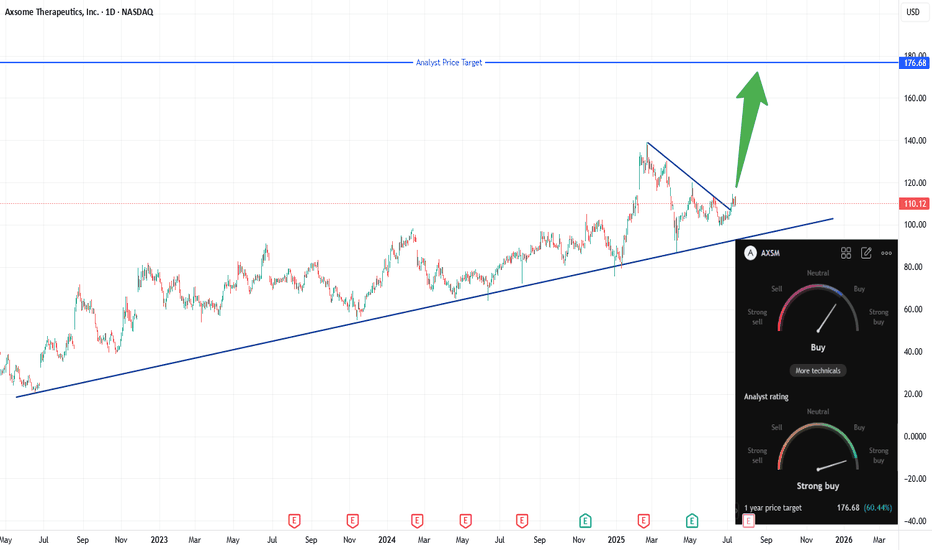

Axsome Therapeutics (AXSM) Breaks Out — Targeting Analyst Price Axsome Therapeutics (AXSM) has just broken out of a multi-month descending trendline, signaling renewed bullish momentum. I will buy at the open, targeting the analyst price target of $176.68 for a potential strong upside move. My stop will be set just below the prior resistance line (~$110), which should now act as support. This setup offers a favorable risk/reward, with the trendline breakout confirming renewed interest and upside potential.

AXSM trade ideas

Axsome Therapeutics - A Pennant Primed to RiseAxsome - NASDAQ:AXSM

✅In position since Feb 2023 with average price $50.00 per share. This is a long term 3 - 5 year hold.

✅ Current unrealized gain at 75%

✅ Stop Loss set at $63.80 for 50% of the position to ensure short term gain capture

⏳We awaiting increasing levels of volume (see the green zone). Volume moving into this zone would be ideal and demonstrate increased interest

⏳The On Balance Volume (OBV) has demonstrated that is consolidates in parallel channels and when it breaks out of them it signals price direction. We can watch the OBV for direction

The chart still looks great and we are sitting in a nice profit position with short term profits guaranteed by a stop. The OBV will be key to watch. I still think this company is ripe for a buy out.

Background of Axsome Therapeutics

AXSM are a Small Bio-Pharma company with market cap of $4.24 Billon.

In August 2022 Auvelity Anti-Depressants was FDA approved & is the only rapid-acting oral medicine for MDD with labelling describing statistically significant antidepressant efficacy by one week.

AXSM received Breakthrough Therapy designation from the FDA for an Alzheimer's disease drug development and are at the NDA phase for developing a drug for acute treatment of migraine.

AXSM are also developing a treatment for narcolepsy and separately for fibromyalgia.

All in, AXSM's offerings are building momentum. They have developed the fastest acting anti-depressant drug and are bringing it to market, and have a four other drugs in development, all of which have a large patient base. The company would be ripe for a buyout.

