Upside break likelyNASDAQ:CEG Constellation Energy Corp (US: CEG) is likely to break above after the bearish gap has been filled multiple times and closes higher. Ascending triangle formation is likely to see bullish continuation to the upside and major uptrend remain intact since its inception. Volume remain healthy.

Long-term MACD shows steady state of bullish momentum.

Despite showing overbought by our mid-term stochastic oscillator, the stock has yet to see adverse correction and bullish pressure remain healthy.

23-period ROC declines but maintain a positive value and Directional movement index shows strong bullish strength.

Strategy

Buy spot @ 345.27 . Buy limit @ 311.65 in the event of a correction..

1st Target is at 420.00 (Est 1 month)

2nd Target is at 780.00 (6 months and beyond)

CEG trade ideas

CEG on the watch listI have been following CEG for a while and am looking to obtain more energy expansion in my portfolio. I would LOVE to buy this stock closer to 275, but this might now happen. There have been weekly wicks into the top of the buy zone, so far I have missed the opportunity as I am in other plays. We note a ranging stochastic, and very elevated volatility. This is because energy growth stocks are associated with Ai expansion. CEG recently partnered with microsoft to restart the 3 mile island nuclear plant but with upgraded technology and safety features. The market might still be soured on nuclear, but it remains a very effective energy source.

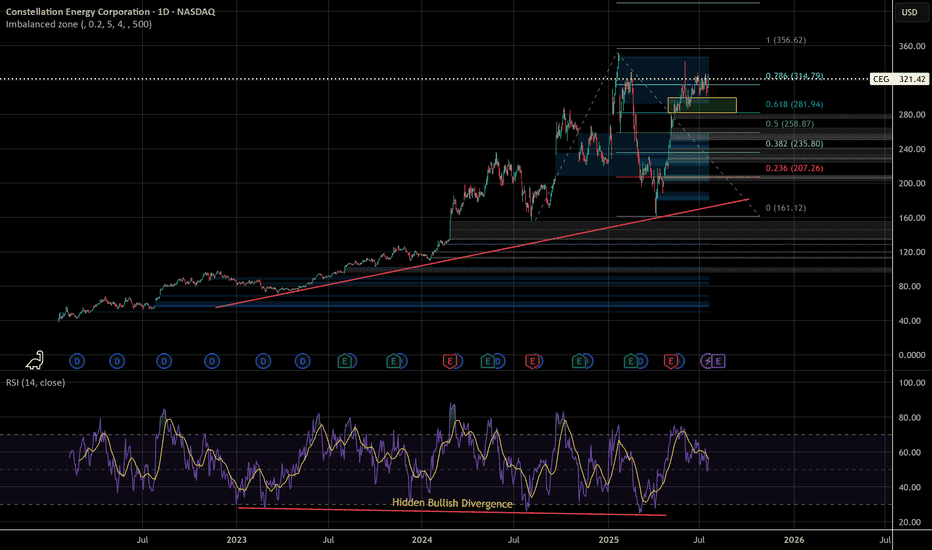

CEG eyes on $224: Golden Genesis that could mark bottom CEG is trying to recover along with the nuclear sector in general.

Currently orbiting a well established Golden Genesis fib at $224.06

Look for a clean bounce off this fib to continue the recovery climb.

==========================================================

.

Here’s the updated version with your additions: --- SpeculatiHere’s the updated version with your additions:

---

Speculative Madness: The Market’s Bubble Stocks

Some stocks aren't just overvalued—they're in full speculative bubble mode. Fundamentals? Irrelevant. When euphoria takes over, rationality disappears.

Here’s my list of bubble stocks that scream unsustainable pricing:

SBUX, T, PLTR, BMY, PYPL, NFLX, GS, ISRG, ARM, C, SHOP, BSX, SPOT, UBS, IBKR, RELX, CEG, CRWD, MSTR, MMM, DASH, COF...

And let’s not forget the obvious: TSLA, META, AMZN, AVGO, GOOGL, JPM, MA, V, WMT.

Honestly, the entire banking sector, brokers, and tech are in bubble territory.

What the hell is going on with this market? Why are algos just buying, buying, buying, squeezing all the shorts?! Unbelievable.

The dump will be insannnnnnnne!!! 🚨

CEG PUT ON WATCHLISTThis Weekly FORECAST

Opportunity for CEG. This setup is my trading idea/plan, if you want to follow: trade at your own risk (TAYOR).

Risk Factors:

1. Market conditions, unexpected news, or external events could impact the trade.

2. Always use risk management strategies to protect your capital.

Hits the volume box does it decline and head back low 200sThe stochastic is the only bullish indicator for me right now. Other than that, it's hanging from a thread and needs a good catalyst. Earnings weren't, but they have been consistently running this past week. However, due to the positioning, we can use the high V box as the resistance mark unless it breaks and forms a new pattern.

CEG Long (Stop Limit)Asset Class: Stocks

Income Type: Daily

Symbol: CEG

Trade Type: Long

Trends:

Short Term: Down

Long Term: Up

Set-Up Parameters:

Entry: 237.90 (at the Breakout)

Stop: 223.79

TP 223.79 (3:1)

Trade idea:

A price pin into a daily Fair Value Gap , Buying the Stop as the price pullback and the SL at the last swing low. The trade setup also use the Elliot wave analysis, where the price is likely to form wave 5 next. The setup has a 3:1 RRR. The RSI is oversold on the 4H , and heading up.

!!Be aware of pending Economic Reports. If price is within 20 pips of proximal value at time of major impact report, then Confirmation entry.

Trade management:

-Split the TP to 3 orders at each TP

-when price hits 1:1 , consider moving stop to entry in case of pullback. So your trade is risk free.

-After TP2 hit, you might consider canceling the TP3 and trail the SL to maximize your profit.

**Disclaimer**:

The trading strategies, ideas, and information shared are for educational and informational purposes only. They do not constitute financial advice or a recommendation to buy or sell any securities, currencies, or financial instruments. You should do your own research or consult with a licensed financial advisor before making any trading decisions. The author assumes no responsibility for any losses incurred from following these trading ideas.

Good Buying Opportunity into CEGThe news about today's huge drop doesn't seem warranted, given that CEG is not directly related to the Amazon-Talen deal. This provides a good buying opportunity for $NASDAQ:CEG.

With the rising demand for power driven by AI data center construction. CEG is one of the stocks that has been brought into the spotlight. They recently struck a deal of $NASDAQ:MSFT.