Activision Blizzard (ATVI)Why is activision's ticker symbol ATVi? Couldn't it be better to be ACTB, or ABLZ?

What a bizarre chart to see. The premarket, most likely, or after hours trading causes loss in volume yet the price increases. I don't know much about these types of accidents. Is this what happens when a multi million dollar short loses? #tradecryptocurrency and never miss the blip.

ATVI trade ideas

Activision Blizzard: Woke up 🌞After trading sideways for the past several weeks, Activision Blizzard stock has risen since the end of last week, reaching resistance at $94.30. In our primary scenario, the next step is to break above this level, which should provide further upward pressure. Note, however, that with our downside alternative at 36%, it is still possible that the price will see another sell-off. This scenario would come into play when the price breaks below support at $86.81. It would then have to push the low of the turquoise wave alt.X down a bit more before it would move higher

ATVI Activision Blizzard arbitrage opportunity Microsoft had agreed to acquire Activision Blizzard ATVI in a cash deal valued at $68.7 billion, equal to $95 per share.

Activision Blizzard owns some of the most popular gaming franchises globally: World of Warcraft, Call of Duty, and Candy Crush.

So there is a 17% upside arbitrage here, if the deal does close.

Activision Blizzard (ATVI:NASADAQ) - Appealing for InvestorsIntroduction

Microsoft's strategic move to acquire Activision Blizzard at a remarkable $69 billion valuation has captured the attention of investors worldwide. This acquisition, if successful, holds the potential to reshape the gaming industry and bolster Microsoft's position within it. However, there are certain intricacies that investors should consider, including the possible financial repercussions if the deal were to fall through.

Implications of the Acquisition Deal

The proposed acquisition of Activision Blizzard by Microsoft not only signifies a substantial investment but also hints at Microsoft's intention to solidify its presence in the gaming sector. The acquisition would grant Microsoft ownership of some of the most renowned gaming franchises, including Call of Duty, Overwatch, and World of Warcraft, potentially opening doors to lucrative opportunities for future growth and revenue generation.

Financial Safeguard: Potential $3 Billion Fee

While the allure of this deal is evident, it's important to note that, in the event of the acquisition's failure, Microsoft has committed to a safeguarding measure in the form of a $3 billion fee payable to Activision Blizzard. This financial provision underscores Microsoft's commitment to pursuing the acquisition earnestly, as the fee serves to mitigate potential setbacks that could arise from deal termination.

Strategic Decision: Call of Duty Exclusivity

A notable aspect of Microsoft's acquisition strategy is the conscious decision not to render Call of Duty an exclusive title. This strategic choice can be seen as a calculated move to enhance the deal's chances of success. By preserving Call of Duty's multi-platform availability, Microsoft not only ensures continued market appeal but also minimizes potential regulatory challenges that could arise from monopolistic concerns.

Increased Likelihood of Success

The decision to maintain Call of Duty's multi-platform accessibility reflects Microsoft's understanding of the contemporary gaming landscape. This approach increases the likelihood of regulatory approval and diminishes the risk of objections from competitors, ultimately bolstering the chances of the acquisition's successful completion.

Conclusion

In conclusion, Microsoft's planned acquisition of Activision Blizzard for $69 billion presents an enticing opportunity for potential investors. The strategic implications of this deal, including the financial safeguard in the event of failure and the well-considered approach to Call of Duty's exclusivity, contribute to the overall attractiveness of this investment prospect. As this acquisition continues to unfold, investors will undoubtedly scrutinize its progress, assessing both the potential benefits and associated risks.

This content is provided for general information purposes only and is not to be taken as investment advice nor as a recommendation for any security, investment strategy or investment account.

$ATVI -Looks real strong on WeeklY!NASDAQ:ATVI - Looks real strong on Weekly just broke out of cup! might be a great play today !

The Activision Blizzard stock witnessed a gain of 0.592% on the last trading day, Friday, July 14, 2023, as the price rose from $89.54 to $90.07. Throughout the day, the stock exhibited a fluctuation of 1.92%, reaching a low of $89.78 and a high of $91.50. Over the past 10 days, the stock has experienced a decline in 6 of them, although it still managed to register a notable gain of 8.41% over the past 2 weeks. Notably, the volume increased alongside the price on the last day, which is considered a positive technical sign. In total, there were 26 million more shares traded compared to the previous day, with a total of 46 million shares being bought and sold, amounting to approximately $4.19 billion.

Presently, the stock is positioned in the upper segment of a wide and somewhat weak rising trend in the short term. This could potentially offer an advantageous selling opportunity for short-term traders, as a reaction back towards the lower part of the trend could be expected. A breakout above the top trend line at $91.27 would indicate a stronger rate of ascent. Based on the current short-term trend, the stock is projected to rise by 6.71% over the next three months. Moreover, there is a 90% probability that the stock will maintain a price range between $84.42 and $97.40 at the conclusion of this three-month period.

ATVI BUYERS ARE BACK, Ascend next...ATVI accumulation is definitely ON. Net buyers has started positioning for the last 4 days at the 75 ish area...

