1RIVN trade ideas

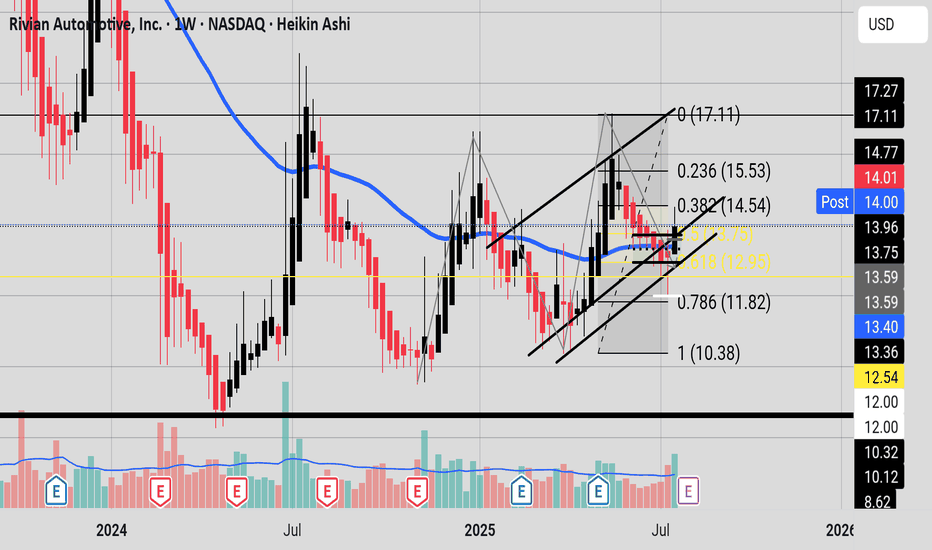

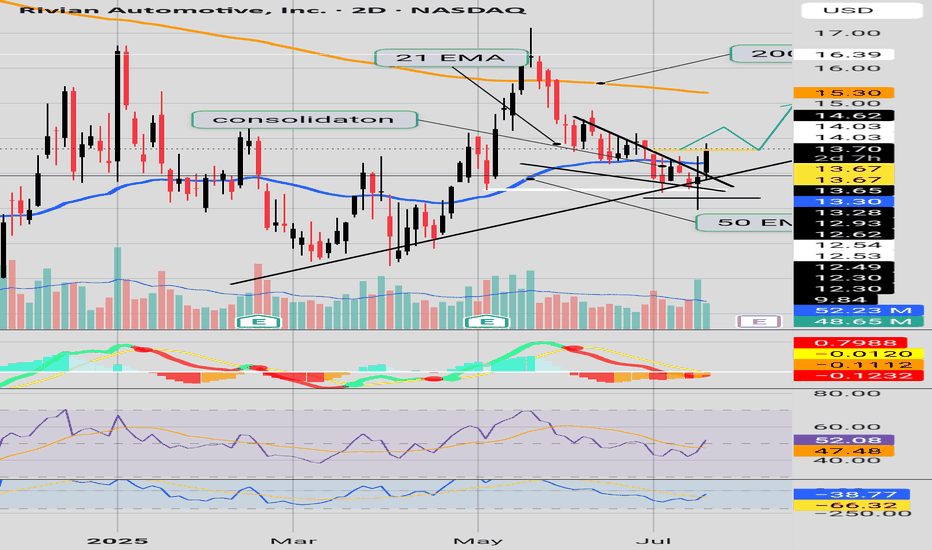

Heiken Ashi CandlesThis week Heiken Ashi candle gave a bullish close above the DOJI Heiken Ashi candle from last week. RSI is above 50. MACD (Chris Moody) look like it may have a bullish cross over soon. Stochastic RSI is getting ready to curl up. What do you think team? do you think the bulls maybe entering their season? Next few days are going to be interesting. If the buyers and investors can maintain the parallel structure the asset will go bullish however if it breaks it, the bears will celebrate. Keep your eyes on the Fibonacci levels, bulls want to see movement toward 14.54 and out of the Fibonacci golden zone.

