AUPH trade ideas

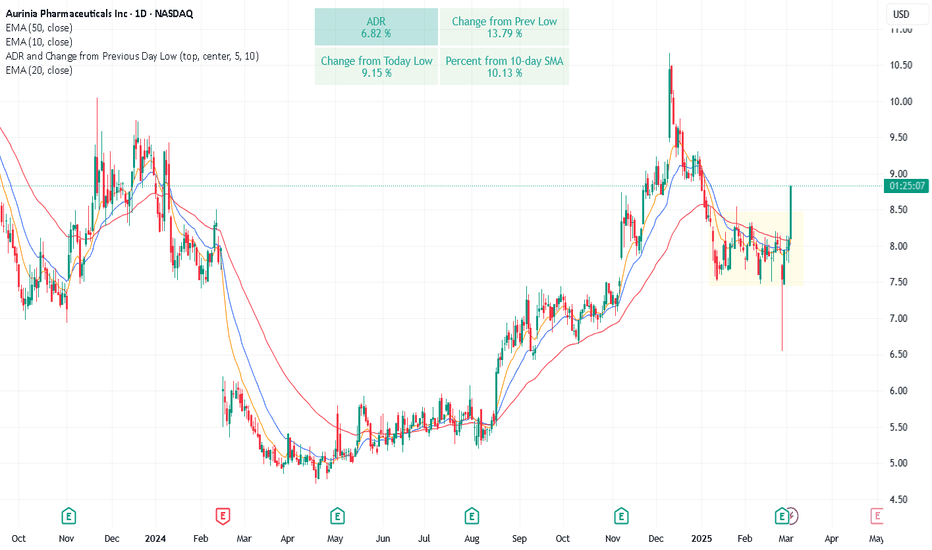

AUPH Aurinia Pharmaceuticals Options Ahead of EarningsAnalyzing the options chain and the chart patterns of AUPH Aurinia Pharmaceuticals prior to the earnings report this week,

I would consider purchasing the 7usd strike price Calls with

an expiration date of 2024-3-15,

for a premium of approximately $1.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AUPH Inverse H&SPrice has broken out of a down channel

I see this breaking down slightly back into the channel, forming a right shoulder along the yellow horizontal and then continuing to pursue the reversal above the channel

Lets see what happens on this Weekly chart

Bars pattern in green shows my idea

Head and Shoulders projects $9.5-10.50 consolidation zone

41% retracement from head to neckline, so 41% from neckline puts it at $10.50. There are multiple horizontal support zones, see chart that also correspond to this zone $9.50 - 10.50. Greenleaf (CEO) is a complete clown. Issuing a statement last week that guidance will likely be aggressive then he issued guidance that was approximately 30% below the analysts. He is a drag on this stock however at 1.5B market cap and projected annual sales of approximately 1B, this appears to be a good entry point now or waiting until the 9.50-10.50 zone.

$AUPH 200MA broken, Pivot points used to calculate R:R.Noticed Auph broke the 200ma did some quick analysis which means jack all but if we continue on this upward trend were likely to see a breakout soon. TA is based on pivot points with supports. Box means support confirmed over a few candles, ellipses is looking for past supports. This isn't investment advice this is some bored dude just jotting down risk to reward ratios on a potential long position. Do what you will with this.

AUPH LongWedge breakout, revisit trendline

ABC Patten:

Swing A crossed SMA50 (1st) and SMA200 (2nd), Wave#1

Swing B tested SMA200 as support. Wave#2

Swing C will be not less than A; Wave#3

Entry 16

Stop 14

Target 22

I am not a PRO trader. I trade option to test my trading plan with small cost.

The max Risk of each plan is less than 1% of my account.

If you like this idea, please use SIM/Demo account to try it.

AUPH BREAKOUTBULLISH WEDGE

Been brewing since FDA approval of Voclosporin. Lots of reasons to speculate a buyout or possible merger with recent voluntary delisting from the TSX and remaining on NYSE. Excellent setup to be a cash cow. Target Price of $35 be EOY playing Oct Calls. PFE and MRNA are LOADED with cash and you know they're sniffing out opportunities and would love to hear your thoughts and positions on this!

Covering all the Plays made a month ago to about a week agoThis is a video I made to cover all the plays made about a month ago up until about two weeks ago. I cut off half way through and honestly I thought it didn't record any of it. So I am posting it now. and I will pick up where it left off probably tomorrow.

If these have helped you trade please like and follow.

by iCantw84it

05.26.2021