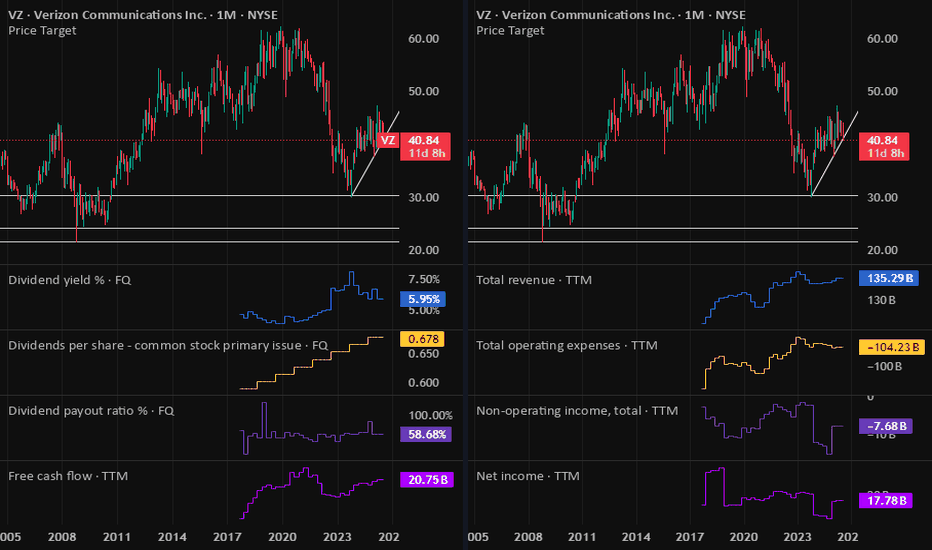

VZ: Verizon Earnings tomorrowwith 6% dividend yield and stock price at support level on the lower channel band, this draw attention to the earnings report tomorrow pre-market hours. Focused on future outlook as well.

If all good, I will buy VZ.

Disclaimer: This content is NOT a financial advise, it is for educational purpose o

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.660 EUR

16.91 B EUR

130.20 B EUR

4.21 B

About Verizon Communications Inc.

Sector

Industry

CEO

Hans Erik Vestberg

Website

Headquarters

New York

Founded

1983

FIGI

BBG01K3XDDG8

Verizon Communications, Inc. is a holding company, which engages in the provision of communications, information, and entertainment products and services. It operates through the Consumer and Business segments. The Consumer segment provides consumer-focused wireless and wire line communications services and products. The Business segment offers wireless and wireline communications services and products, including FWA broadband, data, video and conferencing services, corporate networking solutions, security and managed network services, local and long-distance voice services, and network access to deliver various IoT services and products. The company was founded in 1983 and is headquartered in New York, NY.

Related stocks

Verizon May Be Rolling OverVerizon Communications has been rangebound for more than a year, and now some traders could think it’s rolling over.

The first pattern on today’s chart is the May 2022 low of $45.55. VZ fell below that level in late 2022 and rebounded to it by mid-2024. The stock has been stuck below the same level

Where is Verizon headed next?Some quick points about the slight dip Verizon experienced over the past 5 trading days. Did bears step in and reject higher prices for VZ? Is the potential for a rally over?

In my opinion. No. But why you ask?

This stock trades relatively inverse to 10 year treasury yields. The 4 down days recen

The battle has begun for VZ glory.Just taking a look at the hourly chart and it looks like the bulls broke through resistance, but the bears were able to push them back, for now at least. Every time the bears push the price down, the bulls push it right back up to the edge.

This is bullish IMO. It gives bears less liquidity to slo

Verizon to the Moon? - Click my Post on the 15-minute Chart!TradingView doesn't show a link to my 15-minute chart analysis from today on the daily timeframe, but you can find a comprehensive analysis in my profile.

I just wanted to add an idea here so people would be able to find it on this time-frame.

Either switch to 15-minute, or check my profile to get

Verizon has stepped onto the launch-pad! Let's GO!I posted about this setup last week, and so far it has played out exactly as I described. I wanted to give a little update based on todays price action. I will keep this short as I have provided the key points on the chart. But this is the 5-minute chart from todays session.

The stock appears to ha

Verizon is ready to pop!This stock rallies when 10-year yields fall. Especially if tech stocks take a breather. Tech stocks are on average well into over-bought territory, and 10-year yields have been falling precipitously. Verizon is highly stable and provides a massive dividend which investors flock to when yields fall,

VZ - DO YOU SEE IT? Verizon its saying helllo!

A peaka-boo breakout on the daily chart is being observed.

