APLD heads up at $13.10: Golden Genesis fib may stop the SurgeAPLD on a massive surge over various company news.

Currently about to hit a Golden Genesis fib at $8.10

Looking for usual Dip-to-Fib or Break-and-Retest to buy.

It is PROBABLE that we "orbit" this fib a few times.

It is POSSIBLE that we get a significant dip from here.

It is PLAUSIBLE that we break

Key facts today

Applied Digital (APLD) shares rose 36% after reporting a fourth-quarter adjusted loss of $0.03 per share, outperforming the anticipated loss of $0.15 per share.

Lake Street has raised the price target for Applied Digital (APLD) shares from $14.00 to $18.00 while maintaining a 'Buy' rating.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.10 USD

−231.06 M USD

144.19 M USD

173.16 M

About Applied Digital Corporation

Sector

Industry

CEO

Wesley Carl Cummins

Website

Headquarters

Dallas

Founded

2001

FIGI

BBG000DSJYS8

Applied Digital Corp. is a technology company, which engages in the provision of development and operation of data centers which provide computing power. It operates through the following segments: Cloud Services Business, HPC Hosting Business, and Data Center Hosting Business. The company was founded by Wesley Carl Cummins and Jason Zhang in May 2001 and is headquartered in Dallas, TX.

Related stocks

APLD (Applied Digital):EARNINGS TRADE SETUP (2025-07-30)

🚨 **EARNINGS TRADE SETUP: APLD (Applied Digital)**

🗓️ Earnings: **July 31 (AMC)**

💥 Confidence: **65% Moderate Bullish**

🔥 Recent Run: **+94% past 3 months**

🧠 AI Infrastructure Hype + High IV = Opportunity

---

### 📊 FUNDAMENTALS SNAPSHOT

🟢 **Revenue Growth**: +22.1% YoY

🔴 **Profit Margin**: -11

APLD Trade Setup

🔹 Target: $22.67

🔹 Stop Loss: $9.13

🔹 Entry Zone: Around $15.50 or better on a dip

🔹 Risk/Reward: ~1:1 at CMP, ~2:1 if entry near $13.50

🔹 Bullish momentum intact if it holds above $11.65

📌 Watching for continuation toward 2.0 extension level. Trade safe!

#APLD #TradingView #Stocks #Fibonacc

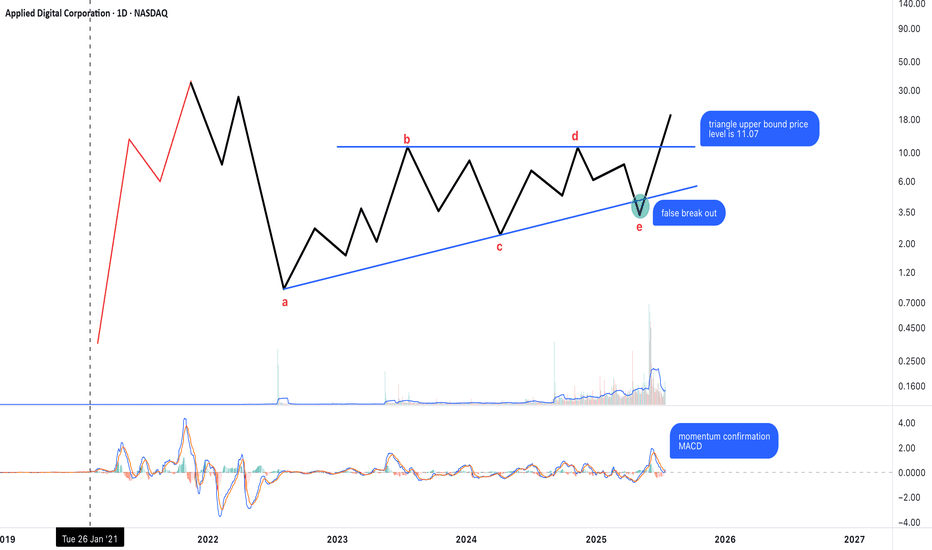

Possible Neutral Triangle Breakout – Key Level at 11.07The chart appears to show a completed neutral triangle (a–b–c–d–e), with a breakout emerging above the upper boundary at 11.07.

Wave a looks like a complex structure (possibly elongated flat or flat + zigzag).

The rest of the legs are mostly zigzag forms, consistent with triangle rules.

