Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.260 EUR

18.35 M EUR

4.79 B EUR

449.00 M

About Toast, Inc.

Sector

Industry

CEO

Aman Narang

Website

Headquarters

Boston

FIGI

BBG01TNWQ0F4

Toast, Inc. engages in the development and provision of consumer payment application for restaurants. It offers terminals, kiosk, guest facing display, and system accessories. The firm also offers point of sale, reporting and analytics, online ordering and delivery, and kitchen display system. The company was founded by Jonathan Grimm, Aman Narang, and Stephen J. Fredette in December 2011 and is headquartered in Boston, MA.

Related stocks

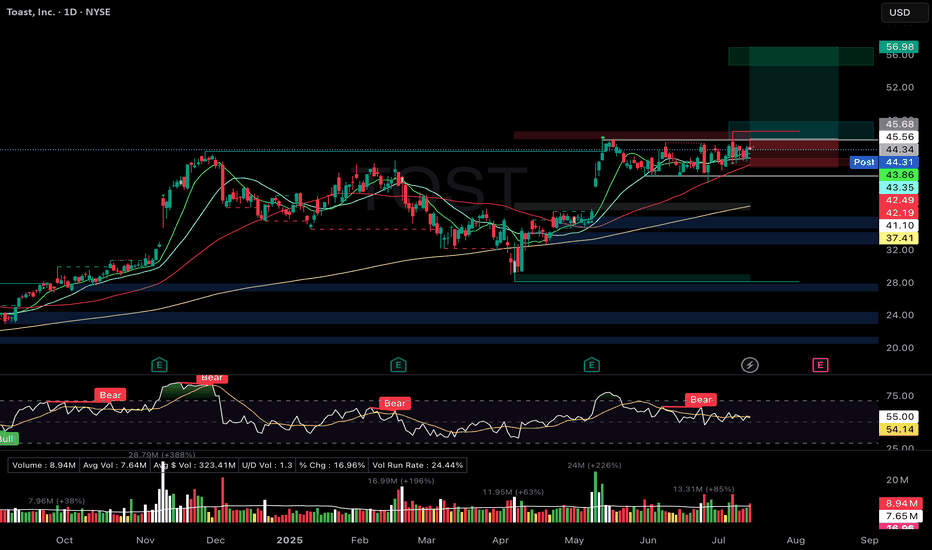

TOST Flat Base Breakout AttemptToast Inc. (TOST)

🚀 Entry: $45.68

📊 Setup: Flat Base Breakout Attempt

🛑 Stop: $42.19

🎯 Target: $56.98

🔑 Why I Entered:

Ideal flat base formation, tight consolidation under $45.56 pivot with volume drying up neatly between key moving averages.

Clear bullish moving average stack (rising 10/21/5

Toast: raise a toast!!!NYSE:TOST this has given so many chances to enter while still maintaining this flag, currently a double inside month and creating a tight flag here

can still enter here for a good risk reward, since the price has not gone anywhere, the IV on the options will be relatively lower and any increase in

Hard to find a "butter" trade than TOST - long at 42.49This is my first actual trade of TOST. No particular bias against it, just haven't traded it before. But looking at its paper results, I wish I had been.

Since the first of the year, it has outperformed QQQ more than 2:1 on a B/H basis, which I always like to see, but don't always get in a trade.