Alert for the Bears Hope for the BullsBears could not bring price below 12.54, bulls have kept the momentum. It seems price has broken out of the consolidaton. Bulls need more momentum and for more levels over 50 on RSI. Bulls need to make Higher Highs and Higher Lows from 13.70 with good RSI levels to keep victory going, if not then last candle victory would be for the bears delight a fake out.

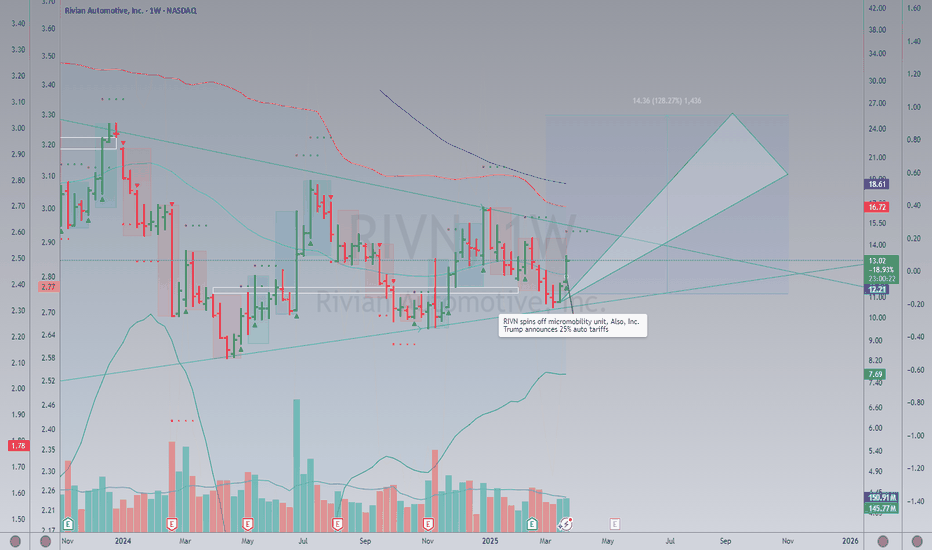

High Wave Candle on the weeklyWe have a High Wave Candle on the Weekly chart.

The candle is at the support of the upward parallel channel.

The candle is also under the 50 EMA.

The candle is at the vicinity of the 0.618 Fibonacci level.

Bears want to see the close of the next candle below 12.45, then the next price target at 11.82; bears ideally would like to see a complete break of structure to the downside and a candle close below 10.38 for a complete bearish takeover.

Bulls want the structure to maintain intact and a close above the Fibonacci Golden Zone 13.75.

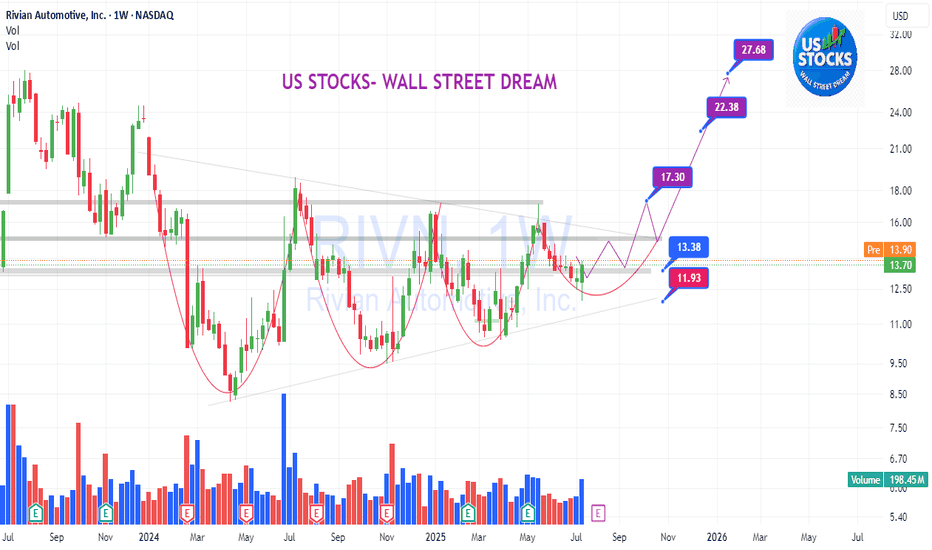

$RIVN - Long Setup BrewingRivian just broke out of a long-term downtrend and is now retesting that previous resistance as support. Price is coiling inside a falling wedge, sitting right above a key structure zone around $13. This area held strong in the past and could act as a launchpad if momentum steps in.

