CAN Long: Bullish Reversal Setup with Upside Potential to 1.55Canaan Inc. ( NASDAQ:CAN ), a key player in Bitcoin mining hardware, has endured a steep downtrend throughout 2025, sliding from peaks near 3.50 down to recent troughs around 0.80 amid crypto sector headwinds. However, the chart is flashing signs of exhaustion and a potential bullish reversal, with price stabilizing and momentum indicators turning positive.

Technical Analysis:

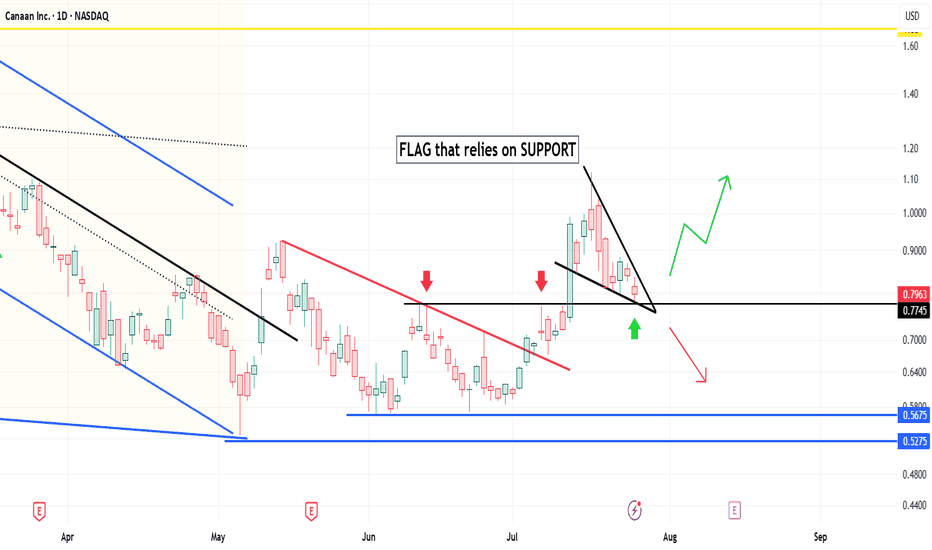

Price Action and Structure: After a series of lower highs and lows, the stock has bounced from support near 0.80, with the latest close at 0.8503 showing buyer interest. Price is pushing against a descending trendline (red down-arrows) and exiting a consolidation cloud (likely Ichimoku Kumo, shaded purple), which could transition from resistance to support on a sustained breakout.

Key Levels:

Support: Immediate floor at recent lows (~0.80), with deeper support at S1 (0.4603) if selling resumes.

Resistances: Layered overhead including R1 (1.0666), R2 (1.0830), R3 (1.2409), R4 (1.3969), and R5 (1.5669). Targeting the higher end near 1.55 aligns with extension toward R5 for a stronger move.

Indicators:

The lower panel oscillator (resembling MACD with red/green bars and lines in red, green, yellow) displays a bullish crossover: green line above red, histogram shifting from red (bearish) to blue/green (bullish). This suggests momentum divergence and potential for upside continuation.

Volume spikes on recent upticks reinforce buying pressure.

Trade Setup:

Entry: Enter long at current levels around 0.85, or wait for a close above cloud resistance (~0.90) for confirmation.

Target: Take profit at 1.55 (near R5 confluence), offering approximately 82% upside from entry based on chart projections and historical patterns.

Stop Loss: Place below key support at 0.57 to account for volatility, providing room for minor pullbacks while protecting capital.

Risk/Reward Ratio: About 2.5:1 (reward of 0.70 vs. risk of 0.28 per share), a solid setup for the potential reversal in this high-volatility stock. Size positions to risk 1-2% of total capital max.

Invalidation: Exit if price breaks decisively below 0.57, signaling downtrend resumption toward lower supports.

