ABCL: When biotechnology not only curesABCL: When biotechnology not only cures, but also makes your wallet happy!

Hello, fellow investors and those who just like to tickle your nerves on the stock exchange!

Today we have on our agenda (and on the chart) - the stock AbCellera Biologics Inc. (ABCL), which seems to have decided to prove that even at the bottom there is life, and then even throw a party with a breakthrough!

As you can see, our hero ABCL has been playing ‘hide and seek with the trend line’ for a long time, showing an enviable resilience in the fall, just like your sofa after a day at work. However, if you look closely, the ‘ma/ema below price’ signalled that buyers, like secret agents, had already taken control of the situation, preparing for the decisive throw.

And here it is, it's happening! The recent ‘breakout + retest’ is not just a technical term, but a real escape from the ‘bearish’ prison with a subsequent test of strength. Not only did price break through resistance, but it came back to see if it was indeed broken. It's like going out of the house, forgetting your keys, coming back in, getting them, and then going out again - only in the stock market it's a sign of strength and determination!

Now that the dust has settled and the ‘1d’ trendline is behind us, our sights are set on the upside. Targets? Of course! ‘tp1-4.81’ and ‘tp2-6.00’ are not just numbers, they are potential points where we can pat ourselves on the shoulder and say, ‘I told you so!’. А ‘2,618 (6,61)’ - is for the very brave and patient who are willing to wait for the true bull dance.

All in all, ABCL seems to have turned a page in its history, swapping sad ballads for upbeat dance hits. But remember, friends: the market is a capricious thing, and even the most beautiful charts can bring surprises. So, act wisely, don't forget about risks and, of course, enjoy the process! Have a good trading!

ABCL trade ideas

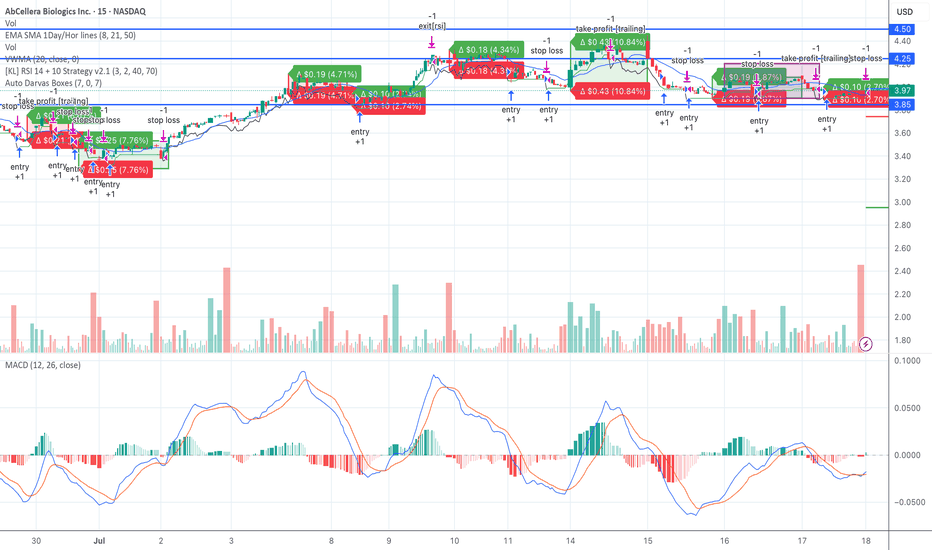

$ABCL – Loaded Base Pattern FormingEntry: $3.90

Stop: $3.50

Target: $4.50–5.00

Status: Active swing, scaling in at Darvas box lows

System: Seed System v2.1 | EMA stack | VWMA confluence | RSI/Volume triggers

NASDAQ:ABCL is riding a tight compression zone just above VWMA with layered Darvas box support. Multiple Seed System entries triggered this week, each followed by fast moves of 4–10%. Recent stop-outs have been shallow, suggesting accumulation.

Today’s candle shows continuation with a bullish MACD curl and volume pulse — watching for breakout above $4.10 with room to $4.50+ short-term.

Risk remains defined under $3.50, and I’ll reassess if the VWMA fails.

The Seed System identifies setup strength by syncing Darvas ranges with EMA/VWMA directionality and volume conviction. This one's been pinging repeatedly — the coil is tightening.