A breakout above the wedge could send it toward $17 in the short term, and if volume supports the move, there's potential for a much larger run toward $28. Watching for confirmation and strength on the retest — this setup looks like it's getting ready.

Not financial advice. Just sharing the chart.

#RIVN #SwingTrade #BreakoutSetup #TradingView #EVstocks

DemandThe asset is in an untouched demand zone that was formed around the first week of May. Will the bulls regain momentum and overcome 12.77 10 EMA? Or will the bears drag price down below 12.50 region? Also the 12.53 region on the day chart is a key level, so if it breaks below the bears have an upper hand and possible CHoC to the downside on daily.

Retest?Price is hovering below the 50 EMA now.

The candle that broke away from the consolidaton and fell under the 50 EMA, had alot of momentum and volume. But the most recent candle tried to reclaim the 50 EMA but fail by it's long upper shadow. The question is was the most recent candle a classical retest candle before the bears proceed to march on. Bulls need to maintain the 12.54 price or risk losing to the Bears.

Bears vs the Bulls the ongoing battleI know the Bulls are hoping this is a fake out and the Bears are hoping this is the beginning. Price has close slightly below the 50 EMA and MACD(Chris Moody) made a bearish cross and RSI dropped slightly lower. Bulls need price to reclaim the 50 EMA(blue curve) and have a bullish breakout out of the golden zone 13.83. Bears want a fully developed bearish MACD and lower RSI and price to move below the 50 EMA.

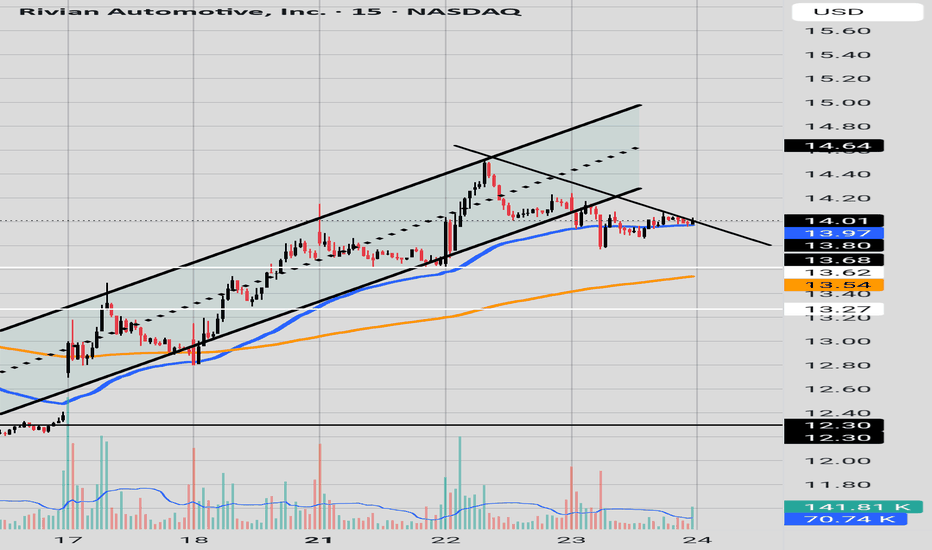

Bearish Breakout + Consolidation with Bullish BiasAfter a strong downtrend since 2022, Rivian (RIVN) broke out of its falling channel in late 2023 and has been forming an ascending channel since 2024. This structure suggests a potential medium-term trend reversal.

The price is currently around $13.60, sitting just above the 200-day moving average (MA200) and near a key support area of the ascending channel. This zone presents a potential technical entry point if the structure holds.

