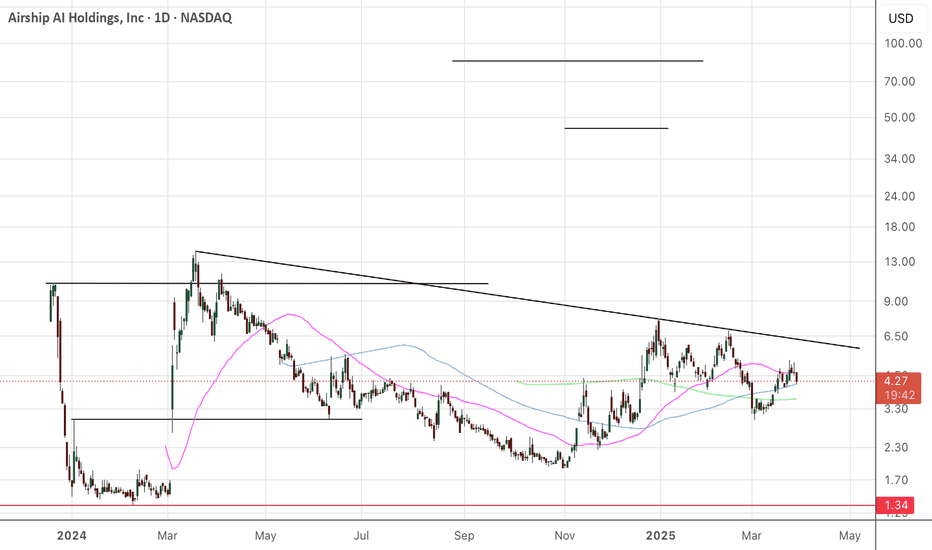

AISPI would post this with no statement needed, but Tradingview doesn't allow it. I think it's a beautiful chart setup with nice clear targets. There is a "tech target", which is the full amplitude of the chart, and then there is a target which takes game theory into account and pulls back 33% from the tech target. That's how I do it.

AISP trade ideas

$NASDAQ:AISP breaking resistance for a 35%++ upsideNASDAQ:AISP broke it's double bottom pattern resistance with some upside potential.

Entry Point: At the current price OR (as I suspect there will be a retest of the $6 resistance) somewhere around $6

Price Target: $8.14 - 35% from the $6 resistance.

6/10/24 - $aisp - took a look at $3. NO way. $1.5-2 maybe k?6/10/24 - vrockstar - NASDAQ:AISP - have some smaller ones on my radar like this one. they're memes until the financials start to back it up. cool story bro, basically.

so they go from 12 mn in revenue to 25 mm this year and w/ ultra high growth rates thereafter? okay maybe. but for a co this size, a sketch chart, no relief or stability after that huge pump - you'll need substance. i'd suggest we need to knee-cap the '24 figures and apply a 1) subscale software multiple (in software remember the bigger the moat, the lower the discount rate - which means higher multiple NOT the other way around and) and 2) acknowledge this isn't a 70-80% gross margin business and 3) there's not a whole lot of R&D being spent here (after all they don't have a ton of cash in the bank, burn 1-2 mm a year - maybe will be more as they grow let's see).

I'd value it like this

1) (50% of valuation at 60 mm): 20 mm revenue in '24 gets a 3x multiple (this is generous i'll point out) b/c it's a good story, and zip code so to speak. that's 60 mm valuation

2) (50% of valuation at 40 mm): R&D budget of let's round up 5 mm a year and then i do some VROCK math on it (this is my heuristic developed in time) which is discount this size co at 30% (again generous - i could say 50% and that's probably more realistic!) - so w/o growth that's 5 mm (it's 3 mm today) and divide by .3 so you get ~16 mm. let's round up for these bros -> 20 mm. and then i say the biz is worth minimally 2x that R&D value put in. it take into consideration buy-out value, monetization value etc. so that's $40 mm

conclusion - 50% at 60 mm, 50% at 40 mm = 50 mm valuation starting point. we're at an enterprise value of >80 mm today. so call it 35-40% downside from an already hairy chart before I even become interested! and without even looking - or backing into this - what do you know! that's about where the stock popped from prior to Mar '24! so there's a massive gap fill that's in range there.

basically - it's a "keep on your radar" but don't jump the gun. it's hard enough to own quality. if you're doing cyber, look at NASDAQ:PANW , NYSE:S , NASDAQ:CRWD and my fav "semi-cyber" NYSE:YOU before you ape on something like this hoping for a quick pop. unless you have really dug in and know the timeline of catalysts, you're fighting a battle against getting dunked on by bag holders looking to shill those on your PnL at this point. the valuation doesn't support these levels fundamentally.

V

Suppressed no one is publishing ideas on this oneI picked up 100 shares of this awhile back just to keep it on my radar, and now it is exploding. I am curious what others think about this one. I suspect it will crash back pretty hard and I am trying to decide if I need to get out and wait for it to pull back before getting back in.