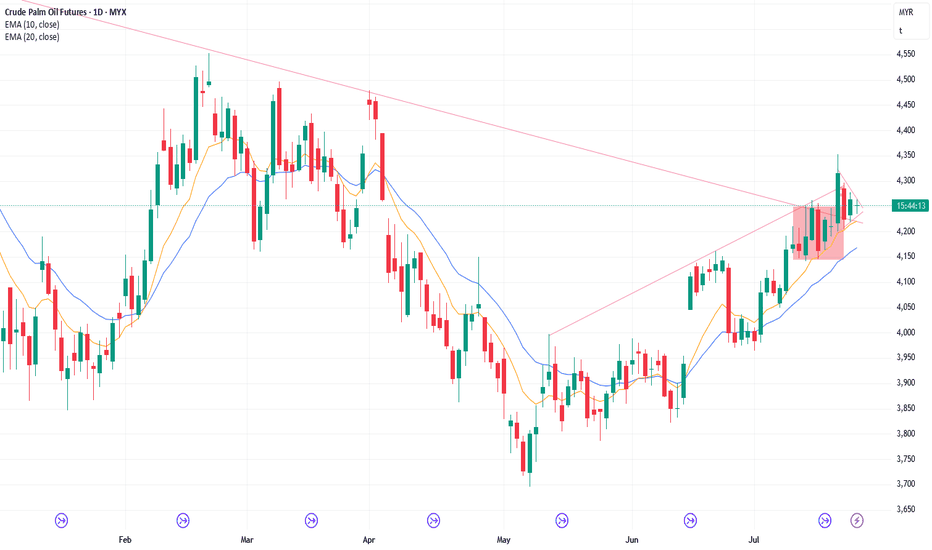

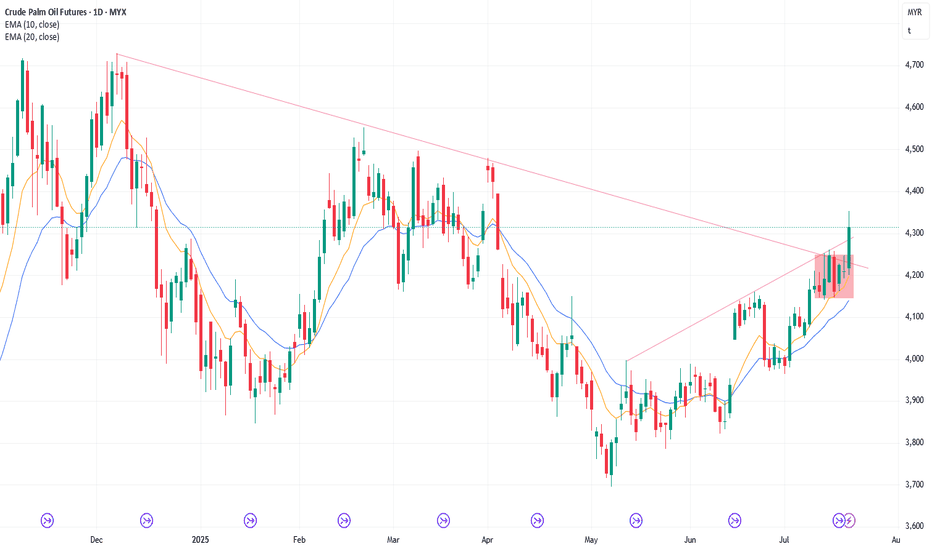

25/7/25 Follow-through Buying or Pullback Instead?

