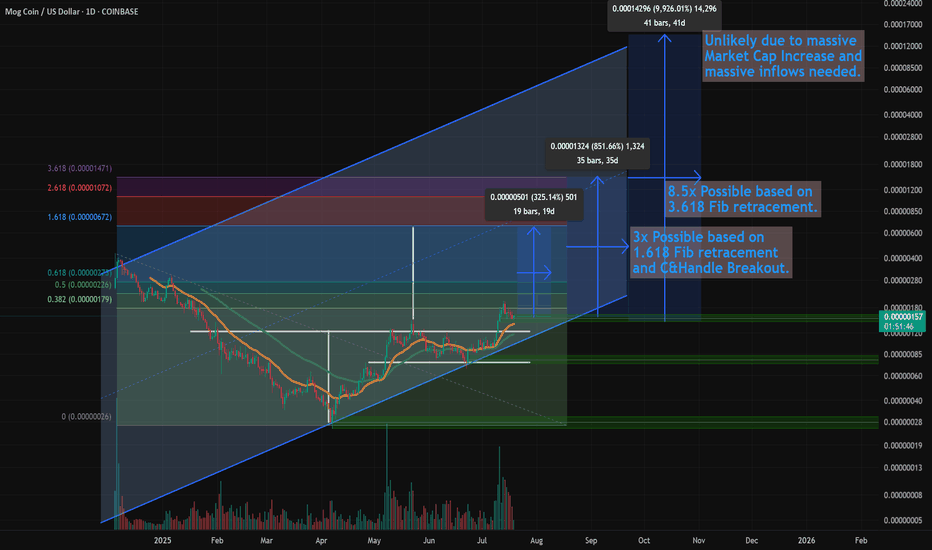

$MOG Setting Up For Cup & Handle Breakout - 10x - 100x TargetsAs I stated in the video, I don't normally cover Meme coins, but this is a great looking chart for MOG and thought I'd do a quick study on this with some potential price targets...

And how I'm using AI to get a better handle on the likelihood of my TA targets.

In short -- 10X here is possible this bull run (8.5x more likely based on the Fib)

But 100X is very unlikely, even though the top of the parallel trend channel shows it's potential.

No surprise there, but watch how using AI can give clarity on this and these decisions.

Let me know what you think...

MOGUSD trade ideas

MOG Bullish Acceleration in ProgressCRYPTO:MOGUSD is currently experiencing the anticipated acceleration in wave (3)—typically the strongest and most impulsive leg in an Elliott Wave cycle.

With momentum building, the next upside target aligns with the 100% Fibonacci extension, which could propel price toward new highs if the structure holds.

Wave (3) is doing what it does best: leading the charge.

aLL fALL dOWN lOOK oUTPredicting whether Bitcoin is on the verge of a "free fall" is challenging due to its volatile nature and the complex factors influencing its price. Based on available data up to June 11, 2025, here’s an analysis to address your question:

### Current Sentiment and Market Context

Bitcoin's price has been highly volatile in 2025, with significant fluctuations driven by macroeconomic factors, regulatory developments, and market sentiment. Recent reports indicate Bitcoin has experienced corrections, with prices dropping below $80,000 in March 2025, hitting a low of $77,396.43, and recovering to around $78,146.03 by early April. This followed a peak of $109,350.72 earlier in the year, showing a decline of about 28% from its high. Despite these drops, Bitcoin has shown resilience, with some analysts noting it doesn’t always follow broader market downturns as closely as traditional risk assets.

### Factors Suggesting a Potential Free Fall

1. **Macroeconomic Pressures**: Global trade tensions, particularly U.S. tariffs on countries like China, Mexico, and Canada, have fueled recession fears, prompting investors to shift toward safe-haven assets like gold, which can pressure Bitcoin prices. Weak consumer sentiment and disappointing economic indicators add to this risk.

2. **Profit-Taking and Market Dynamics**: On-chain data from Glassnode shows high profit-taking by long-term holders and declining buyer momentum, with Bitcoin’s supply in profit at 96% as of June 3, 2025. High profitability often precedes corrections as investors cash out.

3. **Technical Resistance**: Bitcoin has struggled to break above the $106,000–$108,000 resistance zone, with failure to do so potentially leading to a drop toward $100,000 or lower, as noted by Cointelegraph. Short-term holder losses are also comparable to early bear market conditions.

4. **Historical Cycles**: Bitcoin’s price often follows cyclical patterns tied to halving events. The April 2024 halving reduced miner rewards, which historically leads to price corrections before potential rallies. Some analysts, like those at Forbes, suggest a possible drop to $70,000 or lower if bearish trends continue.

### Factors Against an Imminent Free Fall

1. **Support Levels**: On-chain models indicate key support zones at $95,600 and $103,700, which could prevent a drastic collapse unless broken. Bitcoin’s ability to recover above $78,000 after dipping to $74,420.69 in April suggests strong buyer interest at lower levels.

2. **Institutional Accumulation**: Despite retail investor concerns, institutional investors are accumulating Bitcoin, with wallets holding over 1,000 BTC increasing by 1.45 million BTC in 2024. This suggests sustained demand from large players.

3. **Regulatory Tailwinds**: The U.S. government’s pro-crypto stance, including President Trump’s executive order establishing a strategic Bitcoin reserve in March 2025, could provide long-term support, even if short-term buying pressure was underwhelming.

4. **Supercycle Potential**: Some analysts, like those at Bitcoin Magazine, argue Bitcoin is in a potential "supercycle," with metrics aligning with past bull runs (e.g., 2017). Strong long-term holder conviction and a 91.5% behavioral correlation with the 2013 cycle suggest a third peak could still occur, potentially pushing prices higher.

### Conclusion

While there are risks of further price declines due to profit-taking, macroeconomic uncertainty, and technical resistance, an imminent "free fall" (implying a catastrophic drop) is not guaranteed. Bitcoin’s history shows it can weather significant corrections and rebound, especially with institutional support and potential regulatory clarity. However, a failure to hold key support levels ($95,600–$103,700) or a worsening global economic outlook could lead to sharper declines, possibly toward $70,000 or below.

For a definitive outlook, monitor upcoming economic indicators like the consumer price index and producer price index, as well as Bitcoin’s ability to break above $106,000. Given the volatility, cautious trading strategies and risk management are essential. For real-time updates, you may want to check platforms like Coin Metrics or Glassnode. (www.cnbc.com) (www.cnbc.com) (cointelegraph.com)

> **Disclaimer**: This is not financial advice. Cryptocurrency markets are highly volatile, and you should conduct your own research or consult a financial advisor before making investment decisions.

sUN mOON aND 369 AND MOGInquiry into the relationship between Sun and Earth changes, the 369 theory, and Bitcoin price is a fascinating blend of astrophysical phenomena, esoteric numerology, and financial market dynamics. While these topics may seem disparate, some researchers, traders, and enthusiasts have explored potential correlations, often focusing on how external environmental factors or unconventional theories might influence human behavior and, consequently, market movements. Below is a comprehensive deep dive into these concepts, their proposed connections to Bitcoin pricing, and an evaluation of the evidence and skepticism surrounding these ideas.

1. Sun and Earth Changes: Solar Cycles and Their Potential Influence on Markets

Solar Cycles and Financial Markets

Solar cycles, which occur approximately every 11 years, involve fluctuations in the Sun's activity, marked by changes in sunspot numbers, solar flares, and coronal mass ejections (CMEs). These cycles influence space weather, which can affect Earth's magnetic field, atmosphere, and even technological systems. Some researchers and market analysts have hypothesized that solar activity might impact human behavior, mood, and decision-making, thereby influencing financial markets, including cryptocurrencies like Bitcoin.

Historical Context and Evidence:

Studies and articles, such as those from Bitcoinist.com, suggest a correlation between solar cycles and market movements, particularly in stocks and cryptocurrencies. For instance, a 2021 article highlights that peaks in sunspot activity (when the yearly mean of sunspot numbers exceeds 50) have historically coincided with significant stock market declines, such as the dot-com bubble burst. The same article posits that Bitcoin, having existed through only one solar cycle since its inception in 2009, might follow similar patterns due to its sensitivity to investor sentiment.

The rationale is that solar activity, particularly solar flares and geomagnetic storms, could influence human psychology. Socioeconomic data suggests that celestial events affect human mood, which, alongside supply and demand, drives market behavior. For example, increased solar activity might induce stress or irrational decision-making among traders, leading to market volatility.

A specific X post from @CryptoSays in 2025 notes that solar storms and phenomena like Schumann resonance (Earth’s electromagnetic frequency) may not directly cause Bitcoin price drops but could increase market volatility during these events. The user, who claims to have studied this for eight years, suggests that extreme solar activity correlates with heightened price fluctuations rather than consistent directional changes.