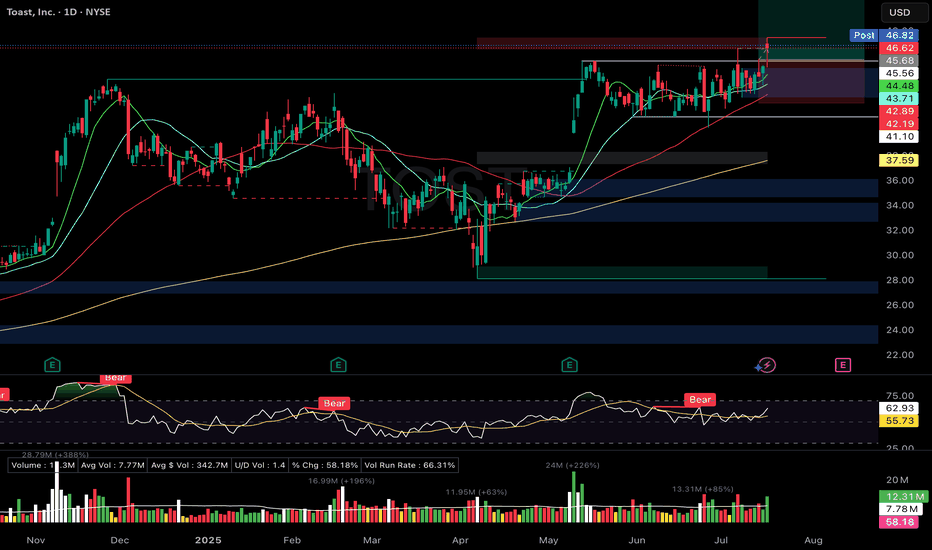

TOST – Flat base breakout. Volume confirmation. Hammer off 21DMATOST – Toast Inc.

Setup Grade: A-

• Entry: $45.68 (7/15)

• Status: Active

• Trailing Stop: $43.96 (2x ATR)

• Setup: Flat base breakout. Volume confirmation. Hammer off 21DMA. RS: 92.

• Plan: Manage breakout hold. Raise stop if price holds above $46.

• Earnings: August 5

ToastyI'm really liking this chart and believe in the fundamentals. I believe we are seeing a pullback and have outlines 3 areas of support below. At least the first should be tested before another uptrend. I'd love it to get lower for selfish reasons and if it got to the 3rd green horizontal i'd buy some

Safe Entry Zone TOSTNote: Switch to 1H TF for better View and more details

Stock Current Movement Ranging.

4h Green is buy Zone stop loss Below.

4h Red Is Resistance Zone.

P.High Lines (Previous High) Consider as Strong Resitances!

Also My Beloved CAthie Wood BEST INVESTOR All Time (based on statics better than Wa

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where 1TOST is featured.

Frequently Asked Questions

The current price of 1TOST is 39.570 EUR — it has increased by 0.33% in the past 24 hours. Watch TOAST INC-CLASS A stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange TOAST INC-CLASS A stocks are traded under the ticker 1TOST.

1TOST stock has risen by 5.28% compared to the previous week, the month change is a 6.31% rise, over the last year TOAST INC-CLASS A has showed a 27.71% increase.

We've gathered analysts' opinions on TOAST INC-CLASS A future price: according to them, 1TOST price has a max estimate of 47.27 EUR and a min estimate of 31.80 EUR. Watch 1TOST chart and read a more detailed TOAST INC-CLASS A stock forecast: see what analysts think of TOAST INC-CLASS A and suggest that you do with its stocks.

1TOST reached its all-time high on Jul 18, 2025 with the price of 40.615 EUR, and its all-time low was 30.985 EUR and was reached on Apr 25, 2025. View more price dynamics on 1TOST chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1TOST stock is 2.97% volatile and has beta coefficient of 1.44. Track TOAST INC-CLASS A stock price on the chart and check out the list of the most volatile stocks — is TOAST INC-CLASS A there?

Today TOAST INC-CLASS A has the market capitalization of 23.16 B, it has increased by 8.29% over the last week.

Yes, you can track TOAST INC-CLASS A financials in yearly and quarterly reports right on TradingView.

TOAST INC-CLASS A is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

1TOST earnings for the last quarter are 0.19 EUR per share, whereas the estimation was 0.17 EUR resulting in a 11.96% surprise. The estimated earnings for the next quarter are 0.19 EUR per share. See more details about TOAST INC-CLASS A earnings.

TOAST INC-CLASS A revenue for the last quarter amounts to 1.24 B EUR, despite the estimated figure of 1.24 B EUR. In the next quarter, revenue is expected to reach 1.29 B EUR.

1TOST net income for the last quarter is 51.76 M EUR, while the quarter before that showed 31.88 M EUR of net income which accounts for 62.38% change. Track more TOAST INC-CLASS A financial stats to get the full picture.

No, 1TOST doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 21, 2025, the company has 5.7 K employees. See our rating of the largest employees — is TOAST INC-CLASS A on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TOAST INC-CLASS A EBITDA is 170.08 M EUR, and current EBITDA margin is 2.28%. See more stats in TOAST INC-CLASS A financial statements.

Like other stocks, 1TOST shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TOAST INC-CLASS A stock right from TradingView charts — choose your broker and connect to your account.