Buying volume has started increasing significantly on a daily basis.

Expect some bounce from here on.

Here are the financial results for the last quarter -- and ATVI has been bringing the goods so far.

----------

Financials

Quarterly financials

MAR 2023

(USD) Mar 2023 Y/Y

Revenue 2.38B 34.79%

Net income 740M 87.34%

Diluted EPS 0.93 86%

Net profit margin 31.05% 38.99%

Operating income 800M 67.01%

Net change in cash 2.18B 301.66%

Cash on hand - -

Cost of revenue 665M 38.83%

ATVI after acquisition1. Activision Blizzard

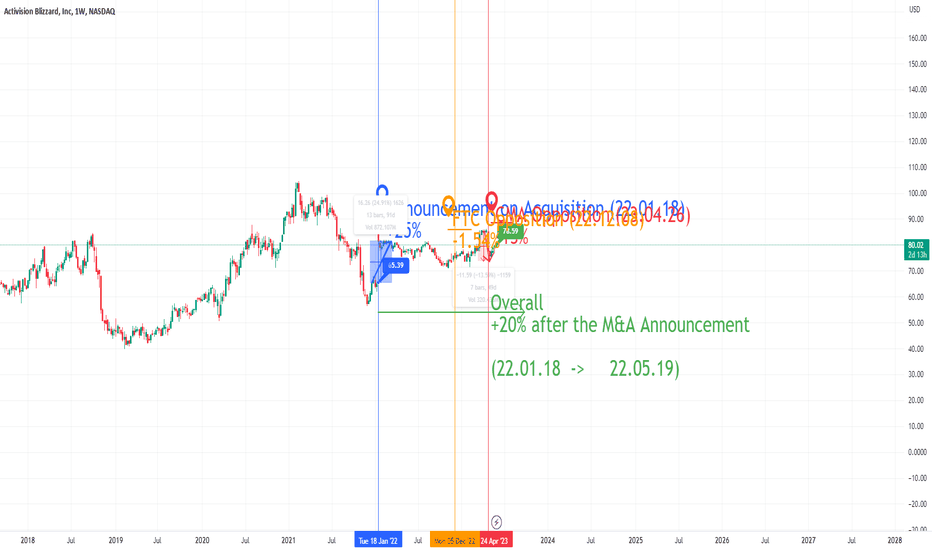

On January 18, 2022, following the announcement of the acquisition, the stock price of ATVI reached its peak at $82 after initially being at $65, which is 25% increase.

Around December 8, 2022, before and after the FTC's indication of opposition, the stock price experienced minor fluctuations of around 10%. However, after the CMA's opposition on April 26, 2023, the stock price plummeted by over 13%.

Overall, since the announcement of the acquisition on January 18, 2022, the stock price of ATVI has risen by over 20% from $65 to $78 on May 19, 2023. Despite this increase, it remains significantly below the premium price of $95 proposed by MSFT (-17%).

2. Microsoft

As of May 2023, Microsoft (MSFT) has a market cap of 2.363 trillion dollars. The acquisition of Activision Blizzard (ATVI) for 69 billion dollars represents approximately 3% of Microsoft's market cap. This indicates that M&A issues related to Activision Blizzard are not correlated with the MSFT stock price. As evidence of this, on January 18, 2022, after the acquisition announcement, Microsoft's stock price only declined by 2.43%. Similarly, on May 15, 2023, when the acquisition received EU approval, the stock price increased by a mere 0.16%. The 7.24% increase in the stock price after the Competition and Markets Authority (CMA) rejection on April 26, 2023, was largely attributed to the company's strong earnings report.

3. Overall Microsoft does not show much fluctuations from the acquisition or any other anti-trust issues. May be due to the high premium paid to ActivisionBlizzard that makes the investors slightly lackluster towards the deal.

ActivisionBlizzard – Very enthusiastic towards the deal. Perhaps due to the expected synergy effect and the high premium paid by the Microsoft. Need to talk about why FTC’s rejection shows little to no effect while the CMA’s rejection has a significant impact in the stock market.

Sony – Mostly the opposite of ActivisionBlizzard

Probable scenarios on the ATVIAs you can see in the chart ATVI Had started A massive uptrend in the last 23 years that it could be NEAR to the END of mentioned uptrend by my point of view.

there are 2 scenario that could happen.

in the first scenario we are going to have A new HIGH which shouldn't have a high difference with the last High! (Orange LINE)

in the second scenario after breaking the black line which would be the best trigger to my idea, the purple will hold the price temporarily and provide a good situaion to make a SHORT position on this share. (Green LINE)

at the end i SHOULD say breaking the black line is the key trigger to (sell/short) on this share.

Break it or make it ?ATVI sideway at Neckline (84.5$). Sideway 4 days continuous in 85.77$-83.28. So if you play options, should wait this plan .

If ATVI break down 83.28 , heavy PUT to 63-64$.