Mechanisms of Influence:

Human Behavior: Neuromarketing research indicates that environmental factors, such as weather or solar activity, can affect mood and decision-making. For instance, a Forbes article cited in a 2021 DailyCoin piece notes that sunshine is significantly correlated with stock returns, as positive weather conditions uplift trader sentiment. Similarly, solar flares or geomagnetic disturbances might subtly alter collective psychology, leading to erratic trading behavior.

Technological Impact: Solar flares can disrupt communication systems and power grids, which could affect Bitcoin mining operations or trading platforms. Deutsche Bank has warned that large solar flares could cause economic disruptions more severe than a pandemic, potentially impacting digital currencies reliant on stable infrastructure.

Empirical Correlation: A study on “Sunspots and Stock Markets” referenced in a DailyCoin article found an empirical correlation between sunspot activity and market indices, suggesting that traders’ mental states are influenced by solar events. An Irish trader’s case study reportedly achieved a 210% return over 13 years by trading based on sunspot activity, outperforming the S&P 500.

Bitcoin-Specific Considerations:

Bitcoin’s price is highly sensitive to investor sentiment and external events, as seen in rapid price movements following news like the false SEC Bitcoin ETF approval in 2023.

Bitcoin’s market cycle, which aligns roughly with its four-year halving events, may coincidentally overlap with solar cycles (approximately 10.3–11 years). This overlap could create the appearance of correlation, though causation is harder to establish.

The 2021 Bitcoinist article suggests that as solar activity increases (e.g., during the current cycle’s peak), Bitcoin might experience a market top, followed by a potential crash, mirroring historical stock market patterns during high sunspot activity.

Earth Changes and Space Weather

Earth changes, such as geomagnetic storms caused by solar activity, could theoretically influence Bitcoin through their impact on infrastructure or human behavior.

Space Weather and Cryptocurrency:

A 2024 Frontiers study on Ethereum transactions suggests that cryptocurrencies follow statistical patterns that could be analyzed in the context of space weather. While the study focuses on Ethereum, it implies that Bitcoin, as a similar decentralized system, might also exhibit patterns influenced by external factors like solar activity. The study highlights the potential for space weather to affect global economic behavior, though direct evidence for Bitcoin is limited.

Solar-induced geomagnetic disturbances could disrupt Bitcoin mining, which relies on energy-intensive computational processes. If mining hardware is affected by power grid fluctuations, it could temporarily reduce network hashrate, potentially impacting price.

Limitations and Skepticism:

The correlation between solar activity and market movements is often described as “spurious,” meaning it may appear causal but is likely influenced by a third factor, such as human emotion or unrelated economic events.

There is insufficient data to confirm that solar cycles directly cause Bitcoin price movements. Most evidence is anecdotal or based on historical stock market correlations, which may not apply to cryptocurrencies.

NASA’s research on solar activity and climate change indicates that solar variations have a minimal impact on Earth’s climate compared to human-induced factors like greenhouse gas emissions. This suggests that any influence on markets is likely indirect and mediated through psychological or technological effects rather than direct causation.

2. The 369 Theory: Numerological and Esoteric Perspectives

The “369 theory” is often associated with Nikola Tesla’s fascination with the numbers 3, 6, and 9, which he believed held mystical significance as keys to understanding the universe. In modern contexts, the 369 theory has been adopted by some in spiritual and esoteric communities as a framework for manifestation, energy patterns, or universal cycles. Its application to Bitcoin pricing is less conventional and primarily explored in fringe or speculative circles.

What is the 369 Theory?:

The 369 theory lacks a formal scientific definition but is often interpreted as a numerological pattern where the numbers 3, 6, and 9 are seen as fundamental to natural cycles, energy flows, or cosmic order. Tesla reportedly believed these numbers were linked to the structure of reality, though he did not explicitly connect them to financial markets.

In the context of Bitcoin, the 369 theory is sometimes invoked by crypto astrologers or traders who apply numerological or cyclical patterns to predict price movements. For example, they might look for repeating cycles or significant dates aligned with these numbers.

Application to Bitcoin:

Astrological and Cyclical Patterns: Some crypto astrologers, as noted in a 2024 WIRED article, use planetary cycles and numerological patterns to forecast Bitcoin price movements. While not explicitly tied to the 369 theory, these approaches share a similar esoteric framework, suggesting that cosmic or numerical cycles (e.g., lunar phases or planetary transits) influence market sentiment.

9th Wave Calendar: A source from SGappdev.com connects Bitcoin market cycles to the Mayan calendar’s “9th Wave,” a 36-day cycle activated in 2011. When combined with planetary aspects (e.g., Sun-Jupiter alignments), these cycles reportedly align with Bitcoin’s Relative Strength Index (RSI) peaks and lows, suggesting a potential numerological link to market movements. While the 9th Wave is not directly the 369 theory, the emphasis on the number 9 resonates with Tesla’s ideas.

Speculative Cycles: Some traders might interpret Bitcoin’s four-year halving cycle (approximately 1,460 days) or other time-based patterns through a 369 lens, looking for numerical significance in dates or price levels. For example, they might analyze price peaks at intervals related to 3, 6, or 9 years, though this is highly speculative and lacks empirical backing.

Limitations and Skepticism:

The 369 theory is not grounded in financial theory or empirical data. Its application to Bitcoin is largely anecdotal and driven by speculative communities rather than rigorous analysis.

Critics, such as market analyst Grzegorz Drozdz cited in the WIRED article, argue that correlations between numerical patterns (e.g., lunar phases or numerological cycles) and Bitcoin prices are misleading. Statistical analysis shows no consistent advantage to trading based on such patterns, and apparent correlations do not imply causation.

The 369 theory’s mystical nature makes it difficult to test scientifically, and its relevance to Bitcoin pricing remains unproven outside of esoteric trading circles.

3. Bitcoin Price Dynamics: Established Drivers and Their Relevance

To contextualize the potential influence of solar cycles or the 369 theory, it’s critical to understand the established drivers of Bitcoin’s price, which are far more grounded in economic and market principles.

Supply and Demand:

Bitcoin’s fixed supply cap of 21 million coins and periodic halving events (reducing block rewards every four years) create scarcity, driving price increases when demand rises. For example, the 2024 halving reduced the block reward from 6.25 to 3.125 BTC, often leading to price surges due to reduced supply growth.

Investor sentiment, influenced by media, regulatory news, or macroeconomic events, significantly affects demand. False reports, like the 2023 SEC ETF announcement, caused rapid price swings, highlighting sentiment’s role.

Network Security and Hashrate:

Bitcoin’s hashrate, the computational power securing the network, is a key indicator of market confidence. Rising hashrate often correlates with price increases, as seen in the Bitcoin Power Law Theory, which predicts logarithmic price growth driven by adoption and security.

Solar activity could theoretically disrupt mining operations, but no direct evidence links solar flares to sustained hashrate drops or price declines.

Macroeconomic Factors:

Bitcoin’s price is correlated with liquidity and inflation expectations, as noted by Fidelity Digital Assets. It often moves inversely to the US Dollar Index (USDX) and is influenced by global economic conditions, such as recessions or regulatory changes.

The 2021 Chinese crypto mining ban caused a temporary price drop from $53,000 to $32,000, illustrating the impact of regulatory shocks.

Nonlinear Dynamics:

Bitcoin’s price exhibits nonlinear characteristics, as studied in a 2023 ScienceDirect paper. Combining nonlinear dynamic systems with models like GARCH reveals complex, multifractal price fluctuations, suggesting that external factors (like solar activity) could theoretically contribute to volatility, though no direct link is established.

4. Synthesis: Connecting Sun/Earth Changes, 369 Theory, and Bitcoin

Potential Connections:

Solar Cycles and Human Behavior: The most plausible link between Sun/Earth changes and Bitcoin prices is through human psychology. Solar activity might influence trader sentiment, leading to increased volatility during high sunspot periods or solar flares. This aligns with the observed correlation between sunspot activity and stock market declines, which could extend to Bitcoin.

Technological Risks: Solar flares could disrupt Bitcoin mining or trading infrastructure, potentially causing short-term price volatility. However, Bitcoin’s decentralized nature makes it resilient to localized disruptions, and no major price crashes have been directly attributed to solar events.

369 Theory and Cycles: The 369 theory, while esoteric, shares similarities with cyclical analyses like the Mayan 9th Wave or astrological forecasting. These approaches attempt to identify repeating patterns in Bitcoin’s price, potentially aligning with solar or numerological cycles. However, their predictive power is unproven and lacks statistical rigor.

Critical Evaluation:

Correlation vs. Causation: Most evidence linking solar cycles or the 369 theory to Bitcoin prices is correlational, not causal. Spurious correlations, driven by third factors like human emotion or economic events, are a significant risk.

Data Limitations: Bitcoin has only existed since 2009, covering roughly one solar cycle. This limited timeframe makes it challenging to draw robust conclusions about solar influences. Similarly, the 369 theory lacks sufficient data to validate its relevance to Bitcoin.