CAN trade ideas

last chance the set up is there sure earnings came out its okmonthly rsi bounced back above the 30 line as previous times in the past

in the weekly timeframe attached the rsi dipped far into 30 indicating oversold areas and by looking at the volume that accumulated around this price range it can indicate a rebound back up if bulls were to maintain these current price sure price can break into the low 0.70s a bit maybe more interest arises than as price drops

fundamentals look aligned with technicals and we can even say the company is undervalued.

monthly weekly daily timeframes were bullish up until pre market before markets open till now volume against the stock willing to sell is weak

CAN BUYBUY CAN at .40 to .25, riding it back up to 3.20 to 6.50 as Profit Targets, Stop Loss is at .10!

If anyone likes mumbo jumbo long useless analysis, than this is NOT for you.

Also, if you are afraid of risk, failure, and want only a 100% sure thing, than

run as fast as you can from here and from the markets,

because it is definitely NOT for you.

WARNING: This is just my opinion of the market and its only for journaling purpose. This information and any publication here are NOT meant to be, and do NOT constitute, financial, investment, trading, or other types of advice or recommendations. Trading any market instrument is a risky business, so do your own due diligence, and trade at your own risk. You can loose all of your money and much more.

Company Overview: Canaan Inc. (CAN)Canaan Inc. is a leading provider of high-performance computing solutions and is primarily known for its focus on blockchain and artificial intelligence (AI). Below is a breakdown of the company’s profile, operations, and its role in the market.

__________

Company Background

Canaan Inc. (NASDAQ: CAN) is headquartered in China and operates at the forefront of the blockchain hardware industry. It is one of the first companies to deliver ASIC-powered Bitcoin mining machines. The company’s flagship products are branded under the "AvalonMiner" series, which are recognized for their energy efficiency and high computing power, making them crucial for cryptocurrency mining operations.

__________

Key Business Segments

Blockchain Hardware:

Canaan is renowned for designing and manufacturing Application-Specific Integrated Circuits (ASICs).

Its products cater to cryptocurrency mining, specifically for Bitcoin, and are widely adopted by miners globally.

Artificial Intelligence:

The company is expanding into AI applications by leveraging its ASIC chip expertise.

It focuses on delivering high-performance edge computing solutions for AI.

Research and Development (R&D):

Canaan invests heavily in R&D to improve chip efficiency and innovate new solutions for blockchain technology and AI.

__________

Recent Developments

Financial Growth and Challenges:

The company has faced challenges due to the volatility of cryptocurrency markets, which affects mining demand.

Recent financial reports highlight strong revenue recovery, driven by Bitcoin's resurgence and growing demand for mining hardware.

Global Expansion:

Canaan has been actively expanding its operations globally to mitigate regional risks, particularly in light of China's stricter regulations on cryptocurrency mining.

Innovation in Mining Technology:

New AvalonMiner models aim to enhance hash rates and energy efficiency, offering miners a competitive edge in profitability.

__________

Competitive Edge:

Canaan’s early-mover advantage in ASIC chip manufacturing positions it as a significant player in the blockchain industry.

With expertise in custom chip design, Canaan is also exploring adjacent markets like cloud computing and AI-powered data centers, which could diversify its revenue streams.

__________

Risks

Cryptocurrency Dependence:

The company’s revenue is tightly linked to Bitcoin’s price, which makes it vulnerable to market downturns.

Regulatory Environment:

Global regulatory scrutiny of cryptocurrency mining poses risks to its operations.

Competitive Pressure:

Canaan faces stiff competition from other mining hardware companies such as Bitmain.

__________

Technical Analysis

Weekly Chart Analysis for CAN

On the weekly chart, CAN is trading pre-market at $2.69, near its recent price range. Historically, the stock peaked at $39.10 and reached a low of $0.72, showing significant volatility over time.

Key Indicators:

- RSI (Relative Strength Index): At 72, the stock is currently overbought, signaling strong upward momentum but also caution for potential pullbacks.

Directional Movement Index (DMI):

- DI+ is at 38, indicating strong bullish pressure.

- DI- is at 6, reflecting minimal bearish influence.