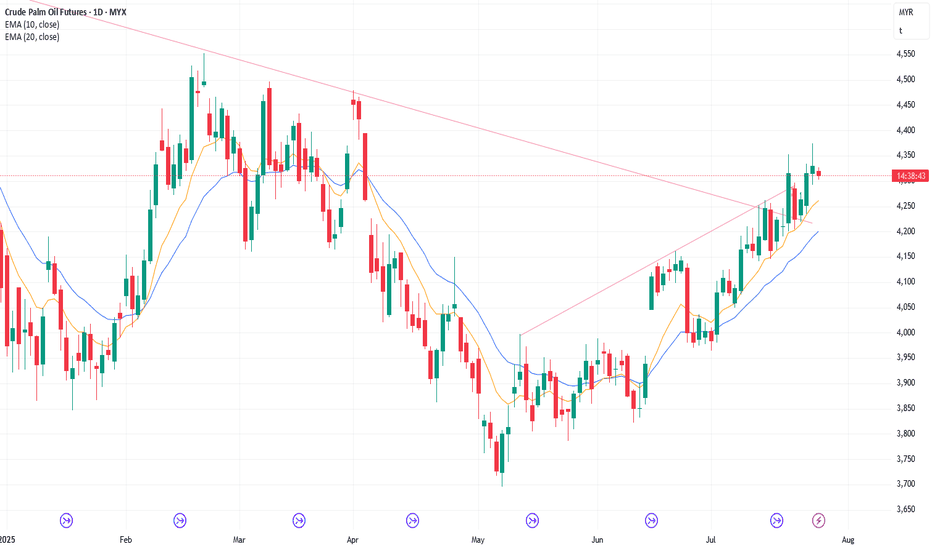

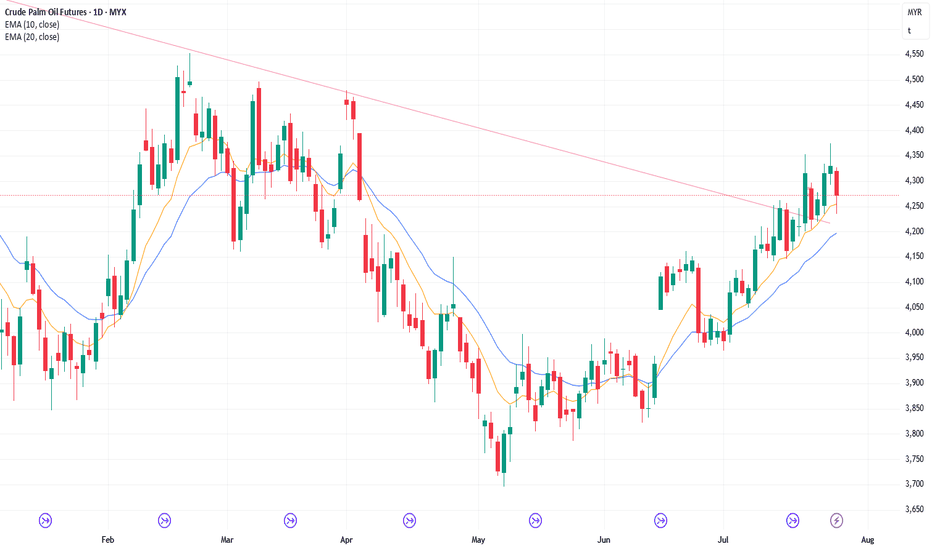

Thursday’s candlestick (Jul 24) was a bull doji closing slightly below the middle of its range with a long tail above.

In our last report, we said the odds slightly favor sideways to up. Traders would see if the bulls could create follow-through buying, breaking above the July 18 high, or if th

Related commodities

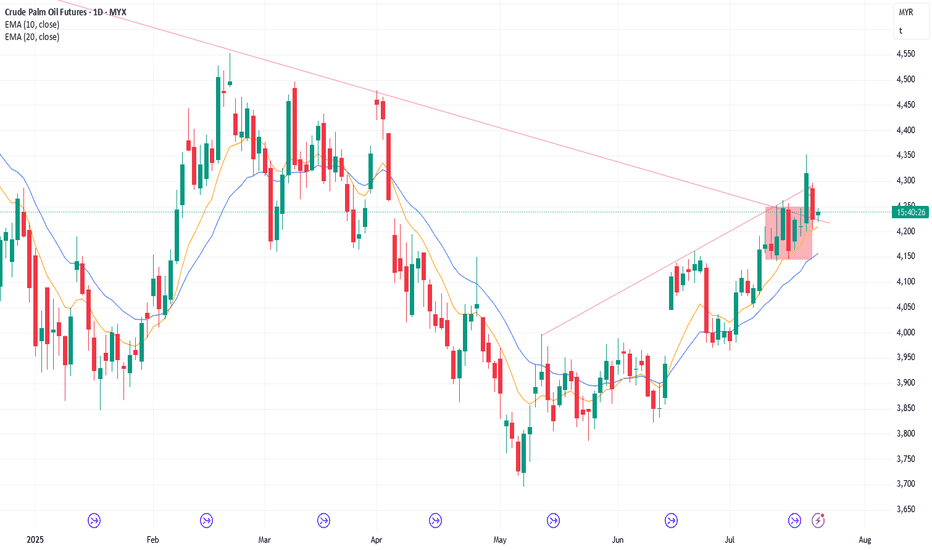

28/7/25 Minor Pullback or Something Stronger?