PUKA

AXSM - A Resume On The Bull Run - BullishNASDAQ:AXSM

- Has been showing strong upside movements with healthy corrections for a while now

- Down about 28% from all-time-high now

- Strong support levels down from the current price ~$70

- Overall doing great as a company

- Take Profit ~$89 as it fills a gap, conservative estimate

- Higher profit can be achieved in the long term

- Stop loss slightly lower than the next major support ~$66

*Not Financial Advice*

Axsome Therapeutics - $AXSM - The Long Term PlayAxsome Therapeutics - NASDAQ:AXSM

▫️ Entered a position in Oct 2022 on the bounce off the 200 week SMA (averaging $50.77c per share)

▫️ That position is presently in 73% profit

▫️ I have no intention of selling at present as we have a strong underside support from the 200 week MA, the 200 day MA and high volume trading zone from $70-78.

▫️ This a longer term play however I think an entry from within the above price zone ($70-78) or having a stop placed under it, if you can weather such a decline would be worthy of a long term position.

Earnings are on the 20th Feb 2024 👀 however the chart is my lead. I look at earnings for long term DCA opportunities

When I initially entered this position I had a 3-4 year time frame in mind. We are 15 months in and sitting pretty at 73% Profit. Patience pays dividends.

Axsome Therapeutics building momentum Axsome Therapeutics Inc (AXSM)

I have been in this spot trade since $50.77. We are now at $72.93. I have much higher targets as you can see from the chart.

This is a long term trade looking to hold for 12 – 24 months however feel that something is going to happen within 6 – 12 months based on the chart.

- Forming pennant on chart and RSI. Potential for breakout.

- Steadily increasing OBV (On Balance Volume) demonstrating continued interested in the trade.

- Stochastic Momentum indicator (not included on chart is driving upwards on the weekly).

- You can see the orange boxes which act as accumulation zones with double bottoms before the larger move occurs.

- We are above the 200 week and using it as support and we are above the 200 day also using it as support so we have limited downside with strong support.

This purchase has been helped me recognized that Pharma appear to companies perform much better when the general market is in decline. They appear to be inverse risk on but also make small advances during risk on periods. It’s a market that I am becoming increasingly interested in as a diversifier and value lock. Obviously this is a smaller pharma company with higher risk in the trade, however if I was Regeneron or Johnson and Johnson and I see Axsome’s patents, drug offerings and the general population they are targeting with depression, Alzheimer’s and fibromyalgia, seems like a no brainer to buy them out.

Fundamentals:

AXSM are a Small Bio-Pharma company with market cap of $3.17 Billon. In August 2022 Auvelity Anti-Depressants was FDA approved & is the only rapid-acting oral medicine for MDD with labelling describing statistically significant antidepressant efficacy by one week.

AXSM received Breakthrough Therapy designation from the FDA for an Alzheimer's disease drug development and are at the NDA phase for developing a drug for acute treatment of migraine. AXSM are also developing a treatment for narcolepsy and separately for fibromyalgia.

All in, AXSM's offerings are building momentum. They have developed the fastest acting anti-depressant drug and are bringing it to market, and have a four other drugs in development, all of which have a large patient base. The company would be ripe for a buyout.

AXSM Return to supplyEvery trader worth their salt needs to trade in at least one crappy biotech.

I say trade, but chances are you will end up an investor... just like those guys who bought at $100.

AXSM has a very nice pipeline. The drop was due to incorrect FDA filing. Perhaps the clean up their act and release some drugs for all the kids (and elderly) to enjoy.

AXSM-NICE BULLISH SETUPHello traders, I see a potential short term bullish stock setup. We are in 2 nice bullish flag pattern and testing support area. If we get a nice rejection from 46-47 area and broke the minor bullish flag pattern. It's possible to push upside around 57. Our expectation is %21 return in short time while we risking just %7. Nice risk reward ratio 1-3.

Please support this idea with like If you find it useful. The information given is not a financial advice. I'm just sharing my ideas regarding on my experiences and knowledges. Remember this analysis is not %100 accurate. To make decision please follow your own thoughts.

AXSM ready to move...AXSM is wound up tight as can be and should be ready to move somewhere soon. .616 FIB level have been support inside a tightening range. Watch the 3 day closure as it is making a strong bullish hammer off the EMA's and the .618 FIB level.

Monthly Volume is following PA nicely and EMA's are catching up. Burning the clock in bullish context with bullish PA, looks like a duck but sometimes the goose can be in disguise.