Astronics Corporation (ATRO) Powers Aircraft SystemsAstronics Corporation (ATRO) designs and manufactures advanced technologies for the aerospace, defense, and electronics industries. Its products include in-flight power systems, lighting, connectivity, and testing equipment used in both commercial and military applications. Astronics’ growth is driven by increasing air travel, modernization of aircraft systems, and rising defense spending that supports demand for mission-critical components.

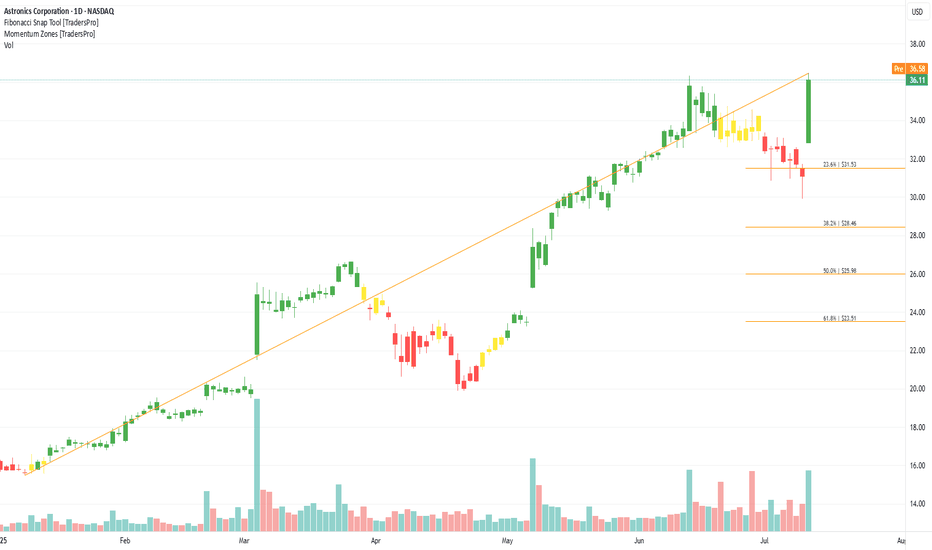

On the chart, a confirmation bar with rising volume highlights strong buying momentum. The price has entered the momentum zone after breaking above the .236 Fibonacci level. A trailing stop can be placed just below that level using the Fibonacci snap tool to lock in gains while allowing for further upside.

ATRO trade ideas

Long Trade Setup – ATRO!📈

🔹 Asset: Astronics Corporation (NASDAQ: ATRO)

🔹 Timeframe: 30-Minute Chart

🔹 Setup Type: Ascending Triangle Breakout (Bullish Continuation)

📌 Trade Plan (Long Position)

✅ Entry Zone: Around $29.21 (Confirmed breakout above resistance)

✅ Stop-Loss (SL): Below $28.83 (Below structure and trendline)

🎯 Take Profit Targets

📌 TP1: $29.82 – Prior swing high / minor resistance

📌 TP2: $30.58 – Measured move and next resistance zone

📊 Risk-Reward Calculation

📉 Risk: $29.21 - $28.83 = $0.38

📈 Reward to TP1: $29.82 - $29.21 = $0.61 → R:R = 1:1.6

📈 Reward to TP2: $30.58 - $29.21 = $1.37 → R:R = 1:3.6 ✅

🔍 Technical Highlights

📌 Ascending triangle breakout with volume push

📌 Bullish close above yellow zone = breakout confirmed

📌 Higher lows + horizontal resistance breakout

📌 Momentum aligned with volume surge

📈 Execution Strategy

📊 Enter at or slightly above $29.21 on breakout confirmation

📉 SL just under $28.83 to avoid false breakdowns

💰 Take partial profit at TP1 and trail SL toward TP2

🚨 Invalidation Risk

❌ Drop below $28.83 suggests failed breakout

❌ Bearish engulfing reversal = re-evaluate entry

🚀 Final Take

✔ Bullish continuation setup with solid R:R

✔ Triangle breakout with volume = high conviction

✔ Let price prove — enter smart, exit smarter

New Setup: ATROATRO : I have a swing trade setup signal. I'm looking to ENTER long if the stock can manage to cross above the last candle high. If triggered, I will then place a STOP below the previous candle, and a price TARGET at around 21.80. **Note: This setups will remain valid until the stock CLOSES BELOW my STOP.