If ATVI make up above 85.77$ , heavy call to 105-107$

Dont try to play if ATVI still run sideway in present range ( 85.77-83.28)

ATVI - A simple take on current price actionHi guys. This is my techical analysis on what i see on Activision. Its a personal favorite, as im a heavy gamer of COD, diablo and more. But just a reminder this is not financial advise, i am not a financial advisor. Everything portrayed here is my opinion.

FYI - i tried to fit an example of MACD that i feel this current action is more closely related to so sorry ahead of time if you cant zoom in on current price action but check out the charts yourself!

WE are looking at the Weekly timeframe

So lets look first at price action:

As you can see, we broke out of this major resistance trend line from the all time highs of Feb 2021 last week.

However, we have yet to confirm whether we stay above or below. We need to pay attention to this weeks close.

Currently, if we were to close here it would be a dragonfly doji candle, which wouldnt be a strong confirmation in my opinion. Since we've been going sideways for a bunch of weeks now. Dragonflies are better to trade when we've been in a clear downtrend. If it prints this, i would wait to see the close of next week for a firm confirmation.

I would like to see a hammer candle. or something with a bigger body which would be confirmation for me to enter a trade.

But the large lower wick is a good sign that there is tremendous buy pressure from this red trend line acting as support.

So with this confirmation, this would mean a trend change from our 2 year down trend.

ALso always be unbiased. If it fails to stay above the Red trend line, look to the horizontal line and or the upsloping trendline thats been support since Feb 2019.

Stop loss would go 5-10% below Red trend line.

NOw the indcators i got. (top to bottom)

1. Stoch RSI

2.MACD

3. RSI

The STOCH RSI - has crossed bullish which favors momentum to the upside

The MACD is also crossed bullish and is slowly moving up over the 0 line. If it confirms above the 0 line, momentum can pick up tremendously. If you look at previous data it leads to massive runs to the upside and when we stay above the 0 line

The RSI is something im watching also. Especially its interaction with the 2 trend lines i drew. We want to get above the trendliens for added bullish momentum or increased buying demand. This would confirm a major trend change along with keeping the red trendline in price action as support.

Well thats what i see. Lets watch and see whats up! This is a trade i will be taking personally.

Let me know what yall are thinking. I would like another perspective! Like, comment and follow! Check out my other charts and i linked my EA analysis down below.

DIsclaimer: This is not fianncial advice and i am not a fiancial advisor. This is just my opinions and for educational purpose as i am a student of the charts!

ATVI is trading with a discount of 25% to the takeover price.ATVI is being a target of takeover (agreed by shareholders) at 95$ by MSFT.

Some of the anti-trust organizations are opposing to it. That`s why the price is around 76.6$ right now (59 bn).The deal might go through as ATVI + MSFT will not create a monopolistic position on the gaming market, which is very fragmented and everything depends on the gamers mood/preferences. Even if the deal is not going through - ATVI shares are stalling because of the uncertainties related to the deal and it did not catch up with the peers to the upside. Another important factor: the company is beating expectations of both EPS and Revenues for 2 quarters already and there can be an interesting momentum. All in one the price has the margin of safety needed for a buy with 95$ PT

Disclaimer: These are my personal notes and are not in any form an investment recommendation. Do your homework or contact an authorized advisor.

Activision (ACTI) .... Sprouting Wings ??Activision (ATVI) earnings are in 5 days. (Feb 6th ... expected $1.51)

We are currently in a developing Butterfly Harmonic

My chart clearly illustrates 2 targets and trendline break challenges (2) along the way.

Enough said

Perhaps a safer trade might be to wait for a breach of challenges 1 and 2

Keep an eye on broader markets and DYODD.

S..

Watchlist 2023-02-07 #LAC #TAL #ATVI #CHGG #LAC SPY had an atypical session yesterday ranging only 0.7% as the market awaits Powell's planned speech today at 12:40 ET. No bias for today until the market digests the contents of the speak and chooses a direction. In the grand scheme, we are amidst a healthy low volume pullback still above key levels.

Capitulation trades: TAL, ATVI, CHGG

TAL - Capitulation Day 2 - We see the down days getting larger and larger until yesterday we had a blow off bottom below a key 6.50 pivot with <2 RVOL. If it can get above this level, this has potential for a swing long. Being mindful of the 200 day MA a 6.64. watching EDU as the sector leader for strength.

ATVI - Capitulation Day 2 - sellers were anticipating a bad earning report and that the UK might block the MSFT deal. However, double beast on earnings is now putting and shorts underwater with a complete reversal in the PM. If it can stay above 73.45 it has room to 75 if it can break above PM high of 74.

CHGG - Capitulation Day 1 - have to see a blow off on high RVOL below 15.75 and quickly reclaim that level to be valid. Plenty of room to move higher if all the sellers are out.

LAC - favorable court ruling on Thacker Pass lithium mine which can now continue construction - huge news. Gap and go at 25.46 if there is selling in the morning. Breakout long above 26.45 on strength. Room to 29, great potential for a swing long.

I focus on names trading elevate RVOL>2, trading past key ranges and pivots, typically with news catalysts