OMESTI - Bullish sentimentThe price has broken above the Kumo, signaling a shift to a bullish trend.

Tenkan-sen > Kijun-sen indicates short-term bullish momentum.

Chikou Span is above the price, confirming bullish sentiment.

The Kumo ahead is thin and turning green, suggesting a potential continuation of the uptrend.

NT Level (0.125) held as support, and the price has bounced.

Entry: Above 0.150, confirmation if the price closes above with volume.

Stop-Loss: Below 0.140.

Price may retest 0.140 (support zone).

Re-entry opportunity at 0.125 (NT level) if a strong rebound occurs.

Bullish bias remains strong as long as the price stays above the Kumo.

Watch for breakout confirmation above 0.150 with volume.

A move above 0.150 increases the probability of reaching 0.205 and beyond.

Note:

1. Analysis for education purposes only.

2. Trade at your own risk.

OMESTI trade ideas

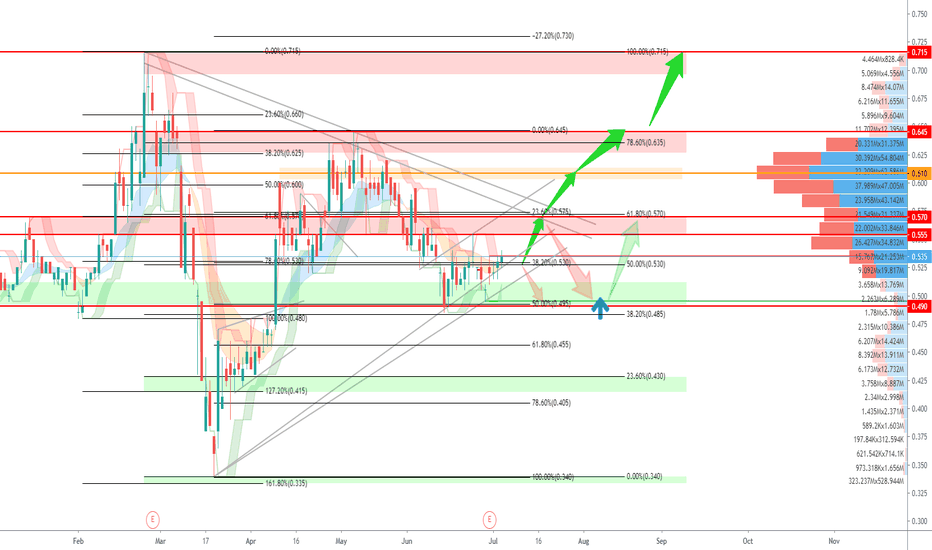

OMESTI CUP AND HANDLEOMESTI developed cup and handle pattern.

Weekly and monthly chart also showing positive signal. Strong resistance at 0.615. Will it break next week? Let's see.

Notice there is one Dato Sri keep buying since end Jan till now in recent announcement And that Dato Sri do have connection with INARI (google his name).. Something cooking?

Disclaimer:

The content provided is my personal experience sharing through technical and fundamental analysis point of view. The content can only be used for education purposes and NOT any recommendation for buying or selling stock. Please ask your remiser/dealer for making decision. Trade at Your Own Risk.

OMESTI - Fib 61.8%, Bullish Engulf & Align with Prev. ResistancePlease consider your own interpretation of Opportunity & Risk:

Green Arrow (Transparency = 0) = Representing Main Price Path

Red Arrow (Transparency = 0) = Representing Main Price Path

Green Arrow (Transparency = 30%) = Representing Alternate Price Path

Red Arrow (Transparency = 30%) = Representing Alternate Price Path

NO BUY CALLS OR INVESTMENT ADVISED ARE PROVIDED.

DISCLAIMER: This analysis is for reference and learning purposes only. It is based on my personal view in the market from a technical analysis standpoint. None of information posted in this chart can be used as investment decisions or investment advises to any parties. Do not trade solely on the information posted in this page. Trade at your own risk and judgement. A trader could potentially lose all money. Only risk capital that can be lost without jeopardizing ones financial security of lifestyle. Please seek licensed professional guidance if you plan to invest your capital seriously.