ATRO (Astronics Corporation) – 30-Min Short Trade Setup!📉 🚀

🔹 Asset: Astronics Corporation (ATRO)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bearish Breakdown Trade

📌 Trade Plan (Short Position)

✅ Entry Zone: Below $24.28 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $25.62 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $22.97 (First Support Level)

📌 TP2: $21.14 (Extended Bearish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $25.62 - $24.28 = $1.34 risk per unit

📈 Reward to TP1: $24.28 - $22.97 = $1.31 (1:0.98 R/R)

📈 Reward to TP2: $24.28 - $21.14 = $3.14 (1:2.34 R/R)

💡 Favorable Risk-Reward Ratio – Aiming for a 1:2.34 R/R at TP2.

🔍 Technical Analysis & Strategy

📌 Bearish Rising Wedge Breakdown – The stock formed a rising wedge and broke below support.

📌 Weak Buying Pressure – The stock has failed to push higher and is testing breakdown support at $24.28.

📌 Volume Confirmation Needed – Increased selling volume below $24.28 confirms momentum.

📌 Momentum Shift Expected – If the price remains below $24.28, it could decline toward $22.97, then $21.14.

📊 Key Resistance & Support Levels

🔴 $25.62 – Stop-Loss / Resistance Level

🟡 $24.28 – Breakdown Level / Short Entry

⚪ $22.97 – First Target / TP1

🟢 $21.14 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation – Ensure strong selling pressure below $24.28 before entering.

📉 Trailing Stop Strategy – Move SL to breakeven ($24.28) after hitting TP1 ($22.97).

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $22.97, let the rest run to $21.14.

✔ Adjust SL to breakeven ($24.28) after TP1 is hit.

⚠️ Fake Breakdown Risk:

❌ If price moves back above $24.28, exit early to limit losses.

❌ Wait for a strong bearish candle close before entering aggressively.

🚀 Final Thoughts

✔ Bearish Setup – Breakdown signals downside potential.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:2.34 R/R to TP2.

💡 Stick to the plan, manage risk, and trade smart! 📉🔥

🔗 Hashtags for Engagement:

#ATRO 📉 #StockTrading 📊 #TradingNews 📉 #MarketUpdate 🔥 #Investing 💰 #ShortTrade 📉 #Stocks 📈 #ProfittoPath 🏆 #SwingTrading 🔄 #DayTrading ⚡ #TechnicalAnalysis 📉 #StockSignals 📊 #FinancialFreedom 💡 #MarketTrends 📊 #StockAlerts 🔔 #TradeSmart 🤓 #Bearish 📉 #RiskManagement ⚠️ #TradingCommunity 🤝 #SmartTrading 💰 #MarketAnalysis 📊 #TrendBreakdown 🚀

Elliott Wave Analysis of ATROAstronics Corporation, listed on NASDAQ under the ticker symbol ATRO, is currently undergoing a wave analysis based on the Elliott Wave Theory, focusing on the hourly timeframe.

Starting from November 2023, where the price was approximately $14, we began identifying the initial wave ((i)). The wave count progressed until the high in February 2024, reaching $20.35, which was labeled as wave ((iii)).

Currently, the stock is believed to be in wave ((iv)), which is expected to consist of three subdivisions: (w), (x), and (y). As of now, we are unfolding wave (y) within wave ((iv)). This wave (y) is further subdivided into wave a, wave b, and the ongoing wave c which can go still lower.

Once wave ((iv)) completes its formation, the expectation is for a rally to the upside, signaling the beginning of wave ((v)). This wave ((v)) has the potential to surpass the high of wave ((iii)), indicating a continuation of the bullish trend.

However, it's important to note that the validity of this wave count may be challenged if the price drops below the $16 level. This would invalidate the current wave count and necessitate a reevaluation of the analysis.

Traders and investors should exercise caution and consider risk management strategies when making decisions based on Elliott Wave Theory, as market movements may deviate from the expected patterns.

Please keep in mind that this analysis is based on historical price data and patterns, and actual market behavior may vary. Always conduct thorough research and analysis before making trading decisions.

I am not Sebi registered analyst.

My studies are for educational purpose only.

Please Consult your financial advisor before trading or investing.

I am not responsible for any kinds of your profits and your losses.