Friday’s candlestick (Jul 25) was a bear bar closing slightly below the middle of its range with a long tail below.

In our last report, we stated that traders would assess whether the bulls could generate follow-through buying or if the bears would create a strong pullback, which would close th

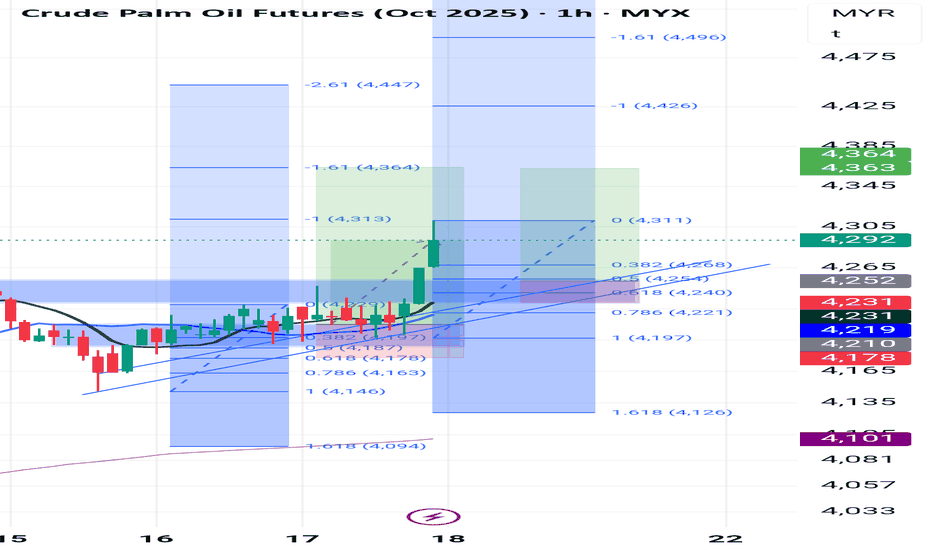

continuation bullish modeBased on the chart tf 1h, looks still strong to bullish mode. retracement area maybe between 4254 to 4230 which is area hh before (major market structure and Fibonacci retracement 0.5 to 0.618. and theres also strong support trendline in that area. however, will see how much the gap this morning .18

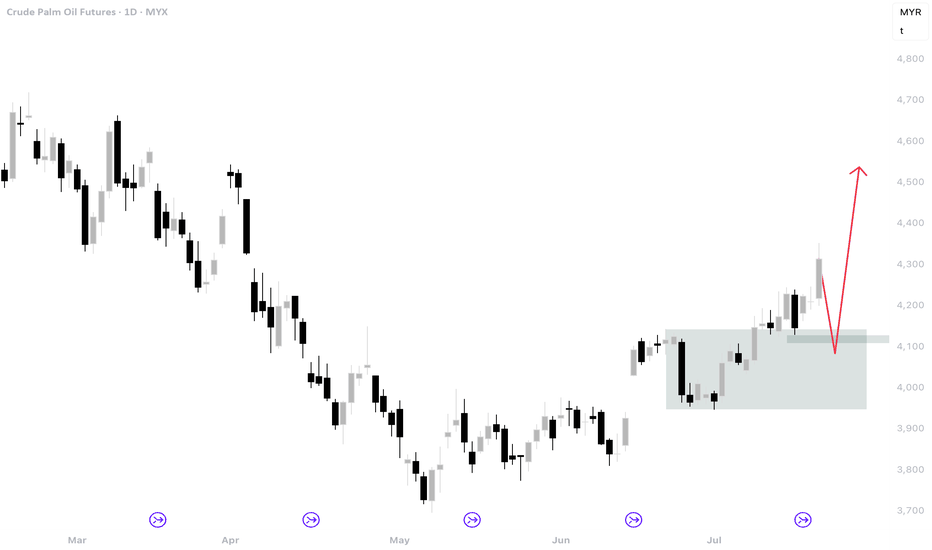

29/7/25 Pullback Underway, Minor or Something More?