PENAFIAN: Analysis ini hanyalah untuk tujuan rujukkan dan pembelajaran sahaja dan bukan cadangan untuk membeli atau menjual stok atau apa jua jenis instrumen kewangan. Anda dinasihatkan untuk menghubungi remieser / dealer / bank pelaburan yang mempunyai lesen atau kelayakan yang sah untuk bertanyakan pendapat dan menguruskan pelaburan anda. Pelaburan dan perdagangan mempunyai risiko tinggi, dan ianya adalah Risiko Anda Sendiri.

OMESTI: Break its major downtrendline and steadily upOMESTI seems like struggle to break 0.840 but by looking at bigger time frame (monthly-chart), volume has been steadily accumulated and looks ready to push further. However, to have strong bullish momentum in longer term, a solid MAROBOZU candle that break 0.930 will definitely push the price further.

Looking at short term, a bullish move will be confirm when its break 0.760 with solid candle and big volume. Immediate support is 0.685

STOCK TRADING : 13) OMESTI- top 20 jewel series of malaysia stocTHIS IS TRADE 103) FRM HAIDOJO TRADING...

-top 20 jewels frm a very popular local bank...

-technical : let's look at some price action...

Omesti has been trading sideway ever since 2015…its price fluctuated within tight range RM0.35- 0.87… it will likely retest the previous high at RM0.70…which is also the X impulse leg of a possible bearish butterfly pattern formation…

Well, personally I don’t trade such aggressive pattern as butterfly pattern…but, it just seems to fit in the place…

current support : RM0.50-0.54

strong support : RM0.35-0.43

resistance : RM0.71, the X impulse leg

higher resistance : formation of D leg ranging frm RM0.82-0.87

“LOOK LEFT, STRUCTURE LEAVES CLUES” …my favorite quote frm Jason Stapleton…

Overall, Omesti is in sideway or consolidation…it needs to break abv the RM0.82-0.87 to retest the RM1.00 region…

WARNING : this is juz a trading idea...trade at your own risk!

**your "LIKE" and "FOLLOW" are my main source of motivation to continue posting more valuable contents...TQ**

OMESTI - Long Bias If Price Retests 0.50 LevelOpportunity and Risk

DISCLAIMER: This analysis is for educational and informational purposes only. It is based on my personal view in the market from a technical standpoint. None of information posted in this page can be used as investment decisions except for educational purpose only. Do not trade solely on the information posted in this page. Trade at your own risk and judgement. A trader could potentially lose all money. Only risk capital that can be lost without jeopardizing ones financial security of lifestyle. Please seek licensed professional guidance if you plan to invest your capital seriously.

PENAFIAN: Analysis ini hanyalah untuk tujuan pembelajaran & pendidikan sahaja dan bukan cadangan untuk membeli atau menjual stok atau apa jua jenis instrumen kewangan. Anda dinasihatkan untuk menghubungi remieser / dealer / bank pelaburan yang mempunyai lesen atau kelayakan yang sah untuk bertanyakan pendapat dan menguruskan pelaburan anda. Pelaburan dan perdagangan mempunyai risiko tinggi, dan ianya adalah Risiko Anda Sendiri.

#4 OMESTI BOD+SNR+FAFUNDAMENTAL ANALYSIS

Sector: Technology

Subsector: Digital Services

Business: Digitalization, Corporate, Banking, Court, ePayment, etc.

PE: 10.43 -- MEH

ROE: 14.15 -- GOOD

ROE > PE: YES -- GOOD

NTA: 0.34 < price -- MEH

DY: 0 -- MEH

YOY: 5 -- GOOD

TECHNICAL ANALYSIS

Support at MA200

Stoch RSI oversold & reversed 47%

BOD on 19 June 2020

No. of shares: 530.84m -- Quite volatile

EP: 510

TP: 560

CL: 495

RRR: 3.33 -- GOOD

OMESTI - Nice breakout and retest from Monthly ChartMonthly Chart

Nice breakout and retest trendline with strong volume. Someone is cooking.

Omesti is near long term support 0.3-0.4

All time high around 1.5

Daily Chart.

Uptrend and Bullish. FiFT+ve

2 Pullbacks right after Slow Turtle Breakout buy.

Currently doing pullback after strong volume (90m) push the price above 0.6

Plan (Ride the trend)

1) buy near daily trendline support, or

2) Fast turtle buy only if uptrend intact.