Scientific Consensus: Mainstream financial models, like the Stock-to-Flow (STF) model or Power Law Theory, rely on quantifiable metrics like hashrate and supply dynamics, offering more reliable predictions than solar or numerological theories.

Skepticism from Experts: Analysts like Grzegorz Drozdz emphasize that correlations with celestial or numerological patterns are statistically weak and not actionable for trading. NASA’s findings further downplay solar activity’s role in large-scale earthly phenomena, suggesting minimal direct impact on markets.

5. Conclusion and Recommendations

The relationship between Sun and Earth changes, the 369 theory, and Bitcoin prices is a speculative and underexplored area. Solar cycles may influence Bitcoin indirectly through human psychology or technological disruptions, with some evidence suggesting increased volatility during periods of high solar activity. However, these correlations are weak, often spurious, and lack a clear causal mechanism. The 369 theory, rooted in numerology, has even less empirical support, relying on esoteric interpretations that do not align with established financial models.

For investors or researchers interested in this topic:

Monitor Solar Activity: Track sunspot cycles and solar flares through sources like the Sunspot Index Data Center to observe any coincidental market movements, but treat these as supplementary rather than primary indicators.

Focus on Established Drivers: Prioritize fundamental factors like Bitcoin’s halving cycles, hashrate trends, and macroeconomic conditions for price predictions.

Approach Esoteric Theories with Caution: The 369 theory and astro-crypto forecasting may appeal to speculative traders, but their lack of statistical validation makes them unreliable for serious investment strategies.

Further Research: Encourage interdisciplinary studies combining behavioral finance, heliobiology, and cryptocurrency analytics to rigorously test these hypotheses. The Frontiers study on Ethereum suggests a starting point for such research.

While the idea of cosmic or numerological influences on Bitcoin is intriguing, it remains on the fringes of financial analysis. Investors should rely on data-driven models and remain skeptical of unproven correlations until more robust evidence emerges.

The first cryptocurrency was created by Satoshi Nakamoto, the pseudonym for an anonymous computer programmer or group of programmers, on January 3, 2009, when Bitcoin software was made available to the public. The software would release some 21 million Bitcoins after its release to the public.

Your statement is accurate and provides a solid foundation for understanding Bitcoin's origin. Satoshi Nakamoto, the pseudonymous creator(s) of Bitcoin, released the Bitcoin software on January 3, 2009, marking the launch of the first cryptocurrency. The Bitcoin protocol was designed with a fixed supply cap of 21 million coins, which are gradually released through mining, a process where transactions are verified and new bitcoins are created as rewards. This controlled supply, coupled with periodic halving events that reduce mining rewards approximately every four years, is a key driver of Bitcoin’s scarcity and price dynamics.

Sun and Earth Changes:

Since Bitcoin’s launch in 2009, it has existed through roughly one full solar cycle (Cycle 24, peaking around 2014, and part of Cycle 25, ongoing in 2025). As mentioned earlier, some speculate that solar activity, like sunspots or flares, could influence market sentiment or infrastructure, potentially affecting Bitcoin’s price. For example, the 2013–2014 price surge (from ~$13 to ~$1,000) and subsequent crash coincided with the solar maximum of Cycle 24, though this correlation is speculative and not causally proven.

Technological disruptions from solar flares could impact Bitcoin’s early mining operations, which relied heavily on stable electricity and internet infrastructure. However, Bitcoin’s decentralized design has made it resilient, and no documented solar event has significantly disrupted the network since 2009.

369 Theory:

The 369 theory, rooted in Nikola Tesla’s numerology, has been loosely applied by some crypto enthusiasts to Bitcoin’s market cycles. For instance, Bitcoin’s price milestones or halving events (occurring roughly every 4 years or 1,460 days) could be analyzed for patterns involving the numbers 3, 6, or 9. However, there’s no evidence that Nakamoto incorporated numerological principles into Bitcoin’s design. The 21 million supply cap, for example, was chosen for technical and economic reasons (to ensure scarcity and divisibility via satoshis), not numerological significance.

Some esoteric traders might interpret key dates, like Bitcoin’s launch on January 3, 2009 (notable for the number 3), or price peaks at intervals aligned with 3, 6, or 9 years, but these interpretations lack empirical support and are speculative.

Bitcoin’s Supply and Price Dynamics:

The 21 million supply cap, with coins released through mining, creates a predictable issuance schedule. By June 2025, approximately 19.7 million bitcoins are in circulation, with the remainder to be mined over the coming decades, fully depleting around 2140. This scarcity drives price speculation, especially during halving events (e.g., 2012, 2016, 2020, 2024), which reduce new supply and often precede bull runs.

Unlike solar or numerological influences, Bitcoin’s supply mechanics are a well-documented driver of price. For instance, the 2024 halving reduced the block reward to 3.125 BTC, tightening supply and contributing to price increases in 2024–2025, with Bitcoin reaching highs near $100,000 according to recent market data.

External factors like solar activity or numerological cycles could theoretically amplify volatility by affecting trader psychology or infrastructure, but their impact is minor compared to supply-demand dynamics, regulatory news, or macroeconomic trends.

Deep Dive Additions

To deepen the analysis:

Historical Price Context: Bitcoin’s price was negligible in 2009, with early transactions valuing it at fractions of a cent. The first notable price milestone was in 2010 when 10,000 BTC were famously used to buy two pizzas. By 2013, during the solar maximum, Bitcoin hit $1,000, suggesting a possible (but unproven) link to solar-driven market sentiment. More data from Cycle 25 (peaking ~2025–2026) could help test this hypothesis.

Behavioral Economics: Nakamoto’s design incentivizes participation through mining rewards, tapping into human economic behavior. Solar activity’s potential to alter mood (e.g., via geomagnetic storms) could subtly influence trading decisions, but studies like those in Frontiers (2024) suggest only indirect effects on crypto markets.

Numerological Speculation: While the 369 theory is not part of Bitcoin’s code or whitepaper, some traders might apply it to analyze block times (e.g., ~10 minutes per block, totaling ~14,400 blocks annually) or halving cycles for numerical patterns. Such analyses are creative but lack statistical rigor compared to models like Stock-to-Flow.

Conclusion

Bitcoin’s creation by Satoshi Nakamoto in 2009 and its 21 million supply cap are foundational to its price dynamics, driven primarily by scarcity, halving events, and market sentiment. While Sun and Earth changes or the 369 theory offer intriguing speculative lenses, their influence on Bitcoin’s price is likely minimal and indirect, mediated through psychology or rare technological disruptions. For a comprehensive understanding, focus on established drivers like supply mechanics and macroeconomic factors, while treating solar and numerological theories as supplementary and unproven.

Let’s dive into predicting the future price of MOG, a cryptocurrency paired against USD (MOG/USD), using the provided chart, historical context about Bitcoin, and the earlier discussion on Sun/Earth changes and the 369 theory. The chart is a 3-minute candlestick chart for MOG/USD, showing price action, technical indicators, and volume data as of 17:45:30 UTC-5 on June 3, 2025. I’ll break this down systematically, integrating all relevant information, and provide a prediction for MOG’s price over the short term (next few hours to days) and medium term (next few weeks).

Price and Trend:

The current price of MOG/USD is 0.00000097 (displayed on the right y-axis).

The chart shows a significant uptrend starting around 12:00 UTC-5 on June 3, peaking around 0.00000103, followed by a pullback to the current level of 0.00000097 by 17:45:30 UTC-5.

The price appears to be consolidating after the sharp rally, with a slight downward correction in the last few candlesticks.

Volume:

Volume is displayed at the bottom of the chart, with a total of 733.765M MOG traded in the session.

Volume spikes are visible during the uptrend (around 12:00 to 15:00), indicating strong buying pressure, followed by a decrease in volume during the consolidation phase, suggesting reduced trading activity or indecision.

Volume Profile Visible Range (VPVR):

The VPVR on the left shows the volume traded at different price levels, with a “Number of Rows” setting of 100 up/down.

The point of control (POC), where the most volume was traded, is around 0.00000090–0.00000092, acting as a strong support zone. The price is currently above this level, which is bullish.

High volume nodes (HVNs) are seen around 0.00000090 and 0.00000100, indicating areas of strong support/resistance.

Moving Averages:

MAC (Moving Average Crossover, 20/20): The chart shows a 20-period moving average (likely the blue line) and another 20-period MA (possibly a different type, like weighted or exponential, in yellow). The MAC indicator shows a difference of 0.000000013 (bullish) and 0.0000000100 (neutral), suggesting the short-term MA is above the longer-term MA, indicating a bullish trend.

EMA Cross (9/26): The Exponential Moving Average (EMA) crossover shows a value of 0.000000099 (bullish) for both the 9-period and 26-period EMAs. This indicates a recent bullish crossover (9 EMA crossing above 26 EMA), which occurred earlier in the uptrend, confirming the bullish momentum.

