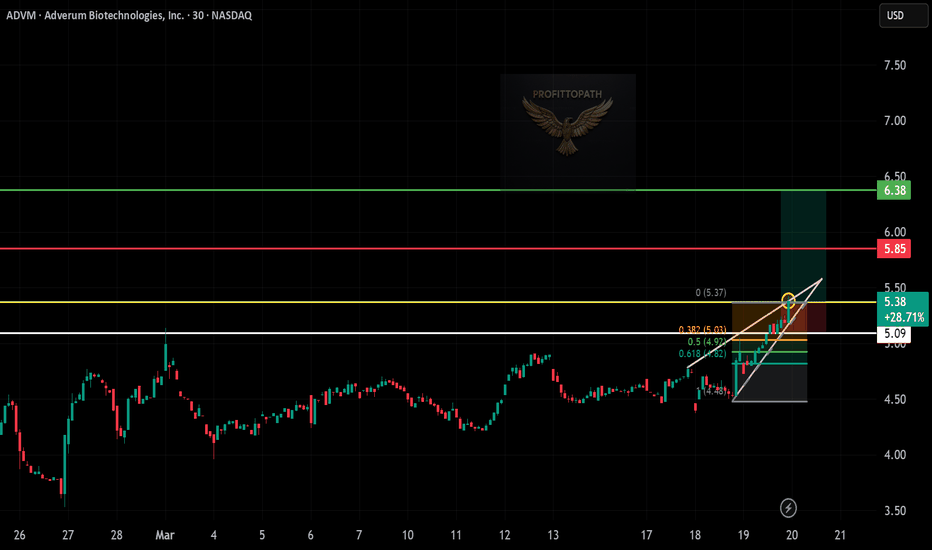

ADVM (Adverum Biotechnologies) – 30-Min Long Trade Setup! 🚀

🔹 Asset: ADVM – NASDAQ

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout (Rising Wedge & Fibonacci Confluence)

📊 Trade Plan (Long Position)

✅ Entry Zone: Above $5.38 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $5.09 (Key Support Level)

🎯 Take Profit Targets

📌 TP1: $5.85 (Resistance Level)

📌 TP2: $6.38 (Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance):

$5.38 - $5.09 = $0.29 risk per share

📈 Reward to TP1:

$5.85 - $5.38 = $0.47 (1:1.62 R/R)

📈 Reward to TP2:

$6.38 - $5.38 = $1.00 (1:3.44 R/R)

✅ Favorable Risk-Reward Ratio toward TP2

🔍 Technical Analysis & Strategy

📌 Rising Wedge Breakout: Price action is holding above key levels, signaling bullish momentum.

📌 Fibonacci Confluence: The 0.382, 0.5, and 0.618 retracement levels provide strong support.

📌 Volume Confirmation Needed: Look for above-average buying volume above $5.38 to validate the breakout.

📌 Resistance at $5.85: A breakout above this will strengthen the bullish move toward TP2.

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure strong buying volume above $5.38 before entering.

📉 Trailing Stop Strategy: Move SL to break-even ($5.38) after hitting TP1 ($5.85).

💰 Partial Profit Booking Strategy

✔ Take 50% profits at TP1 ($5.85), let the rest run toward TP2 ($6.38).

✔ Adjust Stop-Loss to Break-even ($5.38) after TP1 is reached.

⚠️ Risks & Considerations

❌ Fake Breakout Risk: If the price fails to hold above $5.38, exit early.

❌ Confirmation Required: Wait for a 30-min candle close above $5.38 before entering.

🚀 Final Thoughts

✔ Bullish Setup – Strong upside potential.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:3.44 toward TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀📈

🔗 #ADVM #NASDAQ #LongTrade #TradingView #ProfittoPath 💰📊

ADVM trade ideas

Adverum Biotechnologies Inc. | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Adverum Biotechnologies Inc.

- Double Formation

* A+ Set Up)) At 16.5800 USD | Subdivision 1

* No Trade)) | Invalid Pattern Confirmation | Subdivision 2

- Triple Formation

* (Continuation Argument)) At 10.3500 USD

* Numbered Retracement | Downtrend Continuation | Subdivision 3

* Daily Time Frame | Trend Settings Condition

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Neutral

ADVM - Biotech Long ShotBiotechs are still beaten up, especially the gene therapy disrupter stocks, so continuing to buy a little bit here and a little bit here of some of these stocks.

These are lottery stocks, they have few if any marketable products, but the idea is if they do come out with a block buster, well winner winner chicken dinner!!!

Adverum is into ocular gene therapy with several therapies in the pipeline with one to be late-stage clinical study.

