FCPO WEEK 16 2025: 50-50 price action.There is an argument for bullish price next week. However as it stands now the price is still in the 50-50 price action. There is not enough argument to confirm bullish movement. Meaning there is possibility also that it might go south next week.

Scenario 1: If price stays above the 4000 and push higher then it will be bullish. Possibly towards 4500.

Scenario 2: If price move below and stays below 4000 then bearish is back in control to push price possibility towards 3700.

Start of the week it will be reactive mode.

FPOL1! trade ideas

Fcpo prediction this week until closing contractYesterday market open with the gap up..my prediction price will be collect price at bellow before go to higher price,because still have few spot price haven’t collect yet..like got few fair value gap haven’t collect..

This is the spot price maybe will collect before go up trend.

4536 - 4534

4424 - 4418

4314 - 4310

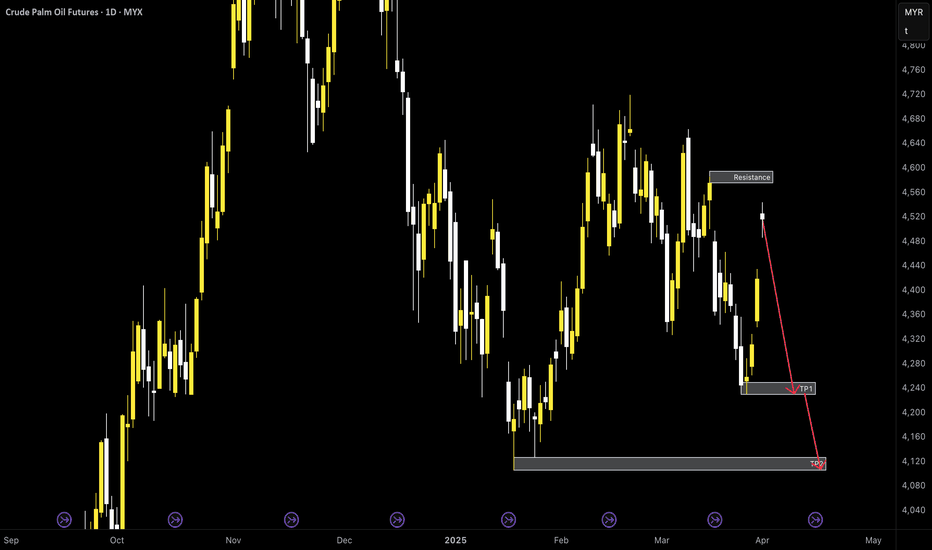

FCPO Week 14 2025: Retracement before going BEARISH.Price went higher today and this might be only a retracement before going lower again. For the remaining of the week, price might consolidate a bit before having any momentum to continue lower. If it indeed going lower, price will up the gaps before targeting TP1. Depending on price action TP2 is a possibility.

For price to fully go bullish, a close above 6600 is required.

Short-Term Upside Potential in Palm OilPalm Oil (FCPO1!) is expected to strengthen in the short term as part of wave b of wave (ii), with a potential test of the 4,525–4,771. However, caution is advised for a possible reversal toward the 4,235–3,973 range to complete wave c of (ii), as indicated by the black labels.

FCPO week 13 2025: Lower to 4200?Looks like the price is going lower and it is bearish. Hopefully next week it could have enough momentum to continuously pushing lower and take out the support area towards 4200. Depending on price action, price would probably going much lower to 4000 where a much stronger support is expected. The only way for price to continue higher is to close above the 4500.

FCPO Week 11 2025: Bullish likely to continue.Price move higher as expected. It is now at resistance level.

Scenario 1: Price break through and close above 4638 - Price will likely going forward to TP2.

Scenario 2: Price help up at resistance and make retracement towards 4560 to 4550 area. If the area holds then it will continue higher towards TP1 and eventually TP2. This is the best scenario since price will have strong based to go higher.

Scenario 3: Price breakthrough and close below support then price will likely targeting area below 4500 and even lower towards 4400.

Let's see the opening on Monday.

Happy trading.

FCPO Week 10 2025: Still 50-50.There is a hint that the price might continue higher. 4480 to 4470 is a support area and it seems to be holding right now. However in order to continue higher price needs to overcome the current resistance area which is around 4560. Closing above the resistance will open the door to 4630 level. That is scenario 1. For scenario 2, if price close below 4470 level then it most probably going lower initially to 4400 level and possibly lower towards 4350.

For now it is still wait and see condition.

Good luck!