- ADX (Average Directional Index) is 36, confirming a strong trend.

- ATR (Average True Range): At 0.3841, the stock exhibits relatively high volatility for its current price level.

The price is attempting to break out of a long period of consolidation. The RSI and ADX values suggest momentum is building; however, traders should monitor for potential profit-taking or a reversal due to the overbought condition.

__________

Hourly Chart Analysis for CAN

On the hourly chart, CAN is trading at $2.69 pre-market, showing short-term bullish trends with a low of $1.44 and a recent high of $3.10.

Key Indicators:

- RSI: At 50, the stock is neutral, indicating balanced momentum with room to either strengthen or weaken.

Directional Movement Index (DMI):

- DI+ at 26 reflects moderate buying pressure.

- DI- at 22 suggests sellers are also active, making the trend less decisive.

- ADX at 18 indicates a weak trend that is yet to solidify.

- ATR: At 0.1163, the hourly chart reflects lower volatility compared to the weekly perspective, suggesting tighter price action.

The hourly price action shows an uptrend following the break of $1.44, but the pullback from $3.10 suggests resistance at higher levels. Current indicators suggest consolidation, with a potential retest of recent highs if buying pressure increases.

__________

Sources:

Canaan Inc. Bull Case Theory on Yahoo Finance - finance.yahoo.com

Stock Analysis Overview for CAN - stockanalysis.com

Canaan Creative Investor Relations - investor.canaan-creative.com

Canaan (CAN) Historical Pre-2020 Rally Setup ReformingI know, I know. Past performance is no guarantee of future results. But man, just look at that Bollinger Band constriction, the huge weekly RSI divergence, and the fact that the current setup lines up almost identical to the pre-2020 rally.

With China's liquidity taps back on and BTC looking primed to begin a new bullish phase (provided Trump wins the election), this just looks too good (imho) to not breakout from here.

NFA, I'm just publishing this for myself to look back on at a later date.

Yes We CANCanaan Inc. (CAN) has had several bullish developments recently. The company continues to focus on expanding its bitcoin mining operations and strengthening its balance sheet through strategic financing and share purchases. Some key highlights include:

Operational Growth: Canaan's bitcoin mining capacity increased significantly, with a 58% boost in computing power by May 2024, reaching a total of 4.0 Exahash/s. This growth comes from re-energizing machines in Kazakhstan and other projects.

Strategic Investments: The company's CEO and CFO announced plans to personally invest no less than $2 million in Canaan’s shares, signaling confidence in the firm’s long-term growth potential. This can provide a positive signal to investors.

Preferred Share Financing: Canaan completed a third tranche of preferred share financing in September 2024, further bolstering its financial position and liquidity

In addition to these specific catalysts, there has been a broader rotation into Chinese tech stocks as investors are seeing opportunities in undervalued sectors like crypto and AI amidst China's economic reopening and government support for technology innovation. Canaan, as a leading player in bitcoin mining hardware, is poised to benefit from this renewed interest.

These factors collectively provide a bullish outlook for Canaan in both the short and long term.

CAN and the importance of consistency and disciplineCAN is a stock I've been trading frequently lately. See the chart above for its entire trading history.

It opened its first day of trading at 12.60 and closed yesterday at 1.21 - a 90% loss since day 1. This has clearly been a wealth destroyer and a stock most people would say to run from as fast as you can - and they wouldn't be wrong. Trading up trending stocks is the easy way to make money. But the fact that stocks do not move in straight lines is my biggest argument for what I do - short term trades that take advantage of those fluctuations.

Now when I first sat down on this slow Saturday night to go back and look at every trade I would have taken with this stock and my system, what I expected to see was a net loss, but not nearly as big as the 90% buy and hold loss. I was going to use this as an example about how being disciplined and consistent can minimize losses even in down markets. What I ended up seeing was something entirely different.

First of all, some stats. The best trade in this stock would have made 59%. The biggest loss is an ugly -95% and counting. In addition to that loss, there are 10 more open trades that have returned so far anywhere from -94% to -75% with 5 of those that have lost 90% or more. The 95% loss was opened near that giant peak @22.97/share.

