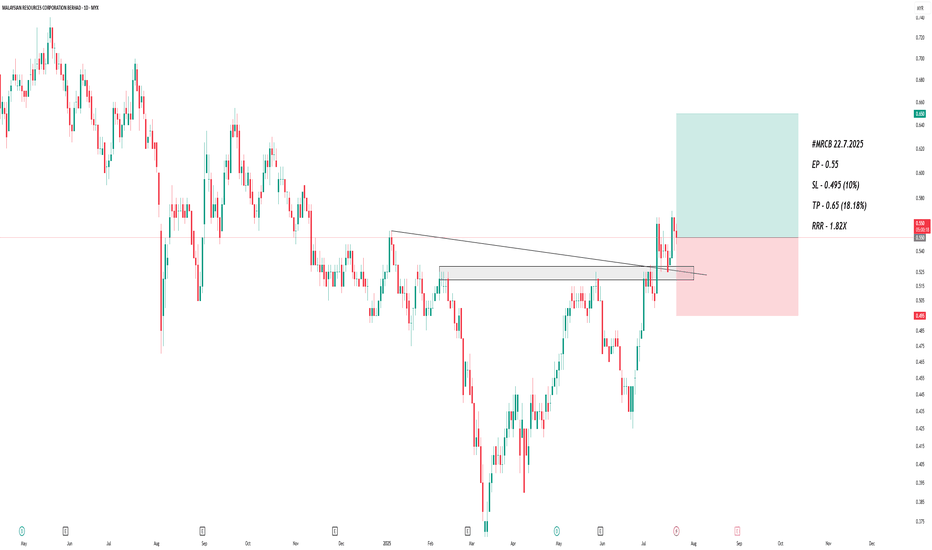

MRCB trade ideas

MRCB - Require an aggressive bullish momentum.N wave with E, V, N & NT projection. Currently price and Chikou Span still below Tenkan Sen, Kijun Sen & down Kumo, considering the market still in bearish position. Require an aggressive bullish momentum to push the price upward with Tenkan Sen as an immediate resistance. if the price breaks above the Kumo and the Chikou Span confirms the breakout, the trade might develop into a stronger bullish trend and towards the completion of the Y wave.

R1 - 0.550 (Tenkan Sen)

R2 - 0.570

S1 - 0.520

S2 - 0.470

Note:

1. Analysis for education purposes only.

2. Trade at your own risk.

[MRCB]: Riding the construction wavePrice has tested resistance formed since September 2023 with some low volume selling on 9.1.2024.

Long & short term moving averages have aligned.

MACD shows bullish momentum.

Between Oct to Nov 2023, prices have tested support with low volume as well as two shakeouts.

Wyckoff accumulation pattern also appears to near its end with possible SOS.

If price manage to break the resistance again, this will go to a new 52 week high definitely and enter the mark up phase.

MRCB, AlgoSignal reveals potential uptrendFeb 19

Several indicators within my algorithmic system are signaling a potential uptrend. These include:

- Increased volume: Activity is picking up, suggesting growing interest and potential momentum.

- Mid- to long-term uptrend: Both the 50-day and 150-day exponential moving averages are pointing upward, indicating a sustained positive trajectory.

These factors collectively point towards the possibility of an upward movement in the near future

MRCB. AlgoSignal reveals potential uptrendSeveral indicators within my algorithmic system are signaling a potential uptrend. These include:

- Increased volume: Activity is picking up, suggesting growing interest and potential momentum.

- Mid- to long-term uptrend: Both the 50-day and 150-day exponential moving averages are pointing upward, indicating a sustained positive trajectory.

These factors collectively point towards the possibility of an upward movement in the near future

MRCB Breakout From DT Line - Good Price to EntryThis undervalued construction and property player in Malaysia, MRCB has shown good performance recently. Pullback from the 52Wk high at 0.705, the price now stabilize around 0.56 to 0.59.

The intrinsic value for Malaysian Resources Corporation Berhad is RM9.91 based on Discounted Cash Flow Valuation, that is discounted 94.2% from current price.

Price now recently break from downtrendline (refer chart) and need to break MID BB (MA20) at daily timeframe to confirm the uptrend mood. My price target using fibo is at TP1 D: RM0.795, TP2 D: RM1.03

Hold for long term investment! cheers

MRCB... protect downside?I didn't hold any position in this counter.

If I do, wil choose to take profit / protect the downside.

Base on day chart, it seems like will pullback.

We cannot control how much we win. But we can control how much we lose. Focus on what you can control!

Disclaimer: Mentioned stocks are solely based on own opinions for education and/or discussion purpose only. There's no buy and/or sell recommendation. Trading involve financial risk on your own. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein.

MRCB Major Support & ResistancePersonally, what I learnt is there must be a Technical Analysis Strategic Plan in order to increase the risk-to-ratios favourable risks.

1. Draw Support & Resistance

2. Identify the stages (Accumulation, Advancing, Distribution, Declining)

3. Entry Triggers

4. Stop Loss

5. Exits

I have learnt during my past mistakes that we should let the stock price comes to us, rather than us chasing the stock prices!

MRCB Major Support & ResistancePersonally, what I learnt is there must be a Technical Analysis Strategic Plan in order to increase the risk-to-ratios favourable risks.

1. Draw Support & Resistance

2. Identify the stages (Accumulation, Advancing, Distribution, Declining)

3. Entry Triggers

4. Stop Loss

5. Exits

I have learnt during my past mistakes that we should let the stock price comes to us, rather than us chasing the stock prices!