23) FCPO : Bear is making its call, but possible reversal...?update frm 20), Fcpo-May were in bearish last week but price frm 4500 is still holding. At least, it is still holding at 4490 and what so special about the end of the week was, formation of Double-Bottom which seemed more like a "Higher-Low" was formed. Price was able to rebound frm low and was tapped out at 1560 resistance.

Fcpo-May needs to break above 4576, the previous lower-high (blue-line), to confirm a possible shift-of-trend. Higher resistance is at 4622-4634 and 4700.

-IF the bear pulls back the price, THEN market will find some support at 4528-4490.

-IF price is below 4490-4500, THEN lower support is at pretty far at 4400, 4300.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

FCPO Week 9 2025: At resistance - wait and see.Price is still bullish however it is at a resistance. Expecting that it will make a retracement before resuming higher. 4600 price area is the level to watch. If price didn't make the retracement and close above 4700 area then there is possibility that it will want to continue higher to target 4770 area.

20) FCPO : Bull might come to an end...or juz correction?update frm 19), Fcpo-May will continue next MOnday, 24-28th Feb 2025, the last week in month of February. What happened last week was fcpo-May made what seemed like a false breakout, 4700-4720, then quickly went down. The range of 4634-4700 is important for bull to stay afloat. Price breaking below 4634 indicates the possible reversal of trend. Price within 4634-4700 is bull...IF bull is aggressive, THEN it may gap up abv 4720 and higher.

IF the market is mild drop, THEN it will range frm the 4555-4634 but it is still bearish. IF market falls below the 4500-4560, THEN the next level is pretty low at 4400-4300, THEN it is a strong bearish market.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

19) FCPO : uptrend resumes...???update frm 16), price frm fcpo-apr has come to an end. Fcpo-May will appear next MOnday, 17-21st Feb 2025. What happened last week was unpredicted. Price gapped up to 4640-4700 then sank lower to the 4630-4650 range. The next day, it gapped down 30pts to 4620 and fell to 4540, then rebound back to 4630...

IF the market is aggressive drop, THEN it will hit the 4540-4490. IF market falls below the critical 4490(4487 to be precise) which is also the previous higher-low, THEN market has probably reverses.

IF the market is slow-ish, THEN it will lower back to 4600-4540. IF the market continues bullish, price has to break abv 4600-4630, and retest the latest high at 4700.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

16) FCPO : uptrend resumes...update frm 15), price frm fcpo-apr has resumed to break to higher-high, above the previous 4400-4420, making the uptrend continues higher at 4600 now (close to). Previous resistance is now the support level, which is 4500-4540. The overhead resistance ranges frm 4630-4650.

IF the market is aggressive(since fcpo-apr ends this week), THEN it will hit the 4630-4650 immediately and go further up.

IF the market is slow-ish, THEN it will lower back to 4500-4540 and play some tug-of-war with bear but Bull is still the major preference. OR tangling between 4540 -4630 region.

IF market falls below the critical 4490(4487 to be precise) which is also the previous higher-low, THEN market has probably reverses.

That's all for tdy. Happy Thaipusam and hapi holiday. Happy hunting.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

15) FCPO : uptrend persists this week update frm 13), price frm fcpo-apr has broken abv the previous HL, 4280 on 28th and 31st Jan 2025. Again, I have missed some really exciting moves bcox of my absence in holiday. Price might move back to 4300-4330 or even 4280 IF it is a deep retracement, form some kinda base thr and rebound.

price could oso gap up further around 4420-4480 as bull pushes further, after testing 4400-4415 tdy. previous Higher-Low was at 4265-4255 and IF this level is broken, THEN the trend has reversed.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

13) FCPO : bull and bear are playing tug-of-warAs I continue frm the previous 11), I quoted that fcpo might test the 4280 soon. Well, this wasn't the case for last week, 20-24th Jan 2025. fcpo was trading within the range frm 4135 - 4280. Although price had fallen frm 21-23rd Jan, market has rebounded in the last minute, which was on the Friday, 24th...so it is possible that a reversal has happened.

Price moving above 4280 will confirm a bullish comeback while price below 4135 indicates a bearish move that eventually hits 4100 and 4000.

PLS remember, I am not a guru and this is not a signal service provider. THIS is mere for fun.

#tradersupporttrader #FCPO #FKLI #futurestrader #cpop #malaysiatrader #bursa #BursaMalaysia

Disclaimer : "I am not a guru and I am working hard to make profit same as everyone else. This is not a recommendation of buy or sell, just a mere idea of trading and trading journal. Please consult your financial advisor for any thought of buying or selling. Trade at your own risk."