Now everyone's first thought is "this is why stop losses are so important". And I won't argue with them too much. But with what I do, I've historically found them to lock in rather than prevent losses. But they are preached for a reason - they're generally a good idea. I just don't use them. You will have losing trades - it's inevitable. We all do. What I do is combat inevitable losses with consistency and very high percentage trades. Hear me out.

My approach - take VERY high percentage trades and hold them until they are profitable. Some will never be. Some will lose 95% if I don't use stop losses. But if I make trades that work out frequently enough, those 95% losses are dampened by the cumulative effect of the wins. So here is the rest of the story on CAN.

I chose CAN because it is a nearly worst case scenario stock. The cumulative record of the system I use is 155-11 on CAN. That means 93% of my trades and exits would be wins on a stock that is down over 90% in that time. What makes this work is the cornerstone of what I do and I can't say this loudly enough.

1) ALWAYS USE EQUAL DOLLAR LOTS

2) KEEP LOT SIZES SMALL ENOUGH

3) FOLLOW THE RULES ON ENTRY AND EXIT

Good trading takes discipline, and believe me when I tell you I learned this the hard way. I've lost a LOT of money over the years trading because I got greedy or because I got scared. Now I also didn't have systems that suited my personality well and that didn't help. But I learned how to lose money long before I learned how to make it.

I tried to get rich quick using position sizes that were much too large. I tried making up for early losses with bigger trades stacked on them figuring the stock HAD to turn in my favor soon. I exited winning trades too early when the sting of a big loss was fresh in my mind. What I learned from all that wasn't just how to lose money. I learned what I needed to do to make money. It took me years to figure out a method of trading that used my hatred of losing advantageously. I knew I'd be stubborn and hold losing trades too long, so I had to find a method won so often that the losers became irrelevant. It wasn't easy, and don't think I'm arrogant enough to think the market can't teach me another lesson. I'm sure it will, and it's why I warn everyone that what I'm doing here is edutainment. But new traders can learn from me and others who have taken their lumps.

There isn't just one way to make money trading. You can lose 75% of your trades and still make money consistently IF YOU ARE DISCIPLINED. But trading that way requires a very different personality than what I do and VERY different money management techniques.

And I will tell you it isn't easy to stay disciplined. When you have a system that wins 90% of its trades, it's tempting EVERY DAY to break the rules and go for a "big score". But all it takes is for that trade to be one of the 5% that not only goes to zero, but ties up all your trading capital while it does so you can't make 20 other winning trades to offset it, and you're done.

Even TERRIBLE stocks can be traded effectively with the right system executed in a consistent, disciplined way. My trades in CAN would have (including those huge losers), averaged +7.2% per lot traded. The median was +7.5% and the total return since 2020 would be 12x lot size. Now that isn't that great, especially since at peak I would have been holding 24 lots. That's a VERY important statistic when it comes to position sizing. Even at $100 per lot, that's $2400 for just that one position. If other positions are tying up capital, as is often the case in strong bear markets, it would be VERY easy to run out of money before winning trades have a chance to cumulatively offset the big losers. That's why each lot is capped at around .1% of trading capital for me.

I also always keep in reserve enough that all open positions I have could have up to 25 lots each and still be liquid. It also means I can't trade every signal I get and I have to be selective. That takes discipline and means that a lot of the time I'm 50% or more in cash. It's very tempting not to be when the market is on a tear like it has been recently. But my mistakes have taught me to follow the rules and be happy with being able to consistently grow my trading account (which allows for larger lot sizes each year btw - same % though).

With CAN for example, the -95% trade would have been the 42nd of 166 trades and the other 5 -88% or worse trades were the next 5 after that. Not being able to make the last 100 trades because I'm out of money is the difference between losing money and making almost 50% total return on those 24 lots worth of capital I'd have needed to make the rest of those trades. 50% over almost 5 years isn't a super impressive return. But this was also a stock down 90% in that time. That discipline translates to the trades in stocks that are up 500% too.