Technical Summary:

Higher highs and higher lows since early 2024

MA200 acting as dynamic support

Well-defined ascen

ding channel projecting higher levels

Trade Idea:

Suggested entry: $13.00 – $13.60

Stop loss: $11.90 (below the channel and MA200)

Take profit 1: $16.00

Take profit 2: $20.00

Take p

rofit 3 (extended): $24.00

If the price respects the channel and rebounds from this zone, we could see continued bullish movement toward $16 and potentially higher. If it breaks below $12.00 and loses the MA200, the bullish idea is invalidated.

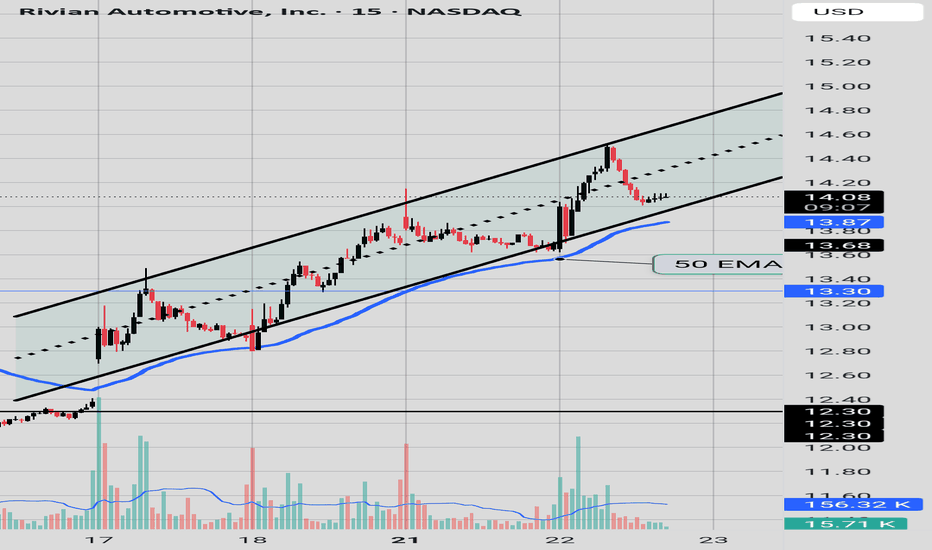

Waiting RIVN is still resting at a major support level above the 50 EMA and in the Fibonacci golden zone. RSI is still above 50; momentum is still leaning bullish.Volume is drying up and is low, and the price hasn’t moved yet. We’re waiting for a breakout or breakdown. SAR indicator, alludes to just a minor pullback and that uptrend is still intact. The next move could possibly be the big one or not.

Trend line vs Trend lineRivian (RIVN) is currently at a binary decision point, sitting just above the 50-week EMA and a key uptrend line. Price is testing a strong confluence zone near $13.38–$13.57, with rejection seen from the $15.49 resistance. A break below this area could lead to a drop toward the $12.43–$11.54 demand zone. You can refine your entry using the high-wave candle by boxing its high and low on the 1-hour chart. A break above the box with volume would signal early bullish momentum; a break below suggests further downside. Confirm the move with hourly RSI above 50 and Stochastic RSI curling up. This setup offers a high-probability directional move as the next few candles decide the trend.(Break down by AI Chat gpt except For Chart)

Rivian Kicking Off Potential UptrendHey, all. I'll get down to it. Obviously NASDAQ:RIVN has been an incredibly tough stock to own. Fake out after fake out. It has been brutal - unless you have been nimble enough to buy the dips and sell the rips.

I would like to posit, however, that NASDAQ:RIVN is going to start marching back higher here over time. In the signal system I have been taught via the T@M strategy, Rivian is putting in a range expansion to the upside on the weekly time frame. If you take the range of the past monthly consolidation period, attach it to the "mode" (or central zone of the consolidation range), it gives you a target of $25 over the next few months. Now, whether this is another fake out just to reverse on us... again... remains to be seen of course. It is early in the idea. But potentially offers a decent risk/reward position here.

I just do not see Rivian really going away at all and, if they can keep refining their business, they could see some success going forward. Anyway, hope you enjoy this idea! As always, position carefully as the market is risky business.

Including the Daily Chart below for your reference as well.