BLDE – VolanX Smart Cycle Activation📈 BLDE – VolanX Smart Cycle Activation

Timeframe: Weekly

Posted by: WaverVanir International LLC | VolanX Protocol

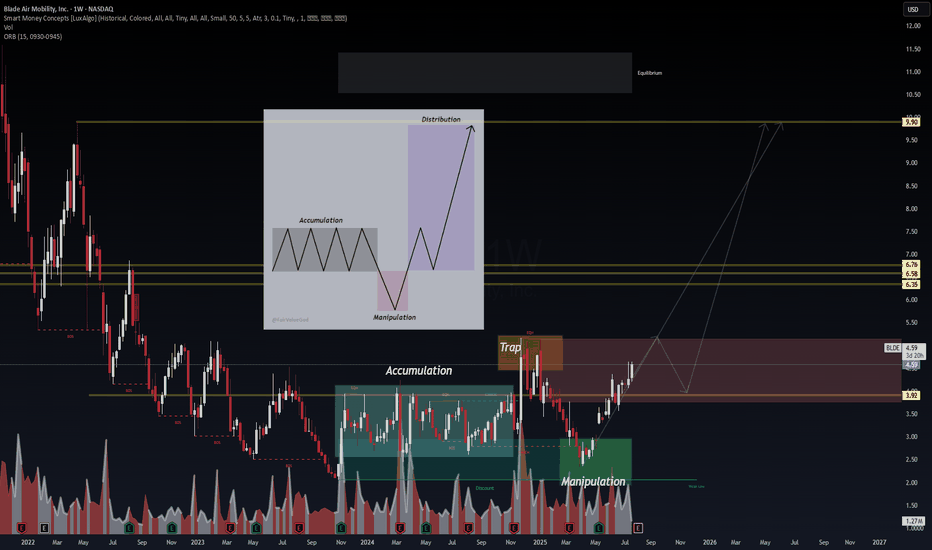

Model: Accumulation → Manipulation → Expansion

After multiple Breaks of Structure (BOS) and prolonged markdown, BLDE has now confirmed a Smart Money Accumulation Cycle. A clear manipulation sweep below prior lows has triggered the upside phase. This chart follows the classic SMC model with:

🔹 Accumulation → Trap → Manipulation → Expansion

🔍 Key Observations:

Accumulation zone: $2.00–$4.00

Trap high: ~$5.00 (liquidity run & rejection)

Clean reclaim of $3.92 structure now acting as launchpad

Next zones of interest:

• $6.35

• $6.58

• $6.76

• Ultimate distribution zone: $9.90

📊 VolanX Thesis:

We are entering a Mark-Up Phase consistent with the VolanX Alpha Expansion Model. As liquidity rotates upward, expect a stair-step climb toward the equilibrium zone near $9.90.

🧠 Strategic Insight:

If price pulls back into the $3.92–$4.10 range, that would be considered a high-probability re-entry for bulls aligned with institutional footprints.

🛡️ Risk Lens:

Monitor for early distribution at $6.76. VolanX Guardian Protocol flags rising volume anomalies in that range.

BLDE trade ideas

WaverVanir_International_LLC | $BLDE Trade Plan ActivationJune 29, 2025 | Chart:

“We don’t predict price. We model narrative probabilities.” – VolanX

🧠 Setup Thesis

Blade Air Mobility ( NASDAQ:BLDE ) is entering a potential Phase 2 expansion cycle after a structural reversal from deep discount levels. Smart Money Concepts (SMC) confirm a Change of Character (CHoCH) from the ~$2.50–$3.00 zone, supported by volume expansion and macro catalyst tailwinds (eVTOL testing, hospital logistics partnerships, strong cash position).

The VolanX Hybrid Predictor, tuned with 0.71 sentiment, projects a neutral-to-flat short-term bias — suggesting a pullback accumulation opportunity, not a breakout chase.

🔍 Key Levels & Trade Plan

✅ Entry Zone: $3.60–$3.80 (Primary), $3.30–$3.50 (Secondary Add)

🛑 Invalidation: Weekly close below $3.10

🎯 Target 1: $5.00 (EQH liquidity)

🎯 Target 2: $6.20 (gap magnet)

🎯 Target 3: $9.90 (macro FVG / high-value zone)

📉 Risk-to-Reward: 1:2.5 to 1:5.5 depending on exit tier

🧬 Catalyst Radar

FAA + eVTOL certifications (2025–2026 roadmap)

Skyports + TOPS logistics network expansion

Potential share buyback or new partnerships

VolanX Sentiment Monitor: trigger re-entry >0.80

⚠️ Risk Disclosure

This post is for educational purposes only. WaverVanir’s views are probability-based and do not constitute financial advice. Always model your risk.