Most investors treat trading as a hobby because they have a full-time job doing something else.

However, If you treat trading like a business, it will pay you like a business.

If you treat like a hobby, hobbies don't pay, they cost you...!

Hope this post is helpful to community

Thanks

RK💕

Disclaimer and Risk Warning.

The analysis and discussion provided on in.tradingview.com is intended for educational purposes only and should not be relied upon for trading decisions. RK_Charts is not an investment adviser and the information provided here should not be taken as professional investment advice. Before buying or selling any investments, securities, or precious metals, it is recommended that you conduct your own due diligence. RK_Charts does not share in your profits and will not take responsibility for any losses you may incur. So Please Consult your financial advisor before trading or investing.

ATR LONG FORECASTAstronics Corp. engages in the provision of electrical power generation and distribution systems. It includes motion systems, lighting and safety systems, avionics products, aircraft structures, systems certification, and automated test systems. It operates through the Aerospace and Test Systems segments. The Aerospace segment designs and manufactures products for the global aerospace industry. The Test Systems segment designs, develops, manufactures and maintains communications and weapons test systems and training and simulation devices for military applications. The firm's products and solutions include Aircraft Data Systems, Aircraft Electrical Power Systems, Airfield Lighting, Custom Design & Manufacturing, Emergency Systems, Enhanced Vision Systems, IFC Antennas and Radome Systems, Inflight Entertainment System Hardware, Interiors & Structures, Lighting Systems, Seat Actuation Systems, Simulation & Training, Systems Certification, Test & Measurement and VIP IFEC & CMS Systems. The company was founded on December 5th, 1968 and is headquartered in East Aurora, NY.

They are essential .

SENNA SEASON

ATROSo here is the plan. ATRO is a smaller cap stock but it is a supplier for Boeing. While everyone continues to rave over Boeing, the suppliers are the one's who are making better money. csimarket.com check out the data here.

Now they make money whether or not boeing makes money or sells their products. It is the same strategy of selling shovels to gold diggers during the gold rush. The earnings are strong for some of these companies but they have seemed to be forgotten. So I like this one which is trading around the 50 ema and is near a low support that has been tested several times. The price gapped down and I like to see gaps fill.

This is a new strategy and is being presently tested.

ATRO Struggling?Price action of ATRO does not look promising.

1. First, from May to Aug timeframe, looked to be forming a bullish wedge candlestick pattern (though RSI did not show any buildup). This is drawn with the dotted black trendline, and ended with a harsh drop due to a earning report about 50% less than expected.

2. The solid black trendline down has formed a consistent rejection point, and most recently the ichi cloud continually pushed down price, causing rejection wicks pointed to by green arrows. And continues to do so. If this goes on like this, there will not be much room for upwards movement.

3. For the SMAs: The price just wicked down from rejection of the SMA21 and SMA50. Up above is the SMA100 in blue, which price may have a difficult time reaching in the first place.

4. Lastly, have been many iterations of rejections and supports, shown circled in black. Dating back to Nov of 2018. This price line has shown up again in the past week or so. Yet another resistance to beat.

There is not much time left in this triangle. However the next earnings release is slated for early November, so maybe things will meander until then.

Now, zooming out to the monthly as shown below:

There is a lot of up and down swings, post the price peak. This reminds me of the BTC chart from the 20k peak. Massive chop with a consistent bottom, until that bottom broke massively and fell 50%. But for ATRO, I am going to put a target of $20 which is near the 0.786 FIB. That is still a pretty massive drop from the current ATRO price of $29. Also see if that 200SMA can give a bounce.

The red box is where an additional region of resistance should be, but that box is already above a lot of other resistances.

Last thing to see is the OBV is in steady decline, which may help to give some clarity despite the price chop.

-- For an alternate perspective here is an article: finance.yahoo.com

$ATRO technical analysis of price action show reversal imminentATRO is reaching the bottom of it's value range (around 30.50). Previously we have found stong volume and support when price drops below value range. Over the last couple of months, the price has been gravitating towards the 35.30 mark which is my control/target price. Last move down was triggered by bullish break of MA20 and MA50 price. Stochastic RSI is currently in the oversold when looking at 1 day chart. We also have a doji forming on extremely high volume which is a good sign of a reversal. Price is set to go up unless there is negative news I am not aware of.