#ABCL #SeedSystem #SwingTrade #BiotechStocks #DarvasBox #MACD #VWMA #EMAStack #VolumeSetup

ABCL at Inflection Point — Breakout or Breakdown?ABCL — Watching for Bounce or Breakdown at Support

Symmetrical triangle breakdown on the 15m sent price back to the 0.786 retracement near $3.91. This zone now acts as a key inflection point.

📈 Bullish Scenario:

If buyers step in here, a reclaim above $4.00 could trigger a breakout toward $4.10 and then $4.34 (1.272 Fib extension) — offering up to 11% upside.

📉 Bearish Scenario:

Failure to hold $3.91 could lead to further downside toward $3.77 (0.618) or even $3.66 — offering up to 6% downside.

📊 Watching for reversal candle confirmation + volume shift before entry.

ABCL — Bullish Breakout with Upside PotentialAbCellera Biologics Inc. (ABCL) has recently confirmed a breakout above a long-term descending trendline, followed by a successful retest of both the trendline and previous local highs. This technical development increases the probability of a sustained upward move.

The first target stands around $5.70, with a potential medium-term extension toward $13.20, offering attractive risk-to-reward parameters.

The company operates in the biotechnology and healthcare innovation sector — one of the most promising and rapidly advancing industries. While such stocks often face increased volatility due to news-driven events, the potential for high returns makes them compelling for both swing traders and long-term investors.

ABCL - Cup & Handle Breakout TradeAbcellera Biologics is a biotech stock setting up in a textbook cup with handle pattern.

The stock has growing institutional sponsorship as shown in the chart from MarketSmith on the chart. It also has a relative strength ranking of 97/100.

Shares formed a cup with a 37% depth and have since drifted back slightly to form a defined handle.

I will consider buying on a break above the dashed downtrend line of the handle.

ABCL - Tight bullish flasNice secondary entry to add to your position.

After breaking out of the previous flag, price consolidated again for almost a week on decling volume.

Enter the stock if it moves over the high from the previous day.

Stoploss can be set at the low of the previous day (tight stop loss) or underneath the rising trend line (loose stop loss)

In a longer term perspective the $15-16 area is a place of congestion and price could rally to this area before taking another breather. The 10 and 30 week MA's are also a bit far so price could get extended when entering this zone.

This stock is already in a stage 2 (Weinstein), so could deserve a place in your LT portfolio.

Increase in inst. owernship.

ABCL Possible Stage 2?I'm a novice learning The Man's ways. My crayon drawing on this chart appears to be a close to a Stage 2 breakout. I think. Since ABCL is a yungun' I substituted the 150 for the 50.

Anyone else have an opinion?

XBI looks like a current leading sector.

I still feel its early but I just do what the chart is telling me... or technically the book is telling me what the chart is telling me. Is this a debt spiral?????

Watch $ABCL Potential Inverse H&S formationBullish

- Stage 1

- Decent sector position within 50%

- No longer making lower lows on the weekly

- Broke out of downward trend line

- Potential inverse H&S formation

- Gaining momentum on the upside seen on the Momentum Theory Indicator

- Smart money have been accumulating

- Decent sales

Bearish

- Great if better P/FCF ratio

- Great if lower PEG ratio

- Bearish macro environment

Entry trigger : For members only

AbCellera Biologics (Long hold)AbCellera is a technology company that searches, decodes, and analyzes natural immune systems to find antibodies that its partners can develop into drugs to prevent and treat disease. AbCellera's full-stack, Artificial Intelligence-powered drug discovery platform integrates modern technologies from engineering, microfluidics, single-cell analysis, high-throughput genomics, machine learning, and hyper-scale data science. AbCellera partners with drug developers of all sizes, from large pharmaceutical to small biotechnology companies, empowering them to move quickly, reduce costs, and tackle the toughest problems in drug development.

Imagine a world where artificial intelligence could find the cure to any disease. That's what this company is all about.

the chart might not be the prettiest, but their mission is one I am willing to invest in.

-------

$37 is my conservative target from the current levels, and it's very possible we make a few more lower lows, but ultimately I think this company has a very bright future despite the recent beat downs.

If and when we reach $37, I'd like to re-evaluate my analysis, & deep dive into the wave structure which brought us there. If it looks clean, then new projections can be made.

💸

Bullish long term but bearish in shortGreat company of they achieve their goals this one might shake the bio sector, i believe in their CEO and investing some in their dreams ...

if we get any positive news from merck pills from FDA we might go to $10 range and if not we will go back to +$20 however this is not covid play for me in long term