“BLDE is not a meme. It’s a model. Accumulate where they forget, exit where they chase.”

🔐 Posted by: WaverVanir_International_LLC

#BLDE #SmartMoney #eVTOL #VolanX #WaverVanir #TradingView #AITrading #UrbanMobility

3/28/25 - $blde - sizing up 5%3/28/25 :: VROCKSTAR :: NASDAQ:BLDE

sizing up 5%

- i've covered 2/3 of the position for aug exp $2.5 strike b/c the implied 13% yield in this chop for an asset which already trades below fair value for 5 mo looks way better than cash

- but 1/3 of the book which i just added on this ((ridiculous -6%)) move and just a factor-end-of-month-small-cap etc etc. thing... seems like good beta.

- valuation ex cash is $100 mm on this which is almost laughable considering they'll be the platform for all EVTOL in the future, have a great med biz that drove them to profitability. route density for consumer now puts that biz in the black too. so 11x EBITDA here going to 5x in '27 seems... "light".

baby and bathwater. these guys have executed exceedingly well. downside quite limited.

"happy" friday everyone playing this turd casino :)

V

Still bullishRespected the Fibonacci reversal target, we just need it to respect the retracement target and have a nice bounce which is also in a high volume area, so it's very likely. Currently still inside the arch which is nice.

It's all lining up very nicely so we shall see if it reaches the target. (Red level of key resistance)

Not important but worth mentioning:

My original drawings were rusty and not my best work, especially with the arch, it was my first time using it. Hopefully this refresher is better. Trial and error. :)

2/27/25 - $blde - playing tmdx here...2/26/25 :: VROCKSTAR :: NASDAQ:BLDE

playing tmdx here...

- sometimes fishing in the non-passive pools can generate some interesting buys as these things get whipped around as if they're being sanctioned, tariff'd or otherwise _____

- NASDAQ:BLDE 's product remains solid. valuation cheap. i'll leave it there. it's a small cap. it could go either way. but the basis is good.

- NASDAQ:TMDX supplies these guys the organ/ medical devices they use to fly around and that's become a pretty big biz for them. the TMDX story has more hair on it than anything. i'm almost tempted to short the print but... i'm not gonna. and i'd like to hedge NASDAQ:BLDE here w/ NASDAQ:TMDX bc i think a massive miss on NASDAQ:TMDX will yank NASDAQ:BLDE back below $3 pretty quickly and i'd want ammo to go.

- so instead of buying outright, i'm loading deep ITM calls on NASDAQ:BLDE for august. the idea is. i want to do 2-3x leverage and in event i'm right... i get paid right away. if i'm wrong, my left arm doesn't need to grow back.

- 3% position gross (post leverage) is all i'm willing to neck here on NASDAQ:TMDX AH print. i'm looking for a nice beat to then front-run the NASDAQ:BLDE tape AH to load shares if we get a pass.

V

2/12/25 - $blde - Adding more2/12/25 :: VROCKSTAR :: NASDAQ:BLDE

Adding more

- last note in 11/18/24 spells out logic on valuation

- not much has changed, but the px went up substantially

- i get the sense ppl trade NASDAQ:BLDE like their other profitless low bid low liquidity trash

- so on a day like today where it gets hammered, it feels more tape-related than fundamental, and i'm usually a buyer

- this is a name i've been incubating, but i'm not stepping it up in the PnL, looking to add more

- the NASDAQ:TMDX association keeps me still less optimistic bc that's a dumpster fire and needs resolution and esp given it's a relevant link to the co's reputation etc. etc.

- so let's see

- but i like putting some of the heavy cash balance to work today

V

11/18/24 - $blde - LT buy under $3.2, going slow11/18/24 :: VROCKSTAR :: NASDAQ:BLDE

LT buy under $3.2, going slow

- have written extensively about this one in the past, so won't dive into details but here's the incremental

- mgmt continues to deliver solid results, turned FCF +ve already and are on track to meet MT targets

- it's in my portfolio sub $3.15 again for a 1.5% size (shares, not options - more on this below), as any risk off event possibly has this retesting $3 again or that $2.8 support, but it's already good enough value for me to begin legging in again

- so what's the way to think about math on this thing w/ such high cash balance (net cash). here's my logic.

- 12 mm "FCF" in '25 seems reasonable. and $30 mm in '26 seems reasonable too.