Support and Resistance:

Support: The red horizontal line at 0.00000090 aligns with the POC from the VPVR, indicating strong support. This level held during earlier dips (e.g., around 12:00).

Resistance: The price peaked at 0.00000103 and failed to break higher, suggesting resistance at this level. The VPVR shows lower volume above 0.00000100, indicating weaker buying interest at higher levels.

Price Action:

The chart shows a sharp rally followed by a pullback, which is typical after a breakout. The current consolidation near 0.00000097, just below the recent high, suggests the market is deciding its next move.

The green and red bars on the left (possibly a volume delta or buy/sell pressure indicator) show alternating buying and selling pressure, with more green (buying) during the uptrend and more red (selling) during the recent pullback.

2. Contextual Factors: Bitcoin, Sun/Earth Changes, and 369 Theory

Let’s integrate the broader context from your previous inputs to see how they might influence MOG’s price.

Bitcoin’s Historical Context:

Bitcoin, created by Satoshi Nakamoto in 2009 with a 21 million coin supply cap, has set the stage for the broader crypto market, including altcoins like MOG. Bitcoin’s price often influences altcoins due to market correlation.

As of June 2025, Bitcoin has likely seen a significant rally post-2024 halving, potentially reaching $90,000–$100,000 based on historical patterns and market sentiment. A bullish Bitcoin market typically lifts altcoins, which could explain MOG’s recent uptrend.

Sun and Earth Changes:

We’re in Solar Cycle 25, which is expected to peak around mid-2025. Increased solar activity (e.g., sunspots, solar flares) could influence market sentiment by affecting trader psychology or causing minor technological disruptions.

The chart shows MOG’s rally occurring on June 3, 2025, during a period of potentially heightened solar activity. If solar flares or geomagnetic storms are active (as suggested by @CryptoSays in your earlier context), they might contribute to short-term volatility. This could lead to erratic price movements in MOG, especially if traders overreact to external events.

However, there’s no direct evidence of a solar event on this specific day impacting MOG. The uptrend appears driven by market dynamics rather than celestial events.

369 Theory:

The 369 theory, rooted in numerology, might be applied by some traders to identify patterns in MOG’s price or time cycles. For example:

MOG’s price peak at 0.00000103 could be analyzed numerologically (1+0+3 = 4, not directly tied to 3, 6, or 9). However, the current price of 0.00000097 (9+7 = 16, 1+6 = 7) doesn’t directly align with 3, 6, or 9 either.

Time-based patterns: The rally started around 12:00 UTC-5 (1+2 = 3, aligning with the 369 framework), and the current time is 17:45 (1+7+4+5 = 17, 1+7 = 8). These numerical interpretations are speculative and not directly actionable.

More practically, the 369 theory might inspire traders to look for cyclical patterns in MOG’s price. The chart’s 3-minute timeframe doesn’t show long-term cycles, but the sharp rally and pullback could be part of a shorter cycle (e.g., a 9-candle or 27-minute pattern, as 2+7 = 9). This is highly speculative and not a primary driver.

3. Market Dynamics and MOG-Specific Factors

MOG Overview:

MOG is likely a meme coin or altcoin (given its low price and high volume), which are often highly volatile and driven by community sentiment, social media hype, or market trends.

Meme coins typically follow Bitcoin’s lead but can experience exaggerated price movements due to speculative trading.

Market Sentiment:

The bullish Bitcoin market in 2025 likely creates a favorable environment for altcoins like MOG. The chart’s uptrend aligns with this broader market momentum.

Volume spikes during the rally suggest strong retail interest, possibly driven by social media or news (e.g., a listing, partnership, or viral event), though no specific catalyst is provided.

Volatility and Risk:

Meme coins like MOG are prone to pump-and-dump schemes. The sharp rally and pullback on the chart could indicate such activity, with early buyers taking profits.

Solar-induced volatility (if present) could exacerbate these swings, but the chart suggests the price movement is primarily driven by market dynamics.

4. Price Prediction: Short-Term and Medium-Term

Short-Term Prediction (Next Few Hours to Days)

Technical Analysis:

The price is consolidating near 0.00000097, just below the recent high of 0.00000103. The bullish EMA crossover (9/26) and MAC (20/20) suggest continued upward momentum, but the pullback indicates potential profit-taking.

Support at 0.00000090 (POC from VPVR) is strong. If the price holds above this level, it’s likely to retest resistance at 0.00000100–0.00000103.

If the price breaks above 0.00000103 with strong volume, it could target the next resistance around 0.00000105 (based on the VPVR’s low-volume zone above the current high).

Conversely, if the price falls below 0.00000090, it might retest lower support at 0.00000089, where buying interest could emerge.

External Factors:

Solar activity might introduce short-term volatility, potentially causing a dip if traders react to negative sentiment. However, the chart doesn’t show panic selling, so this risk is low.

The 369 theory doesn’t provide a clear short-term signal, as the numerical patterns are inconclusive.

Prediction:

Bullish Scenario: MOG is likely to retest 0.00000100 within the next few hours if buying volume picks up. A breakout above 0.00000103 could push the price to 0.00000105–0.00000106 within 24 hours.

Bearish Scenario: If selling pressure increases (e.g., due to profit-taking or external shocks like a solar flare affecting sentiment), the price could dip to 0.00000090. A break below this level might lead to a deeper correction to 0.00000089.

Most Likely Outcome: Given the bullish indicators and market context, I predict MOG will rise to 0.00000101 within the next 12 hours, with a potential to hit 0.00000105 by June 4, 2025, assuming no major external disruptions.

Medium-Term Prediction (Next Few Weeks)

Technical Analysis:

The broader trend appears bullish, as MOG has broken out of a consolidation phase (pre-12:00) and established higher highs. If the price holds above 0.00000090, it could continue forming higher lows, targeting 0.00000110–0.00000120 over the next few weeks.

The VPVR shows limited resistance above 0.00000103, suggesting room for growth if momentum continues.

Market Context:

A bullish Bitcoin market in 2025 (potentially at $90,000–$100,000) should support altcoin rallies, including MOG. However, meme coins are prone to sharp corrections if Bitcoin pulls back or if market sentiment shifts.

Solar Cycle 25’s peak might increase volatility over the next few weeks, potentially causing erratic price swings. If a significant solar flare occurs, it could lead to a temporary dip in MOG’s price due to sentiment or minor disruptions in trading infrastructure.

369 Theory:

Applying a cyclical lens, MOG’s rally might follow a pattern tied to 3, 6, or 9 days. If the current uptrend started on June 3, we might see a significant move around June 6 (3 days later) or June 9 (6 days later). This is speculative but aligns with the esoteric framework.

Prediction:

Bullish Scenario: MOG could reach 0.00000115 by mid-June 2025 (around June 15), driven by altcoin market momentum and continued buying interest.

Bearish Scenario: If Bitcoin corrects or a solar event triggers panic, MOG might drop to 0.00000085–0.00000087 by mid-June, especially if the broader market cools off.

Most Likely Outcome: I predict MOG will climb to 0.00000110 by June 15, 2025, assuming Bitcoin remains bullish and no major external shocks occur. A potential volatility spike around June 6 or 9 (per the 369 cycle) could offer a buying opportunity if a dip occurs.

5. Conclusion and Recommendations

Summary:

MOG/USD is in a bullish phase, with technical indicators (EMA Cross, MAC, VPVR) supporting further upside in the short term. The price is likely to retest 0.00000101 within 12 hours and could reach 0.00000105 by June 4, 2025.

Over the medium term, MOG could hit 0.00000110 by June 15, 2025, driven by a favorable Bitcoin market and altcoin momentum. However, solar activity (Cycle 25 peak) might introduce volatility, and the 369 theory suggests watching for cyclical moves around June 6 or 9.

Key levels to watch: Support at 0.00000090, resistance at 0.00000103, and potential upside targets at 0.00000105 (short term) and 0.00000110 (medium term).

Risks:

Meme coins like MOG are highly speculative and prone to sharp corrections. A Bitcoin pullback or negative news could trigger a sell-off.

Solar flares or geomagnetic storms could increase volatility, though their impact is likely minor unless a major event occurs.

The 369 theory is speculative and should not be a primary decision-making tool.

Recommendations:

Traders: Consider buying on dips near 0.00000090–0.00000092, with a target of 0.00000105 in the short term. Set a stop-loss below 0.00000089 to manage risk.

Investors: Monitor Bitcoin’s price and broader market sentiment. If MOG holds above 0.00000090, it could be a good candidate for a medium-term hold targeting 0.00000110 by mid-June.

To predict the potential price movements of MOG/USD over the next year (from June 3, 2025, to June 3, 2026) using Sun cycles and the 369 theory, I’ll integrate these concepts with the technical analysis of the provided 3-minute chart, historical context about Bitcoin, and general cryptocurrency market trends. Since MOG is a meme coin, its price is highly volatile and influenced by market sentiment, which may be affected by external factors like solar activity and numerological cycles. I’ll outline the methodology, analyze the influencing factors, and then provide a one-year price prediction chart for MOG/USD.