Stock picking is great if you can do it well. I started out doing that and learned I'm OK at it, but not good enough. What I've learned is that a good strategy, paired with consistency and discipline makes stock picking a lot less important. CAN is proof of that.

Canaan - long position 1300% Profit

Canaan stock has experienced a downtrend since March 2021 without any apparent reason. Despite this, it's essential to note that Canaan is one of the top Bitcoin Mining Companies, boasting a price to book value under 1 and having no debt. Additionally, they have successfully sold many miners in 2023 to prominent companies like Clean Spark and others.

In our opinion, this stock appears to be significantly undervalued at the moment, and we believe the current pullback is likely just a correction, presenting an opportunity to consider adding more to one's investment.

- Can't missed this!

CAN, HUGE growth prospect. Can't missed this!CAN, has recorded significant net buying this past few days with volume surging +70% from 2.66M to 4.32M. This is hinting of significant accumulation in anticipation of the awaited growth season.

On weekly histogram, the stock registered higher lows - the shifting interval is 6 months. This depicts an initial trend reversal move with the current price range as the new base.

Pricewise, weekly descending trendline has been broken. The stock is currently sitting at 1.0 FIB Level, this is beyond bargain-discount already. The current levels is providing an attractive price to seed. The range is also hovering a 2.7 year longstanding solid support at 2.0 range and it is bouncing off it with precision.

Expect some significant price valuation from the present price level.

Spotted at 2.4

TAYOR

Safeguard capital always.

CAN Canaan Options Ahead of EarningsIf you haven`t bought CAN before the previous earnings:

Then analyzing the options chain and the chart patterns of CAN Canaan prior to the earnings report this week,

I would consider purchasing the 1usd strike price Calls with

an expiration date of 2024-5-17,

for a premium of approximately $0.08.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CAN it recover? Another strong weekly RSI divergence spottedCAN has been one of, if not THE, worst performing mining stocks this cycle.

Like the rest, it's completely decorrelated from the recent BTC price action and looks a little oversold to me.

Weekly RSI divergence been building really nicely though since end of December.

Just publishing this idea to track how it plays out post-halving. I might take a small punt if it dips back to its recent low/ nips under a dollar.

Improving Macro Picture Points To A Better Future For CAN Pt2Reloading this trade based on the chart breakout.

Very steep pullback after the last breakout.

Lets see if we now have the energy to continue moving higher.

The bottoming of the business cycle and rising

liquidity should now begin to drive bitcoin and Crypto assets higher.

Price to book value 0.62

Price to Tang. book 0.68

Price to free cash flow 1.86

Price to sales 1.04

Value indicators point to a turn around.

Small Cap

Value

High beta

Technology

Nasdaq

Semiconductors

The company ticks all the right boxes for the

current Macro Economic backdrop of Spring, soon to be summer.

Positive Macro Conditions likely to last for 12-18 Months

allowing for trade advancement and maturity.

Based on the price signature, a strong move higher

of many multiples should now be underway.

Continued advancement of bitcoin most likely

needed for positive outcome.

Trendchanges and its author are not registered financial advisors. Everything that is documented by Trendchanges and its author within the news letter or online should be interpreted as market commentary and not as investment advise or instructions to buy or sell any financial asset.

Trading and investing carries risk and you should fully understand the risks involved.

Its recommended that you confer with an independent financial advisor who can assess the risks for your own financial situation. This is important as trading can result in the complete loss of your capital. If trading on margin losses can exceed your original deposit.

Trendchanges and its author will not accept any liability for any losses resulting from the use of the material presented if readers do decide to take action as a result of information communicated in the newsletter or online.

Although every effort is made to insure the accuracy of the information contained within this publication, Trendchanges and its author does not guarantee the accuracy of the information, either from the content within or from any external third part links which my be used.

Past trading performance is not an indication or guarantee of future results.

Improving Macro Picture Points To A Better Future For CANThe bottoming of the business cycle and rising

liquidity should now begin to drive bitcoin and Crypto assets higher.