FCPO - Correction in progressTrend : Uptrend

Current Wave : Wave 1 to Wave 2

Note: If the counting is right, the minor wave is currently moves toward Wave C to complete Wave 2. I am sure the Wave C is not yet finished. Thus we need to wait until we see a reversal structure to confirm the completion of Wave 2. At this moment the corrective wave structure forming just a simple ABC. If the correction wave become complex, we may see a combination of correction wave pattern (3-3-3 or 3-3-5 or 3-5-3). Just sit back and relax.

This is only my point of view. Not a recommendation to buy or sell.

Just sharing the idea only.

TAYOR

FCPO Outlook: Key Levels and Strategies for the Week AheadRecent Market Overview

MYX:FCPOJ2025 MYX:FCPOK2025 MYX:FCPO1!

The market, both for outright contracts and spread contracts, has shown significant signs of consolidation recently. As such, I believe a comprehensive analysis is necessary to identify contracts worth monitoring, key price levels to watch, and whether the market leans bullish or bearish in the near term.

April Contract

From Friday’s daily chart closing price, it seems that the price has found support around 4,130 points. However, the overall trend remains bearish, as evidenced by a clear double-top pattern, a break below the neckline, and two retests of the neckline on the daily chart.

I foresee two possible scenarios for the upcoming price action: consolidation or continued decline. If the market consolidates, the range will likely be between 4,120 and 4,500 points. If the market continues to decline next week, I expect resistance around the 4,000-point level, which is approximately 300 points below the current price.

May Contract

Friday’s closing price on the daily chart suggests that the May contract has also found support around 4,100 points. The recent price action mirrors that of the April contract, showing a double-top pattern, a break below the neckline, and two retests of the neckline.

However, the 4,000-point support level for the May contract appears stronger than that of the April contract. Currently, the benchmark contract is the April contract. Does this imply that when the May contract becomes the benchmark (on February 17), the price will find support at 4,000 points and then reverse into an uptrend?

If my hypothesis is correct, the upcoming price action will likely involve a third test of the neckline and consolidation, as we await the May contract to become the benchmark.

Summary of Outright Contracts

Based on the April and May contracts, I anticipate a relatively stronger market next week, with a potential third test of the neckline around 4,500 points for the April contract.

Additionally, Chicago soybean oil futures showed no significant decline this week, closing at 45.72 points. The price still has approximately 3.30 points of room before hitting resistance at 49.00–50.00 points. If prices fail to rise and instead decline on Monday, a reassessment will be necessary.

APR25 - JUL25 Spread Contract

The daily chart for the APR25 - JUL25 spread contract shows a clear ongoing downtrend. The observed price range is roughly between 100 and 200 points, with Friday’s closing price at 122 points.

I do not find this contract appealing for entry. If outright contract resistance is at 4,000 points, the support level for this spread contract is likely around 100 points. With only 22 points of downside room to that support level, the risk-reward ratio is unfavorable for short positions. For long positions, the price must first test 100 points and show signs of reversal before considering an entry.

MAY25 - AUG25 Spread Contract

The daily chart for the MAY25 - AUG25 spread contract also shows a downtrend, though the pattern is less well-defined compared to the APR25 - JUL25 spread contract. Key support and resistance levels are estimated at 50, 100, 150, and 200 points. Friday’s closing price was 122 points.

Compared to the APR25 - JUL25 spread, I find this contract less favorable for trading due to its less distinct overall pattern.

JUN25 - SEP25 Spread Contract

The daily chart for the JUN25 - SEP25 spread contract also indicates a downtrend, with prices having tested the final support zone of 0–20 points. Friday’s closing price was 37 points, showing signs of a rebound.

The overall pattern appears relatively well-formed, and there is sufficient upside potential, with resistance levels at 80 and 150 points. If the outright contract price action aligns with my forecast for a rebound to the neckline, this spread contract could rise to 150 points.

Summary of Spread Contracts

After analyzing these three spread contracts, I believe the JUN25 - SEP25 spread contract is the most reasonable for a long position next week, followed by the APR25 - JUL25 spread contract.

If Monday’s price action does not align with expectations and declines instead, a reassessment will be necessary. I plan to enter a long position in the JUN25 - SEP25 spread contract on Monday. If prices reverse downward after entry, I will implement a stop-loss at 17 points. If outright contracts trend downward on Monday, I will refrain from entering the market.