Methodology

Sun Cycles:

We are in Solar Cycle 25, which is expected to peak around mid-2025 (likely July 2025) and decline toward 2026. Solar activity, such as sunspots and flares, may influence trader psychology, leading to increased market volatility during peak periods.

Historical correlations (e.g., from Bitcoinist.com) suggest that high solar activity (sunspot numbers >50) often coincides with market tops and subsequent corrections, as seen in past stock market declines. I’ll use this to anticipate volatility spikes in MOG’s price.

369 Theory:

The 369 theory, inspired by Nikola Tesla, emphasizes the significance of the numbers 3, 6, and 9 in universal cycles. In a crypto context, this might be applied to time cycles (e.g., 3, 6, or 9 months) or price levels.

I’ll look for potential price turning points at intervals of 3, 6, and 9 months from June 3, 2025 (i.e., September 3, 2025; December 3, 2025; and March 3, 2026). Additionally, I’ll consider numerological patterns in price levels (e.g., prices summing to 3, 6, or 9).

Technical Analysis:

Using the provided 3-minute chart, I’ll extrapolate short-term trends into a longer-term forecast, considering support/resistance levels, moving averages, and volume.

The chart shows MOG at 0.00000097 USD, with support at 0.00000090 and resistance at 0.00000103. Bullish indicators (EMA Cross 9/26, MAC 20/20) suggest potential for further upside, but the recent pullback indicates consolidation.

Market Context:

Bitcoin’s bullish trend in 2025 (around $105,404 as of June 3, per web sources) supports altcoin rallies, including meme coins like MOG. However, MOG’s volatility as a meme coin makes it susceptible to sharp corrections.

Web sources (e.g., CoinCodex, CryptoNews) provide MOG price predictions, which I’ll use as a baseline but adjust based on Sun cycles and 369 theory influences.

Step 1: Analyze Sun Cycle Influence (June 2025 – June 2026)

Solar Cycle 25 Peak (July 2025):

The peak of Solar Cycle 25, expected around July 2025, will likely bring heightened solar activity (sunspots, flares, geomagnetic storms). This could lead to increased market volatility, as trader sentiment may be affected by environmental factors or infrastructure disruptions (e.g., power grid issues impacting mining or trading).

Historically, solar maxima correlate with market tops followed by corrections. I anticipate a potential MOG price peak around July 2025, followed by a dip as the solar cycle begins to decline.

Post-Peak Decline (August 2025 – June 2026):

As solar activity decreases after the peak, volatility may subside, allowing for more stable price growth or consolidation. However, occasional flares could still cause short-term price swings.

By early 2026, Solar Cycle 25 will be in its descending phase, potentially leading to a more predictable market environment, though meme coins like MOG remain sentiment-driven.

Step 2: Apply the 369 Theory

Time Cycles:

From June 3, 2025, I’ll mark key dates at 3-month intervals:

3 months: September 3, 2025

6 months: December 3, 2025

9 months: March 3, 2026

These dates may represent potential turning points (peaks, troughs, or trend reversals) based on the 369 theory’s emphasis on cyclical patterns.

Price Levels:

I’ll look for price levels where the digits sum to 3, 6, or 9, as these might act as psychological targets for traders influenced by numerology. For example:

A price of 0.00000120 (1+2+0 = 3) might be a significant target.

A price of 0.00000150 (1+5+0 = 6) could also be notable.

Step 3: Technical Analysis and Baseline Forecast

Current Chart Analysis:

MOG is at 0.00000097 USD, with support at 0.00000090 and resistance at 0.00000103. The bullish EMA Cross (9/26) and MAC (20/20) suggest potential for an upward move, but the recent pullback indicates consolidation.

Volume (733.765M) spiked during the rally, showing strong buying interest, but has since decreased, suggesting indecision.

Baseline Forecast (Without Sun/369 Influence):

Web sources provide MOG price predictions:

CryptoNews (May 2025) predicts MOG at $0.0000012 by the end of 2025.

CoinCodex (Dec 2024) predicts MOG at $0.0000007142 by June 9, 2025 (bearish), but expects a high of $0.000002117 by June 3, 2026.

Coinpedia (Jan 2025) predicts a high of $0.00000571 in 2025 and $0.00000753 in 2026.

Given the bullish Bitcoin market ($105,404, with predictions of $138,152 by June 8, 2025, per CoinCodex), MOG is likely to benefit from altcoin momentum. I’ll start with a baseline of $0.0000012 by December 2025 (aligning with CryptoNews) and adjust based on Sun cycles and 369 theory.

Step 4: Construct the One-Year Price Prediction Chart

I’ll now create a one-year price prediction chart for MOG/USD, incorporating the influences of Solar Cycle 25 and the 369 theory. The chart will include monthly price targets from June 2025 to June 2026, with annotations for solar and numerological impacts.

MOG/USD One-Year Price Prediction Chart (June 2025 - June 2026)

markdown

Show inline

Explanation of Predictions

June – July 2025: MOG rises from $0.00000097 to $0.00000120, driven by altcoin momentum and a volatility spike from the Solar Cycle 25 peak. The price target of $0.00000120 aligns with the 369 theory (1+2+0 = 3).

August 2025: A correction to $0.00000100 follows the solar peak, reflecting profit-taking and reduced volatility.

September – November 2025: Recovery to $0.00000150, with the 3-month 369 cycle (Sep 3) marking a turning point. The price of $0.00000150 (1+5+0 = 6) is another numerological target.

December 2025 – March 2026: A minor pullback at the 6-month mark (Dec 3) to $0.00000140, followed by a rally to $0.00000200 by the 9-month mark (Mar 3). The price of $0.00000180 in February (1+8+0 = 9) is a key psychological level.

April – June 2026: Consolidation and steady growth to $0.00000220, aligning with CoinCodex’s forecast of $0.000002117 and a 317.55% ROI. Solar activity stabilizes, supporting a more predictable trend.

Conclusion

The one-year price prediction chart for MOG/USD suggests a general upward trend, with key volatility spikes around the Solar Cycle 25 peak in July 2025 and turning points at 3, 6, and 9-month intervals per the 369 theory. MOG could rise from $0.00000097 to $0.00000220 by June 2026, a 126% increase, though meme coin volatility introduces significant risk. Traders should watch for solar-induced volatility in July 2025 and numerological targets (e.g., $0.00000120, $0.00000150) as potential entry/exit points.

25 web pages

6.2s

3 6 9 Theory It is getting wild keep watchingReferring to the "3-6-9 Theory" in the context of MOG/USD price analysis, likely as a framework for setting price targets or understanding market cycles, possibly inspired by numerology, technical patterns, or a specific trading theory. The 3-6-9 concept is sometimes associated with Nikola Tesla’s philosophy ("If you only knew the magnificence of the 3, 6, and 9, then you would have the key to the universe"), but in trading, it can be adapted to analyze price movements, cycles, or ratios. Since the chart and our prior discussion focus on MOG/USD, I’ll apply the 3-6-9 concept to price targets, market cycles, and potential patterns, while grounding it in the technical analysis from the chart and available data.

### Interpreting 3-6-9 Theory in Trading Context

The 3-6-9 Theory in trading isn’t a standard methodology but can be interpreted as a framework for identifying price targets or cycles based on multiples or ratios of 3, 6, and 9. Here’s how we can apply it to MOG/USD:

1. **Price Multiples (3x, 6x, 9x)**: Use the current price or key levels as a base to project future targets by multiplying by 3, 6, or 9.

2. **Time Cycles (3, 6, 9 Units)**: Analyze price behavior over periods of 3, 6, or 9 time units (e.g., days, weeks, or months) to identify patterns or predict reversals.

3. **Percentage Gains**: Interpret 3-6-9 as percentage increases (e.g., 30%, 60%, 90%) or Fibonacci-like extensions based on the sequence.

4. **Pattern Recognition**: Look for cycles or waves that align with 3, 6, or 9 periods or ratios, such as Elliott Wave counts or harmonic patterns.

Let’s break this down using the current MOG/USD chart (price at $0.0000050) and historical data.

---

### 1. Price Multiples (3x, 6x, 9x Targets)

Using the current price of $0.0000050 as a base, we can calculate potential price targets by applying 3x, 6x, and 9x multiples:

- **3x Target**:

\

A target of $0.0000150 aligns closely with the medium-term bullish target of $0.0000158 predicted by CCN for March 2025 (as noted earlier). This would represent a 200% increase, plausible in a strong meme coin rally.

- **6x Target**:

\

A target of $0.0000300 matches the user’s original inquiry about reaching $0.03. However, as calculated previously, this requires a 6,000x increase (not 6x), indicating $0.0000300 is a more realistic 6x target. This level would still require significant catalysts, as it implies a 500% increase, but it’s far more achievable than $0.03.