Reason for the buy? Well a nice insider buy trade of $2.5 million in July which can often be a sign that something is in the making, or at least they have a lot of faith in the company moving forward.

Probably buy 100 shares here, that is a small under $700 position so if it goes to zero I am not hurting, but if it becomes a 10 or better bagger that is a nice hit. I mean various investors had the company above $200 for a while, so it is not unreasonable to get that type of move.

However the chances of that are low which is why we keep our risk low.

Anyways, good luck and I will touch base soon.

Adverum Biotechnologies, Inc.On the above bi-Weekly chart price action has corrected over 90% since June 2020. A number of reasons now exist to be bullish , including:

1) A strong buy signal prints (not shown).

2) Regular bullish divergence . Multiple oscillators printing divergence.

3) Price action confirms support on past resistance.

4) Falling wedge breakout + backtest.

Is it possible price action falls further? Sure.

Is it probable? No.

Ww

Type: trade

Risk: <=6% of portfolio

Timeframe: Don’t know.

Return: Don’t know

Stop loss: <= 50 cents

ADVM | Adverum Biotechnologies, Inc. Healthcare US STOCKSBullish trend 📉

Stock: ADVM | Adverum Biotechnologies, Inc.

Healthcare | Biotechnology | USA | NASDAQ

Trend Analysis: The stock's price has been consistently following a uptrend characterized by higher highs and higher lows. Traders may look for buying opportunities as the stock approaches the buying limit.

time to add target 2.25time to add target 2.25 stoploss 1.13..Adverum is moving forward with its eye disease gene therapy that caused headaches in April 2021, but is doing so with fewer staff on board.

The biotech is laying off 78 employees, or about 38% of its workforce, in order to conserve cash and keep the lights on into 2025, according to an SEC filing.

ADVM Technical Analysis 🧙Adverum Biotechnologies Inc is a US-based clinical-stage gene therapy company. It develops gene therapy product candidates intended to provide durable efficacy by inducing sustained expression of a therapeutic protein. The company has primarily generated revenue through license, research and collaboration arrangements with its strategic partners. Its lead product candidate is ADVM-022 which is a single, in-office intravitreal (IVT) injection gene therapy designed to deliver long-term durability with treatment response, reduce the treatment burden of frequent anti-vascular endothelial growth factor (anti-VEGF) injections, and improve real-world vision outcomes for patients.

Adverum Biotechnologies Inc 🧙Adverum Biotechnologies Inc is a US-based clinical-stage gene therapy company. It develops gene therapy product candidates intended to provide durable efficacy by inducing sustained expression of a therapeutic protein. The company has primarily generated revenue through license, research and collaboration arrangements with its strategic partners. Its lead product candidate is ADVM-022 which is a single, in-office intravitreal (IVT) injection gene therapy designed to deliver long-term durability with treatment response, reduce the treatment burden of frequent anti-vascular endothelial growth factor (anti-VEGF) injections, and improve real-world vision outcomes for patients.

If you want not to miss ideas like this one,🎯 subscribe and press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!

ADVR updateI think it hit the bottom. From this point on, it will most likely move up (considering all the volume going in). Any news catalyst will easily trigger the stock.

About my point about Phase 2 trial issue in an earlier post, any biopharma company has the risk of a failed Phase 2 trials and/or side-effects. That is why they do these trials, not immediately distribute to public. I am optimistic with the company's vision.

ADVM Technical Analysis 🧙Adverum Biotechnologies Inc is a US-based clinical-stage gene therapy company. It develops gene therapy product candidates intended to provide durable efficacy by inducing sustained expression of a therapeutic protein. The company has primarily generated revenue through license, research and collaboration arrangements with its strategic partners. Its lead product candidate is ADVM-022 which is a single, in-office intravitreal (IVT) injection gene therapy designed to deliver long-term durability with treatment response, reduce the treatment burden of frequent anti-vascular endothelial growth factor (anti-VEGF) injections, and improve real-world vision outcomes for patients.

If you want more trading ideas like this one ,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!

ADVM Technical Analysis 🧙Adverum Biotechnologies Inc is a US-based clinical-stage gene therapy company. It develops gene therapy product candidates intended to provide durable efficacy by inducing sustained expression of a therapeutic protein. The company has primarily generated revenue through license, research and collaboration arrangements with its strategic partners. Its lead product candidate is ADVM-022 which is a single, in-office intravitreal (IVT) injection gene therapy designed to deliver long-term durability with treatment response, reduce the treatment burden of frequent anti-vascular endothelial growth factor (anti-VEGF) injections, and improve real-world vision outcomes for patients.

If you want more trading ideas like this one ,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!