Jump!Recently, EA has made a strong upward jump, coming very close to the significant resistance at $169.82. However, the price quickly fell again, providing us with sufficient confirmation to consider the magenta wave (2) as completed. The current wave (3) should extend below the support at $114.60, and

Electronic Arts: A Leader in the Gaming IndustryElectronic Arts (EA) is a renowned game developer and publisher that's been around since 1982. Founded by William M. Hawkins III and William Gordon, the company has grown to become a major player in the gaming industry.

**What does EA do?**

* Develops and publishes games across various genres, inc

Electronic Arts Inc. Stock Sees Momentum Ahead of Earnings Electronic Arts Inc. (NASDAQ: NASDAQ:EA ) is gaining attention as the gaming industry shows signs of recovery. The stock closed at $142.93 on April 11, 2025, reflecting a gain of $3.54( 2.54%) for the day. Its next earnings report is scheduled for May 6, 2025.

The gaming industry grew rapidly durin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ERTS5129009

Electronic Arts Inc. 2.95% 15-FEB-2051Yield to maturity

7.30%

Maturity date

Feb 15, 2051

ERTB

EL. ARTS 16/26Yield to maturity

5.29%

Maturity date

Mar 1, 2026

ERTS5129008

Electronic Arts Inc. 1.85% 15-FEB-2031Yield to maturity

4.95%

Maturity date

Feb 15, 2031

See all 1EA bonds

Curated watchlists where 1EA is featured.

Frequently Asked Questions

The current price of 1EA is 128.78 EUR — it has decreased by −0.36% in the past 24 hours. Watch ELECTRONIC ARTS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange ELECTRONIC ARTS stocks are traded under the ticker 1EA.

1EA stock has risen by 0.92% compared to the previous week, the month change is a −1.96% fall, over the last year ELECTRONIC ARTS has showed a −3.39% decrease.

We've gathered analysts' opinions on ELECTRONIC ARTS future price: according to them, 1EA price has a max estimate of 180.71 EUR and a min estimate of 127.36 EUR. Watch 1EA chart and read a more detailed ELECTRONIC ARTS stock forecast: see what analysts think of ELECTRONIC ARTS and suggest that you do with its stocks.

1EA stock is 0.36% volatile and has beta coefficient of 0.36. Track ELECTRONIC ARTS stock price on the chart and check out the list of the most volatile stocks — is ELECTRONIC ARTS there?

Today ELECTRONIC ARTS has the market capitalization of 32.46 B, it has increased by 1.56% over the last week.

Yes, you can track ELECTRONIC ARTS financials in yearly and quarterly reports right on TradingView.

ELECTRONIC ARTS is going to release the next earnings report on Jul 29, 2025. Keep track of upcoming events with our Earnings Calendar.

1EA earnings for the last quarter are 1.25 EUR per share, whereas the estimation was 0.97 EUR resulting in a 28.42% surprise. The estimated earnings for the next quarter are 0.08 EUR per share. See more details about ELECTRONIC ARTS earnings.

ELECTRONIC ARTS revenue for the last quarter amounts to 1.66 B EUR, despite the estimated figure of 1.44 B EUR. In the next quarter, revenue is expected to reach 1.06 B EUR.

1EA net income for the last quarter is 234.78 M EUR, while the quarter before that showed 283.03 M EUR of net income which accounts for −17.05% change. Track more ELECTRONIC ARTS financial stats to get the full picture.

Yes, 1EA dividends are paid quarterly. The last dividend per share was 0.17 EUR. As of today, Dividend Yield (TTM)% is 0.51%. Tracking ELECTRONIC ARTS dividends might help you take more informed decisions.

ELECTRONIC ARTS dividend yield was 0.53% in 2024, and payout ratio reached 17.90%. The year before the numbers were 0.57% and 16.24% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 21, 2025, the company has 14.5 K employees. See our rating of the largest employees — is ELECTRONIC ARTS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ELECTRONIC ARTS EBITDA is 1.82 B EUR, and current EBITDA margin is 25.36%. See more stats in ELECTRONIC ARTS financial statements.

Like other stocks, 1EA shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ELECTRONIC ARTS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ELECTRONIC ARTS technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ELECTRONIC ARTS stock shows the sell signal. See more of ELECTRONIC ARTS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.