Price to book value 0.62

Price to Tang. book 0.68

Price to free cash flow 1.86

Price to sales 1.04

Value indicators point to a turn around.

Small Cap

Value

High beta

Technology

Nasdaq

Semiconductors

The company ticks all the right boxes for the

current Macro Economic backdrop of Spring, soon to be summer.

Positive Macro Conditions likely to last for 12-18 Months

allowing for trade advancement and maturity.

Based on the price signature, a strong move higher

of many multiples should now be underway.

Continued advancement of bitcoin most likely

needed for positive outcome.

Trendchanges and its author are not registered financial advisors. Everything that is documented by Trendchanges and its author within the news letter or online should be interpreted as market commentary and not as investment advise or instructions to buy or sell any financial asset.

Trading and investing carries risk and you should fully understand the risks involved.

Its recommended that you confer with an independent financial advisor who can assess the risks for your own financial situation. This is important as trading can result in the complete loss of your capital. If trading on margin losses can exceed your original deposit.

Trendchanges and its author will not accept any liability for any losses resulting from the use of the material presented if readers do decide to take action as a result of information communicated in the newsletter or online.

Although every effort is made to insure the accuracy of the information contained within this publication, Trendchanges and its author does not guarantee the accuracy of the information, either from the content within or from any external third part links which my be used.

Past trading performance is not an indication or guarantee of future results.

Canaan Raises $50 Million to Bolster Crypto Mining Production

In a strategic move to fortify its position in the competitive crypto mining industry, Canaan, ( NASDAQ:CAN ) a prominent mining rig manufacturer listed on Nasdaq, has successfully raised over $50 million through preferred shares financing. The company aims to utilize the funds to enhance its research and development capabilities, expand production scale, and address general corporate needs. Despite the recent funding success, Canaan's ( NASDAQ:CAN ) stock has experienced a notable decline of 32.87% since the beginning of the month.

Key Points:

Capital Injection for Expansion:

Canaan disclosed in a recent filing that it secured the capital from an undisclosed institutional investor by issuing and selling up to 125,000 series A convertible preferred shares. The company has expressed its intention to deploy the net proceeds for research and development initiatives, expansion of production scale, and other general corporate purposes.

Market Performance:

The announcement of the financing coincides with a 6.45% decline in Canaan's ( NASDAQ:CAN ) stock, closing at $1.45 on Thursday. The stock has witnessed a substantial 32.87% decrease since the beginning of the month, reflecting the challenges faced by the company in the current market dynamics.

Q3 2023 Financial Report:

Canaan's ( NASDAQ:CAN ) financial performance in the third quarter of the previous year revealed a significant shift, with the mining rig maker reporting a net loss of $80.1 million. This is a notable contrast to the same period in 2022 when the company reported a net income of $6.3 million, indicating the volatility and challenges prevalent in the crypto mining sector.

Strategic Partnerships:

Despite market headwinds, Canaan ( NASDAQ:CAN ) has recently secured follow-on purchase orders for over 17,000 bitcoin mining machines. The orders come from Cipher Mining Inc. and Stronghold Digital Mining Inc., both Nasdaq-listed companies, showcasing Canaan's ability to maintain strategic partnerships in the industry.

5. Future Outlook:

The infusion of $50 million in preferred shares financing is expected to position Canaan ( NASDAQ:CAN ) for future growth and innovation. With a focus on research and development, the company aims to stay competitive in the rapidly evolving crypto mining landscape, marked by technological advancements and increasing demand.

Conclusion:

Canaan's ( NASDAQ:CAN ) recent financial maneuvering underscores the challenges faced by crypto mining companies amid market fluctuations. The infusion of $50 million in capital reflects a strategic effort to navigate these challenges, with a clear focus on innovation and expansion. As the crypto industry continues to evolve, Canaan's ( NASDAQ:CAN ) ability to adapt and leverage strategic partnerships will be critical for its sustained success in this dynamic market.