MOCAUSDT trade ideas

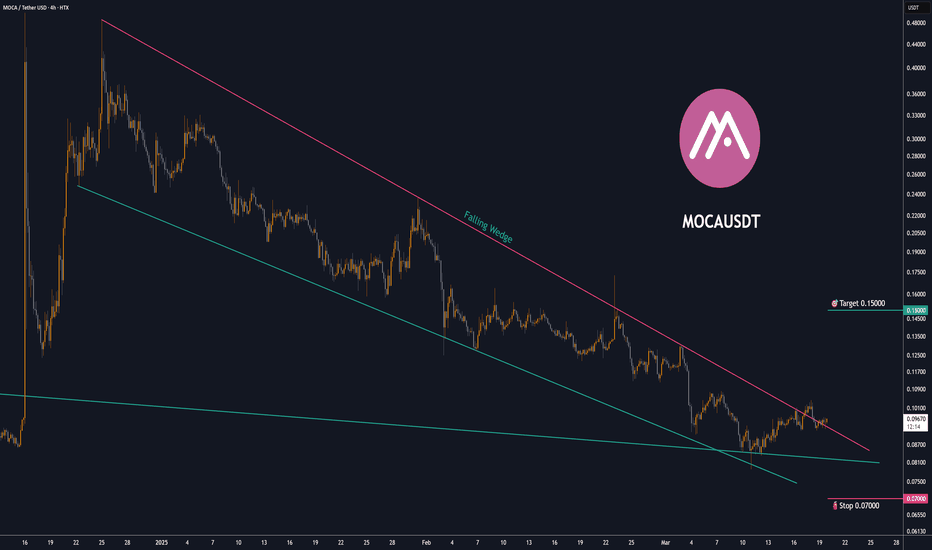

MOCA buy/long setup (4H)After hitting an origin zone, a bullish iCH has formed on the chart, and a trigger line has been broken.

We are now looking for buy/long positions in the demand zone, targeting the levels marked on the chart.

A daily candle closing below the invalidation level will invalidate this outlook.

Do not enter the position without capital management and stop setting

Comment if you have any questions

thank you

MOCAUSDT: Oversold, Yet Ready to Explode? The Market Decides!Is the Bottom In? MOCAUSDT Flashes Buy Signals!

The crypto market never sleeps, and neither do opportunities. MOCAUSDT is currently hovering at $0.18582, down a staggering 62% from its all-time high of $0.48845 recorded just 39 days ago. But is this decline setting the stage for a major comeback?

Technical indicators suggest we are at a make-or-break moment. The RSI14 is at 33.2, approaching oversold territory, while MFI60 sits at 43.8, indicating potential buying momentum. Moreover, the price is struggling near the 200 MA (0.18844), a critical level that could dictate the next major move.

Interestingly, a series of VSA Buy Patterns have emerged over the past 48 hours, hinting at accumulation by smart money. Will this trigger the much-anticipated breakout, or is another dip inevitable?

One thing is certain—the next move will be decisive. Are you ready to take advantage of it?

MOCAUSDT Roadmap: Smart Money Moves and Key Market Reversals

Understanding the market is all about catching the right waves at the right time. Let’s break down how MOCAUSDT moved recently, which patterns played out, and what traders can learn from these price shifts.

January 29: VSA Buy Pattern 3 – The market showed signs of a manipulation buy, signaling the start of an upward move from $0.17241 to $0.1772. This pattern was validated as price continued rising, confirming the bulls were stepping in.

January 30: Buy Volumes Max → Sell Volumes – A massive buying volume spike from $0.17809 pushed the price up to $0.19745, but sellers quickly took control, leading to a sharp reversal. This switch from buy to sell dominance marked a critical liquidity grab before the next wave.

January 31: VSA Sell Pattern 1 & 3 – A textbook manipulation sell setup, where price hit $0.22752 before retracing. This was the first major rejection confirming that the bullish move had peaked. Following this, VSA Buy Pattern Extra 2nd appeared at a lower price point, signaling accumulation near $0.20923.

February 1: VSA Manipulation Buy Pattern 4th – Smart money stepped back in, sending the price higher from $0.19388 to $0.19525, reinforcing the long bias. The key takeaway? Every strong dip in this cycle was met with aggressive buybacks.

February 2: VSA Buy Pattern Extra 2nd – The latest signal showed another attempt at accumulation, with price stabilizing around $0.18867. However, the move lacked the aggressive momentum seen in previous buy setups, meaning traders should watch for confirmations before jumping in.

Conclusion: Reading the Tape

MOCAUSDT has been in a highly reactive accumulation-distribution cycle, where every liquidity grab led to a strong price reaction. The roadmap suggests smart money is accumulating, but not in a rush to push the price up aggressively. For traders, the key levels to watch are whether buyers step in at the recent $0.185 range, or if we see another liquidity grab before the real move.

Are we gearing up for a breakout, or is another shakeout on the horizon? Stay sharp, and trade smart.

Technical & Price Action Analysis: Key Levels to Watch

MOCAUSDT is playing the range game, bouncing between key levels. Here’s what traders need to keep on their radar:

Support Levels:

0.17241 – If buyers don’t defend this level, expect it to flip into resistance, trapping late longs.

0.16567 – A critical retest zone; failure to hold means lower bids will get tested.

0.16455 – The last line of defense before deeper corrections.