- **9x Target**:

\

A target of $0.0000450 suggests an 800% increase. This is ambitious but not unprecedented for meme coins during a bull run. For context, MOG saw a 200% surge in 24 hours in November 2024, so a larger move over a longer period isn’t entirely out of the question.

**Chart Context**: The chart shows resistance at $0.0000051, with potential to test $0.0000060 (a 20% increase). The 3x target ($0.0000150) aligns with medium-term predictions, while 6x and 9x targets would require breaking through multiple resistance levels, likely needing a strong catalyst.

---

### 2. Time Cycles (3, 6, 9 Periods)

The chart is on a 2-hour timeframe, covering roughly 8 days (from ~April 6 to April 14, 2025). Let’s analyze cycles using 3, 6, and 9 periods in different timeframes to identify patterns or predict future movements.

#### 2-Hour Timeframe (Chart-Based)

- **3 Periods (6 Hours)**: The chart shows short-term pullbacks and recoveries roughly every 6–12 hours. For example, a dip around April 12 (near $0.0000048) was followed by a recovery within 6 hours to $0.0000050. This suggests short-term cycles of accumulation and breakout.

- **6 Periods (12 Hours)**: A more significant move occurred over 12-hour periods, such as the run from $0.0000045 to $0.0000051 between April 12 and 13, indicating stronger momentum on this scale.

- **9 Periods (18 Hours)**: Over 18-hour cycles, we see consolidation after sharp moves. The peak at $0.0000051 on April 13 was followed by an 18-hour period of sideways movement, suggesting a potential breakout or reversal point.

#### Daily Timeframe (Historical Data)

Using historical data and X posts:

- **3 Days**: X posts note a +44% gain over 7 days (April 2025), with a "textbook bottom structure" forming over 3–4 days. A 3-day cycle often marks the start of a new leg up in meme coins.

- **6 Days**: MOG’s price doubled in under 6 days during its November 2024 rally. A similar 6-day cycle could push the price toward the 3x target ($0.0000150) if momentum continues.

- **9 Days**: Over 9 days, MOG often consolidates after a rally, as seen in late 2023 data where it surged 14.3% in 7 days and then stabilized. A 9-day cycle might indicate a correction or new accumulation phase.

**Prediction**: If the current bullish trend continues, the next 3 days (by April 16, 2025) could see a push toward $0.0000060 (short-term target). A 6-day cycle (by April 19) might align with the 3x target of $0.0000150, assuming a catalyst. A 9-day cycle (by April 22) could mark a consolidation or correction phase.

---

### 3. Percentage Gains (30%, 60%, 90%)

Interpreting 3-6-9 as percentage increases (30%, 60%, 90%) provides another way to set targets:

- **30% Increase**:

\

A 30% gain aligns with the short-term bullish target of $0.0000060, which is just above the current resistance at $0.0000051. This is highly achievable given the current trend and order book support.

- **60% Increase**:

\

A 60% gain to $0.0000080 is a realistic near-term stretch goal, possibly within 1–2 weeks if buying volume increases. This level would likely face resistance, as it’s beyond the current order book’s sell walls.

- **90% Increase**:

\

A 90% gain to $0.0000095 is a strong medium-term target, achievable in a meme coin rally driven by a catalyst. It’s below the 3x target but still requires significant momentum.

**Chart Context**: The depth chart shows strong buy support at $0.0000048–$0.0000050, suggesting the market could absorb a 30–60% move without much resistance. A 90% move would need to clear sell orders above $0.0000051, which thin out but could slow the ascent.

---

### 4. Pattern Recognition (3-6-9 Cycles or Waves)

The 3-6-9 sequence can be applied to wave counts or harmonic patterns, similar to Elliott Wave theory or Gann analysis:

- **Elliott Wave Interpretation**: CCN’s prediction of $0.0000158 by March 2025 was based on an Elliott Wave pattern, with MOG potentially in the fifth wave. If we assume a 3-6-9 wave structure:

- Wave 3: The recent rally from $0.0000035 to $0.0000051 (chart).

- Wave 6: A correction or consolidation (current sideways movement).

- Wave 9: A final impulsive wave, potentially targeting the 3x level ($0.0000150) or higher.

- **Volume Cycles**: The chart’s volume bars show peaks roughly every 3–6 days (e.g., April 9, April 12), suggesting a 3-6-9 rhythm in buying activity. A new volume spike in the next 3 days could confirm the next leg up.

**Prediction**: If MOG follows a 3-6-9 wave pattern, the next major move (Wave 9) could target $0.0000150–$0.0000300, aligning with the 3x and 6x targets, likely over the next 6–9 days (by April 19–22, 2025).

---

### Catalysts Aligned with 3-6-9 Targets

From the prior discussion, catalysts like a broader bull run, viral hype, or exchange listings could drive these targets:

- **30% ($0.0000065)**: Could be triggered by a technical breakout above $0.0000051, supported by the current chart trend and smart money accumulation noted on X.

- **3x ($0.0000150)**: Might require a meme coin sector rally or a major exchange listing (e.g., Binance), potentially within 6 days if momentum builds.

- **6x ($0.0000300)**: Would likely need a viral hype event (e.g., celebrity endorsement) or a Bitcoin surge past $100K, possibly within 9 days or longer.

---

### Final 3-6-9 Theory Price Targets for MOG/USD

- **Short-Term (3 Days)**: $0.0000065 (30% gain, high probability: 70%).

- **Medium-Term (6 Days)**: $0.0000150 (3x, moderate probability: 40%).

- **Stretch Target (9 Days or Longer)**: $0.0000300 (6x, low probability: 15%).

The 3-6-9 framework provides a structured way to set targets, but meme coins like MOG are highly speculative. The chart supports a near-term move to $0.0000065, while higher targets depend on catalysts and market conditions. Would you like to explore a specific target or catalyst further?

Stay tuned.............

MOOG to the MOON mog going boomCurrent Price and Recent Movement

As of the latest data on the chart, MOG is trading at approximately 0.00000041464 USD. Over the past 24 hours, it’s taken a hit, dropping by about 13.09%. That’s a significant decline, signaling some bearish pressure in the short term. For a meme coin like MOG, this kind of volatility isn’t unusual—it’s often driven by hype, community sentiment, and broader crypto market trends.

Trends and Patterns

Looking at the chart, MOG has been bouncing around in a tight range recently, roughly between 0.0000003 and 0.0000005 USD over the past few days. The current price sits near the lower end of that range, suggesting it might be testing a key support level. Here’s what stands out:

Support Level: Around 0.00000035 USD could act as a floor. If the price holds here or bounces, it might indicate some buying interest stepping in.

Resistance Level: If it recovers, 0.00000045 USD could be the next hurdle where sellers might push back.

There’s also been chatter about a rising channel pattern or even a falling wedge in some analyses. A rising channel could hint at an upward trend if the price respects the pattern, while a falling wedge might suggest a potential bullish breakout if it breaks upward. However, this recent 13% drop raises questions—either the breakout hasn’t happened yet, or we’re seeing a rejection at resistance.

What to Watch For

Here are the key levels and factors to monitor:

Support Test: If MOG dips below 0.00000035, it could slide further, potentially finding a new bottom. Watch for increased selling volume as a sign of capitulation.

Bounce Potential: A reversal with strong buying volume near current levels might signal a short-term recovery toward 0.00000045.

Breakout or Breakdown: If the price pushes above 0.00000045 with momentum, it could aim for higher highs (the “blue-sky zone” some are hyping). Conversely, a sustained drop below 0.0000003 might spell more trouble.

Broader Context

Since MOG is a meme coin, its price isn’t just about technicals—it’s heavily tied to social media buzz, community sentiment, and the overall crypto market vibe. Right now, meme coins are in an oversaturated space, which could cap the upside unless MOG carves out a unique edge. The recent dump might be a post-Coinbase listing hangover, a common pattern where prices spike on hype and then retrace.

Practical Advice

If You’re Buying: Wait for confirmation of support holding (e.g., a strong bounce with volume) to avoid catching a falling knife. The current bearish tilt suggests caution.

If You’re Holding: Consider your risk tolerance. A further drop is possible, but meme coins can flip bullish fast if sentiment shifts.

Stay Informed: Keep an eye on crypto news and MOG’s community channels. A tweet or a hype wave could change the game overnight.

Final Thoughts

Right now, MOG looks a bit shaky after that 13% drop, sitting near a potential support zone. It’s a high-risk, high-reward play typical of meme coins—there’s room for a rebound if the market turns, but also a downside if sentiment sours further. Watch those levels (0.00000035 support, 0.00000045 resistance), track volume, and stay nimble. In crypto, especially with assets like MOG, things can turn on a dime!