- let's say $25 mm in '26, and acknowledging we're basically growing FCF at some pretty good pace at that pt, a 10% discount rate would seem to give you enough wiggle room where nobody would argue (AND! assume no growth) that's... 25/0.1 = $250 mm enterprise value

- so let's further "discount" that 250 by 25% to incorporate a '25 YE target and with some (again) healthy conservatism b/c after all, this *is* a small cap and it's more of a market-related risk IMO not a biz risk, so 25%... that's $250/1.25 = $200 mm. $200 mm vs. the EV today of $135 mm is $65.

- so let's add $65 now to the market cap of $250 today... so the implied equity value on this logic at YE'25 would be $315. $315/$250 today = about 25% upside. and that 25% on today's stock price puts us near $4

- so my logic says discount ANOTHER 25% to get YE'24 target and you're basically at $3.2 today (PS - i never reverse engineer my logic! this is where it comes out).

- so buying in the sub $3.5 territory I think is good MT accumulation. Sub $3 better and anywhere in recent support territory $2.8 below is for all practical purposes a "no brainer" and i'd probably be back to a 3-5% position there.

- for now 1.5% feels comfy for a name I know well.

What do u think?

V

Blade Air Mobility Inc. | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

8/6/24 - $blde - Big into print ~2.8/shr8/6/24 :: VROCKSTAR :: NASDAQ:BLDE

Big into print ~2.8/shr

- have written before that value <$3 and deep f'n value <2.5

- we have a setup where the stock clearly looks like it was whacked on small cap flows (if you watch any number of small caps you'll notice the same -30% move in the last weeks)

- as a reminder these guys fly around organs (a better ambulance business) and also ppl with more disposable income to the airport (i have always pitched it as "uber for rich people"). it's a good service.

- they have piles of cash and will be profitable this year

- this thing trades as if it's any other run of the mill SPAC (there are a few that have broken out and shed this taint - NYSE:HIMS is a good example).

- but the valuation on NASDAQ:BLDE is particularly compelling b/c of the inflection to profitability and massive cash stack

- i'd not be surprised if NYSE:UBER buys this company in the next 12 months. it checks that box i look for as well.

- while this *shouldn't* be such a negative, but it is, our friend Cathie is the largest shareholder at 8%. she's just been such a contra-indicator that it's worth noting

- i'd also flag two notable "gaps" in the chart. one at the ~2.5$ level from March '24 and one at the ~$2.3 level in Nov '23. while market markets like to fill these for reasons i won't get into - it's typically more relevant for larger stocks (and more liquid options chains) than smaller caps. so any beat will render these gaps effectively useless.

- HOWEVER, they are relevant b/c any miss or mediocre result does probably tend to at least the $2.5 level.

- the way i've been navigating these mkts lately is only finding stuff i'm comfortable buying with 20% dips. this means i goal seek for a size where i like the stock as is, and any lower i'm not feeling like i need to cut and run and take the L. this is one of those.

- so while i think the multi-year upside and genuinely the setup b/c of the small cap setup (and sell off) puts this in a good space for a 10%+ move and continued run (i think 15-20% is possible but i'm not counting on it)... i'm also aware that it's a very small cap company in a tape that is ruthless and might still not be done puking at any given time.

so while risky. i like the valuation. i like the setup b/c of the hole that small caps put in the chart (as if this were any of those - and it's not IMHO). and i'm conscious of the gaps lower. oh... these guys buyback shares ;)

I'm 5% size into the print. i'll take it toward 10% the closer we go to low $2's (assuming there's nothing fundamentally *wrong*) and probably a 5-7% position if good result but we dip - similar to what we saw on NASDAQ:CELH and i've been adding, same with NASDAQ:NXT logic.

that was a long one. if you're still here - thanks.

let's see.

V

6/14/24 - $blde - value <$3, DFV <$2.56/14/24 :: VROCKSTAR :: NASDAQ:BLDE

While we're on blast from the past names (go check out NASDAQ:POWW write up today on the whack move), i figured this should be a good oppty to update my thinking on $blde.

I've traded this oscillator since the IPO and probably my higher hit rate (i've only traded it long and made money 100% of the time, probably 10x over).

so it's one i'm very familiar with.

i call it "uber for rich people" or which is becoming "uber for rich people and dead people's organs"

both are great businesses, but the med biz is the real grower/ $TDMX is such an obvious buyer for this biz - but we can address that in the future.

so what's the latest here?

