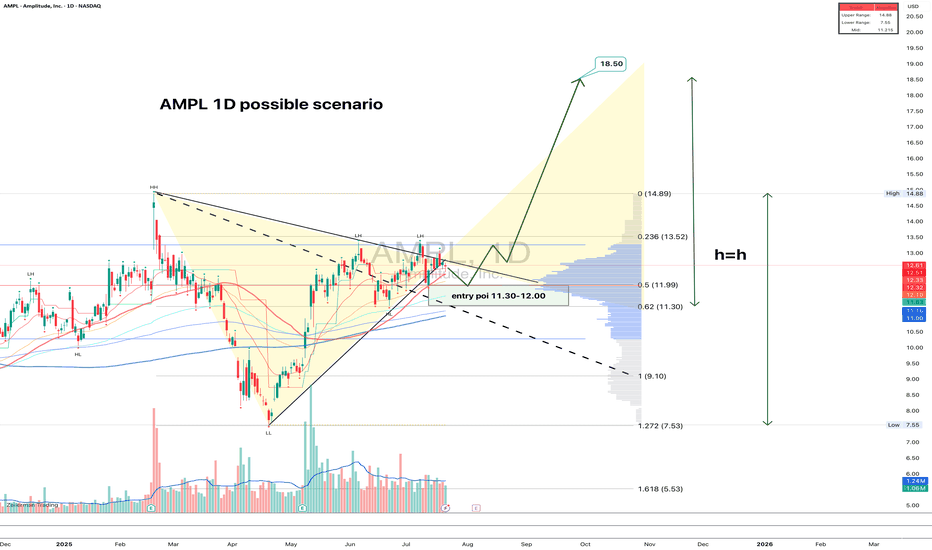

AMPL: structure clean, volume right, fundamentals warming upAMPL just broke out of a symmetrical triangle on the daily chart. The breakout was confirmed with decent volume, and now price is calmly pulling back into the 11.30–12.00 zone — exactly the kind of textbook retest that gets serious traders interested. The 0.618 Fib level sits at 11.30, and 0.5 at 11.99, strengthening this entry area. Volume has tapered off post-breakout, which is typical before a continuation. Moving averages are stacked bullish, confirming the trend shift. First upside target is 13.52, followed by 14.89, and if the full h = h move plays out, price could reach 18.50. A natural stop sits just below 11.00. Clear structure, solid risk control — this is one of those setups that checks all the boxes.

On the fundamental side, Amplitude remains a key player in product analytics and digital optimization. After a slow 2024 marked by cost-cutting and stagnating revenue, the company is showing early signs of recovery this year. The broader SaaS market has stabilized, and AMPL is benefiting from renewed enterprise demand, especially for AI-driven user behavior analytics. Recent earnings came in better than expected, and institutional interest has quietly returned. Valuation is still moderate at these levels, giving it room to re-rate if momentum builds.

A clean breakout with technical alignment and an improving macro picture - when both sides of the story match, it's worth paying attention.

AMPL trade ideas

Amplitude: 2021 IPO Comeback Kid $AMPL $COIN $SNOWDoesn't look like there are many buyers for $AMPL, a peer of $COIN $SNOW 2020-2021 IPO cohorts, though business results look promising in the long-term.

I'd say anything above $10 is a good entry for this as a long-term tech stock that can outperform in future cycles.

Amplitude Inc (NASDAQ:AMPL)

The 8 analysts offering 12-month price forecasts for Amplitude Inc have a median target of $17.50, with a high estimate of 20.00 and a low estimate of 15.00 . The median estimate represents a +32.28% increase from the last price of 13.23.

In the chart above, I have 3 bullish scenarios. All 3 are negated if the price drops below $10

As of now, it looks like there's still a lot of post-IPO sell pressure and aside from price defense at $10 late this year, not much new insti investor interest.

"We're so early!" - Famous Last Words

Amplitude might be getting ready to breakout. Hello Friends!

Amplitude has declined by 70% from it’s highs. Back in February analyst had a price target of $40 and $60 for 2022. Currently is consolidating and a breakout can have its eye on two price targets.

Target#1: $27.50

Target #2: $33.00

After $33 a gap fill opportunity to $40 might be an option. But at this point, one step at a time.

As always thanks for your follows, likes, and comments. Let’s learn and grow together. Cheers!

Bullish Dragon Breakout on AmpltudeWe have broken back above a Bearish Trendline and are Springing back above the 1.13 fib extension while testing the Neckline of a Potential Double Bottom and the RSI is back above the 50 line. Best case scenario here is that this price action is followed by a major Retrace to the upside between the 61.8% and 78.6% Retraces.

$AMPL is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $52,27;

stop-loss — $47,74;

take-profit — $65,86/MOC price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.