Resistance Levels:

0.25966 – The first real battle for bulls; if price rejects, expect a fade back into the range.

0.2951 – Major liquidity zone; breaking above could trigger a trend shift.

0.31409 – If bulls clear this, game on for the next leg up.

Powerful Support Levels:

0.2371 – Big money has been watching this level. If it doesn’t hold, sellers will start dictating the trend.

Powerful Resistance Levels:

0.08949 & 0.06603 – Levels that could cap any weak breakouts. If price stalls here, expect consolidation or a fakeout before the next real move.

Trade Logic: If support levels don’t hold, they flip into resistance, and every failed breakout becomes a new short opportunity. The market isn’t giving out free money—trade smart, wait for confirmations, and don’t get caught chasing weak moves.

Trading Strategies Using Rays: Navigating MOCAUSDT Moves with Precision

The market moves in waves, but instead of relying on static levels, we focus on Fibonacci Rays—dynamic price structures that outline the natural rhythm of movements. These rays, based on mathematical and geometric principles, give us a predictive roadmap where price reacts, either bouncing or breaking through.

Key takeaway? Trade after price interacts with a ray and confirms direction. The movement will continue from one ray to the next, forming the key targets of our trade.

Optimistic Scenario: Bulls Take Control

If buyers step in at key Fibonacci ray intersections, we can expect a continuation to higher levels. The first confirmation will be the price breaking above MA200 (0.18844) and staying above.

Entry: Buy after price interacts with a ray at 0.17241, forming a reversal.

First target: 0.2371 – The next ray and powerful support turned resistance.

Second target: 0.25966 – A strong resistance level where a pullback could occur.

Final bullish target: 0.2951 – If momentum stays strong, this is the next major liquidity grab zone.

Pessimistic Scenario: Sellers in Control

If the price fails to hold MA200 (0.18844) and breaks below Fibonacci rays, expect a move lower to the next liquidity zone.

Entry: Sell after rejection at 0.18844 if price fails to reclaim it.

First target: 0.17241 – The closest ray where buyers might step in.

Second target: 0.16567 – If weakness persists, this is the next stop.

Final bearish target: 0.16455 – The ultimate support before deeper losses.

Trade Ideas: Key Setups to Watch

Ray-to-Ray Bullish Breakout: Buy above 0.18844, target 0.2371, stop-loss below 0.17241.

Ray-to-Ray Bearish Breakdown: Sell below 0.18844, target 0.17241, stop-loss above 0.19525.

Range Rebound Trade: Buy near 0.17241, take profits at 0.18844, stop-loss below 0.16567.

Momentum Scalping: If price bounces at 0.2371, buy and target 0.25966, stop-loss below 0.225.

All these setups are backed by VSA rays, which are already plotted on the chart—so stay patient, wait for interaction, and ride the move from ray to ray.

Your Move, Traders! 🚀

That’s the full breakdown—now it’s your turn! Got questions? Drop them right in the comments below, and let’s discuss the best trading setups together.

If you found this analysis useful, hit Boost and save this idea—you’ll want to check back and see how price respects these rays. Trading isn’t about guessing, it’s about understanding key reaction points, and now you have them.

My private strategy automatically plots all rays and levels, making trade setups clear and structured. If you’re interested in using it, shoot me a private message—it’s exclusive, but we can discuss how you can get access.

Need analysis on a different asset? I can chart any market with precision. Some ideas I share for free, while others can be done privately—depends on what you need. Let me know in the comments which asset you want covered next, and if there’s enough interest, I’ll make it happen!

And of course, if you’re serious about trading—follow me on TradingView. That’s where all the real-time updates and insights go first. See you in the next one! 🔥

MOCA/USDTKey Level Zone: 0.1780 - 0.1800

HMT v5 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

MOCA/USDT: READY FOR A BIG PUMP!!🚀 Hey Traders! 👋

If you’re loving this setup, smash that 👍 and hit Follow for proven trade ideas that actually deliver! 💹🔥

MOCA is currently trading within a symmetrical triangle on the 4-hour chart and bouncing perfectly off the lower trendline. A solid breakout from this structure could lead to a massive pump! 🚀

Here’s the plan:

📌 Entry Range: Current Market Price (CMP); add more on dips.

🎯 Target: 200%–250% gains.

🛡️ Stop Loss (SL): $0.158.

⚙️ Leverage: Keep it low (max 5x).

💬 What’s Your Take?

Are you bullish on MOCA’s breakout potential? Drop your analysis, predictions, or strategies in the comments below! Let’s crush this market together and lock in those gains! 💰🔥

MOCA is at the end of its trend (2H)From the point where we placed the green arrow on the chart, MOCA appears to have formed a large triangle.

It seems that wave C of the large triangle is a double combination, and we are currently in the second part of this combination, which is itself a triangle.

At present, we appear to be in wave c of this smaller triangle. Wave c also seems to be a diametric, and we are now in the final stages of this diametric.

It could reject downward from the red zone.

The closure of a 4-hour candle above the invalidation level would invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Moca/usdt altcoin shortJust now opened a short position on this altcoin. Seems like its gonna have a weekly correction. Bitcoin also falling so I think that's good confluence in-terms of correlation.

Its bullish on weekly and daily but bearish on 4hr and lower timeframes.

Am aiming for .18

Could fall lower but might get some reaction there and am satisfied with a 4r given it plays out.