This stock has coiled in a tight multi week range for a long time and is ready to explode higher if this breakout holds.

Typically a boring name that doesn't do much but when it starts to trend it can really g

VZ Weekly Trade Plan – 2025-06-08🧾 VZ Weekly Trade Plan – 2025-06-08

Bias: Moderately Bearish

Timeframe: 1 week

Catalysts: Dividend optimism vs. MACD weakness

Trade Type: Short-term directional put

🧠 Model Summary Table

Model Direction Entry Strike Option Type Target Stop Confidence

Grok Moderately Bullish $0.35 (ask) $44.00 Call

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

VZ5700819

Verizon Communications Inc. 3.0% 29-SEP-2060Yield to maturity

7.57%

Maturity date

Sep 29, 2060

C

VZ.HQ

Chesapeake & Potomac Telephone Co. of West Virginia 8.4% 15-OCT-2029Yield to maturity

7.40%

Maturity date

Oct 15, 2029

VZ5181143

Verizon Communications Inc. 2.987% 30-OCT-2056Yield to maturity

7.03%

Maturity date

Oct 30, 2056

VZ4606939

Verizon Communications Inc. 4.75% 15-MAR-2048Yield to maturity

6.75%

Maturity date

Mar 15, 2048

VZ4779888

Verizon Communications Inc. 4.9% 15-DEC-2048Yield to maturity

6.68%

Maturity date

Dec 15, 2048

VZ4663140

Verizon Communications Inc. 4.7% 15-AUG-2048Yield to maturity

6.64%

Maturity date

Aug 15, 2048

See all 1VZ bonds

Curated watchlists where 1VZ is featured.

Frequently Asked Questions

The current price of 1VZ is 36.955 EUR — it has increased by 1.20% in the past 24 hours. Watch VERIZON COMMUNICATIONS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange VERIZON COMMUNICATIONS stocks are traded under the ticker 1VZ.

1VZ stock has fallen by −0.20% compared to the previous week, the month change is a 0.34% rise, over the last year VERIZON COMMUNICATIONS has showed a −0.92% decrease.

We've gathered analysts' opinions on VERIZON COMMUNICATIONS future price: according to them, 1VZ price has a max estimate of 49.36 EUR and a min estimate of 36.60 EUR. Watch 1VZ chart and read a more detailed VERIZON COMMUNICATIONS stock forecast: see what analysts think of VERIZON COMMUNICATIONS and suggest that you do with its stocks.

1VZ stock is 1.57% volatile and has beta coefficient of 0.35. Track VERIZON COMMUNICATIONS stock price on the chart and check out the list of the most volatile stocks — is VERIZON COMMUNICATIONS there?

Today VERIZON COMMUNICATIONS has the market capitalization of 155.98 B, it has decreased by −0.53% over the last week.

Yes, you can track VERIZON COMMUNICATIONS financials in yearly and quarterly reports right on TradingView.

VERIZON COMMUNICATIONS is going to release the next earnings report on Oct 21, 2025. Keep track of upcoming events with our Earnings Calendar.

1VZ earnings for the last quarter are 1.04 EUR per share, whereas the estimation was 1.01 EUR resulting in a 2.82% surprise. The estimated earnings for the next quarter are 1.03 EUR per share. See more details about VERIZON COMMUNICATIONS earnings.

VERIZON COMMUNICATIONS revenue for the last quarter amounts to 29.29 B EUR, despite the estimated figure of 28.65 B EUR. In the next quarter, revenue is expected to reach 29.24 B EUR.

1VZ net income for the last quarter is 4.25 B EUR, while the quarter before that showed 4.51 B EUR of net income which accounts for −5.83% change. Track more VERIZON COMMUNICATIONS financial stats to get the full picture.

Yes, 1VZ dividends are paid quarterly. The last dividend per share was 0.58 EUR. As of today, Dividend Yield (TTM)% is 6.28%. Tracking VERIZON COMMUNICATIONS dividends might help you take more informed decisions.

VERIZON COMMUNICATIONS dividend yield was 6.71% in 2024, and payout ratio reached 64.77%. The year before the numbers were 6.99% and 95.63% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 11, 2025, the company has 99.6 K employees. See our rating of the largest employees — is VERIZON COMMUNICATIONS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. VERIZON COMMUNICATIONS EBITDA is 42.10 B EUR, and current EBITDA margin is 35.98%. See more stats in VERIZON COMMUNICATIONS financial statements.

Like other stocks, 1VZ shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade VERIZON COMMUNICATIONS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So VERIZON COMMUNICATIONS technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating VERIZON COMMUNICATIONS stock shows the sell signal. See more of VERIZON COMMUNICATIONS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.