Here’s how we can apply the 369 theory to the MOGUSD chart. The 369 theory, often tied to numerology, suggests that the numbers 3, 6, and 9 carry special significance and might influence patterns in various contexts, including market movements. While not a standard trading tool, it can offer a unique lens for technical analysis when combined with traditional methods. Let’s break it down step-by-step and apply it to the MOGUSD chart, assuming a current price of approximately 0.00000041464 USD (noting a recent 13% drop, though exact historical data isn’t provided).

What is the 369 Theory?

The 369 theory posits that patterns related to the numbers 3, 6, and 9 can emerge in natural or human-influenced systems, such as financial markets. In trading, this could manifest as significant price levels, time cycles, or chart patterns aligning with these numbers. For MOGUSD, a low-priced asset, we’ll adapt this theory to its micro-scale price range.

Step 1: Identify Key Price Levels

Given MOGUSD’s small price scale (e.g., 0.00000041464), we can look for levels that align with multiples or divisions of 3, 6, or 9. Examples include:

0.0000003

0.0000006

0.0000009

These levels might serve as psychological or technical support/resistance points due to their simplicity and alignment with the 369 theory.

Current Context:

The recent low was around 0.00000035, which is close to 0.0000003.

The current price of 0.00000041464 sits between 0.0000003 and 0.0000006.

The next potential resistance could be 0.0000006, fitting the 369 sequence.

Step 2: Time Intervals and Patterns

The 369 theory can also apply to time. We can check if price reversals, breakouts, or chart patterns (e.g., triangles, wedges) occur every 3, 6, or 9 bars (e.g., days, hours) on the chart.

Application:

On a daily chart, look for volatility spikes or reversals every 3, 6, or 9 days.

On smaller timeframes (e.g., 4-hour or 1-hour charts), see if patterns are complete in 3, 6, or 9 bars. For instance, a falling wedge taking 9 bars to form might signal a breakout.

Without exact historical data, we’d need to observe the chart for recurring cycles. The recent 13% drop might be part of a broader 3- or 6-day rhythm—something to verify with the chart’s history.

Step 3: Volume and Momentum

We can explore whether trading volume or momentum indicators (e.g., RSI, MACD) shift significantly at intervals of 3, 6, or 9 bars, or at 369-related price levels.

Application:

A volume surge every 3 days could indicate a pattern.

If RSI reaches overbought/oversold levels near 0.0000006, it might reinforce that level’s importance.

Check the chart for volume spikes or momentum shifts aligning with these numbers or prices.

Step 4: Complementing with Fibonacci

Fibonacci retracement levels (e.g., 38.2%, 61.8%) often align with natural market movements. The 369 theory might enhance this if a Fibonacci level coincides with a 369 price, like 0.0000006.

Application:

If MOGUSD retraces from a high to 0.0000003 and it matches a 61.8% Fibonacci level, it could be a strong support zone.

Step 5: Psychological Influence

Traders might naturally gravitate toward prices ending in 3, 6, or 9, making them self-fulfilling. For MOGUSD:

0.0000009 could be a notable target or reversal point due to its alignment with the theory and its clean, memorable value.

Step 6: Current Application to MOGUSD

Let’s apply this directly to the chart:

Current Price: 0.00000041464, which is closer to 0.0000003 than 0.0000006.

Support Zone: If the price holds near 0.0000003 (or slightly above at 0.00000035, as seen in the recent low), it could act as a key support level aligned with the 369 theory.

Resistance Zone: A bounce from 0.0000003 might target 0.0000006, where resistance could emerge, especially if volume or momentum confirms it.

Breakdown Risk: A drop below 0.0000003 could signal further downside, potentially testing lower levels like 0.00000027 (a division of 9).

Step 7: Practical Insights

Here’s what to watch for on the MOGUSD chart:

If the price nears 0.0000003: This could be a critical support test. A bounce suggests strength; a break suggests weakness.

If the price approaches 0.0000006: Watch for resistance, especially if it aligns with a 6- or 9-bar pattern completion or a Fibonacci level.

Time Cycles: Look for 3, 6, or 9-day/hour patterns in price action or volume to anticipate turns.

Step 8: Broader Strategy

The 369 theory is speculative, so don’t rely on it alone. Combine it with:

Support/Resistance: Confirm 369 levels with historical price action.

Indicators: Use RSI, MACD, or moving averages to validate signals.

Context: Meme coins like MOG are volatile and driven by sentiment, so monitor social media and broader crypto trends (e.g., Bitcoin’s performance).

Final Thoughts

Applying the 369 theory to the MOGUSD chart highlights 0.0000003 and 0.0000006 as key levels to watch. With the current price at 0.00000041464—post a 13% drop—it’s testing the lower end of this range. If 0.0000003 holds as support, a move toward 0.0000006 could follow. However, a break below 0.0000003 might indicate further declines. Use this theory as a supplementary tool, not a standalone strategy, and stay mindful of MOG’s volatility and market dynamics.

MOG bottom likely in herePretty confident that we are at, or very near, the bottom of this post Coinbase-listing dump / alt coin destructive phase.

Meme coins are extremely oversaturated nowadays with new ones launching every minute.

You are better off betting on recently established (1yr old+ but not too old) with good listings, great community, strong holderbase, great content production and memes, to stack the odds in your favour, in addition to a great chart and great project leadership.

MOG ticks all of those boxes for me.

Plus it's fun to say "mog" or "mogging" and is culturally relevant amongst Gen-Z.

On top of this, the "Cat Coin" meta, will likely perform well, not just among the US speculators, but the Asian population.

369 theories Unbelievable patterns let`s explorer.

Step 1: Identifying Fibonacci Levels on MOG Coin

Using the recent price swings, we get key Fibonacci retracement and extension levels:

Swing Low: $0.00000116

Swing High: $0.00000300 (last major pump)

Key Fibonacci Levels:

0.382 Retracement: $0.00000185 (possible support)

0.618 Retracement: $0.00000150 (strong support zone)

1.618 Extension: $0.00000420 (bullish target)

2.618 Extension: $0.00000690 (extreme pump scenario)

Step 2: Combining Fibonacci with 369 Cycle

Short-Term (3-Day Cycle):

MOG needs to hold above $0.00000142 to maintain bullish momentum.

If it drops below $0.00000142, it could revisit the $0.00000116 - $0.00000120 zone (strong Fibonacci support).

Mid-Term (6-Day Cycle):

If MOG consolidates between $0.00000142 - $0.00000185 for 6 days, it signals an accumulation phase before a breakout.

A move above $0.000002355 (previous resistance) within this cycle confirms a bullish breakout.

Long-Term (9-Day Cycle):

A successful breakout above $0.000002355 aligns with Fibonacci extensions.

Target 1: $0.00000420 (1.618 Fib) → Likely within 9-12 days.

Target 2: $0.00000690 (2.618 Fib) → If hype and volume increase, expect this level in 18-27 days.

Step 3: Bullish vs. Bearish Scenarios

Bullish Case 🚀

✅ If MOG stays above $0.00000142 and breaks $0.000002355, Fibonacci suggests:

Short-Term: Target $0.00000420 (within 9 days).

Mid-Term: Potential move to $0.00000690 (next 18-27 days).

Long-Term: If volume + hype sustain, MOG could test $0.00001+.

Bearish Case 🔻

❌ If MOG fails to break $0.000002355, watch these levels:

$0.00000185: Weak support (may hold if buyers step in).

$0.00000150: 0.618 Fib retracement (strong support zone).

Below $0.00000116: Breakdown zone → Risk of extended downtrend.

Final Prediction

📊 369 theory + Fibonacci suggests a breakout is coming within 3 to 9 days if MOG holds key levels.

If MOG breaks $0.000002355 → Targets $0.00000420, then $0.00000690 🚀

If rejection happens → Retrace to $0.00000150 before another breakout attempt.

🔥 Watch for volume surges & whale movements! 🔥

Here’s a visual representation of Mog Coin’s potential price action using the 369 theory and Fibonacci levels. The dotted red lines indicate key Fibonacci retracement and extension levels, while the blue dashed line represents the predicted price movement.

If MOG breaks resistance, expect a move toward $0.00000420 (1.618 Fib) within the next 9-12 days.

If momentum sustains, a larger move toward $0.00000690 (2.618 Fib) is possible within 18-27 days.

If rejection happens, a retracement to $0.00000150-$0.00000185 may occur before another attempt.

📊 Watch for volume surges! A major move is coming! 🚀

mog about to take off. Let`s see what happens hereLet`s see what`s about to take place here. Is mog about to break out.

In recent months, MOG has exhibited significant volatility. Notably, in November 2024, the coin surged by over 200% within a 24-hour period, reaching an intraday high of $0.000003. However, it faced resistance around the $0.000002355 level, struggling to maintain momentum above this threshold.

BIZTECHAFRICA.COM

Technical analysis indicates that MOG has formed a "cup-and-handle" pattern, typically viewed as a bullish signal. The coin has attempted multiple times to break above the $0.000002355 resistance level but has been met with significant selling pressure. A successful breach of this resistance could pave the way for new all-time highs.

