Illuminate the Path Upward!** Comments and Like are appreciated; New Subscribers are glowing! **

What I see...

+ Prices found Support from 200MA

+ Bullish reversal bar formed with healthy volume

+ Past Bullish Kicker candles implied a few days for bullish burst

+ 10MA still above 50MA

- RSI is in bearish territory

- MACD is also under signal line and in bearish territory

- High volatility prices; require tight Stop!

- Widening of Bollinger Band

- Slight upper shadow from today's bar

What I setup

+ Long entry above today's high

- Stop under Friday's Close

+Target is at the downward sloping trendline

:: Duration is 2-4 days

1LITE trade ideas

$LITE can fall in the next daysContextual immersion trading strategy idea.

Lumentum Holdings Inc. manufactures and sells optical and photonic products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

The share price fell after bad earnings. It looks like it will continue falling.

The demand for shares of the company still looks lower than the supply.

So I opened a short position from $67,72;

stop-loss — $69,89.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Lumentum Electrical Products - Will it Revisit All-time High?What I see...

+ INside NR7 on -2d, followed by

+ Inside NR3 and NR7 combo

+ ...on lower vol. after earnings

+ RSI at 54

+ Price support by upward trend and 10MA

+ Both 10 and 50 MAs are above 200MA... Prices held strong through mid-Feb and mid-Mar volatility!

- Upper shadows when prices reache downward resistance line

- MACD is closing into signal line

What is my setup...

+ Long entry above -3d (aggressive)

- Stop at bottom of -3d (aggressive)

+ Target at all-time set back in Feb.

LITE buy off the inside day "NASDAQ:LITE"]NASDAQ:LITE Great fundamentals with it being ranked 1st in its group. It broke that 82 resistance prior to earnings and failed but looks to be setting up again off earnings. It did miss guidance as that's the case with a lot of companies right now but it has demonstrated great growth if you look at the weekly and monthly. It has had three inside days in a row which is a sign of sellers and buyers reaching a state of equilibrium with a bullish close on Friday. I'll be looking to start a half position through 82 against the 20 day MA and scale my second half into it once it proves itself.

Fiber-Optics Leader Lumentum (LITE) Near Buy PointLumentum (LITE) is near a buy point, after touching 3 points on uptrend line which validates it as a confirmed uptrend line. Consider to buy above the near-term resistance line marked on the chart. LITE has a good sales growth as well on the EPS growth rate for the last 3-years. LITE will announced its earnings today (Tuesday 5 May 2020). I highly suggest you to trade this stocks after its earnings release to avoid market whipsaws. Please place appropriate stop loss according to your risk appetite.

LITE - DAILY CHARTHi, today we are going to talk about the Lumentum Holdings Inc and its current landscape.

Huawei and its suppliers received exciting news, as the U.S. Commerce Department renewed a 90-day period extension, that grants to American companies’ permission to continue to do business with the giant Chinese telecom companies. Commerce Secretary Wilbur Ross's announcement included that the need for extension was also due to the necessity of some rural communities of the Huawei 3G and 4G networks. The extension should keep the supplying chain going, principally of the Americans ones like Lumentum Holdings Inc that have its revenues highly exposed to Huawei demand (11% of its revenue) and have now another quarter of relief from the tension of loose a so significant company like Huawei. The concerning aspect it’s if this extension doesn't lift the results of its supplier on the next quarter, considering that the Chinese company might already be restructuring its supply chain, as the uncertainty created by the ongoing Trade War that ended blacklisting the company on the U.S. The Huawei CEO Ren Zhengfei also already have been clearly vocal that isn't concerned with the U.S decisions and said that Huawei could grow without the U.S markets.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

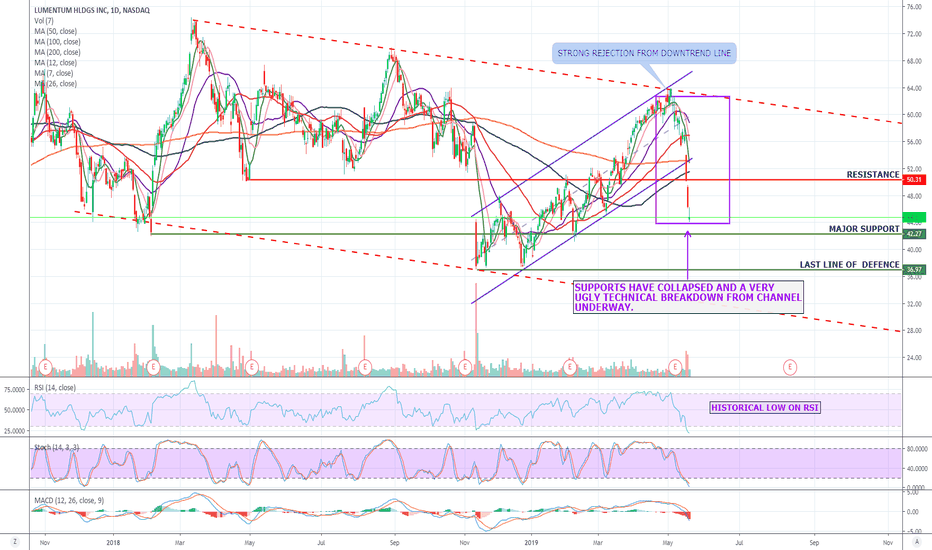

$LITE JUMP SHIP TIME IN LUMENTUM , $37 TARGETIt is a horrible time to be invested in TECH, it is obviously going to be sacrificed in the trade war, Huawei has become enemy Number 1 and any company with Chinese exposure has suffered great loss in value in the past few weeks. NASDAQ:LITE has considerable exposure and has now lowered guidance due to the ban initialised on Huawei. The chart of Lite is technically broken, having lost the support off all MA's and the RSI is now at a historical low due to the velocity of the selling. That low is just about the only positive to cling to, there is a chance of a bounce but that it not a trade we would be willing to take. The stock is now in a wee defined downtrend from March 18 with $42 and $37 the next targets on the downside.

If by any chance there is a resolution with China this will rocket higher but that is not on the horizon, given the rhetoric.

Company Description

Lumentum Holdings, Inc. engages in the manufacture of optical and photonic products enabling optical networking and commercial laser. It operates through the Optical Communications (OpComms) and Commercial Lasers business segments. The OpComms segment includes modules and subsystems to support and maintain customers in the Telecom and Datacom markets. The Commercial Lasers segment covers subsystems used in a variety of original equipment manufacturer applications.

LITE Bounced From Key Support Level of the Bullish ChannelLumentum Holding stock price fell sharply earlier this week as market sell-off resumes. Where, price fell to test key support level as seen in the chart. In which, price bounced quickly bounced from this level. Nevertheless, price could fall lower to test final support level, before we could see a bearish reversal.

Trade Step-ups:

Bullish Reversal: Price rejects a move lower to test the final support level. Profit levels to look for are 70.00 & 77.00 respectively.

Bearish Breakout: Price breaks the current support level, look for a move to test the final support level.