3Q's ago late '23 co reported +ve net income. heck yes! they told us all the seasonally the next q wouldn't be profitable but they're defn making progress toward that in '24. cool.

but the market for names that are tiny and not well institutionalized doesn't read press releases and so when they reported lower sales and op profit in 4q (early this year in Mar) the stock had an OMG WTF WEN GO PROFIT AGAIN

the smart money (hello btw) bout the LIVING DAYLIGHTS out of that dip to $2.5. it wasn't easy though i'll tell u. it never is. and it never gets easier (though it helps to see it many times in many situations so you can size manage and manage emotions too).

we slingshot way past fair value (which i was thinking was ~3ish and so when we touched $4 i was out in the low 3's already having gone "oh well").

well here we are again. sub $3. with a great business, the tourists back out of the stock having driven it higher w/ their expired options OTM and worthless. between $2.5-$3 is a sliding scale of value.

the stock has SO MUCH CASH that the enterprise value is $100 mm which is basically 2x gross profit growing teens. that's hella cheap for a breakeven biz this year inflecting next, w a high growth medical segment that keeps finding ways to grow faster.

competent management (thank gawd - at this size company u never know)

so it's a buy here <$3. for me it's a 1.5% position, but more a placeholder for me as i'd like to size up if we get some further risk off on the macro side of things and end up closer to the $2.5 mark again. it's an EXCELLENT stock to rent out to the tourists with high IV when it starts to pump. and that's a big consideration for the positions i take.

anyway. will update more if/as things unfold but wanted to drop my thoughts on a small cap that i believe is a multi-year compounder at a good value (not great) today and worth keeping on your radar.

have a good weekend fam

V

PS - DFV... deep f'kn value if u r not familiar with the roaring kitty's handle lol

RiskMastery's Breakout Stocks - BLDE EditionWelcome to RiskMastery's Breakout Stocks - Stocks with breakout potential.

In this edition, we'll be looking at NASDAQ:BLDE ...

I believe this code is at a point of potential volatility.

If price can hold above $3.73 ... Bullish potential may be unlocked.

My key upside targets include:

- $4.60 (Conservative)

- $6.59 (Medium)

- $8.50 (Aggressive)

If however price falls below $2.58 ... Bearish risk potential may be unlocked.

(My key risk targets - C, M,& A - are as noted on the chart)

Enjoy, and I look forward to being of further service into the future.

If you'd like to connect, feel free to reach out and comment below.

Mr RM | Risk Mastery

Disclaimer:

This post is intended for educational purposes only - Publicly available RiskMastery information & content is not intended to be financial advice in any shape or form. Please do your own research and seek advice from a licensed professional before acting on any of the information contained within this post. This post is not a solicitation or recommendation to buy, sell or hold any positions in any financial instrument. All demonstrated trades are merely incidental to the educational training RiskMastery aims to provide. You are solely responsible for your own investment and trading decisions, of which should be made only according to your own opinion, knowledge and experience. You should not rely on any of the information contained on this site or contained in any RiskMastery material on any website or platform. You assume the sole risk of any trade or investment you elect to make. RiskMastery and affiliates shall not be liable to you for any monetary losses or any other damages incurred directly or indirectly, from your use, reliance or reference of RiskMastery materials, content and educational information. Thank you for your understanding and cooperation - We look forward to working with you into the future to navigate the fine line of trading and investment success.

BLDE Blade Air Mobility Options Ahead of EarningsAnalyzing the options chain and the chart patterns of BLDE Blade Air Mobility prior to the earnings report this week,

I would consider purchasing the 5usd strike price Calls with

an expiration date of 2024-8-16,

for a premium of approximately $0.60.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$BLDEBlade Air Mobility Inc has fallen Monday morning, with the stock decreasing -5.24% in pre-market trading to 10.66.

BLDE's short-term technical score of 20 indicates that the stock has traded less bullishly over the last month than 80% of stocks on the market.

In the Airports & Air Services industry, which ranks 47 out of 146 industries.

BLDE ranks higher than 23% of stocks.

Blade Air Mobility Inc has risen 55.60% over the past month, closing at $7.66 on August 23.

During this period of time, the stock fell as low as $7.66 and as high as $11.25. BLDE has an average analyst recommendation of Strong Buy.

The company has an average price target of $15.67.

When we look at the technical side of things we can see it’s broken above resistance and even with yesterday’s markets fall it was still able to stay above resistance.

We could say previous resistance is now acting as support on the lower timeframes.

We have the MACD sitting comfortably above 0.50 and the RSI above 50.

I’m fairly bullish on this.

Keep this on your watchlist.

- Factor Four

BLADE long term hold. Daily chart on BLADE is showing us that it is attempting to break the line of resistance. MACD looks to be closing green but it is staying stagnant. RSI seems steady and i do see this stock undervalued at the moment. ARK invest keeps on buying this company which to me is a bullish sign for this stock. This is a long term hold for me.