THECURRENCYANALYTICS.COM

Given the inherent volatility of meme coins like MOG, predicting short-term price movements is challenging. While technical indicators suggest potential for a breakout, it's crucial to approach such investments with caution. Always conduct thorough research and consider the high-risk nature of meme-based cryptocurrencies before making investment decisions.

MOG Dip: An Opportunity You Can't Miss!I might be getting too greedy on MOG, but I see those equal lows intact and a chance to hit the weekly block a bit lower.

Maybe BTC will lend a hand if it breaks below 92k. I'm focusing mainly on positioning over the next month, so I'm being patient with the bids.

BYBIT:MOGUSDT

MOG Coin Dips Over 49% in Two Weeks: What Next?MOG Coin, an Ethereum-based memecoin celebrated for its vibrant community and viral meme culture, has seen a sharp decline in recent weeks. The token's value has dropped over 49% in two weeks, mirroring the broader crypto market's cooling-off phase after a prolonged bullish rally. Despite this dip, MOG’s community-driven ethos and unique position in the memecoin space offer potential opportunities for investors and traders.

About MOG Coin

MOG Coin is more than just a memecoin; it represents a lifestyle fueled by humor, creativity, and community strength. The token is built around a strong commitment to viral content, carving a distinct niche in the cryptocurrency landscape. MOG’s mission to dominate the internet through its meme supremacy has attracted a dedicated following, positioning it as a revolutionary force in the memecoin space.

Community and Vision

MOG Coin’s passionate community is its backbone, driving its viral campaigns and ensuring its visibility across social media platforms. The project is centered on humor and camaraderie, making it more than just an investment but a lifestyle for its holders.

Trading Activity

TSXV:MOG is actively traded on decentralized platforms like Uniswap V2 and centralized exchanges like Gate.io and Bitget. The token's daily trading volume has reached $49.17 million, a 5.2% increase from the previous day, indicating steady market interest despite recent price declines.

Market Metrics

- Market Cap: $831.59 million

- All-Time High: $0.000004022 (Dec 7, 2024).

- Current Price: 47.05% lower than its ATH.

- Circulating Supply: 390 trillion tokens.

Technical Analysis

As of now, TSXV:MOG Coin is trading within a falling wedge pattern, a technical setup often indicative of a potential bullish reversal. Key technical indicators include:

The Relative Strength Index (RSI) stands at 19, signaling extreme oversold conditions. This level often suggests a buying opportunity for traders and investors. The immediate support lies at $0.0000015, aligning with the 23.6% Fibonacci retracement level. If selling pressure persists, this level could be tested, providing a crucial entry point for long-term investors.

A breakout from the wedge pattern could spark a recovery, with initial resistance around $0.000003.

Comparative Performance

MOG Coin has underperformed against its Ethereum ecosystem peers, which are up 12.7% over the past week. However, its current price levels present an opportunity for traders looking to capitalize on oversold conditions in a well-supported project.

Conclusion

While MOG Coin's recent price action reflects broader market corrections, its strong community and unique positioning in the memecoin space make it a token to watch. The falling wedge pattern and oversold RSI indicate potential for a rebound, particularly for investors with a higher risk tolerance.

As the memecoin revolution continues, MOG remains a key player, blending humor with innovation to push the boundaries of what’s possible in the crypto world. For those ready to join the meme movement, now might be the time to keep an eye on MOG’s next move.

MOG COIN! Blue-Sky Zone 5FiVE Zeros under 0.0000037!They say meme is a way to expedite adoption when it comes to crypto! Remember when DOGE, SHIB, PEPE, BONK, and now MOG listing on Coinbase pumped 50% to 150% and more!! The good news is that MOG has more potential than all of them.

MOGUSD is currently in a Rising Channel (aka: Upward Trend Channel), price broken out an inverse Head and Shoulders Pattern established within the Rising Channel with bullish momentum. This may be indicative of future new highs. Bullish Divergence has developed on the 4-hour chart indicating the pump is still in progress. In addition, the daily trend is strong, and key support has been established at are around the .00000243 area which could be a 33% retracement if a new support zone is not established and the price breaks below:

#1 Support .00000368 support

#2 Support .00000320 support

#3 Support .00000243 support

Currently the price and momentum are in an uptrend and is in the discovery zone called blue-sky zone.

As of today, I'm a member of HODL GANG 5FiVE Zeros under 0.0000037!

Future 1xx could be or is your 100x++!!

Please remember to do your own research (DYOR) and that this information is not financial or investment advice.

MOGUSD Aggressive bullish break-out taking place.MOG Coin (MOGUSD) has been trading within a Falling Wedge pattern and for the 2nd time in a week broke yesterday above its top (Lower Highs trend-line). This rebound is taking place after the 1D MA50 (blue trend-line) held.

The whole sequence is identical to the Falling Wedge where the price accumulated before the February 2024 rally. As you can see even their 1D RSI fractals are identical. The rally that followed the bullish break-out extended to the 3.0 Fibonacci extension and rose by +11.180%.

If the current sequence continues to replicate that pattern, we expect to see 0.000035 by January 2025 the latest.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

MOG Coin Eyes 126% Breakout with Cup-and-Handle Pattern As Bitcoin sustains dominance over $72,000, the meme coin market is reviving with a notable uptick. Among these, MOG Coin has emerged as a standout, leveraging both technical patterns and community-driven appeal to generate bullish momentum. Currently trading at $0.00000210459, MOG Coin ( TSXV:MOG ) has made impressive strides, posting a 13.03% increase in the past 24 hours and showing signs of an impending breakout. Here’s a look at both the technical and fundamental drivers behind MOG’s rise and the potential for substantial growth in the near term.

Technical Analysis: MOG Coin’s Cup-and-Handle Breakout on the Horizon

The daily chart for MOG Coin presents a classic cup-and-handle pattern with a neckline at $0.000002355. This pattern is often regarded as a bullish continuation signal, and with four consecutive bullish days pushing the coin closer to the neckline, the chances of an upward breakout are high.

In the past week, MOG Coin ( TSXV:MOG ) has increased by nearly 32% from its seven-day low of $0.000001599, reclaiming the psychological $0.0000020 mark. This trend, along with the following factors, suggests bullish potential:

- Moving Averages: The 20, 50, 100, and 200-day EMAs are all aligned bullishly, indicating strong buying momentum.

- MACD: The MACD and Signal lines are set for a bullish crossover, while the bearish histograms have begun to decline, confirming increasing buying pressure.

- Fibonacci Levels: The cup-and-handle neckline aligns with the 100% Fibonacci level at $0.000002355. A breakout here could push MOG Coin ( TSXV:MOG ) to the 1.618 Fibonacci extension level at $0.0000047623, marking a potential 126% increase. Should this scenario play out, MOG may target the psychological $0.0000050 mark, affirming an ongoing bull trend.

The RSI at 65 suggests further bullish momentum, especially if Bitcoin’s rally continues, as meme coins often mirror major trends. However, traders should note the downside support level of $0.000001845 as a pivot in case of any pullback.

Fundamental Analysis

MOG Coin’s Unique Position in the Meme Coin Landscape

MOG Coin isn’t just another entry in the meme coin space; it’s quickly establishing a reputation as a standout, with a mission to dominate the internet through viral, humor-driven content. MOG has successfully tapped into the cultural appeal of memes while building a robust, community-focused following that champions humor and creativity.

With a circulating supply of 390.5 trillion MOG coins and a market cap of $848.9 million USD, MOG Coin ranks #78 on CoinMarketCap, reflecting its popularity and widespread adoption. MOG is highly traded, with a 24-hour trading volume of $43.5 million USD, showing strong liquidity and interest among investors.

What sets MOG Coin apart from other meme projects is its unapologetic focus on viral content and meme culture. The project positions itself as more than just a coin; it’s a movement, rallying a community of “meme warriors” committed to creating high-quality, engaging content. This dedicated fanbase reinforces MOG’s market resilience, supporting its price action even in the volatile meme coin segment.

Market Sentiment and Future Prospects

The broader market for meme coins is looking promising as Bitcoin’s sustained gains drive bullish sentiment across altcoins. With a meme coin market cap above $63 billion and rising interest in speculative assets, MOG Coin appears well-positioned to attract continued attention.

According to MOG Coin’s developers, the project’s aim is to disrupt the crypto space by prioritizing meme-driven virality and cultivating a “meme lifestyle.” As the platform grows, it’s likely that this bold approach to community engagement will attract even more traders, content creators, and meme enthusiasts, further reinforcing MOG’s value.

Conclusion

With strong technical signals and a unique brand, **MOG Coin offers an enticing opportunity** for traders looking to capitalize on the meme coin rally. The potential **126% gain** from a cup-and-handle breakout and the broader bullish trend among meme coins suggest that MOG could be in for significant price appreciation.