False bre

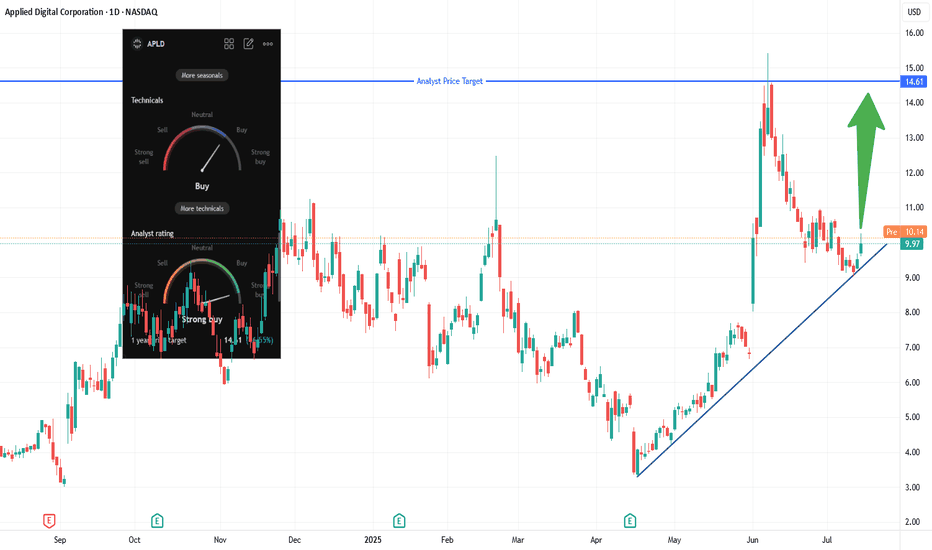

APLD Long: Trendline Bounce + CoreWeave AI Lease🎯 Trade Setup Overview

Entry: Market at Open

Stop‑Loss: Below the trendline at ~$9.00

Primary Target: $14.60–$15.50 (analyst zone + historical highs)

Reward/Risk: ~50–60% upside vs ~7–10% downside = solid R:R ~5:1

📈 Technical Rationale

The stock recently bounced off a long‑term ascending trendlin

Applied Digital Preparing For Lift OffAPLD is looking great, it fell right into my pull back zone and looks like it will run again. I bought $4.50, but sold after bagging 200%. I have been patiently waiting for the next opportunity and I think this is it. I think we have a nice bull flag here that will lead us back up. Not financial ad

A 10x on APLD ? Applied Digital has confirmed a multi-year symmetrical triangle breakout on the weekly chart, marked by immense volume and a clean breakout above long-term downtrend resistance. The base of the triangle spans several years, with consistent higher lows forming a solid support line.

🔺 Breakout Volume

APLD - SWING TRADE BUYING ZONESAPLD. The stock was in a perfect parallel channel accumulating zone for many days. Finally we saw a breakout 8.47$

The stock rallied almost a 100 percent after the breakout and is still in a good uptrend.

Major rejection was at 10.20 to 11.65 which is the weekly bearish order block. We have seen 4

APLD $13.86 buyApplied digital has been on a tear for the past few weeks fuelled by the news that Nvidia has bought a stake in the company and the deal with wall streets latest darling Coreveave.

Digging a little deeper, looking at the options chain there are a huge number of calls all the way up to $20. The shor

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of APLD is 12.55 USD — it has increased by 31.01% in the past 24 hours. Watch Applied Digital Corporation stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Applied Digital Corporation stocks are traded under the ticker APLD.

APLD stock has risen by 19.02% compared to the previous week, the month change is a 31.40% rise, over the last year Applied Digital Corporation has showed a 158.13% increase.

We've gathered analysts' opinions on Applied Digital Corporation future price: according to them, APLD price has a max estimate of 24.00 USD and a min estimate of 13.00 USD. Watch APLD chart and read a more detailed Applied Digital Corporation stock forecast: see what analysts think of Applied Digital Corporation and suggest that you do with its stocks.

APLD reached its all-time high on Aug 5, 2003 with the price of 112.30 USD, and its all-time low was 0.005999 USD and was reached on Dec 30, 2011. View more price dynamics on APLD chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

APLD stock is 15.26% volatile and has beta coefficient of 2.98. Track Applied Digital Corporation stock price on the chart and check out the list of the most volatile stocks — is Applied Digital Corporation there?

Today Applied Digital Corporation has the market capitalization of 3.44 B, it has increased by 7.82% over the last week.

Yes, you can track Applied Digital Corporation financials in yearly and quarterly reports right on TradingView.

Applied Digital Corporation is going to release the next earnings report on Oct 14, 2025. Keep track of upcoming events with our Earnings Calendar.

APLD earnings for the last quarter are −0.03 USD per share, whereas the estimation was −0.15 USD resulting in a 80.43% surprise. The estimated earnings for the next quarter are −0.15 USD per share. See more details about Applied Digital Corporation earnings.

Applied Digital Corporation revenue for the last quarter amounts to 38.01 M USD, despite the estimated figure of 37.84 M USD. In the next quarter, revenue is expected to reach 60.95 M USD.

APLD net income for the last quarter is −52.54 M USD, while the quarter before that showed −35.55 M USD of net income which accounts for −47.76% change. Track more Applied Digital Corporation financial stats to get the full picture.

No, APLD doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 1, 2025, the company has 150 employees. See our rating of the largest employees — is Applied Digital Corporation on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Applied Digital Corporation EBITDA is 11.35 M USD, and current EBITDA margin is −15.97%. See more stats in Applied Digital Corporation financial statements.

Like other stocks, APLD shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Applied Digital Corporation stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Applied Digital Corporation technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Applied Digital Corporation stock shows the strong buy signal. See more of Applied Digital Corporation technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.