Monday’s candlestick (Jul 28) was a bear doji bar closing around the middle of its range with prominent tails.

In our last report, we stated traders would see if the bears could create follow-through selling, or if the pullback phase would be weak and sideways instead.

The market traded slight

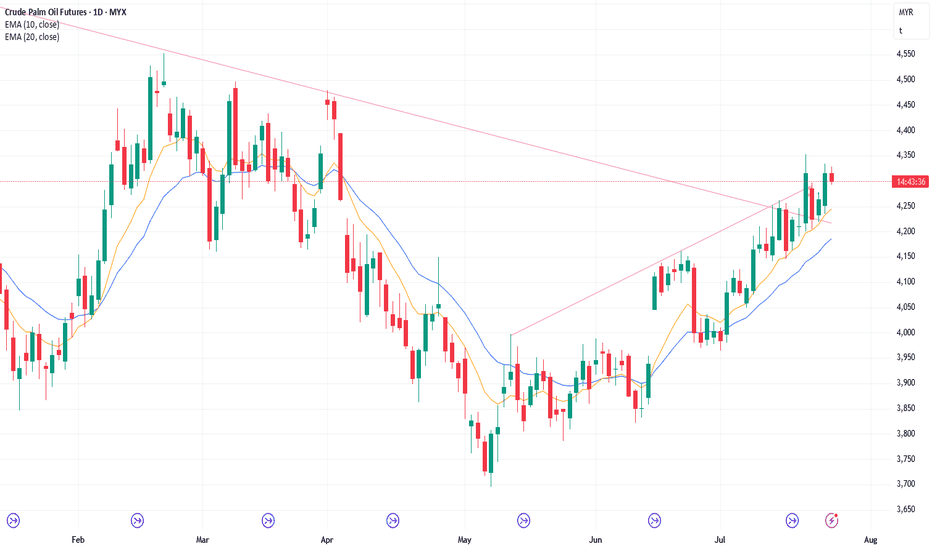

24/7/25 Buying Pressure Is Slightly Stronger

Wednesday’s candlestick (Jul 22) was a bull bar closing near its high.

In our last report, we said traders would see if the bulls could create follow-through buying and test near the July 18 high, or if the market would form a breakout below the triangle and ii (inside-inside) pattern instead.

23//7/25 No FT Selling Again. Market in Breakout Mode

Tuesday’s candlestick (Jul 22) was an inside bull bar closing near its high.

In our last report, we said traders would see if the bears could create follow-through selling, or if the market would trade higher and retest the July 18 high instead.

The market traded higher for the day, and the be

22/7/25 Can Bears Finally Create Follow-through Selling?

Monday’s candlestick (Jul 21) was a big inside bear bar closing in its lower half with a prominent tail below.

In our last report, we said traders would see if the bulls could create follow-through buying, or if the follow-through buying over the next 1-2 days would be limited. If this is the c

21/7/25 Can Bulls Create FT Buying Over Next Few Days?

Friday’s candlestick (Jul 18) was a big bull bar closing in its upper half with a prominent tail above.

In our last report, we said traders would see if the bulls could close the day's candlestick near its high, or if the daily candlestick would close with a long tail above or below the middle

18/7/25 Weekly Candlestick To Close Near Its High or Tail Above?

Thursday’s candlestick (Jul 17) was a doji bar with a long tail above.

In our last report, we said traders would see if the bulls could create a follow-through bull bar testing the July 14 high, or if the market would form a lower high (versus July 14) and be followed by some selling pressure i

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Crude Palm Oil Futures is 4,284 MYR / TNE — it hasn't changed in the past 24 hours. Watch Crude Palm Oil Futures price in more detail on the chart.

The volume of Crude Palm Oil Futures is 5.41 K. Track more important stats on the Crude Palm Oil Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Crude Palm Oil Futures this number is 65.67 K. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Crude Palm Oil Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Crude Palm Oil Futures. Today its technical rating is buy, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Crude Palm Oil Futures technicals for a more comprehensive analysis.